Just_Super

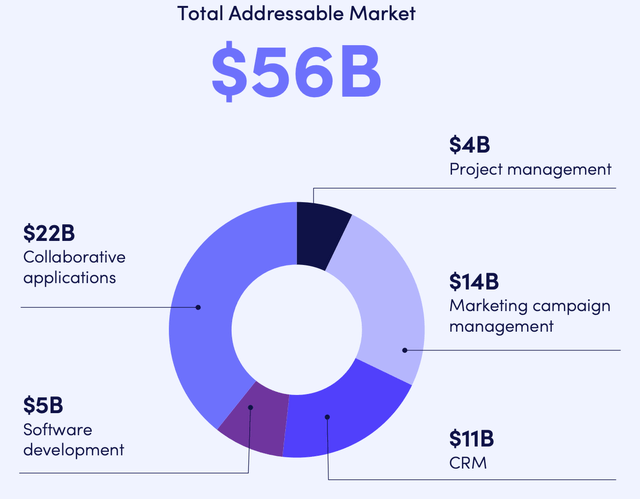

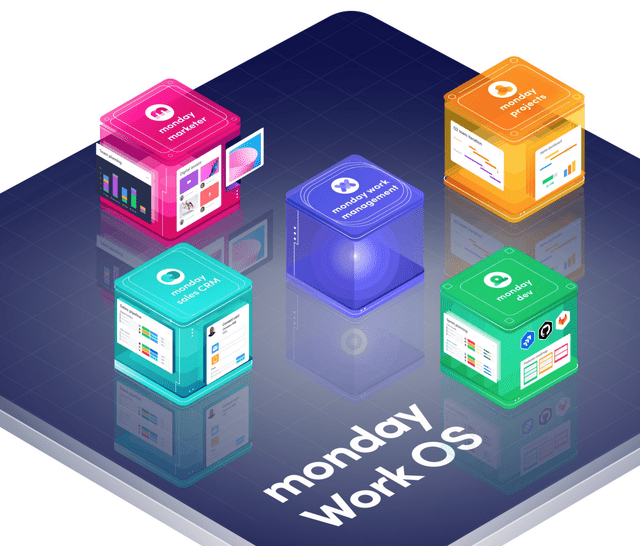

monday.com Ltd. (NASDAQ:MNDY) is a leading project management platform that has expanded its product range to increase its total addressable market (“TAM”) from $26 billion (Collaborative applications and Project management) to $56 billion (including CRM, Sales, Marketing, and Software development). So far, this risky tactic has been working well as the company has generated rapid growth, beating both top and bottom line estimates in the third quarter of 2022. In this post, I’m going to break down the company’s business model, financials, and valuation, let’s dive in.

Monday.com TAM (Investor presentation)

Business Model Recap

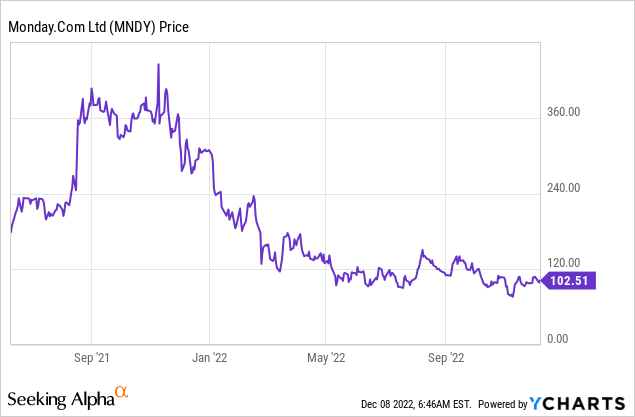

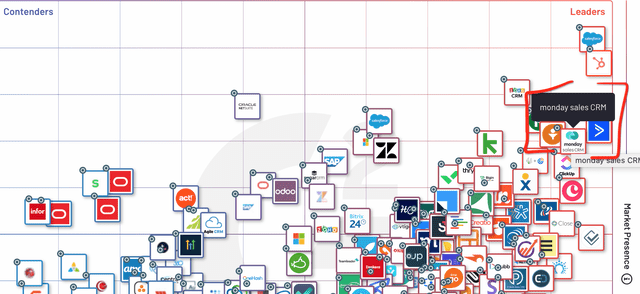

monday.com Ltd. is a Project Management software platform that helps teams to improve collaboration and increase efficiency. The product has 4.7 stars out of 5 on G2, which is higher than competitors such as Asana (4.3 out of 5), Trello (4.4 out of 5) and AirTable (4.6 out of 5 stars). Its products include a work management platform, a marketing platform, a sales CRM, and a project platform. The company also offers a “dev” platform for product development teams which acts as an alternative to Atlassian’s Jira.

