nikkytok/iStock via Getty Images

Introduction

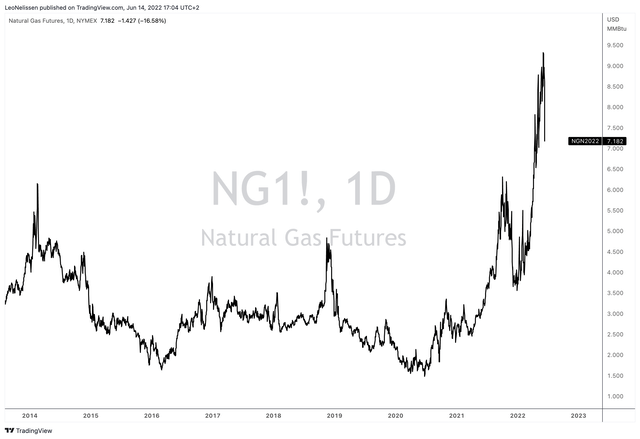

We’re in an energy crisis. Oil is consistently trading above $100 per barrel, natural gas is trading at multi-year highs, and Europe is competing with Asia to get access to highly sought-after liquid natural gas supplies to reduce Russian natural gas imports (in Europe’s case) or to move towards a cleaner energy future in the case of both Asia and Europe.

A few days ago, I wrote an article titled “Thanks To Politicians, Exxon Mobil Remains A Buy”. In that article, I discussed the supply side of fossil fuels.

In this article, I want to focus on natural gas and the long-term potential of liquified natural gas – LNG.

That’s where the EQT Corporation (NYSE:EQT) comes in. This Pennsylvania-based energy company is the country’s largest natural gas producer. The company has more than 25 trillion cubic feet of proven natural gas (and related) reserves and major operations in the Marcellus play. The company is in a terrific spot to benefit from high prices, and accelerating LNG demand in a “new era” for LNG.

So, let’s get to it!

A New Natural Gas Era

The energy crisis is the most fascinating subject I’ve “ever” covered. Not because I like what’s happening – a lot actually worries me – but because it impacts every single aspect of the global economy, which makes it not only interesting to research but also the cornerstone of every long-term macro outlook.

Not only do I cover European macro daily via Intelligence Quarterly, but I’m also based in Europe. Because of the war in Ukraine, the importance to diversify away from Russian natural gas is more important than ever.

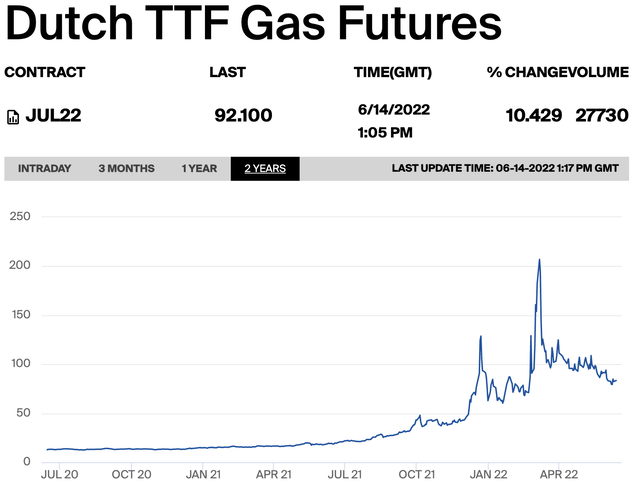

Because of political risks like the risk of Putin cutting gas exports and macro risks that we will discuss in this article, European benchmark prices for natural gas (Dutch TTF) are trading at EUR 90. That’s up from roughly EUR 20 prior to the energy crisis.

Intercontinental Exchange

On top of that, natural gas is benefiting from long-term demand growth as it is a much cleaner energy alternative for countries looking to reduce coal exposure.

