Octavian Lazar/iStock via Getty Images

Thesis

The iShares Russell 1000 Growth ETF (NYSEARCA:IWF) seeks to track the Russell 1000 Growth Index. As per the Index’s literature:

The Russell 1000® Growth Index measures the performance of the large cap growth segment of the US equity universe. It includes those Russell 1000 companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium term (2 year) growth and higher sales per share historical growth (5 years). The Russell 1000® Growth Index is constructed to provide a comprehensive and unbiased barometer for the large-cap growth segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect growth characteristics.

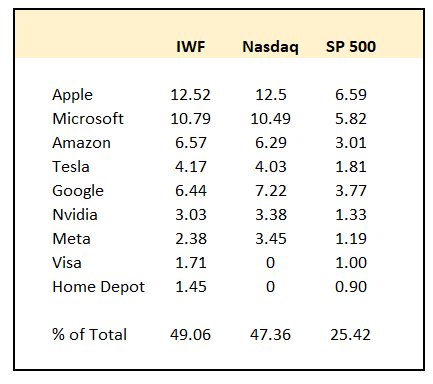

IWF is overweight the information technology sector and its top holdings closely resemble the Nasdaq:

Holdings (Author)

IWF has a high concentration in the former market “darlings”. 2021 saw a voracious retail appetite for trading which translated into higher prices for retail brokerages such as Robinhood (HOOD) and the now-infamous “gamma squeezes” in the FAANG stocks. The vast liquidity induced by the zero rates Fed policy and the massive pump-up in its balance sheet resulted in a one-way highway for stocks and the discovery of the easy money that can be made via call options when stock prices go up. That is the story of 2021. This year will be remembered by a violent upswing in rates, by galloping inflation and the slaughter of the 2021 leaders:

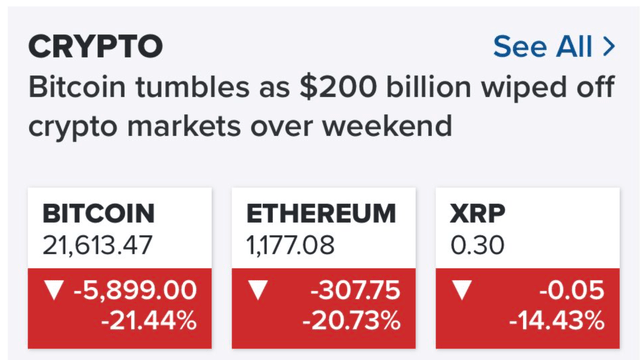

That is the news that a reader could have found on NBC News after the latest weekend action in Cryptocurrencies. In the Performance article section below, we present a chart with historic investment performances and the winners and losers for every year going back two decades (courtesy of Fidelity). Bitcoin and Large Caps – Growth have been the winners for the past few years in terms of performance and have driven a vicious cycle amplified by Covid – the higher the stocks and cryptos went the more interest from the retail crowd in making “easy money” because their neighbor did. Zero rates and high liquidity tends to do that.

A curious reader might ask what is the exact correlation between Bitcoin and IWF outside of utilizing a “growth” cohort that was pumped up by retail money in 2021. The answer might surprise you in finding out that Tesla will most likely need to incur a loss via an impairment of the $1.5 billion Bitcoin it put on its balance sheet not so long ago. The fact that the title of the article is “Tesla could take a big loss on its Bitcoin bets” rather than “How did Tesla’s cash management optimization fare” should tell you plenty about some of the corporate actions witnessed in 2021.

With the latest CPI report showing inflation is once again re-accelerating, market participants have now increased their views on both the neutral Fed Funds rate as well as the pace of increases by the Fed. Analysts are once again starting to price in a 75 bps rate hike. Volatility around rates and the ultimate neutral Fed Funds rate is not going to be firmed up until inflation starts easing. The Tech sector is the most susceptible one to the risk-free rate used to discount future earnings and will be impacted the most by the rise in rates. While we have already seen a massive re-pricing year to date, we do not believe the move is done yet, with growth names to continue to be under pressure until valuations move to more attractive levels.

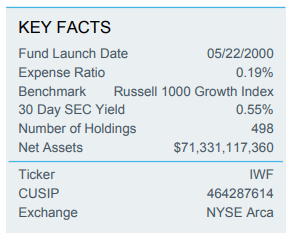

Metrics

AUM: $55.3 bil

30-day SEC Yield: 0.55%

Expense Ratio: 0.19%

Sharpe Ratio: 0.83

St Deviation: 18.54

Holdings

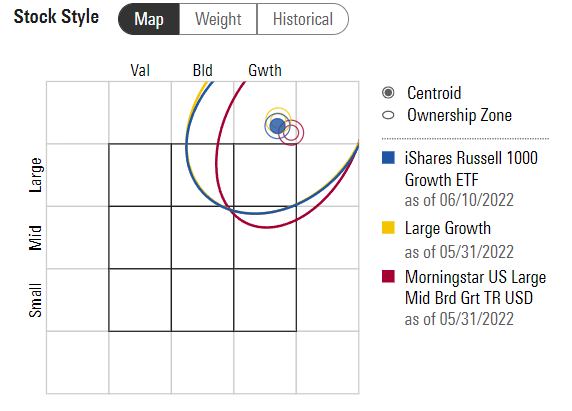

The exchange traded fund falls in the Large Cap – Growth category:

