putilich/iStock via Getty Images

The meltdown of FTX (FTT-USD) continues to spark controversy and commentary. A recent theme in this commentary is that the FTX disaster represents a failure of centralization that decentralized finance – “DeFi” – could correct. Examples include contributions by the very smart and knowledgeable Campbell Harvey of Duke, and an OpEd in WSJ.

I agree that the failure of FTX demonstrates that the crypto business as it is, as opposed to how it is often portrayed, is highly centralized. But the FTX implosion does not demonstrate that centralization of crypto trading per se is fundamentally flawed: FTX is an example of centralization done the worst way, without any of the institutional and regulatory safeguards employed by exchanges like CME, Eurex, and ICE.

Indeed, for reasons I have laid out going back to 2018 at the latest, the crypto market was centralized for fundamental economic reasons, and it makes sense that centralization done right will prevail in crypto going forward.

The competitor for centralization advocated by Harvey and the WSJ OpEd and many others is DeFi. This utilizes the nature of blockchain technology and smart contracts to facilitate crypto trading without centralized intermediaries like exchanges.

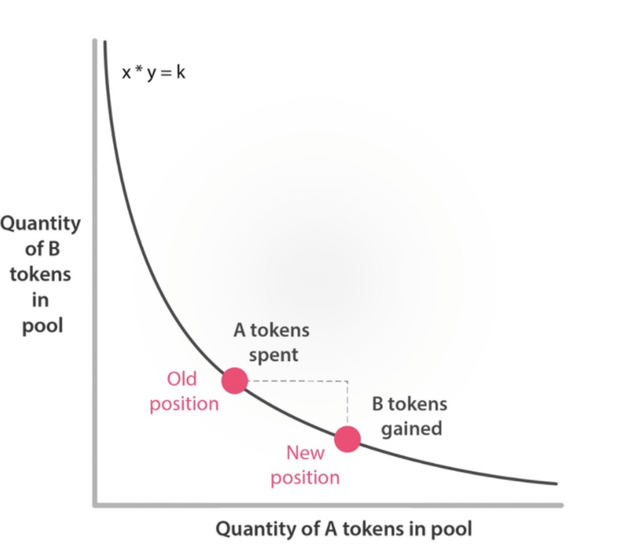

One of the exemplars of the DeFi argument is “automated market making” (“AMM”) of crypto. This article provides details, but the basic contours are easily described. Market participants contribute crypto to pools consisting of pairs of assets. For example, a pool may consist of Ether (ETH-USD) and the stablecoin Tether (USDT-USD). The relative price of the assets in the pool is determined by a formula, e.g., XETH*XUSDT=K, where K is a constant, XETH is the amount of ETH in the pool and XUSDT is the amount of Tether. If I contribute 1 unit of ETH to the pool, I am given K units of USDT, so the relative price of ETH (in terms of Tether) is K: the price of Tether (in terms of Ether) is 1/K.

Automated Market Maker Equation (CoinDesk)

Fine. But does this mechanism provide price discovery? Not directly, and not in the same way a centralized exchange like CME does for something like corn futures. DeFi/AMM essentially relies on an arbitrage mechanism to keep prices aligned across exchanges (like, FTX once upon a time and Binance now) and other DeFi AMMs. If the price of Ether on one platform is K but the price on another is, say, .95K, I buy ETH on the latter platform and sell Ether on the former platform. (Just like Sam and Caroline supposedly did on Alameda!) This tends to drive prices across platforms towards equality.

But where does the price discovery take place? To what price do all the platforms converge? This mechanism equalizes prices across platforms, but in traditional financial markets (TradFi, for the cognoscenti!), price discovery tends to be a natural monopoly, or at least has strong natural monopoly tendencies. For example, in the days prior to Reg NMS, virtually all price discovery in NYSE stocks occurred on the NYSE, even though it accounted only for about 75-80 percent of volume. Satellite markets used NYSE prices to set their own prices. (In the Reg NMS market, the interconnected exchanges are the locus of price discovery.)

Why is this? – The centripetal forces of trading with private information. Something that Admati-Pfleiderer analyzed 30+ years ago, and I have shown in my research. Basically, informed traders profit most by trading where most uninformed traders trade, and the uninformed mitigate their losses to the informed by trading in the same place. These factors reinforce one another, leading to a consolidation of informed trading in a single market, and the consolidation of uninformed trading on the same market except to the extent that the uninformed can segment themselves by trading on platforms with mechanisms that make it costly for the informed to exploit their information, such as trade-at-settlement, dark pools, and block trading. (What constitutes “informed” in crypto is a whole other subject for another time.)

It is likely that the same mechanism is at work in crypto. Although trading consolidation is not as pronounced there as it is in other asset classes, crypto has become very concentrated, with Binance (BNB-USD) capturing around 75-80 percent of trading even before the FTX bankruptcy.

So theory and some evidence suggests that price discovery takes place on exchanges, and that DeFi platforms are satellite markets that rely on arbitrage directly or indirectly with exchanges to determine price. (This raises the question of whether the AMM mechanism is sufficiently costly for informed traders to insure that their users are effectively noise traders.)

The implication of this is that DeFi is not a close substitute for centralized trading of crypto. (I note that DeFi trading of stocks and currencies is essentially parasitical on price discovery performed elsewhere.) So just because SBF centralized crypto trading in the worst way doesn’t mean that decentralization is the answer – or will prevail in equilibrium as anything more than an ancillary trading mechanism suited for a specific clientele, and not be the primary locus of price discovery.

The future of crypto will therefore almost certainly involve a high degree of centralization – performed by adults, operating in a rigorous legal environment, unlike SBF/FTX. That’s where price discovery will occur. In my opinion, DeFi will play an ancillary role, just as off-exchange venues do today in equities and did prior to Reg NMS.

One last remark. One thing that many in the financial markets deplore is the fragmentation of trading in equities. It is allegedly highly inefficient. Dark pools, etc., have been heavily criticized.

Fragmentation and decentralization is also a criticism leveled against OTC derivatives markets – here, it has been fingered as a source of systemic risk, and this criticism resulted in things like OTC clearing mandates and swap execution facility mandates.

It’s fair to say, therefore, that in financial market conventional wisdom, decentralization = bad.

But now, a failure of a particular centralized entity is leading people to tout the virtues of decentralization. Talk about strange new respect!

All of these criticisms are largely misguided. As I’ve written extensively in the past, fragmentation in TradFi is a way of accommodating the diverse needs of diverse market participants.

If crypto trading is to survive, well-operated centralized platforms will play an outsized role, supplemented by decentralized ones. Crypto is not so unique that the economic forces that have shaped market structure in stocks and derivatives will not operate there.

So don’t overgeneralize from a likely (and hopefully!) extreme case driven by the madness of woke crowds.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment