ablokhin

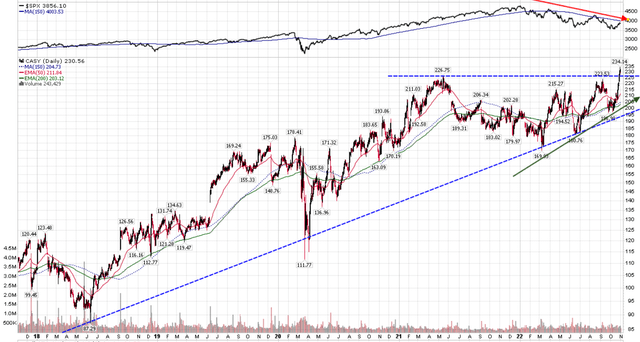

I found Casey’s General Stores Inc. (NASDAQ:CASY) while screening for relative outperformers. CASY has been making new all-time highs while the S&P 500 has declined 20%.

Casey’s, like all convenience store operators, is benefiting from the recent surge in fuel margins driven by supply/demand imbalances. Convenience stores have also benefited from investors looking for safe havens during the recent bear market. While operating momentum remains strong with healthy growth in inside sales and strong fuel margins, storm clouds are starting to gather on the horizon as inflation eats into prepared food margins and fuel volumes decline YoY. Momentum investors can stick with the trade a little bit longer, but long-term investors should be thinking about an exit.

Company Overview

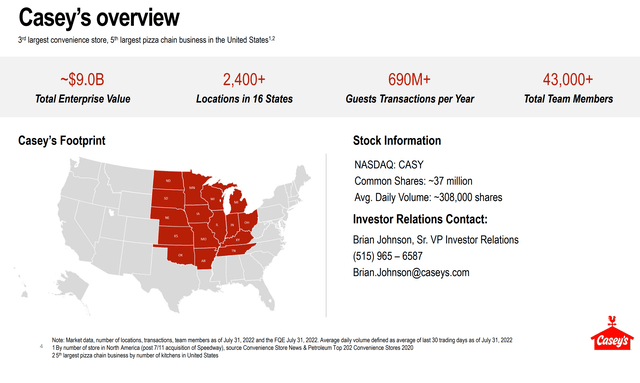

Casey’s General Stores, Inc. is the 3rd largest operator of convenience stores in the U.S. with more than 2,400 stores in the U.S. Mid-Western states (Figure 1).

Figure 1 – Casey’s Overview (CASY Investor Presentation)

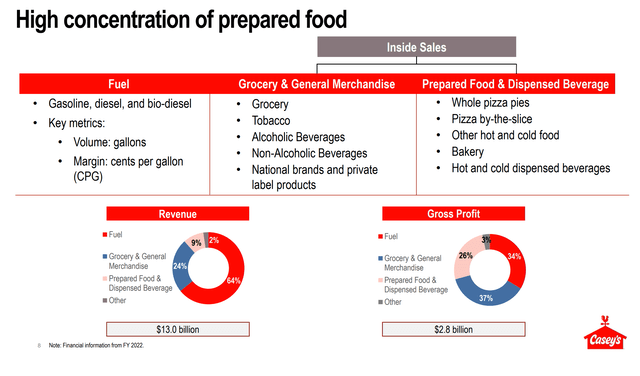

Figure 2 shows a breakdown of Casey’s revenues and profits. One of the key differentiating factors in the Casey’s story is that more than 50% of the company’s stores are located in rural towns with 5,000 people or less, so Casey’s stores play the role of grocery and general merchandise stores in addition to selling fuel. This shows up in Casey’s gross profit breakdown, where only 1/3 of gross profit dollars are derived from fuel, and 2/3 are from grocery, general merchandise, and prepared foods.

Figure 2 – Casey’s revenue and gross profit breakdown (CASY Investor Presentation)

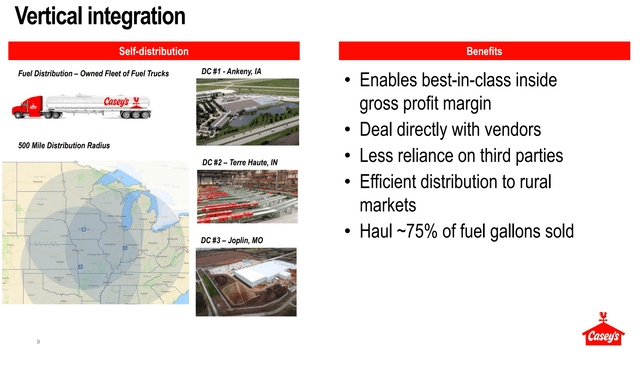

Casey’s is also vertically integrated with its own distribution centers and fleet of fuel trucks that help the company maintain best-in-class gross margins and reduces reliance on third parties (Figure 3).