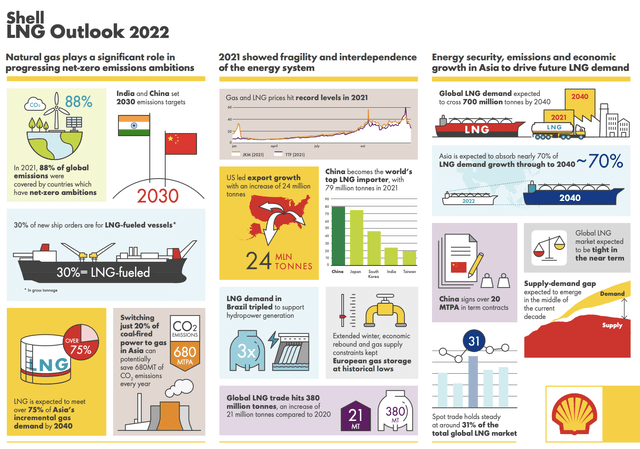

British oil giant Shell (SHEL) summarized a few key facts in its 2022 LNG outlook. Note that LNG is basically liquified natural gas. LNG is the only way to ship natural gas between countries without a pipeline. For example, natural gas is being produced in the United States. It is then liquified and stored in ships. These ships then unload in Asia or Europe where facilities turn LNG into gas again.

With regard to demand, we’re seeing high growth. Asian demand, for example, is expected to account for 70% of global LNG demand by 2040. In 2021, China was the world’s top importer, accounting for almost 80 million tonnes of LNG. In 2040, global LNG demand is set to exceed 700 million tonnes. In Brazil, demand tripled due to higher hydrogen production. Total LNG trade was 380 million tonnes in 2021. An increase of 21 million tonnes over 2020.

Shell

Note Shell’s supply versus demand comparison on the right side in the overview above. Sky-high demand is expected to outgrow supply by a mile.

EQT also discussed demand developments in a recent presentation. EQT estimates that there’s a total of 175 billion cubic feet per day of coal-to-gas switching demand. Hence, the plan is to quadruple US LNG capacity to 55 billion cubic feet per day by 2030 to replace international coal at an unprecedented pace.

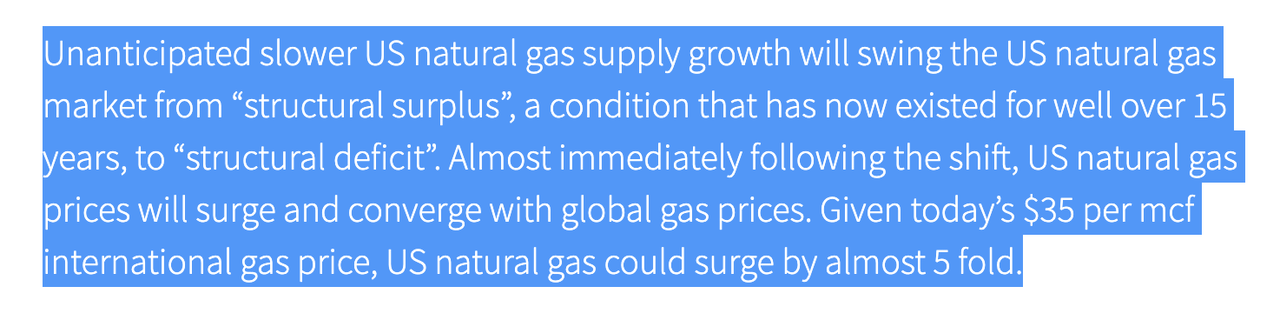

I’ve commented on that a lot on i.e., Twitter where I made the case that one of the reasons for low pre-pandemic inflation is gone: natural gas production is peaking.

Twitter (@Growth_Value_)

