07_av/E+ via Getty Images

A Quick Take On Opera Limited

Opera Limited (NASDAQ:OPRA) recently reported its Q1 2022 financial results on April 28, 2022, reaffirming its previous 2022 revenue guidance estimates.

The company provides a family of internet browser software products and related advertising and other content worldwide.

In my view, OPRA looks inexpensive on a variety of metrics and is well positioned with some of its specialty products to increase its growth and margins.

My outlook on the stock is a Buy at around $5.00 per share.

Opera Overview & Market

Oslo, Norway-based Opera was founded in 1995 to create software solutions for internet web page browsing environments, for desktops and mobile devices.

The firm is headed by Co-CEO Song Lin, who was previously Opera’s Chief Operating Officer.

The company’s primary offerings include:

-

Browser software

-

Advertising manager

-

Gaming portal

-

Shopping rewards

-

Communications

-

Ancillary products

The firm acquires customers primarily via online marketing and through major mobile application platforms.

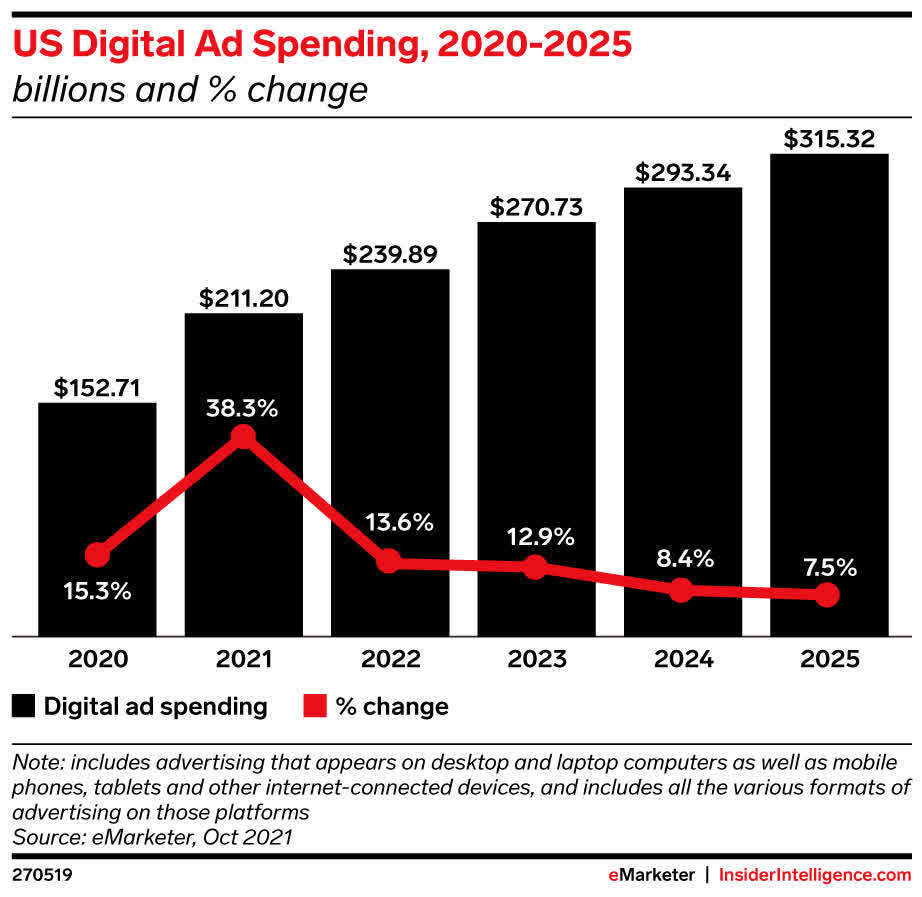

According to a market research note by eMarketer, the market for digital ad spending was an estimated $153 billion in 2020 and is forecast to reach $315 billion by 2025.

In 2020, despite the global pandemic, digital ad spending grew by 15.3%.

The note asserts that 2021 saw significantly increased digital advertising growth after a slower than expected 2020, but that future growth rates will decline through 2025.