Figure 3 – Casey’s is vertically integrated (CASY Investor Presentation)

What Bear Market?

Investors will be forgiven for not seeing signs of the current bear market when they look at Casey’s stock price. While the S&P has been suffering from a bear market since the beginning of the year, retreating more than 20% YTD, Casey’s stock price has recently broken out of a two-year consolidation pattern into new all-time highs (Figure 4).

Figure 4 – CASY is breaking out to new all time highs (Author created with price chart from stockcharts.com)

The reason for Casey’s outperformance is two-fold. First, according to American Fuel and Petrochemical Manufacturers (“AFPM”), a trade association representing the US refiners, global refining capacity fell by 3.3 mmbpd since 2020 with approximately 1/3 of this reduction in the U.S. Old refineries were converted to produce renewable fuels or shuttered permanently due to tightening environmental regulations. This reduction in refining capacity represents almost 6% of U.S. refining capacity at the beginning of 2020.

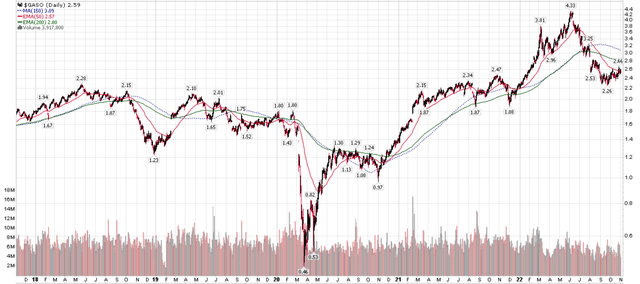

At the same time, fuel demand rebounded strongly after COVID restrictions were lifted. This surge in demand, coupled with shrinking supply, has led to a strong rebound in fuel prices, with wholesale gasoline prices going from a COVID low of $0.46 / gallon to over $4 / gallon this past summer (Figure 5).

Figure 5 – RBOB Gasoline Price (stockcharts.com)

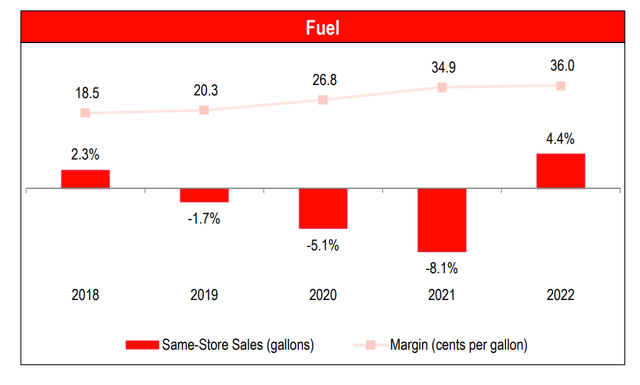

More importantly, the tight market dynamics (demand outstripping supply) have meant increasing fuel margins for retailers like Casey’s. For Casey’s, its margin per gallon of fuel sold has increased from 18-20 cents / gallon prior to the pandemic to 36 cents / gallon in 2022, significantly boosting profitability (Figure 6).

Figure 6 – Casey’s fuel margin (CASY Investor Presentation)

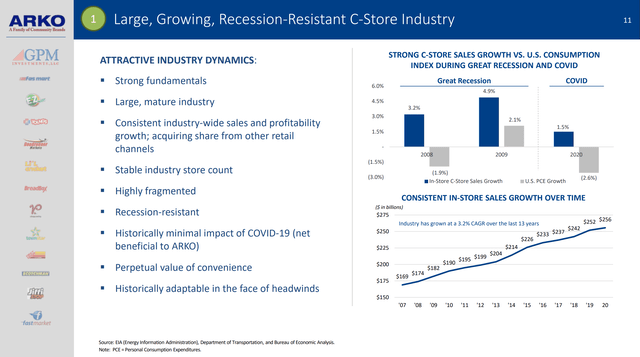

Second, with an ongoing bear market, investors have been bidding up safe haven companies that can continue to grow revenues and earnings despite the threat of a slowing economy. Convenience stores is one of the most defensive industries in the market as they primarily sell fuel, a consumer staple. C-store sales grew even during the 2008 Great Financial Crisis and the 2020 COVID-pandemic when the rest of personal consumption expenditures fell (Figure 7).