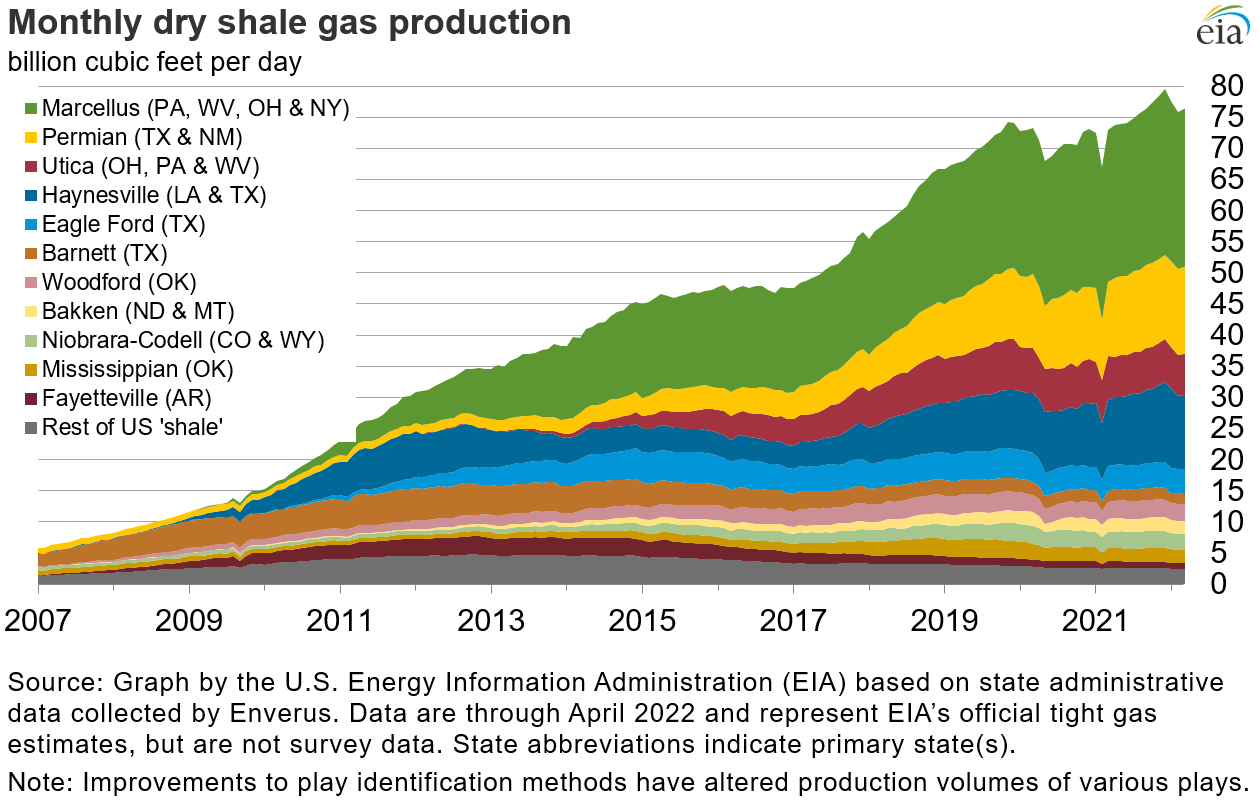

For example, between the Great Financial Crisis and the pandemic, natural gas production in the United States was absolutely “wild” rising from roughly 10 billion cubic feet per day to 75 bcf/d. A lot of growth was provided by Marcellus, which is where EQT operates.

EIA

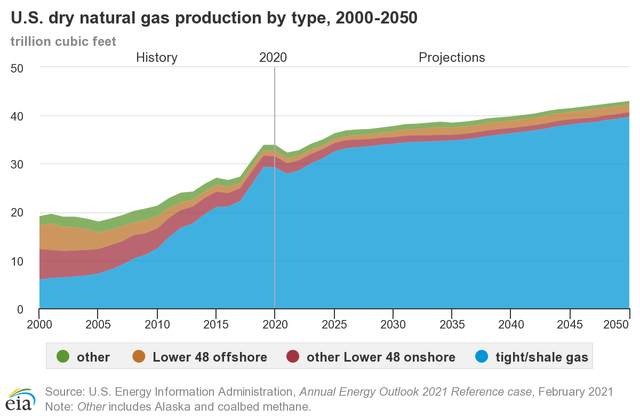

As the graph above shows, supply growth has flattened since 2020. This is not expected to change as the big growth story (shale revolution) is over according to every single estimate I could get my hands on. The one below shows the EIA’s estimate.

EIA

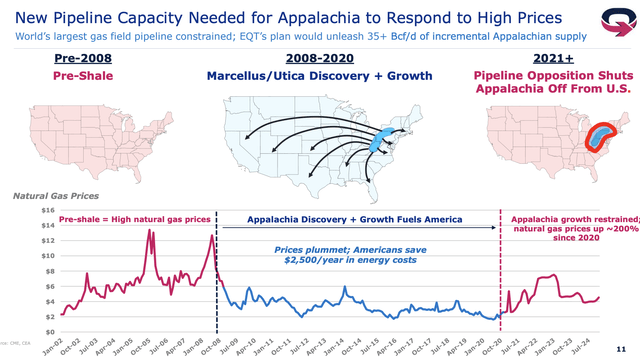

Moreover, and with regard to EQT’s own findings, the company published a fascinating chart showing how supply headwinds impact pricing. Prior to the shale revolution, prices were elevated. Since the second half of 2020, the Marcellus/Utica plays are experiencing new supply issues – also related to pipeline opposition.

