master1305

Written by Nick Ackerman, co-produced by Stanford Chemist. A version of this article was published to members of the CEF/ETF Income Laboratory on November 15th, 2022.

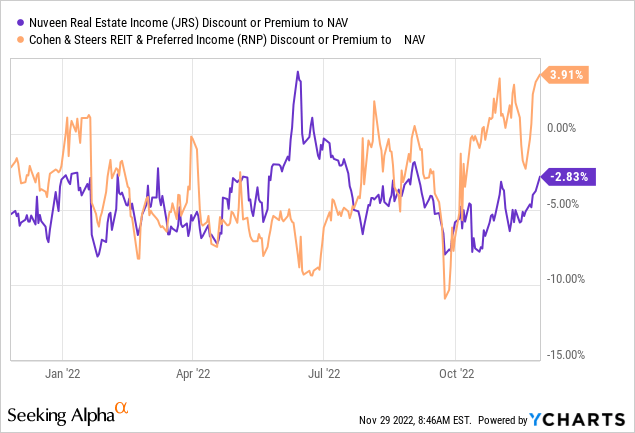

Nuveen Real Estate Income Fund (NYSE:JRS) has narrowed its discount since the last time we looked at the fund. However, it is still a relatively attractive discount for the more established real estate-focused funds. Cohen & Steers REIT & Preferred & Income (RNP) is a fairly close match with its split between real estate equity positions and preferred exposure.

One of the causes for RNP to run up to a premium is the year-end special that is likely making investors excited to crowd in. Longer-term results of RNP have also produced better results. However, with the valuation difference at this time, JRS could be seen as a bit more attractive.

After the ex-div date, I believe that RNP shares could slip. That could at least make JRS a better short-term bet, but longer term, RNP has been the big winner.

The distribution yield is currently higher for JRS. However, that could come under pressure as the sustainability of that payout is in question.

The Basics

- 1-Year Z-score: 0.75

- Discount: 2.83%

- Distribution Yield: 10.13%

- Expense Ratio: 1.29%

- Leverage: 30.55%

- Managed Assets: $341.77 million

- Structure: Perpetual

JRS has an investment objective of “high current income and capital appreciation.” Their intention to achieve this is through investing “primarily in income-producing common stocks, preferred stocks, convertible preferred stocks and debt securities issued by real estate companies.” They also more specifically note that “at least 75% of the Fund’s managed assets will be in securities rated investment grade.”

The last time we touched on JRS, we noted that the fund’s borrowings had come down.

In fact, it looks like they had to trim their borrowings from $144 million at the end of 2021 to $123.4 million. That could cause permanent damage due to not having the same amount of capital to rebound with when the market rebounds. As we saw through July, there was a strong rebound. That might not necessarily continue, but it already highlights the risk of a highly leveraged fund when they eventually have to cut back on its borrowings.

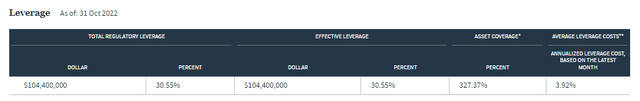

Once again, we see that borrowings have come down. They are now sitting on borrowings of $104.4 million at the end of October. As the market and the REIT space continue to be pressured by rates, it seems they’ve had to limit their borrowings. That is one of the reasons that earnings potential to cover a higher distribution can be a concern.

JRS Leverage Facts (Nuveen)

The costs of the leverage are also rising, which can also reduce the net investment income that is left over for shareholders. To offset some of this negative impact, the fund has entered into interest rate swaps. This will partially offset the higher interest rates experienced.

JRS Interest Rate Swaps (Nuveen)

Performance – Other Options To Consider

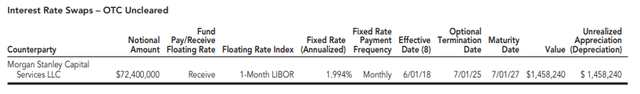

As noted above, RNP is quite a similar fund. However, there are a couple of other considerations in the space. There is Neuberger Berman Real Estate Securities Income Fund (NRO); similarly, they invest in a split between equity REITs and preferreds. There is also the newer fund from Cohen & Steers, Cohen & Steers Real Estate Opportunities and Income Fund (RLTY). As a new fund, it has sunk to a large discount and is probably still too new for some investors.

When comparing discounts, RLTY seems like the best opportunity at this time. NRO is overpriced relative to JRS. Which is why I recently sold my JRS position in favor of adding RLTY. That being said, RLTY’s discount is quickly evaporating more recently.

