Jezperklauzen/iStock via Getty Images Iovance

The intelligent investor is a realist who sells to optimists and buys from pessimists – Benjamin Graham (Warren Buffett’s mentor).

In biotech investing, regulatory filing development is very important because it can determine the fate of a small/young company. As such, you should pay extra attention to this development, especially when it’s relating to the company’s first approval. After years of therapeutic innovation, Iovance Biotherapeutics, Inc. (NASDAQ:IOVA), I have written about positively before, is poised to complete its application filing for the lead medicine, lifileucel. Therefore, you can bet that this event will define the company’s success. In this research, I’ll feature a fundamental analysis of Iovance while focusing on the upcoming regulatory development.

Figure 1: Iovance chart.

About The Company

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. I noted in the prior article:

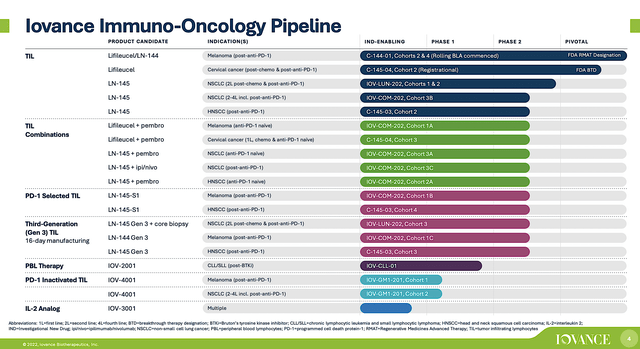

Operating out of San Carlos, California, Iovance is focused on the innovation and commercialization of stellar medicine to deliver hopes in seemingly hopeless cancers. As a therapeutic pioneer, Iovance harnesses the power of Tumor-Infiltrating Lymphocytes (“TILs”) to expand its pipeline of “smart medicines.” As you will see, leveraging TILs is an ingenious way to ramping up key immune cells in your body to decimate cancers. Interestingly, this novel treatment is applicable to a variety of solid tumors, including melanoma, cervical, head and neck, and non-small cell lung cancers (NSCLC).

Figure 2: Therapeutic pipeline.

Significant Partnership

On this front, you can see that there is no significant partnership. The company is still actively searching for launch partnerships. However, there are two research and development collaborations. They include Wuxi and Cellectis S.A. (CLLS), which were formed in 2019 and 2020, respectively. The deal with Cellectis is for Iovance to use Cellectis’ Talen technology to edit TIL’s genes. In general, I favor biotech partnerships for their tremendous advantages, as elucidated below.

First and foremost, the partner would help absorb the costs associated with the capital-intensive therapeutic development process. Second, they can either take over the future launch or co-launch the drug with the smaller operator. Third, they provide their development expertise as well as their relationship with the FDA. Fourth, they can instill confidence in investors. After all, there is no point in doing a partnership unless the partner sees great value in the development pipeline.

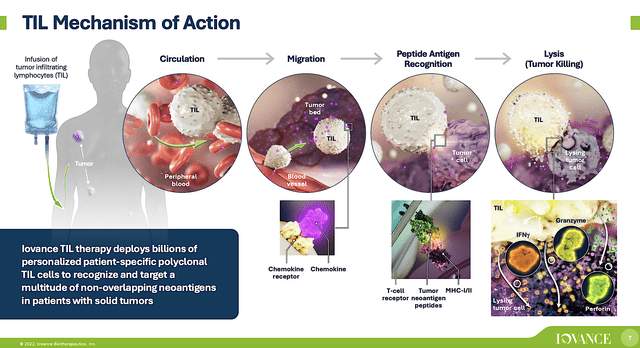

Mechanism of Action & Disease Context – Lifi For Metastatic Melanoma

Shifting gears, let us analyze TIL/Lifi’s mechanism of action (MOA). After all, it can give you invaluable insight into forecasting clinical outcomes and therapeutic success. As you can see, inside a tumor’s microenvironment, cancer cells release chemical messengers that suppress the number of immune cells and their functioning. Consequently, the body’s natural defense (i.e., immune) system usually succumbs to a losing battle against cancer.