Hence, we’re once again in a new “era” of elevated natural gas prices, which gets even worse (for consumers/customers) when incorporating high chances of significant supply shortages in the years and decades ahead.

EQT Corp.

So, how does this benefit EQT?

Buying A Money Printer Named EQT

Like all major energy companies, EQT is now in a different place compared to pre-pandemic years. Prices are high, total supply is subdued, and the focus is on free cash flow instead of production growth.

EQT is America’s largest natural gas producer with more than 1,800 core net locations. A fun fact is that if EQT were a country, it would be the 12th-largest natural gas producer. It accounts for 6% of total US production. All of the company’s production is located in the Appalachian with a capacity of 4.0 bcf/d.

The company expects to do $17 billion in free cash flow through 2027. Analysts believe that the company can achieve $3.1 billion in 2023 free cash flow. That would imply a 19.7% free cash flow yield using the $15.7 billion market cap. The company itself expects a 25% FCF yield as hedges expire.

For 2022 and 2023, the company has 65% and 45% of volumes hedged, respectively.

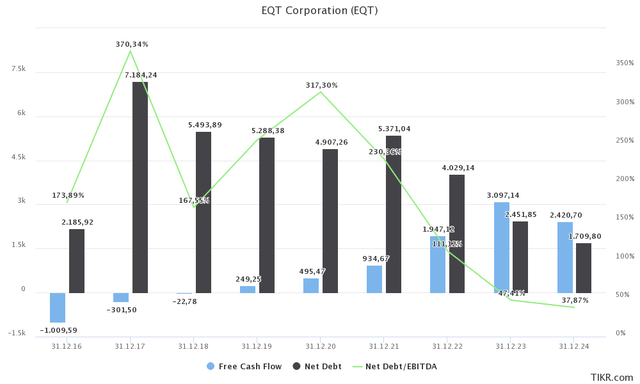

If we assume that analyst expectations are right, the company is in a good spot to get rid of its massive debt load. In 2017, the company had $7.2 billion in net debt. Back then, it was 3.7x EBITDA. This year, the company is set to lower net debt to $4.0 billion, which would imply a 1.1x net leverage ratio. Next year, the net leverage ratio is set to fall to less than 0.5x EBITDA, opening up a lot of opportunities to return cash to shareholders as FCF is expected to reach $3.1 billion ($3.5 billion according to the company).

TIKR.com

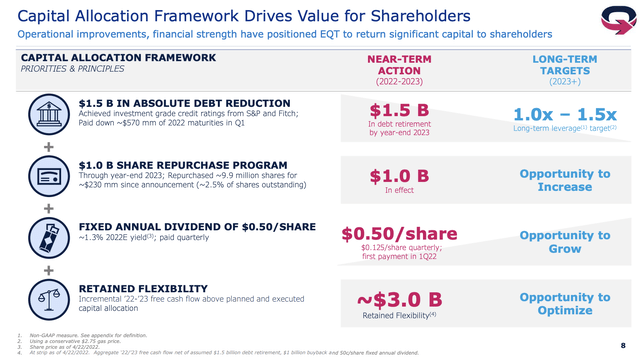

The slide below shows the company’s capital allocation framework. First of all, the company targets a net leverage ratio of 1.0x to 1.5x EBITDA after 2022, which is extremely feasible. If the company can achieve $17 billion in cumulative FCF through 2027, it can easily cover $3.4 billion in maturities until 2027. After that, the company has less than $1.6 billion in debt outstanding.

EQT Corp.

Because of this healthy financial situation, the company is in a fantastic spot to return money to shareholders. By the year-end of 2023, the company is looking to repurchase $1.0 billion of its own shares. Since announcing this plan in December, the company has bought back close to $230 million of its own shares. That’s roughly 2.5% of total shares outstanding.

The company also initiated a dividend of $0.50 (per year), paid quarterly ($0.125). This translates to a 1.2% yield.

These numbers aren’t wild, but there’s room to grow shareholder payout. Especially because the company expects incremental 2022/2023 FCF above the planned and executed allocation of $3.0 billion. Add to that that the debt load will be below the company’s target in 2023 at the current pace.

While the company doesn’t yet commit to future buybacks and dividend hikes – I expect no details until 2023 – it did comment on potential plans for its accelerating FCF:

So being able to buy back our stock, being able to do — maybe raising our dividend and accelerating the debt repayment, all 3 things look interesting to us as options along with maybe investing in LNG and other things like that, for sure.

