sankai

Dear readers/followers,

In my last article on ams-OSRAM (OTCPK:AMSSY), I took a bullish stance on this Austrian company that’s active in the small form-factor electronics sector. It’s not an easy sector to be in overall, but it’s a crucial one as Europe works to create more of its own capacities in the sector and lessen the current global overreliance on Asia as a manufacturer.

The fact remains, this is a growing and high-demand market, where ams-OSRAM is one of the market leaders – and the recent results don’t exactly make the company bad in any way either.

Let’s update the thesis here.

Revisiting ams-OSRAM

First, a small reminder of what exactly the company is – because I don’t often review Austrian businesses. This particular one arose out of the fairly well-known steel company Voestalpine AG when the company decided to diversify operations into fabs and semi operations.

The first partner for the company was American Microsystems Inc., with whom the company cooperated. The resulting fab was chosen to be the top fab in 1992, and it was the first semi-company to go public back in 1993, with an IPO on the Vienna stock exchange.

Since that time, the company has been through multiple mergers and structural overall shifts, moving to buy OSRAM and a few other companies which turned this business into an Austrian-based powerhouse.

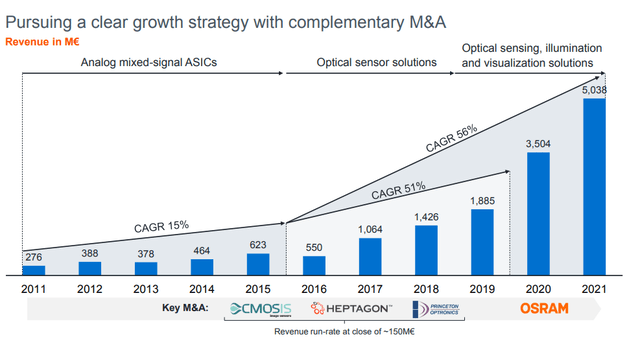

The current share price history would somehow suggest that the business has a poor track record or history, but nothing could be further from the truth. ams-OSRAM has an excellent history, enhanced and more than doubled in revenues by the addition of OSRAM.

This is further confirmed by the simple fact that ams-OSRAM has been able to outperform other peers in the semi Industry by factors and multiples of several X over the past seven years at the very least.

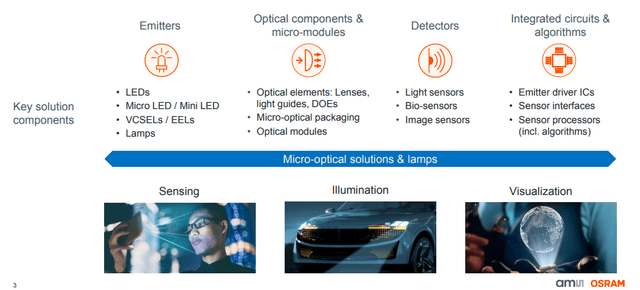

So what does it do? The name suggests some of it already if you know OSRAM, but the company’s operational divisions are centered around sensors and interfaces based on analog and mixed-signal semi-design. This is primarily sensors, illumination, and visualization.

These products are both used in Consumer communications, power management, and highly specialized solutions, as well as industrial applications, medical ones, and entire sectors in the automotive and aerospace industry.

These sectors are attractive, as you might understand. They’re timeless, and they’re certainly not going anywhere. They might be volatile, which turns the share price volatile, which is undesirable, but the fundamentals in the business remain very safe.