As a form of precision/personalized medicine, Lifi is engineered tumor-infiltrating lymphocytes (i.e., key immune cells, including B and T cells) that are harvested from the patient. After collection, these cells are bioengineered and thereby grown in massive quantities. Lastly, they are then injected back into the patients for cancer destruction. Hence, Lifi tilted the battle against cancer in the patient’s favor in this whole process, which takes roughly 22 days.

Figure 3: TIL mechanism of action.

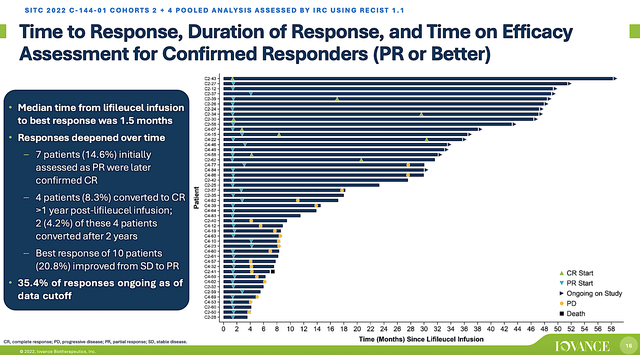

Robust SITC Data Presentation

Given that the aforesaid Lifi’s mechanism of action and cancer’s disease context fits together like puzzle pieces, the clinical results (thus far) have been phenomenal. Accordingly, Iovance presented superb data on November 10, for its Phase 2 (C-144-01) trial that assessed the safety and efficacy of Lifi in patients afflicted by metastatic melanoma. From the figure below, you can appreciate that Lifi generated the composite of 35.4% overall responses for Cohort (i.e., groups) 2 and 4. That’s quite remarkable because these patients are extremely sick, as they already failed prior treatments (i.e., anti-PD-1/L1 and BRAF/MEK therapies).

Interestingly, the median time after Lifi treatment to best responses was rapid (i.e., 1.5 months). Moreover, patients with an initial partial response were converted to complete responders. Taken all together, you can bet that Lifi works.

Figure 4: Lifi’s OR data from the C-144-01 trial.

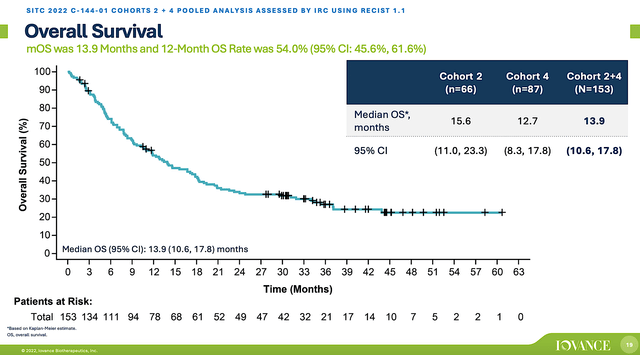

Nowadays, the FDA places heavy emphasis on overall survival (i.e., OS). Therefore, drugs with improved OS would have a much easier chance of getting approved. On this metric, you can see that both Cohorts (2 and 4) enjoyed the 13.9 months of OS average. While that might not seem much, it’s almost 1-fold higher than 7.8 months OS for chemotherapy.

Figure 5: Lifi’s OS data from the C-144-01 trial.

Lifi’s Regulatory Development

Riding robust data, Iovance already started a rolling Biologic License Application (i.e., BLA) back in August of this year. With a rolling application, Lifi has been getting priority reviews (i.e., expedited service with extra support from the FDA). As such, Iovance can file a portion of its BLA on an ongoing basis for the agency to review documents as early as possible.

On November 18, the company provided updates on Lifi’s BLA. Based on the press release, Iovance already received the FDA feedback regarding its application. There is nothing major that can halt Lifi’s regulatory process. Precisely speaking, the FDA shared with Iovance what needs to be done for its supplemental assay validation and comparability data for Lifi. Commenting on the development, the interim President and CEO (Dr. Frederick Vogt) enthused,

We continue to make substantial progress with our ongoing BLA submission and remain close to the finish line. The FDA has provided recent valuable feedback to the IND application and remains supportive during the rolling BLA submission process. Iovance is fully committed to securing FDA approval as soon as possible to deliver the first individualized, one-time cell therapy for advanced melanoma patients, who have a significant unmet medical need.

