Diego Thomazini

Introduction

In June, I wrote a bullish article on SA about residential property developer Landsea Homes (NASDAQ:LSEA) in which I said that the recent acquisitions were paying off well and the company looked cheap. The market valuation of the company has declined by about a third since then as mortgage rates in the USA have been rising rapidly over the past couple of months. However, I think the fundamentals look good as Landsea Homes booked an adjusted net income of $31.5 million in Q2 2022 and the backlog rose by over 30% to more than $900 million as of June. In addition, the adjusted home sales gross margin increased to 29.1% from 23.5% a year earlier. In my view, Landsea Homes looks more undervalued now compared to June. Let’s review.

Overview of the Q2 2022 results

In case you haven’t read my previous article about Landsea Homes, here’s a short description of the business. The company started operations in 2014 and is involved in the development of entry-level and move-up residential properties in the states of Arizona, California, Florida, New York, and Texas. Its High Performance Homes program is centered around the core pillars of automation, sustainability, energy efficiency, and healthy lifestyles.

Landsea Homes

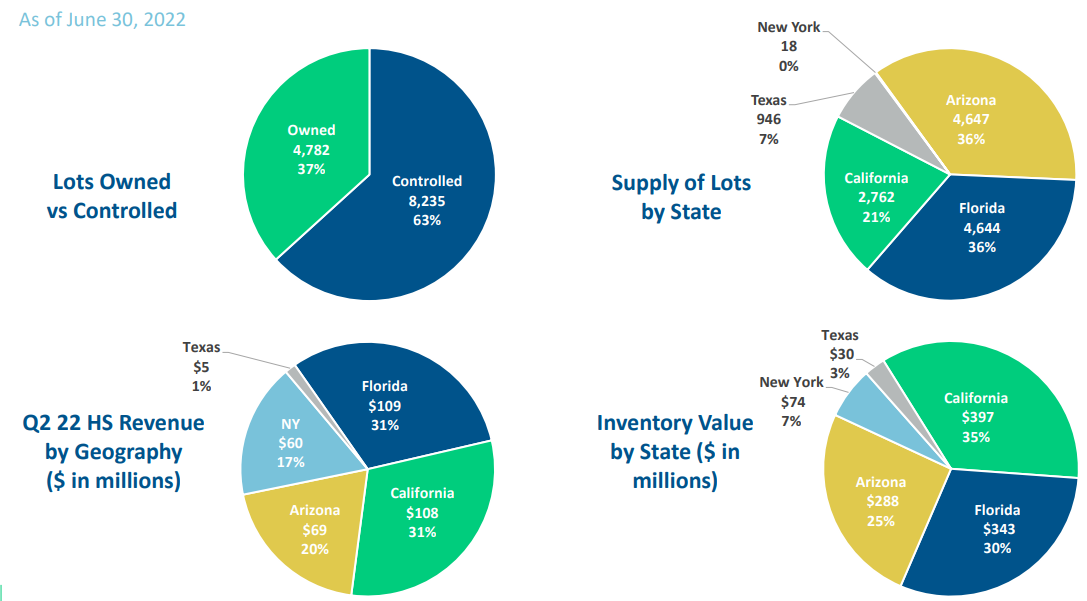

As of June 2022, Landsea Homes had a portfolio of 13,017 owned and controlled lots, with the majority of them located in Arizona, Florida, and California. The value of its real estate inventory stood at $1.13 billion at the end of Q2 2022.

Landsea Homes

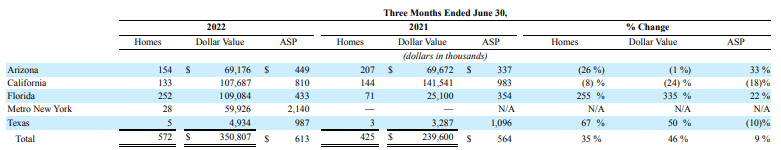

Turning our attention to the financial performance of the company, I think that the Q2 2022 results were good as the average sale price (ASP) of home deliveries rose by 9% year on year to $613,000. In January 2022, Landsea Homes acquired Florida-focused Hanover Family Builders for $264.2 million. and it seems things are going well on that front as the ASP in that state increased by 22%. Hanover had homes in Orlando-area communities with higher price points than Landsea Homes.