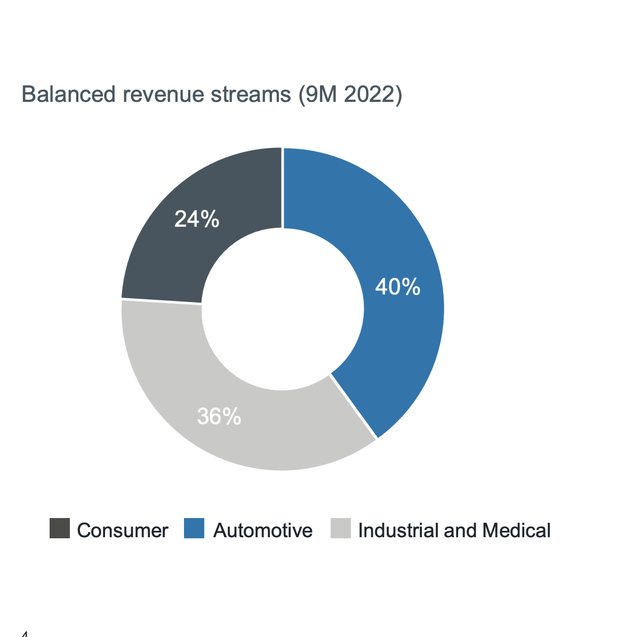

Because, looking at the share price you might obviously expect that 3Q22 was a bad quarter – yet nothing could be further from the truth. ams-OSRAM delivered results in accordance with expectations. The market for optical solutions remains very attractive, if somewhat automotive-heavy.

The company continues to target a double-digit revenue CAGR of over 10%, in outgrowing the company’s peers, while maintaining a double-digit 20% EBIT margin, and continuing to drive savings. The company wants to have about the same segmentation in terms of revenue that it has, with one exception – the consumer segment should be larger than it currently is.

Debt is not an issue for the company – it’s lower than 1.8x, with a max target of below 2x net debt/adjusted EBITDA. The company is also very much “in the now”, with proposed future projects being absolutely in line with the company’s product portfolio.

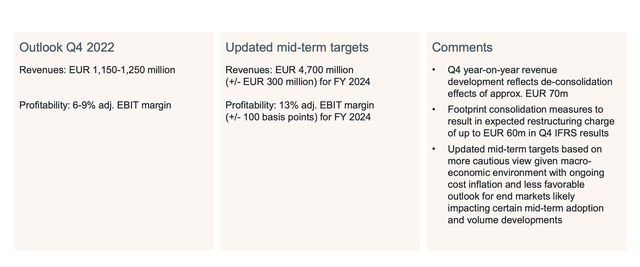

The company, in fact, managed results around the midpoint of its guidance range despite a demanding market and problematic supply chains and macro. ams-OSRAM delivered strong operating cash flow, and reduced its debt significantly on a gross basis, resulting in lower net leverage as well. For 4Q22, the company expects revenues of over €1.2B, and also for the margin to stay close to that double-digit level on an adjusted EBIT basis. That isn’t to say that there aren’t challenges – but these challenges were expected, and at least by me, already included in the overall thesis for the company.

Instead, let’s look at how the company has managed to reduce its R&D expenses and SG&A expenses as a percentage of revenue – going from over €145M in 2021 to lower than €125 in less than a year for G&A for instance, driving decent bottom-line improvements, and leading to the current forecasts for the full year, which while not record-breaking, are quite good in context for the environment.

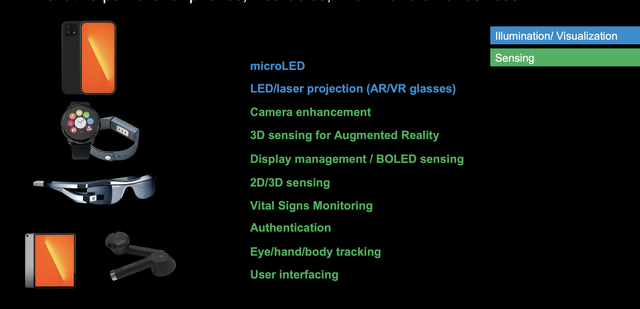

Fundamentally speaking, ams-OSRAM is likely to continue to enjoy advantages from the increased number of chips on a per-device basis, as it allows for greater functionality with things like IoT. IoT will require a large amount of energy-efficient sensors, and this is exactly what the company does.

Osram, in this perspective, has been a way for the company to diversify its operations and accelerate that diversification. The company generated €3B in revenues from three adjacent segments of Semiconductors, Automotive and Digital, with the logic behind the M&A being the ability to master the entire range of optical solutions, including emitters, optical components, to detectors, and algorithms.

The integration of these techs into the portfolio is expected to lead to new company product opportunities, from optical sensors in micro-LED screens to MLED itself (a suggested successor technology to OLED).

ams-OSRAM has a sector advantage due to experienced and strong R&D, including a good team of analog engineers who are driving innovation, as analog devices can’t be designed automatically by a computer and require hard-to-learn engineering competencies, which are becoming rarer and rarer in today’s market.

