Andy Feng/iStock Editorial via Getty Images

Shares of NIO (NYSE:NIO) dropped off after the electric vehicle maker reported earnings for the first-quarter last week. However, the EV start-up beat top line and EPS predictions despite growing production challenges in the first quarter. NIO’s outlook for the second-quarter disappointed, unfortunately, which helped create new obstacles for NIO’s shares in the short term. With inflation accelerating again in May, shares of NIO are going to have a very hard time powering higher this year.

Deteriorating unit economics

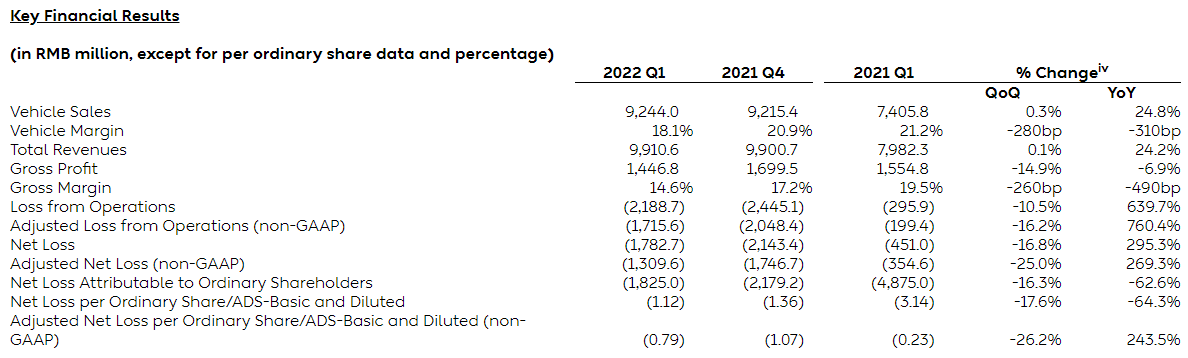

In Q1’22, NIO had net sales of $1.56B, beating top line expectations by $80M. NIO’s non-GAAP loss was $0.13 per-share, which was $0.03 per-share better than expected.

Despite the top line and EPS beat, the earnings card was not very impressive, and it showed multiple problems that NIO will have to work through in the coming months. One of two concerns for me was that revenue growth continued to slow down markedly in the first quarter, a side effect of curtailed production and weaker delivery growth due to COVID-19 lockdowns. NIO generated total revenues of 9.91B Chinese yuan in the first quarter which calculates to $1.56B, showing 24% year over year growth. In Q4’21, NIO’s revenue growth was significantly stronger at 49.1% year over year, so the production slowdown is really a lot more severe than initially feared and starting to have a revenue impact.

Because revenue growth slowed down in the first quarter, the company also saw a deterioration in its unit economics. NIO’s vehicle margins decreased 310 basis points year over year to 18.1%, indicating that supply chain problems and a more unfavorable sales mix have started to impact unit profitability at the EV maker. While I can deal with delayed profitability, deteriorating vehicle margins imply that NIO is keeping fewer dollars for each electric vehicle sold. Since NIO is operating in the premium segment and has vehicle margins twice as high as rival XPeng (XPEV), a decrease in vehicle margins is having a much larger dollar impact for NIO than for its rivals that compete in a lower-priced segment.

NIO

Disappointing delivery outlook for Q2’22

NIO’s delivery outlook for the current quarter was weak as well. The EV maker expects to deliver only 23 thousand to 25 thousand electric vehicles this quarter, despite ET7 sedan production expected to ramp up nicely. The delivery range implies year over year growth of 5.0% to 14.2%. In Q1’22, NIO delivered 25,768 electric vehicles, so Q2’22 delivery predictions imply a quarter over quarter drop of up to 10.7% as COVID-19 restrictions and factory lockdowns are seen as ongoing production challenges for the electric vehicle company.

NIO’s guidance has created new obstacles for the stock

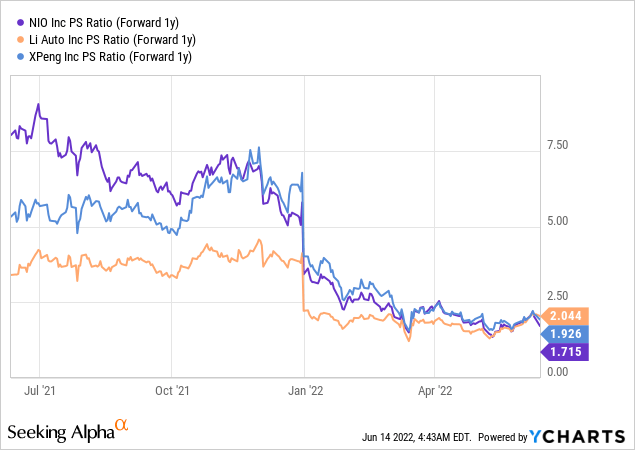

I believe the market is currently not prepared to value NIO based on its long-term potential in the electric vehicle industry… and the firm’s valuation shows this. NIO’s shares are truly cheap, selling for a market-capitalization-to-sales ratio of 1.7 X. XPeng’s and Li Auto’s (LI) commercial prospects are also heavily discounted, showing that the market is currently not very appreciative of EV makers. The market currently doesn’t like growth stocks and recent spikes of market volatility indicate that it may take a while before investors see capital flowing back into the electric vehicle sector.

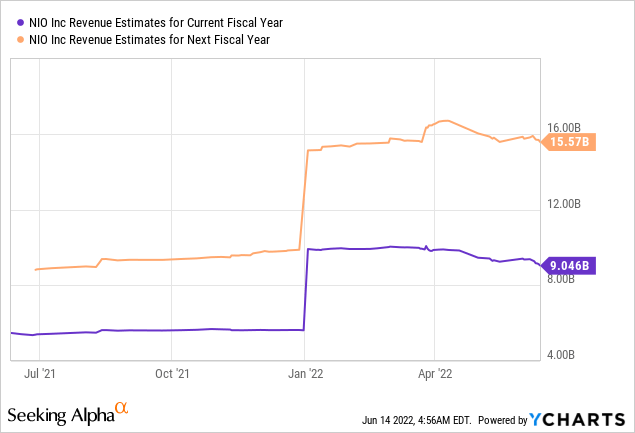

Unfortunately, I expect NIO’s FY 2022 and FY 2023 revenue estimates to keep dropping…

Risks with NIO

NIO’s biggest risks relate to the ongoing production ramp in FY 2022. NIO is going to start deliveries of the ET5 sedan in September, if everything goes according to plan, but timeline risks have increased materially this year as COVID-19 lockdowns in China have exacerbated already-severe supply chain problems. A sharper slowdown in production and delivery growth in 2022 is the single biggest issue for NIO and its stock. The outlook for the second quarter was also not strong enough to justify a reversal in NIO’s short term stock trend. Because supply chain problems are likely here to stay, investors must brace themselves for a continual slowdown in delivery growth this year.

Final thoughts

NIO’s short-term picture looks bleak, unfortunately. Growth companies like NIO need to convince investors that they can ramp up production and revenues fast, otherwise investors are not willing to pay a premium valuation factor. The current macro setup with increased production risks and inflation indicates a more challenged growth picture for NIO going forward. That NIO’s unit economics are deteriorating is a concern, too, and it could create new obstacles for the stock in the short term!

Be the first to comment