The chart below shows the report’s forecasted growth trajectory and digital ad spend percentage of total, from 2020 to 2025:

U.S. Digital Ad Spending (eMarketer)

Opera’s Recent Financial Performance

-

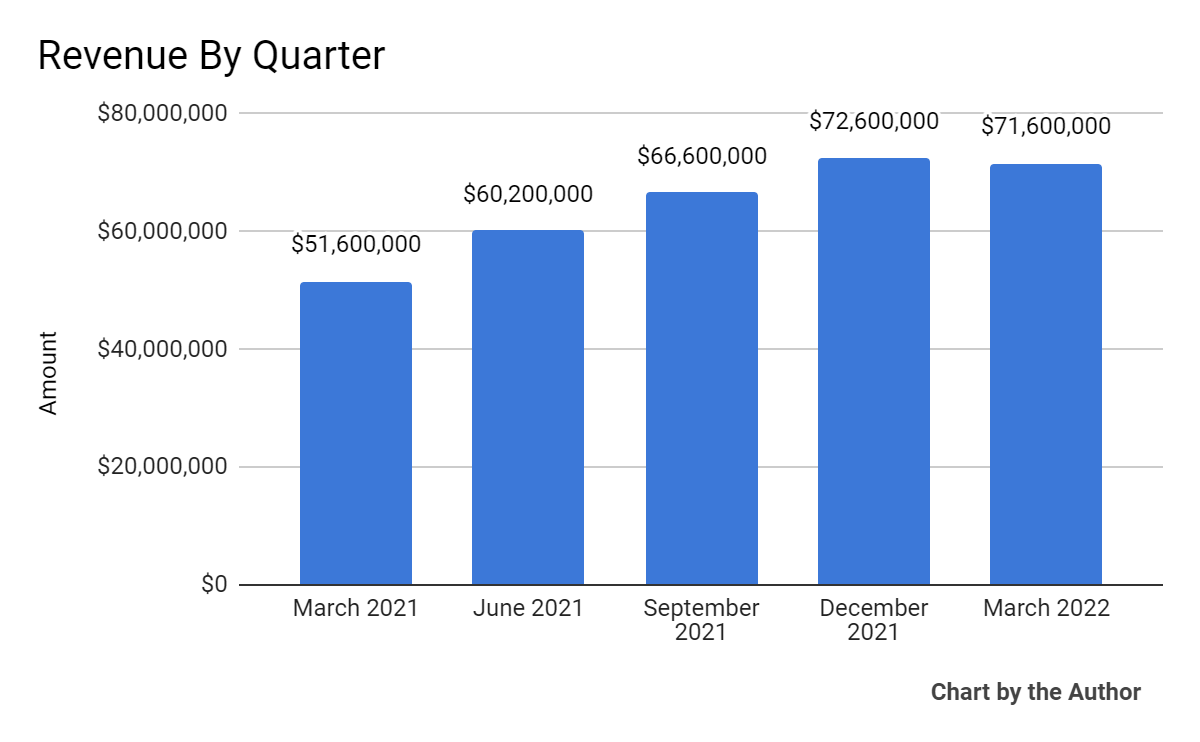

Total revenue by quarter has risen impressively in the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