Landsea Homes

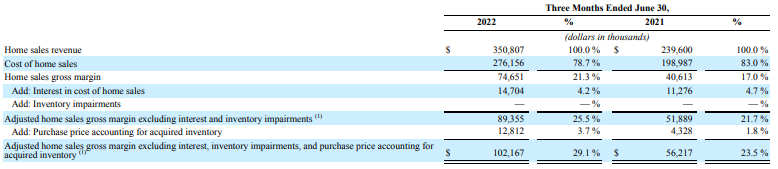

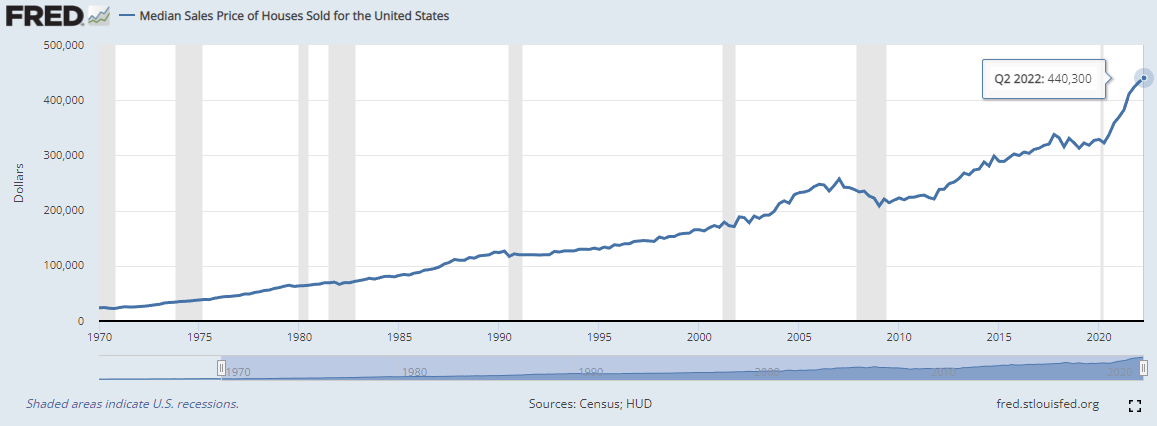

The home sales gross margin expanded 430 basis points year-over-year to 29.1% on a fully adjusted basis thanks to higher prices and margins in California as well as the expansion of the high-margin Florida segment. As deliveries reached a near record 572 during the quarter, Landsea Homes generated an adjusted net income of $31.5 million, compared to $17.5 million a year earlier. Adjusted EBITDA, in turn, soared from $32.6 million to $56.6 million.

Landsea Homes

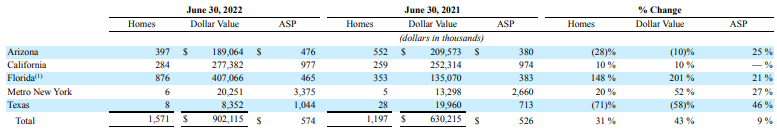

Net new orders came in at 538 and the ASP seems to be holding well across all markets, which allowed the company to close June with a strong backlog of 1,571 units with a total dollar value of $902.1 million.

Landsea Homes

However, Landsea Homes isn’t immune to the slowdown in the property market which is fueled by rising interest rates and low consumer confidence and the company revealed in its Q2 2022 earnings call that demand tapered off as the quarter progressed.

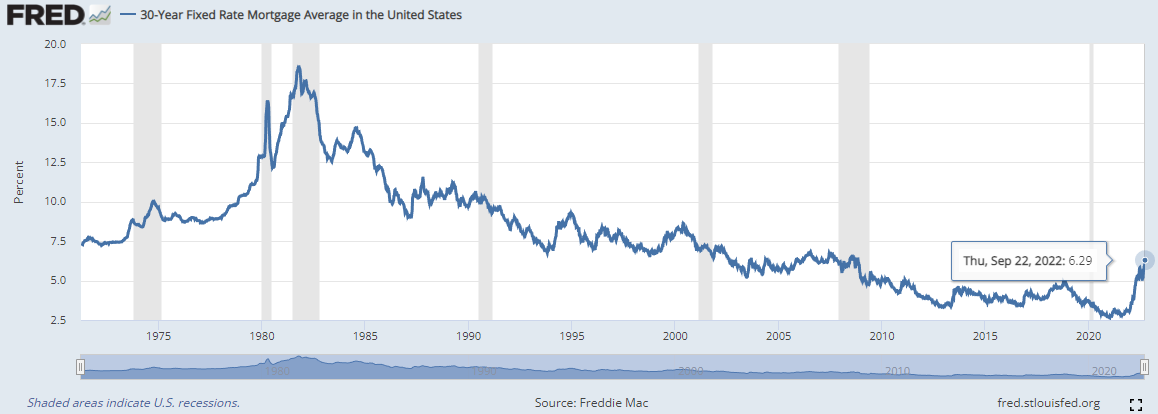

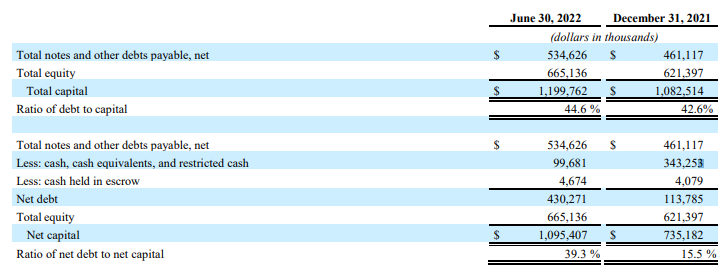

Looking at the data, we can see that 30-year fixed rate mortgage levels are currently rising at one of the fastest paces in history and they have already more than doubled over the past year. While median sales prices for homes are still rising, the pace of the growth has been slowing down.