Monday.com product (Q3,22 report)

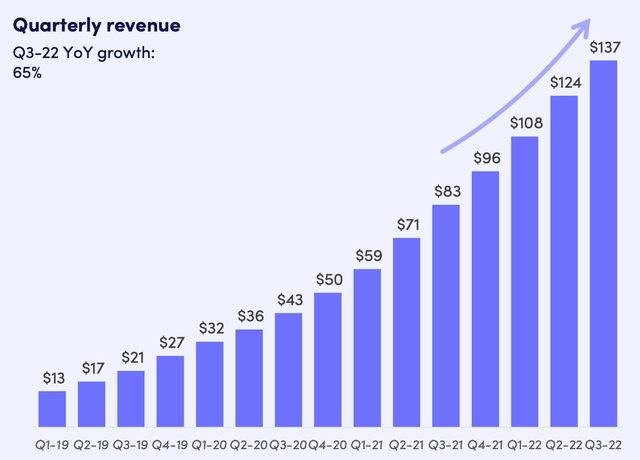

The company is aiming to create a new category of software (Work OS) that puts all “work” tools in a single place, to help break down barriers. Surprisingly, monday.com Ltd.’s CRM (Customer Relationship Management) software has gained significant traction, contributing to over half of new Work OS (operating system) product sign-ups. This is surprising for a project management tool, as the company is effectively competing with the likes of Salesforce (CRM), which even has the ticker “CRM,” and HubSpot, Inc. (HUBS). According to G2 reviews, Salesforce still takes the number one spot just to the most number of reviews (13,317). However, monday.com Ltd. has a higher rating by customers with 4.6 stars out of 5, versus Salesforce which has just 4.3 stars out of 5.

The unique thing about monday.com Ltd. is the company has created “modules” that work together, and automation can be set up easily with a “no code” dashboard.

Growing Financials

monday.com Ltd. reported strong financial results for the third quarter of 2022. Revenue was $136.9 million which increased by an outstanding 65% year over year or 68% on an FX-adjusted basis. The top line was driven by strong enterprise customer growth, which increased to 1,323 up a rapid 116% year over year. Management’s strategy has been to grow “upmarket” by adding a great number of enterprise features to its Work OS platform. This improvement included a 25% increase in “board” load time. In addition, there are mobile experience improvements and 99.8% uptime (“crash free”), which is vital for enterprise customers. The company also improved its integrations with the popular sales automation platform Salesforce and Product management platform (Jira) by Atlassian. monday.com Ltd. has expanded its sales team, which has allowed it to better entice the whales of industry to sign up as customers.

monday.com Ltd.’s larger customers with over $50,000 in ARR now make up 26% of total ARR in the quarter, up from 18% in the prior year. This is a testament to the aforementioned enterprise strategy.

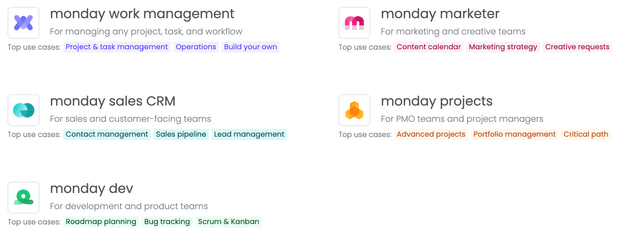

The organization’s customers are also finding the platform useful for managing teams, as its customers with over 10 users now contribute to 76% of Annual Recurring Revenue, up from 70% in the prior. The more users on the platform generally increase its “stickiness” and results in higher customer retention. For example, monday.com’s average net dollar retention rate was 120% in Q3,22. However, for its customers with over 10 users, this retention rate was over 135%.