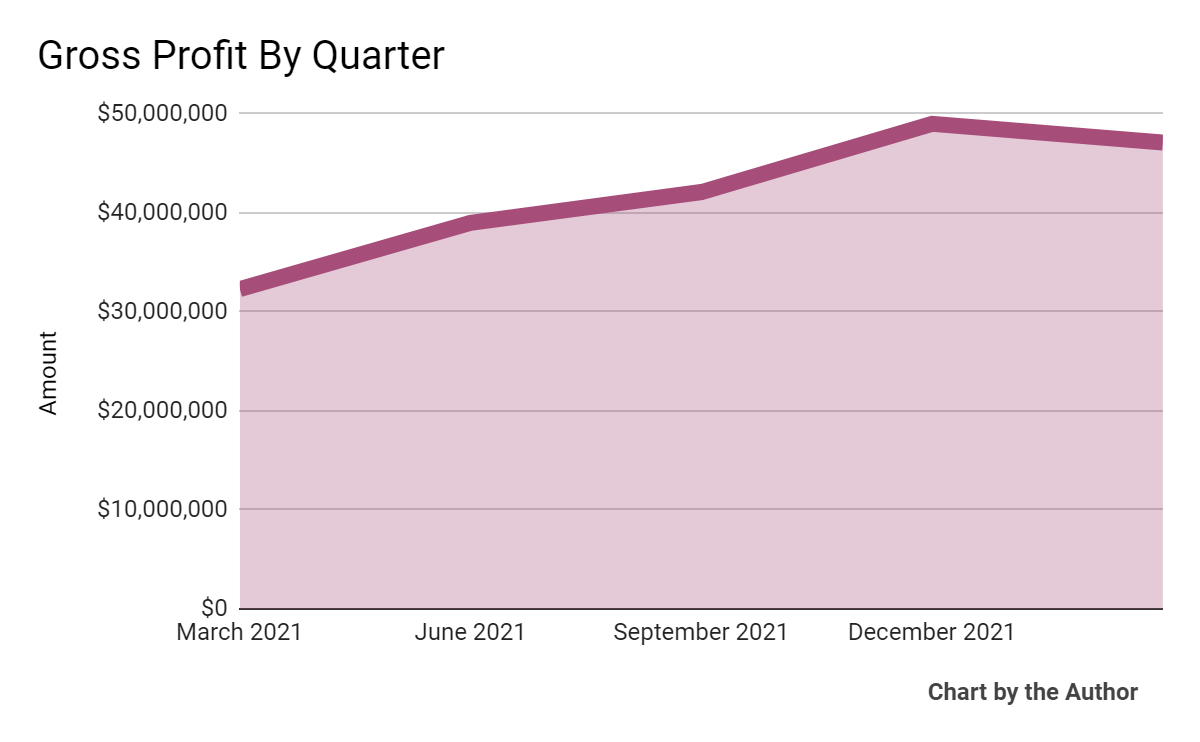

Gross profit by quarter has grown with approximately the same trajectory as that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