FRED FRED

Looking to the near future, Landsea Homes expects to deliver 575 to 630 homes in Q3 2022 and 2,500 to 2,700 homes for the full year. The delivery ASPs, in turn, are forecast to be in a range of $550,000 to $575,000 in Q3 and $525,000 to $550,000 for the full year. This means that Landsea Homes should book record deliveries in Q4, and I find it encouraging that the ASPs are expected to decline only modestly in such a challenging property market. The home sales gross margin for 2022 is expected to be in a range of 24% to 26% on an adjusted basis which I find compelling.

Landsea Homes

In my view, Landsea Homes is well-positioned to weather a storm in the residential property market thanks to its focus on affordable homes in areas with growing jobs markets and positive migration rates. The impact of any macro headwinds should be softer here.

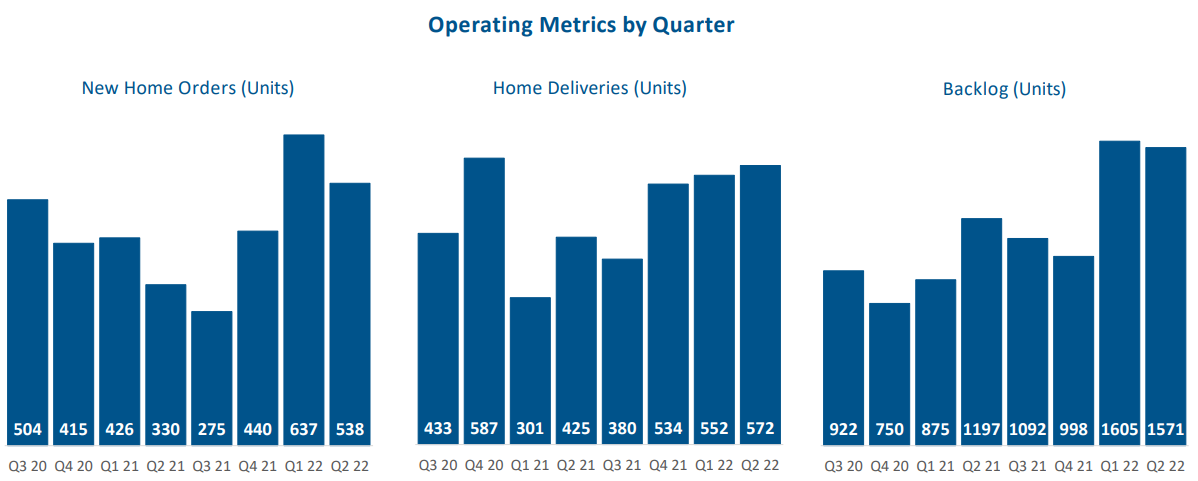

Turning our attention to the balance sheet, the situation looks good as the net debt to net capital ratio was at a manageable level of 39.3% as of June following the Hanover acquisition. The tangible net worth was $595.7 million as of the end of Q2 and Landsea Homes is trading at an annualized EV/Adjusted EBITDA ratio of just 2.8x as of the time of writing.

Landsea Homes

In Q2 2022, the company bought back 5.1 million shares at $7.06 per share and I think that the $10 million remaining on its share repurchase program authorization could provide a boost for the share price in the near future.

Turning our attention to the risks for the bear case, the major one is that I’m underestimating the severity of the unfolding contraction in the US property market. During its Q1 2022 earnings call, Landsea Homes said that it expects less than 10% of its portfolio to fall out at a mortgage rate of 6%. We’re already past 6% and it’s likely that even conservative property developers like this one will be severely affected if we get to something like 8%.

Investor takeaway

Landsea Homes expects to make record home deliveries at decent ASP levels over the coming months and this should result in improved net income at a time when some property developers are starting to struggle amid high mortgage rates and low consumer confidence. Landsea Homes is well positioned for a property market downturn thanks to its focus on affordable homes as well as areas with positive migration and growing jobs markets and I think it looks cheap. The company is currently trading below 3x annualized EV/Adjusted EBITDA, and the tangible net worth was $595.7 million as of June. In addition, the backlog seems strong.

Yet, US mortgage rates are already past 6% and I think that any further increases could significantly affect Landsea Homes down the road. Overall, I think that the share price could get back to $7 by the end of the year unless the US home market falls off a cliff and I rate this company as a speculative buy.

Be the first to comment