Customers with 10 plus users (Q3,22 report)

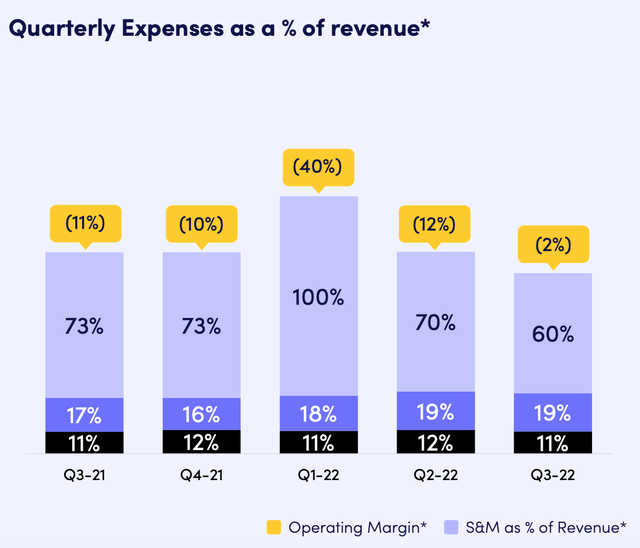

The company reported a super high gross margin [non GAAP] of 89%, which was aligned with expectations. The business increases its R&D expenses as a portion of revenue from 17% in 2021 to 19% in 2022 or $26.3 million. This was driven by the aforementioned build-out and innovation of its Work OS platform. A positive was Sales and Expenses reduced as a portion of total revenue from 73% in 2021 to 60% in 2022 or $82.4 million. This was a positive sign overall as it means the business is improving the efficiency of its marketing spend and demonstrating operating leverage as it scales. Management is forecasting a similar trend in the next quarter, with S&M expenses in the “low 60s” and I would like to see this fall further.

General and Administrative expenses [black bar on graph below] made up 11% of revenue or $15.2 million which was equivalent to the prior year. The company has increased its headcount by 63 people to 1,552 people since the last quarter, but management has slowed down this rate of hiring due to economic uncertainty, which is prudent.

Operating Expenses as a portion of revenue, Non GAAP (Q3,22 report )

The company reported earnings per share [EPS] of negative $0.51 which beat analyst expectations by $0.60. On a Non-GAAP basis, the company reported EPS of $0.05 which beat expectations by $0.59.

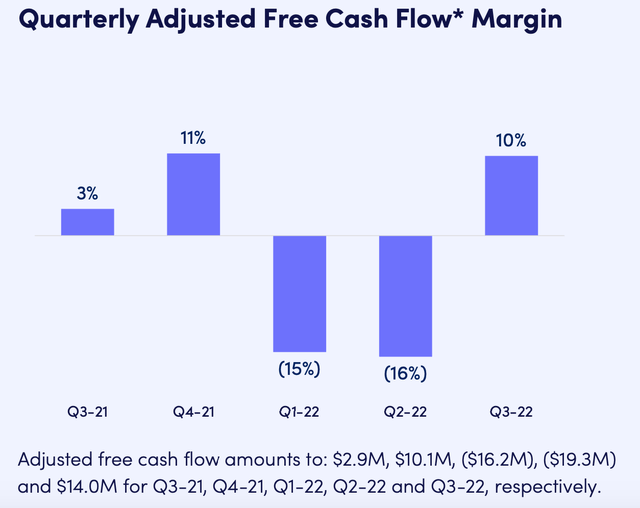

The company reported Adjusted Free cash flow of $14 million which includes $7 million from financial income. Its Adjusted Free cash flow margin has increased from 3% in Q3,21 to 10% by Q3,22, a substantial improvement.

For extra information, “Adjusted” Free Cash flow is defined as net cash from operations minus property and equipment expenses. In addition to capitalizing of software development costs.

Adjusted free cash flow margin (Q3,22 report)

monday.com Ltd. has a strong balance sheet, with $852.6 million in cash and cash equivalents. In addition, the business has minimal debt of ~$84 million.

Moving forward management is expecting between a 47% and 49% revenue growth rate in Q4,22. This is slightly lower than the 65% growth rate reported in Q3,22 but still solid overall. Management believes the major headwind will come from a strong U.S dollar which will impact international revenue. I also predict the macroeconomic environment will lengthen sales cycles, as business decision-makers become more cautious.