Category (Morningstar)

The fund’s holdings closely mirror the Nasdaq and are set to track the benchmark Index:

Holdings (Author)

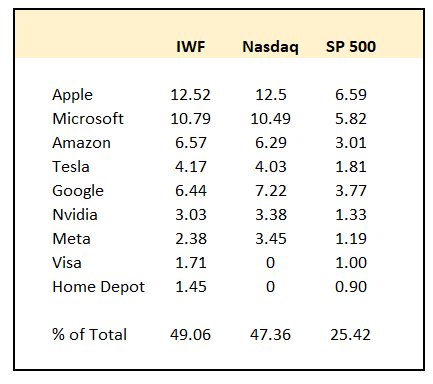

The fund has 498 holdings:

Holdings (Fund Fact Sheet)

Performance

After outperforming from 2017 to 2021, we feel Large Cap – Growth companies are due for a pause:

In the above graph courtesy of Fidelity, “LG” stands for Large Cap – Growth companies and the top of the table represents the best performing asset during that specific calendar year. For 2020 we can see that LG occupies the second slot, right after Bitcoin (“B” in the table above). Similarly, for each of the past four years, “LG” can be found at the top of the performance charts. Conversely, 2022 is led by commodities and followed by gold and cash. Yes, if an investor would have just stayed in cash since the beginning of the year, they would have outperformed most asset classes in 2022.

What is more interesting and can be construed as a reference point, is the period from 2000 to 2003 after the 90s internet bubble deflation. We can see that during the start of the 2000s “LG” can be found at the bottom of the table, with a pronounced underperformance. We believe we might see something similar for 2022 and 2023.

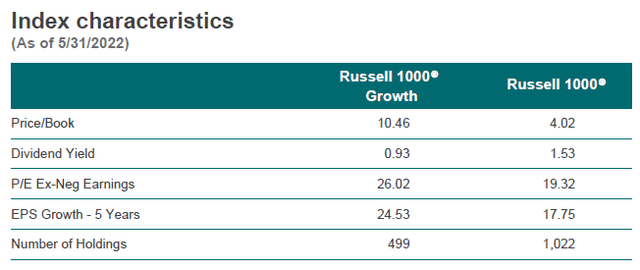

If we look at the Index characteristics, we can note that the exhibited P/E ratios are still quite high:

Characteristics (Index Fact Sheet)

We believe that similarly to the 2000-2003 time frame, the ratios are going to normalize, which is going to be a drag on performance.

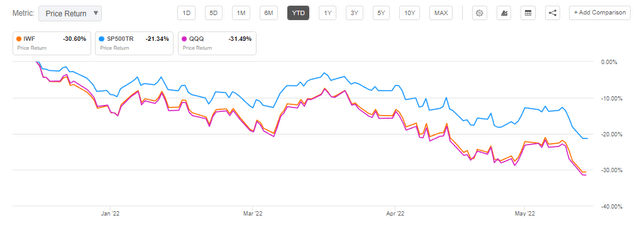

On a year to date basis, the ETF has mirrored the Nasdaq performance:

YTD Performance (Seeking Alpha)

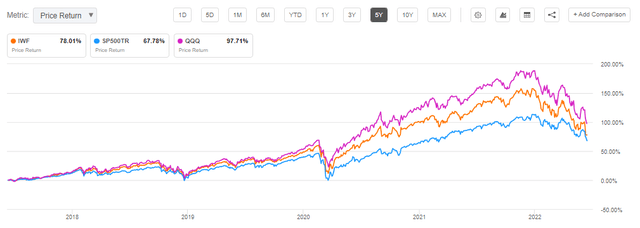

On a longer, 5-year time frame, the ETF has outperformed the S&P 500 but underperformed the Nasdaq:

5-Year Performance (Seeking Alpha)

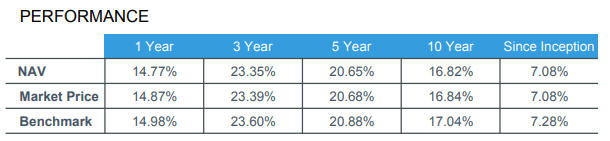

IWF has posted incredible annualized returns in the past decade on the back of the technology boom within everyday life and related capital allocation to the sector:

Total Return (Fund Fact Sheet)

We feel 2022 and 2023 are going to be different, with a substantial negative performance in store as P/E Ratios normalize and a mild recession is experienced in the U.S.

Conclusion

The excesses of 2021 and a loose monetary policy are being unwound as we speak. Higher rates to fight an out-of-control inflation have resulted in a bear market in the S&P 500 year to date and will continue to put pressure on stocks, especially on growth names. After outperforming since 2017, we feel Large Cap – Growth companies are due for a pause and will underperform similarly to what we saw in 2000 to 2003 after the internet bubble burst. IWF is set to track specifically those names that saw outsized performances in the past years and will get squeezed by higher rates.

Be the first to comment