Figure 7 – Convenience stores have been recession resistant (ARKO Investor Presentation)

Slow And Steady Expansion Plans…

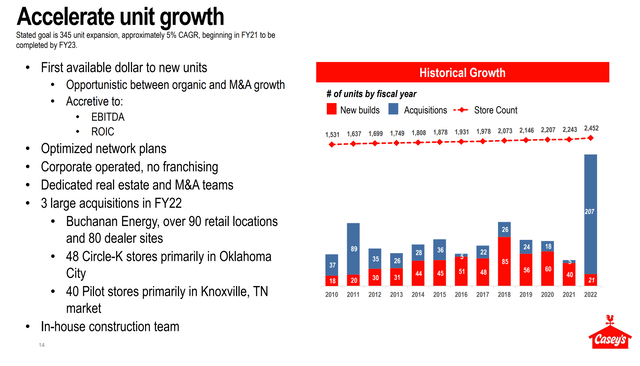

Another attractive aspect to the Casey’s story is its slow and steady growth plans through organic new store developments and M&A transactions. Since 2010, Casey’s store count has grown by 921 stores or a 4% CAGR. The pace of growth has increased in recent years to a 5% CAGR since 2021 (Figure 8).

Figure 8 – Casey’s has grown steadily through the years (CASY Investor Presentation)

…Lead To Attractive Financial Model

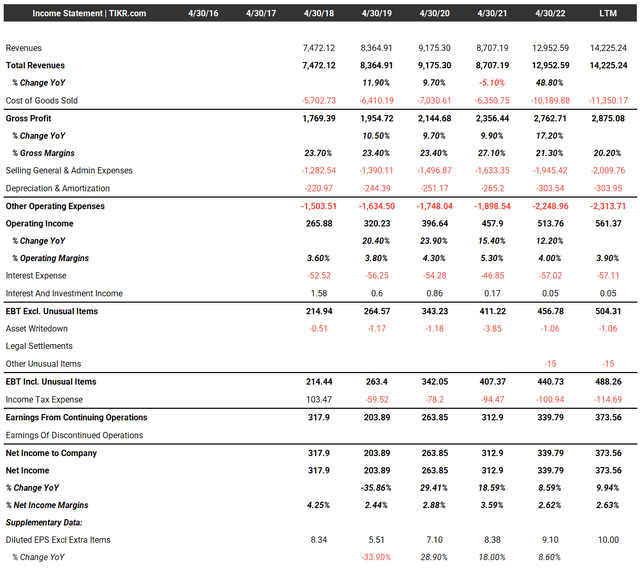

Steady low-single-digit (“LSD”) store count growth, coupled with low to mid-single-digit (“MSD”) inside-sales growth (better merchandising and prepared foods) have led to attractive 10% revenue and earnings growth for Casey’s in the past couple of years (Figure 9).

Figure 9 – Casey’s financial summary (tikr.com)

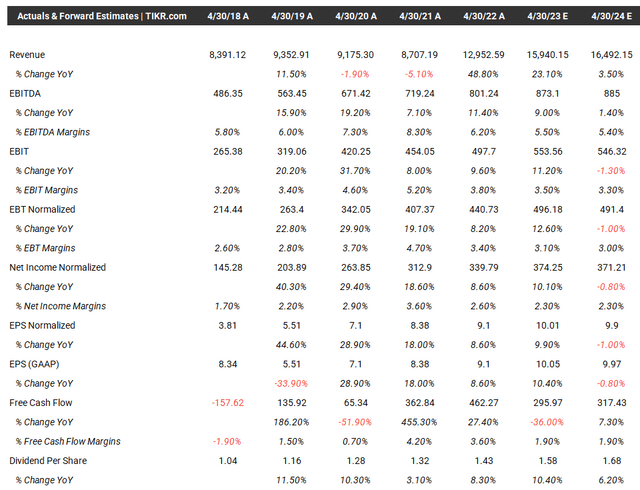

Looking at forward estimates, Wall Street analysts expect continued strong growth at Casey’s for F2023 (April year-end), with revenue growth of 23% and EPS growth of 10% (Figure 10).

Figure 10 – Casey’s consensus estimates (tikr.com)

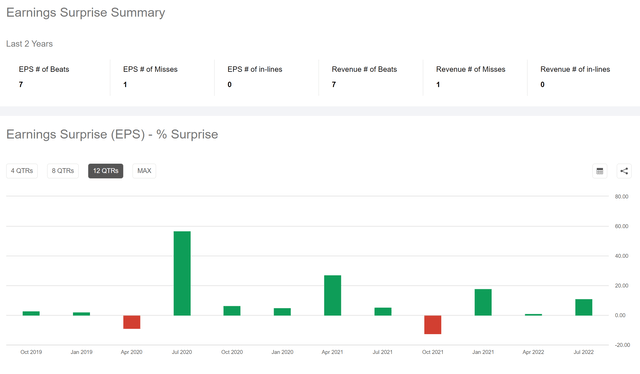

Furthermore, Casey’s has a history of beating analyst expectations, with both revenues and earnings beating consensus 7 out of the past 8 quarters (Figure 11).