Advanced Valuation

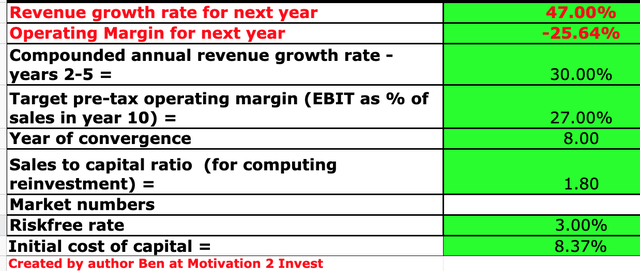

In order to value monday.com Ltd., I have plugged the latest financials into my advanced valuation which uses the discounted cash flow (“DCF”) method of valuation. I have forecasted 47% growth rate for next year, and 30% revenue growth over the next 2 to 5 years. “Next year’s” growth rate includes Q4,22 in the model and is based on an extrapolation of management estimates. I have then prudently forecasted 30% revenue growth rate over the next 2 to 5 years.

Monday.com stock valuation 1 (created by author Ben at Motivation 2 Invest)

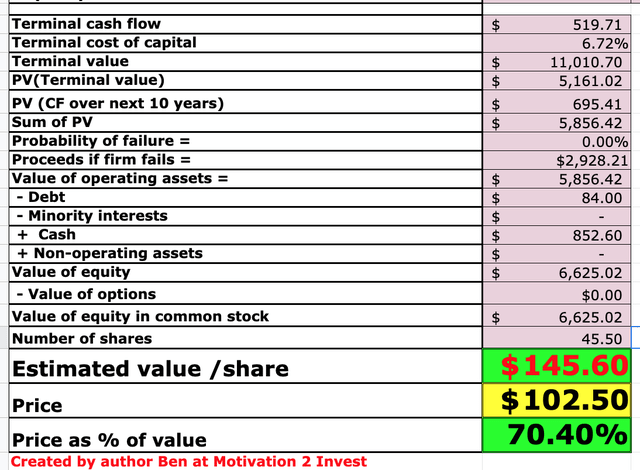

To increase the accuracy of the valuation, I have capitalized R&D expenses, which has lifted operating income. In addition, I have forecasted the operating margin to increase to 27% over the next 8 years. 23% is the average operating margin for a software company, but I believe monday.com Ltd. can surpass this due to its enterprise customer base and large number of upsell opportunities.

Monday.com stock valuation 2 (Created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $145.6 per share. The stock is trading at $102 per share at the time of writing and thus is ~30% undervalued.

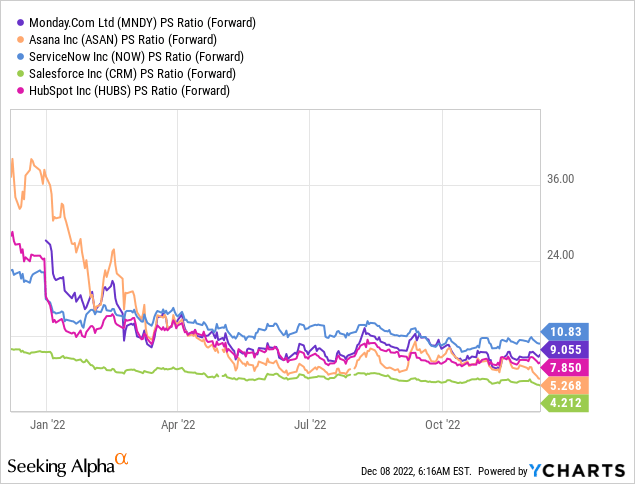

As an extra datapoint monday.com Ltd. trades at a Price to Sales ratio = 9, which is cheaper than historic levels. Relative to software industry peers, the company trades at the higher end of the valuation scale, but it is growing much faster.

Risks

Longer Sales Cycles/Recession

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. Therefore, I am predicting longer sales cycles, as decision-makers delay budgetary spending due to uncertainty.

Competition

monday.com Ltd. faces immense competition as it is effectively competing on all fronts. On one side the company is competing with project management platforms like Asana and Air Table. Then on the other side, it is competing with giants such as Salesforce and HubSpot which have built an entrenched ecosystem that specializes in sales & marketing automation. This is a risk, as there is a danger that the company may become a “jack of all trades, master of none.” However, a positive is that the modules are an easy upsell to customers and the total addressable market is larger.

Final Thoughts

monday.com Ltd. is a great software company that is continually innovating and growing at a blistering pace despite macroeconomic headwinds. monday.com Ltd. stock is undervalued intrinsically and relative to historic multiples. This is assuming the business can continue to grow revenue at least a 30% rate and increase its operating margin over the next 8 years.

Be the first to comment