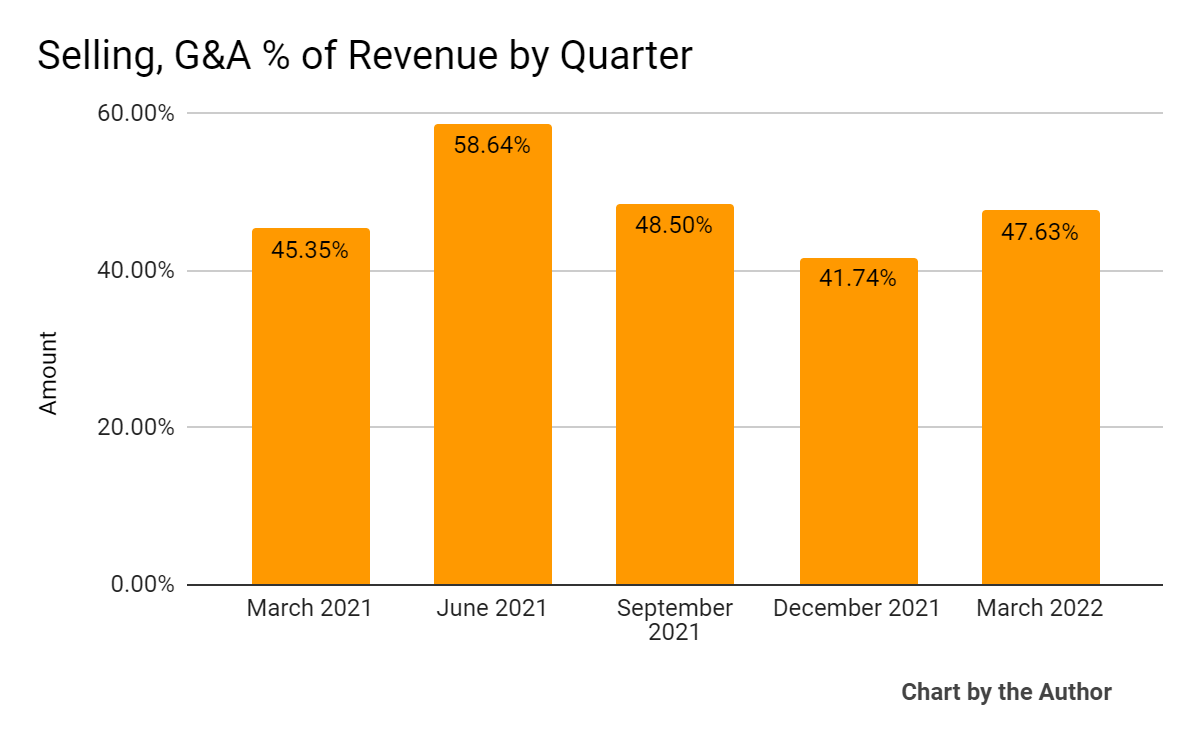

Selling, G&A expenses as a percentage of total revenue by quarter have performed as follows:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

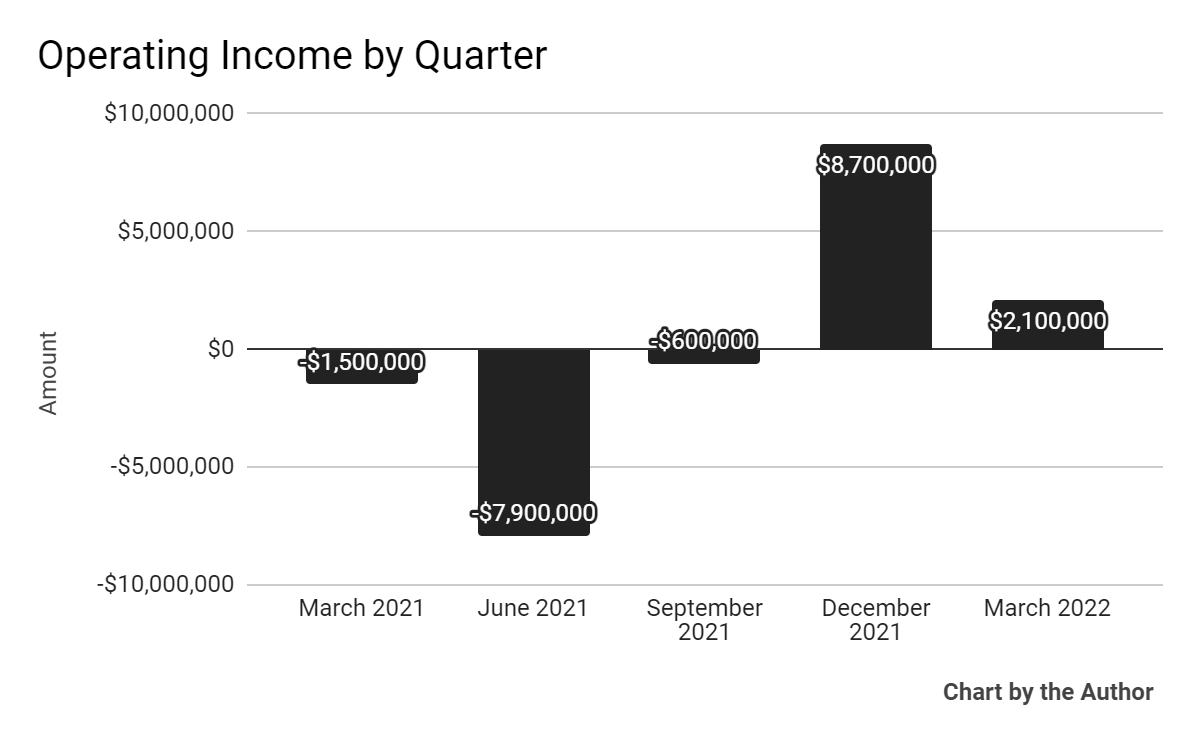

There has been no clear trend for operating income:

5 Quarter Operating Income (Seeking Alpha)

-

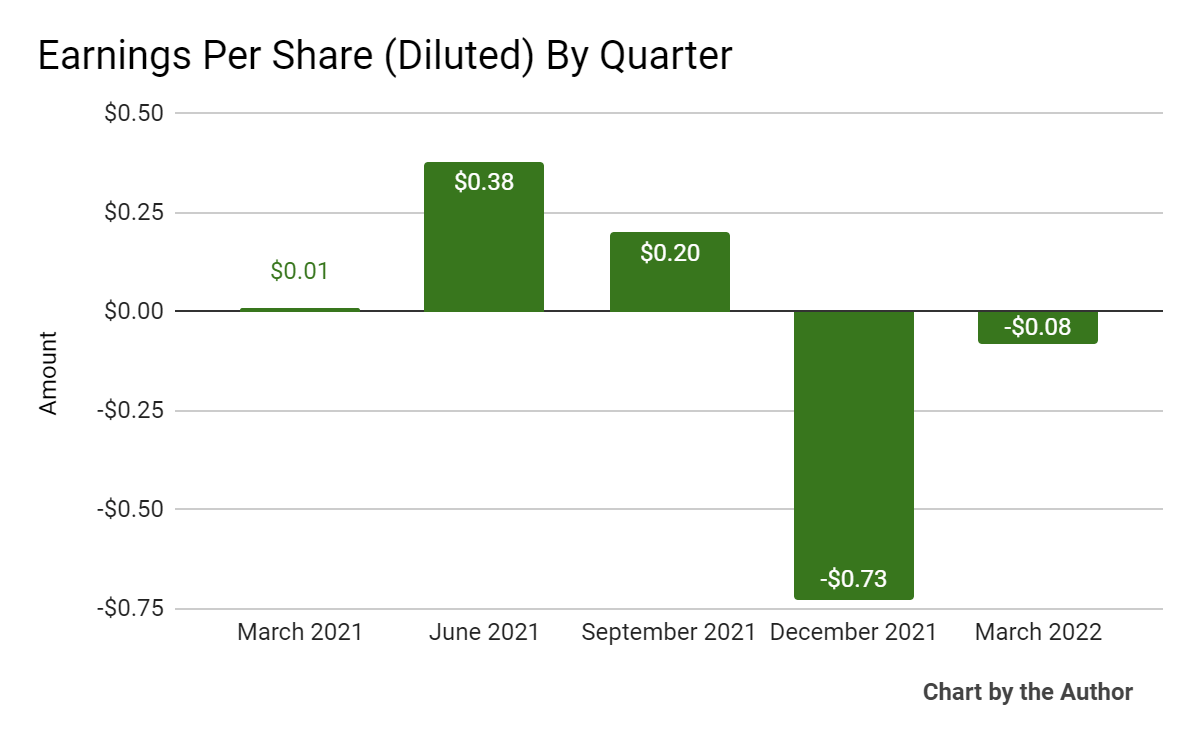

Earnings per share (Diluted) have recently turned negative:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