Figure 11 – Casey’s has a history of beating estimates (Seeking Alpha)

Valuation

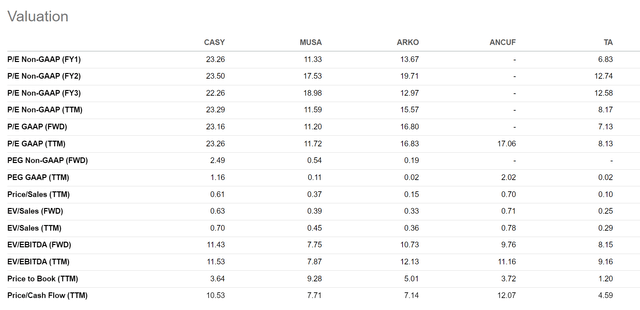

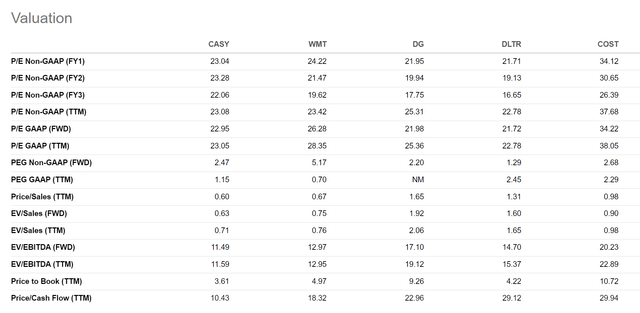

Valuation is where it gets challenging to make a case for Casey’s. The company is currently trading at 23.3x non-GAAP Fwd P/E, significantly higher than convenience store peers like Murphy USA Inc. (MUSA) and Arko Corp. (ARKO), which trade at 11.3x and 13.7x respectively (Figure 12).

Figure 12 – CASY valuation vs. Convenience Store Peers (Seeking Alpha)

Casey’s valuation multiple is much closer to general merchandise peers like Walmart Inc. (WMT) and Dollar General Corporation (DG) which trade at 24.2x and 22.0x Fwd P/E respectively (Figure 13).

Figure 13 – CASY valuation vs. General Merchandise Peers (Seeking Alpha)

However, note that 64% of Casey’s revenues are driven by volatile fuel prices, so Casey’s topline is not as stable as general merchandisers (although gross profit dollars may remain sticky, if fuel margin / gallon stays high).

Risk

There are a number of risks to Casey’s General Stores. First, a worsening economy may cause a slowdown in inside sales (author’s note, sales inside the store as opposed to fuel sales which occur outside the store). To date, that has not shown up in Casey’s financials. In the latest quarter (Q1/F23), Casey’s reported inside same-store sales growth of 6.3%. However, investors should keep an eye on inflation, as it has negatively impacted prepared food margins by 5.4% YoY.

Figure 14 – CASY Q1/F23 Inside Sales Growth (CASY Q1/F23 report)

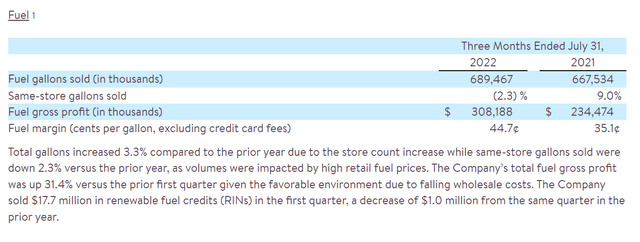

Another risk to Casey’s is the fuel margin, which reached a high of 44.7 cents / gallon in Q1/F23, one of the highest quarterly fuel margins ever. While the margin may be sustainable until the supply/demand situation improves, we are beginning to see demand destruction as same-store gallons sold fell 2.3% YoY. Furthermore, fuel margins in the 40-cent range may prompt further political scrutiny, as evidenced by President Biden’s recent rhetoric.

Figure 15 – CASY Q1/F23 Fuel Sales Growth (CASY Q1/F23 Report)

Finally, notice from Figure 8, Casey’s has added over 200 stores from M&A transactions in F2022. This is a departure from the company’s tradition of adding more stores organically than through M&A. While these may be due to one-time opportunistic acquisitions, investors should be mindful that adding stores through M&A increases the risk of overpaying, and introduces integration risks, especially for larger chains of stores.

Conclusion

In summary, Casey’s, like all convenience stores, is benefiting from the recent surge in fuel margins driven by supply/demand imbalances. Convenience stores have also benefited from investor flows in search of safe havens during the recent bear market. While operating momentum remains strong with healthy growth in inside sales and strong fuel margins, storm clouds are starting to gather on the horizon as inflation eats into prepared food margins and fuel volumes decline YoY. We are probably in the 6th to 7th inning of the convenience store trade, and momentum investors can stick with it for a little while longer (use the recent breakout point as a stop loss), but long-term investors should be thinking about an exit.

Be the first to comment