The preservation of these competencies is the key to the quality of future products: e.g. the new NFC booster has allowed a reduction in the size of NFC antennas, enabling one to be fitted in the Apple Watch, where a traditional antenna wouldn’t fit.

We do have some disadvantages to consider prior to investing. BB isn’t a great credit rating, but I expect this to go up again as the company lowers its overall debt.

The company also has no dividend, which makes this an extreme rarity for me in investing. I do invest in companies without a dividend, but I prefer there to be clarity for the introduction of one – we don’t have that here.

Russia and Ukraine have nearly no impact at all – less than 1% of sales went to these regions, but the overall macro impacts on automotive which is the most important growth driver are significant.

The current shortage of commodities coming from Russia has forced the car industry to review its production objectives downwards, which will negatively impact the main sales contributor of ams-OSRAM in the short term.

It’s correct to characterize this company as a play on “patience” in the sensor sector, with future potential in MLED.

Let’s look at the company’s valuation.

Here is the latest valuation thesis for ams-OSRAM.

ams-OSRAM valuation

As I said in my previous article, if we for a moment forget the fact that the company lacks a dividend, there is an upside to every single other valuation perspective for the company.

ams-OSRAM is a sensor/semi/optical company. These businesses, such as Infineon, STMicroelectronics (STM), and NXP, trade at P/E multiples of close to 21X, EV/EBITDA of between 5-11X, and book multiples of 2.5X. Premia is not unusual in these markets. This company still trades at less than 8x P/E at this point, less than 3x EV/EBITDA, and a low P/B multiple below 1x. That is what we call a discount here.

The is some justification for this discount – lack of a dividend, the integration issues – all of this means that I assign a 20-25% discount to the company, and consider it completely justified. However, after the company really delivers on these (in the future), the earnings will be considerable, and growth will be there. So for now – discounts.

Still, even discounting the company’s cash flows and various valuation trends, I view the company undervalued by more than 100% to its peers at this time, with DCF valuation showing us long-term impressive growth trends and implying a high upside for the US ticker, and a share price target of around 12 CHF – which is almost twice the current share price we’re seeing. Now, the market has been positive for this company for some time, and has been successively cutting its PTs for going on a year at this point. At this time, however, I believe the bottom to be reached for ams-OSRAM.

When it comes to NAV, we use an EV/Sales multiple, and we target a range of 1.3-1.5X of sales, coming to the north of 9B CHF for the company’s gross assets, or around 6.7B CHF based on the company’s current debt and commitments.

I had a PT in the low 20s in CHF for the company in my last article. While I’m not moving it much at this point, I am making clear that this is a long-term investment, and a play on longer-term trends across the world, not the short term. If you have less than a 5-10 year timeframe here, I don’t believe you should invest in ams-OSRAM at all.

My position in the company is small – and I continue to bump it very slowly, currently as close to 6-7 CHF as I possibly can. I’m in the red for now, but this is one of those stocks I want to slowly “build” on because I fully realize how long it will take for the company to reach its fair heights. However, there’s no doubt in my mind that this is exactly what it will do. The company will, as I see it, turn around its negative GAAP trends either next year or in 2024, at which point the synergies, the macro, and the markets will see the company delivering very impressive results. There is even the expectation of the company giving us a dividend for the next year (Source: S&P Global), as it did last time in 2017.

For those reasons and for the bottom-feeding valuation, I’m willing to call the company a “BUY” here.

Thesis

- ams-OSRAM is a market-leading play on key sectors and MLED trends that will play significant roles in the next 5-20 years of the semi, electronics, and IT development. I view the company as being well-positioned for longer-term growth and outperformance, but not a short-term one.

- The key is to buy this company significantly below normalized discount multiples, and that is currently possible with the shares below 7 CHF.

- I view the company as a “BUY” with a long-term PT of 15-18 CHF per share, but it needs to be noted that it will take a long time for the company to reach these heights.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The company does not fulfill my dividend criteria, but every other criteria i have. This makes it a “BUY” to me at this time, but one that requires you to understand what you’re getting into.

Be the first to comment