Valuation & Outperformance

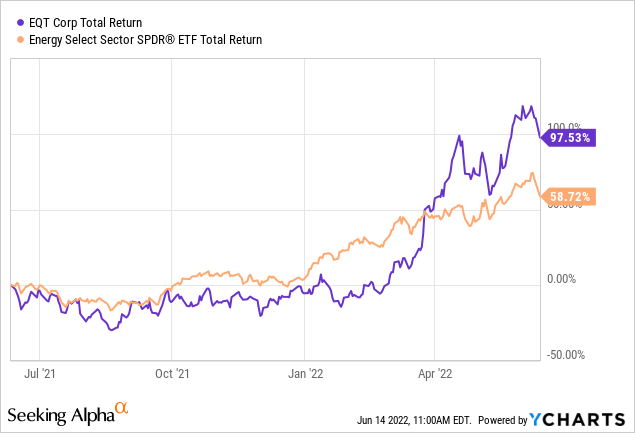

EQT has returned 98% over the past 12 months. This beats the energy ETF (XLE) by 40 points. That’s remarkable. I expect this outperformance to continue as the company is ramping up shareholder returns in 2023 and beyond while benefiting from the accelerating natural gas bull case.

With that being said, natural gas prices are currently weakening. NYMEX Henry Hub futures are down 16% while I am writing this as a result of a fire at one of America’s largest LNG export facilities: Freeport LNG. The fire happened last week, yet it is now expected that it could take months until the facility can operate again. This means lower export volumes. That’s bad news for the EU (higher local energy prices) and good news for the US as more natural gas will stay in the country – hence lower Henry Hub prices.

TradingView

While it does lower EQT’s market cap by roughly $1.0 billion (while I am writing this), it won’t derail the long-term bull case. If anything, it makes the entry price juicier.

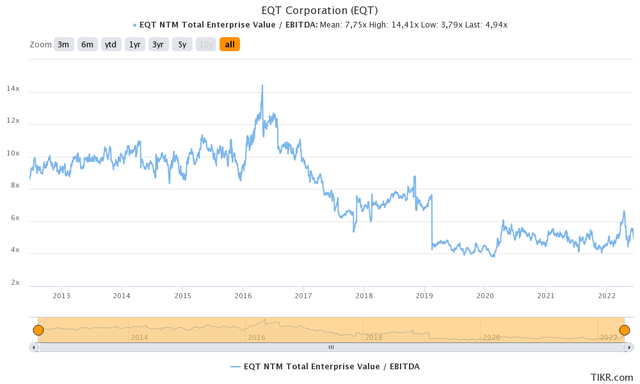

Using the company’s $15.7 billion market cap and $2.45 billion in expected 2023 net debt gives the company an enterprise value of $18.15 billion.

This implies a 3.5x multiple using 2023 EBITDA estimates, which is rather cheap using the historic EV/EBITDA valuation. In this case, I used next-twelve-months EBITDA in the chart below.

TIKR.com

Based on these numbers, I would give the company a fair value of $60-$65 per share. The problem is getting there. I do not recommend trading this stock. Long-term investments make more sense given that we’re dealing with a long-term bull case that will further develop in the years (and decades) ahead.

Takeaway

American natural gas companies are not only in a good spot but the backbone of the global push for natural gas. Asian countries will accelerate LNG demand to slowly but steadily replace coal while further ramping up total energy demand given the rise in economic output in the decades ahead. Meanwhile, Europe is going through a “forced” energy transition as it looks to diversify its energy imports given the ongoing war in Ukraine.

Given the development of demand, it is extremely unlikely that supply can keep up. This is paving the way for high natural gas prices in the long-term, benefiting America’s largest LNG producer EQT.

EQT is in a great spot to accelerate shareholder returns as it is set to reach its leverage target next year. Thanks to high prices, the company is generating a high, double-digit free cash flow yield. In addition to lowering debt, the company initiated a dividend and started repurchasing its own shares.

Needless to say, I am a long-term EQT bull. I expect the stock to clear $60 next year with way more long-term upside as the company’s hedges expire – while demand accelerates.

The only reason I’m not buying is that I have 20% energy exposure already. I want to diversify first before I add even more energy exposure.

(Dis)agree? Let me know in the comments!

Be the first to comment