On the same day, Iovance held a conference to answer analysts’ questions. Based on the management responses, you can expect that Iovance is on track to complete its rolling BLA by 1Q2023. The management seems confident about its ability to fulfill the FDA’s requirements.

As you know, Iovance was supposed to finish the BLA filing this quarter. Due to the small delay, the market was punishing the stock. Nevertheless, Iovance could receive approval next year. That aside, there is also a combo study of Lifi with an immune-checkpoint inhibitor that would be used for confirmation after approval.

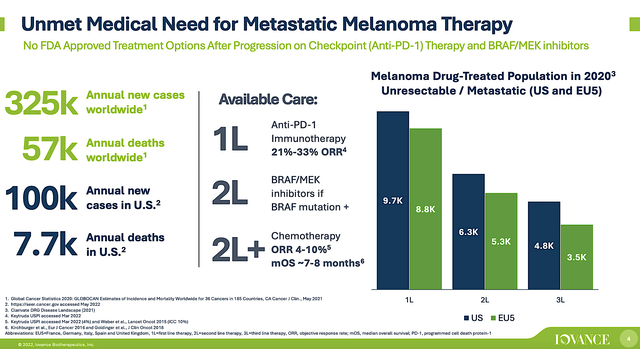

Potential Market

Viewing the figure below, there are only 325K new cases of metastatic melanoma each year. There are also other first and second-line drugs. Despite that Lifi gives the patient the best chance of survival, being the last-line drug put it at a marketing disadvantage. Simply put, unless Iovance prices Lifi at a huge premium (i.e., at least $150K), it’ll be difficult to generate meaningful sales.

Figure 6: Potential metastatic melanoma market for Lifi.

Financial Assessment

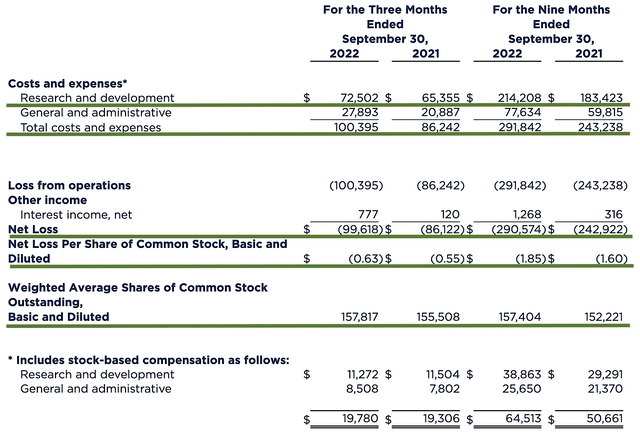

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 3Q2022 earnings report for the period that concluded on September 30.

As with other developmental-stage companies, Iovance has yet to generate revenues. As such, let us analyze other meaningful metrics. On that note, the research and development (i.e., R&D) registered at $72.5M compared to $65.3M for the same period a year prior. I viewed the 11.0% R&D increase positively because the money invested today can turn into blockbuster results tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $99.6M ($0.63 per share) net losses compared to $86.1M ($0.55 per share) net declines for the same comparison. On a per-share basis, the bottom line is depreciated by 14.5%. You can see that this made sense because the company invested more in R&D.

Figure 7: Key financial metrics.

About the balance sheet, there were $366.6M in cash. Against the $100.3M quarterly OpEx, there should be adequate capital to fund operations into 3Q2023. Simply put, the Iovance cash position is a bit weak relative to the burn rate. As such, it’s likely that the company would raise capital either this quarter or the next.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the biggest risk for Iovance is if Lifi monotherapy can gain FDA approval in late 2023. There is also a concern that the confirmatory combo study of Lifi might not generate positive data. With Dr. Mariah Fardis’ departure, there can be other issues deeper than the surface that investors do not know.

Final Remarks

In all, I recommend Iovance Biotherapeutics as a buy with 4.5/5 stars. Despite its rocky transition, Iovance Biotherapeutics is a promising growth stock that is operating at “growth inflection.” The company is set to give the FDA any requisite data to complete its rolling BLA for Lifi. If the filing is successful in Q1 next year, you can anticipate that investors’ sentiment for Iovance Biotherapeutics, Inc. stock would significantly improve. And if the confirmatory study proves to be positive, TILs would likely become mainstream treatment in the future.

Be the first to comment