Gustavo Caballero

Normally, we are quite cautious about firms operating in the consumer discretionary segment, due to the current macroeconomic environment. Numerous headwinds, including low consumer confidence levels, rising input costs, inventory management problems, supply chain disruptions and elevated freight costs, are causing significant challenges for the companies and having substantial negative impact on the demand for their products and services. This is eventually also reflected in their financial performances.

Build-A-Bear Workshop, Inc. (NYSE:BBW) operates as a multi-channel retailer of plush animals and related products. The company operates through three segments: Direct-to-Consumer, Commercial, and International Franchising. Its merchandise comprises various styles of plush products to be stuffed, pre-stuffed plush products, and sounds and scents that can be added to the stuffed animals, as well as a range of clothing, shoes, accessories, and other toy and novelty items. And according to the strong second quarter earnings result, the firm appears to be an exception within the consumer discretionary segment, as the firm has delivered record-breaking first half total revenues and pre-tax income.

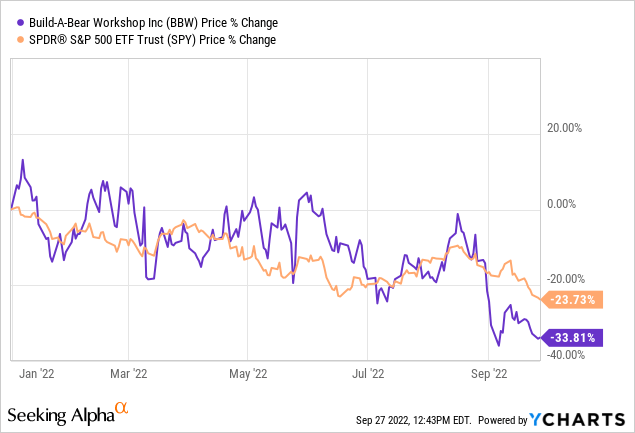

Despite the strong results, however, the stock has substantially underperformed the broader market year-to-date.

In this article, we are going to take a look at whether BBW is indeed as attractive as it appears at first sight. We will highlight some of the pros and cons, including the main risks that need to be understood before investing in the firm.

Strong second quarter results and promising outlook

Revenues in the first half of the year totaled $218.3 million, an increase of 17.1% compared to the same period in 2021. From this, $100.7 million were generated in the fiscal second quarter, representing an increase of 6.3% year over year.

While first half pre-tax income was $25.8 million, substantially higher than $22.7 million a year ago, in the second quarter pre-tax income was only $7.6 million, down from the $9.5 million in Q2 2021. This decrease in the second quarter was largely driven by the incremental freight expenses of about $3.8 million.

These figures look impressive in the current macroeconomic environment. Further, the firm has mentioned that the cost pressure is likely to improve in the second half of the year, also resulting in an improving gross margin.

Gross profit margin was 49.6%, compared to 53.2% in the fiscal 2021 second quarter. The 360 basis-point contraction in gross profit margin was primarily driven by the negative impact of an increase of approximately 400 basis points in transportation costs, as well as other inflationary pressures, partially offset by leverage of fixed occupancy and warehouse costs and lower promotional activity. The Company expects its ongoing mitigation efforts along with some moderation in freight cost pressure to contribute to an improvement in gross profit margin in the second half of fiscal 2022 versus the first half of 2022.

Due to the strong first half results and optimistic outlook, the firm has reiterated its full year guidance.

Given its positive first half and year-to-date performance, the Company has confidence that it is continuing to make progress on its strategic initiatives including the acceleration of its digital transformation, the evolution of its retail experience and footprint and the leveraging of its strong balance sheet and cash flow to make capital allocation decisions that are intended to drive growth and enhance shareholder value. With its current momentum continuing into the third quarter, the Company is reaffirming its fiscal 2022 guidance […]

While it feels reassuring for shareholders and potential investors that the firm has faith in its full year guidance, we once again recommend to be cautious.

We see two major factors that could have an impact on the performance going forward:

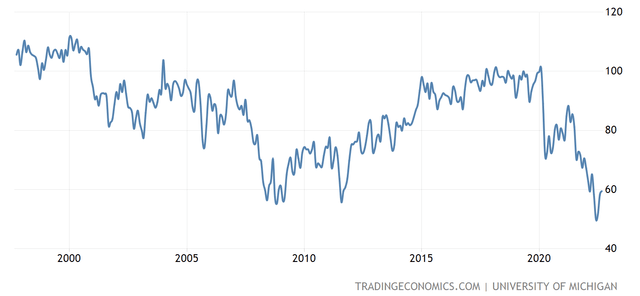

1. Consumer confidence

Consumer confidence remains at extremely low levels, signaling that people are likely to change their spending behaviour, by cutting back on purchases of discretionary and non-essential goods. Which in turn could lead to a declining demand for BBW’s products.

U.S. Consumer confidence (tradingeconomics.com)

2. Inventory management

Inventory has increased significantly year-over-year. The reason for this has been stated by the firm:

Total inventory at quarter end was $87.7 million, an increase of $40.4 million from the end of the fiscal 2021 second quarter reflecting strategically planned accelerated inventory purchases intended to partially mitigate inflationary and supply chain pressures. The increase in inventory as compared to the end of the fiscal 2021 second quarter reflects: (i) higher on-hand units compared to last year’s unusually low level driven by supply chain disruptions; (II) increased freight and other inflationary costs; and (III) a shift in product mix. The Company noted that it is comfortable with the composition and level of its inventory which supports increased consumer demand and critical seasonal products.

While the company expects to end the year with total inventory below the 2021 fiscal year-end level, we have seen how other retailers have been struggling this year with inventory management. Firms like Walmart (WMT) and Target (TGT) had problems with obsolete inventory and had to use large discounts to reduce their stock.

For these reasons, despite the strong first half, we believe that there may be further downside for the stock.

Share buyback program

While dividend payments represent direct cash payment to the shareholders, a share buyback is when a company buys back its own outstanding shares to reduce the number of shares available on the open market and thereby increase the value of the remaining shares. It can often signal confidence and show that the firm believes that its shares are undervalued.

In recent years, there has been some volatility in the number of shares outstanding. However, in the second half of 2021, the firm started a repurchase program worth $25 million. This repurchase program has been completed. As announced recently, the board has authorized a new share repurchase program of $50.0 million. Just to put this figure into perspective, the current market cap of the firm is about $190 million, therefore a $50 million share repurchase would reduce the number of shares outstanding by more than 25%, which could create significant value for the shareholders.

In our opinion, this has both advantages and disadvantages.

Advantage, as mentioned before, is the increase of the value of the remaining shares. Disadvantage could be reduced financial flexibility. Also, according to the last report, the cash and cash equivalents of the firm is only $14.4 million, which by far does not cover the announced repurchase program. From a capital allocation point of view, we also have to question the decision. In the current market environment, is it really the share buyback program, which should have priority? Is it really the best use of cash at the moment?

As the macroeconomic environment remains highly uncertain in the near term, we are not convinced that this large share buyback program is the best step that the firm can do. For this reason, we recommend staying away from the stock for the time being.

Key takeaways

On one hand, the strong performance in the second quarter and in the first half of the year, along with the reaffirmed full year guidance, makes BBW attractive. On the other hand, we believe that macroeconomic headwinds may keep negatively impacting the firm’s financials.

Inventory management may also lead to challenges, like we have seen in the case of WMT and TGT earlier this year.

We are not entirely convinced that the current decision for a large, new share repurchase program is the best way of allocating capital in the current market environment.

For these reasons, we rate the stock as a “sell.”

Be the first to comment