JHVEPhoto

Intro

We wrote about Celestica Inc. (NYSE:CLS) in January of this year, when we liked what we saw with respect to margin growth in last year’s fiscal third quarter. The Lifecycle solutions portfolio continued to be an area of encouragement, with top-line growth driving the company’s earnings forward. Unfortunately, though, the market remains unconvinced, as shares have lost close to 27% since we penned our last piece more than eight months ago.

Here we have the classic example of a company’s fundamentals being in conflict with what we are seeing on the technical chart. What do we mean by this? Well, given the trends we are witnessing in Celestica’s business (which we will get into), many bulls may simply not be able to explain the stock’s poor share-price performance over the past five weeks in particular. Celestica’s recent share-price action many times, for example, can react to the stock’s (or sector’s) unknown fundamentals (fears) which can send the share price into a literal tailspin.

However, with shares of Celestica now trading with a forward GAAP earnings multiple of 7.22 and with the company´s increasing sales available at a bargain discount (forward sales multiple of 0.15), there is too much to like here for the present downswing to be sustained in nature. The trends below back up our premise, which is why we see a bottom in Celestica sooner rather than later.

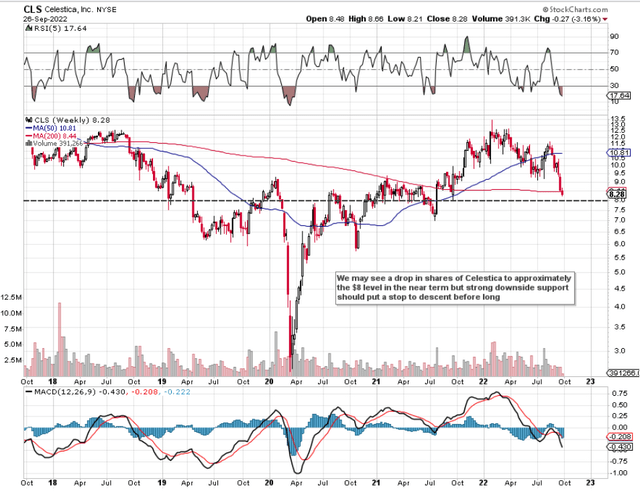

Celestica Technical Underside Support (Stockcharts.com)

Balance Sheet

Shareholders’ equity ($1.529 billion) grew by more than $100 million over the past four quarters, as net worth continues to go from strength to strength. Furthermore, the number of Celestica shares outstanding continues to come down, with the Q2 ending number of 123.2 million having already dropped to 104 million as we stand today (09/27/2022). Book value growth and a reduction of the number of shares outstanding are exactly the trends shareholders want to see in the stocks they own.

These trends are the result of strong cash-flow generation, with almost $87 million of operating cash flow being generated in the second quarter of this year alone. Management has been doing an excellent job managing working capital, as inventory has increased meaningfully in recent quarters. Moreover, capital investment remains elevated and is set to increase to support ongoing initiatives, which again is what shareholders want to see.

Strong Potential Across Multiple Businesses

Sales are expected to increase by almost 20% in this fiscal year, with earnings expected to return 30% growth over fiscal 2021. Margins remain elevated due to strength in both the company’s CCS & ATS segments. Margins in CCS were particularly to the fore in Q2, with strong growth both sequentially and over a rolling-year basis. These trends led to management raising its full-year guidance to now come in at approximately $6.7 billion in sales, along with roughly $1.70 in adjusted earnings per share. Suffice it to say, even if market conditions change and these estimates are not achieved, present trends point to sustained momentum, as we can see below.

The growth of the lifecycle solutions portfolio definitely has brought stability to the company (in terms of longevity and margin growth), where management now believes the company is far more recession-proof compared to previous times. Furthermore, in the industrial segment, irrespective of whether an economic contraction is around the corner or not, investment in green energy and automotive connectivity will remain elevated for obvious reasons.

The A&D business also offers downside support due to how defense spending tends to remain elevated irrespective of the cycle it is going through. To this point, bulls will be hoping that more fresh defense wins will minimize any recession risk due to how defense spending gets spanned out over time.

Growth opportunities in Celestica’s HealthTech business are plentiful in nature, and one would also think that demand for data center investment in the HPS business will not change over the near term irrespective of economic conditions at the time. In fact, management really only pointed to the Enterprise segment as having recession-type risk, but we are nowhere near any inflection point here given the strong order-book growth on hand.

Conclusion

Therefore, to sum up, there is every chance that Celestica drops down to approximately the $8 level in this latest down move. However, given the company’s upward earnings revisions, very low valuation, and bullish trends both within the ATS & CCS segments, we see little downside risk from that point. We look forward to continued coverage.

Be the first to comment