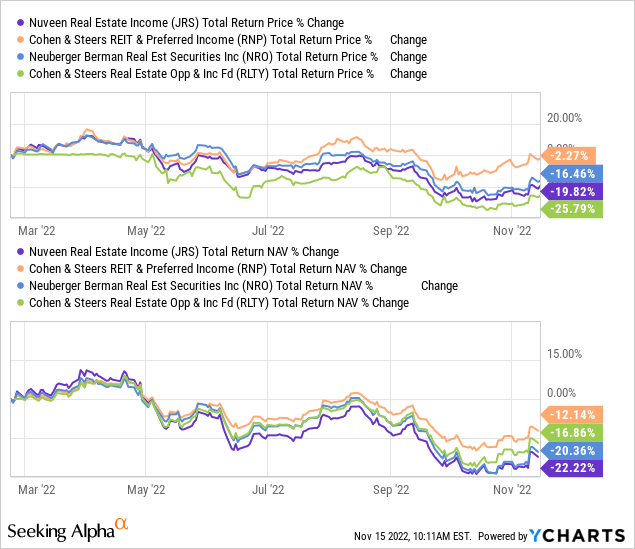

On an almost YTD basis, JRS has been the laggard of the group. I say “an almost YTD basis” because RLTY launched in February 2022.

The only place it outperformed is on a total share price return basis as RLTY slipped to a discount over 13%. Therefore, the total share price return of JRS was higher simply by not dropping the same as RLTY.

Ycharts

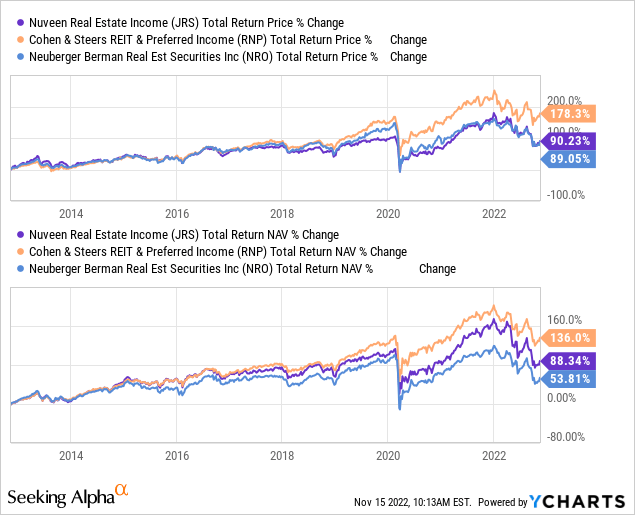

When looking longer-term, we will eliminate RLTY to see a comparison. For that, we can see that JRS has outperformed NRO. However, both JRS and NRO lagged behind the better-managed RNP.

Ycharts

The biggest hit that JRS and NRO took was primarily in 2020. During the COVID crash, these funds had to deleverage. With deleveraging, they were forced to sell investments at a low and not have that invested to rebound. As we know, the rebound happened quickly. 2022 is similar for JRS, but instead, now it appears to be a slow deleveraging process. So it won’t hurt all at once, but it seems to be several cuts along the way.

Distribution – Double-Digit But Sustainability Questioned

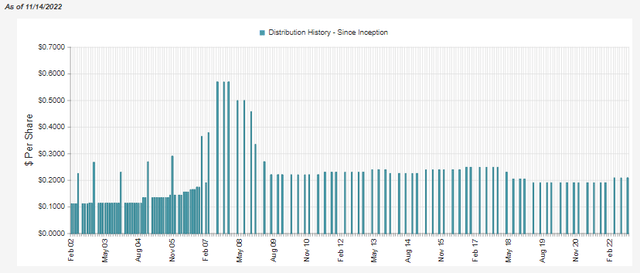

One of the things that surprised me about JRS is that they raised their distribution heading into this year. At the time, they didn’t seem to have to deleverage, but it still seemed odd as REITs appeared weak.

JRS Distribution History (CEFConnect)

Their coverage will rely significantly on capital gains. Seeing REITs performing weakly, that’s what really surprised me about the raise. NII distribution coverage came in at almost 30%.

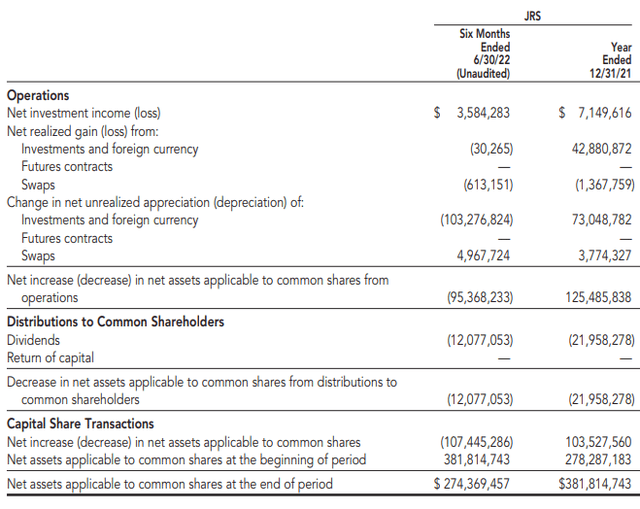

JRS Semi-Annual Report (Nuveen)

They had no realized gains during the first six months of the year. They had a substantial portion of unrealized depreciation. The bright spot was the contribution of interest rate swaps on an unrealized appreciation basis. On the other hand, the swaps contributed to realized losses.

When needing capital gains to cover the distribution, this isn’t a good trend. This is because they are paying out assets that won’t be available for future earnings, whether that is income or realized gains. The deleveraging amplifies this impact.

All things equal, that should mean the annual report that comes out next year should reflect a drop in NII. That’s why the 10.13% distribution yield might appear attractive, but caution is warranted if they can maintain the current level for an extended period. That would be barring any snap recovery in the market.

JRS’s Portfolio

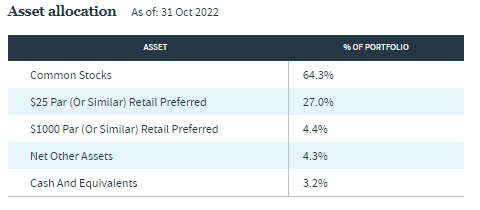

JRS’s portfolio is split between equity and preferred positions, which leaves them more flexible to invest where they see fit.

JRS Asset Allocation (Nuveen)

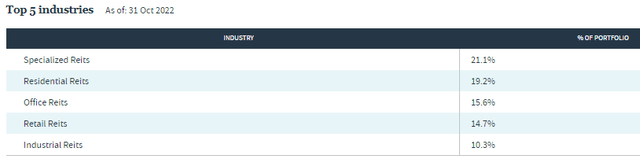

The industry exposure is someplace that I have previously highlighted as being a bit riskier. They invest in residential, office and retail REITs, which can all be more impacted during a recession. Office exposure is in a longer-term decline as office demand remains lower than pre-pandemic levels with a work-from-home movement.

JRS Industry Allocation (Nuveen)

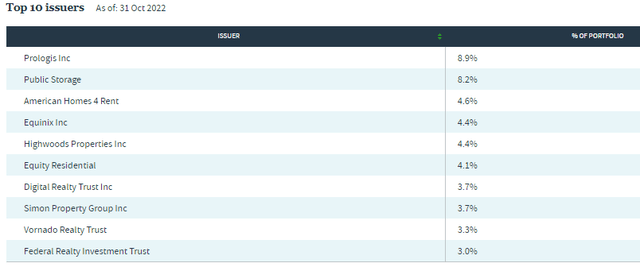

That being said, several of the top positions are fairly attractive. We have Prologis (PLD) as an industrial REIT that can benefit over the longer term from e-commerce. They recently closed the acquisition of Duke Realty, making the largest industrial REIT even larger. PLD is a significant holding in JRS’s portfolio. The fund holds 84 positions overall, with PLD at nearly a 9% weighting.

JRS Top Ten (Nuveen)

Public Storage (PSA) is the second largest holding for JRS, with a significant weighting of 8.2%. The name of the REIT sums it up; they focus on self-storage and are classified as a specialized REIT.

Equinix (EQIX) is part of the specialized REIT segment in which JRS invests. EQIX specializes in internet and data centers. Digital Realty (DLR) operates in the same space. These types of REITs can be more focused on growth going forward. They’ve certainly taken a hit on a YTD basis, but they also previously ran up to quite expensive levels.

Potentially noteworthy is that JRS doesn’t hold any exposure to either of the major tower REITs in their REIT fund. These are American Tower (AMT) and Crown Castle (CCI), both of these positions are present in JRS’s sister fund, Nuveen Real Asset Income and Growth Fund (JRI). It’s also present in each of the Cohen & Steers funds.

Conclusion

JRS has deleveraged a bit further, which can put added pressure on the earnings potential of the fund going forward. That raises the question of even further potential stress on the fund’s already elevated distribution yield. At this time, RLTY seems to be a better consideration. However, it is a newer fund, so some investors won’t find it appealing. Another choice could be RNP, but waiting patiently for the premium to come down seems prudent. For those more comfortable holding JRS at this time as a diversifier, that’s certainly an attractive proposition as well. The fund’s discount also makes it fairly attractive to consider.

Be the first to comment