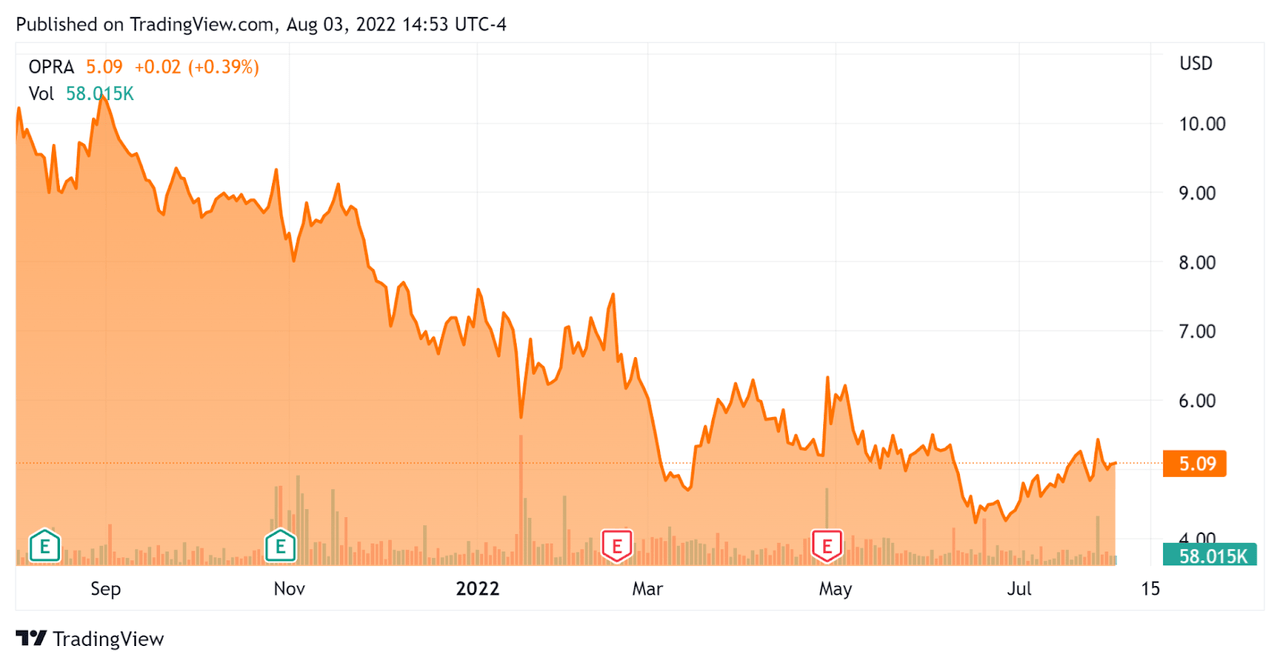

In the past 12 months, OPRA’s stock price has fallen 47.6% vs. the U.S. S&P 500 index’s drop of around 5.9%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Opera

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$406,010,000 |

|

Market Capitalization |

$583,740,000 |

|

Enterprise Value / Sales [TTM] |

1.50 |

|

Revenue Growth Rate [TTM] |

53.39% |

|

Operating Cash Flow [TTM] |

$32,750,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.23 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

OPRA’s most recent GAAP Rule of 40 calculation was 57% as of Q1 2022, so the firm has performed well recently in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

53% |

|

GAAP EBITDA % |

3% |

|

Total |

57% |

(Source – Seeking Alpha)

Commentary On Opera

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted its revenue growth in Western markets with advertising revenue now accounting for 54% of the company’s revenue.

OPRA is focusing its efforts on upper-tier markets and users. For example, it launched its GX browser aimed at gamers, which has grown to more than 2 million mobile and 14 million PC users.

GX generates $2.70 in annualized revenue per user, which is more than 3 times higher than Opera as a whole. Management intends to introduce tailored advertising as well as other economic models.

As to its financial results, revenue exceeded the top-end of its previous guidance and despite a revenue headwind associated with the war in Ukraine.

Operating expenses were in line with management’s expectations as OPRA eked out a small GAAP operating profit.

The company previously divested ownership stakes to focus on its core business, raising cash and marketable securities by quarter-end to nearly $400 million. It currently has a $50 million share buyback program in place, but only purchased $3 million in Q1.

Also, management is seeking to divest its OPay stake, which it currently has on the books at an $84 million valuation.

Looking ahead, management reiterated its revenue and adjusted EBITDA guidance, but expected to reduce marketing spend in Q2.

Regarding valuation, the market is valuing OPRA at an EV/Revenue multiple of 1.5x despite very strong revenue growth, breakeven operating results, and a renewed focus on its core business.

The primary risk to the company’s outlook is a softer advertising market due to a macroeconomic slowdown. Since most of the firm’s revenue is now from advertising, this dynamic will be important to watch.

Potential upside catalysts could be the sale of its OPay stake and improvements in its eastern European region business if headwinds there abate.

In my view, OPRA looks inexpensive on a variety of metrics and is well positioned with some of its specialty products to increase its growth and margins.

My outlook on OPRA is a Buy at around $5.00 per share.

Be the first to comment