Edson Souza/iStock via Getty Images

Urban One, Inc. (NASDAQ:UONE) recently announced that political advertising later in the year could enhance quarterly revenue. In my view, with very few analysts covering the company, market participants seemed to forget UONE’s stable free cash flow margins and the company’s portfolio of stations. In my opinion, new products like CLEO TV and perhaps agreements with digital platforms could make the company even more profitable. There are risks from negotiations with agencies that sell UONE’s advertising and the cyclicality of UONE’s business. However, under conservative and realistic assumptions, my discounted cash flow model implied a valuation close to $11.73 per share.

Massive Reach All Over The Country And Revenue Could Creep Up At The End Of 2022

Urban One, Inc. is a multimedia business targeting African-American and urban consumers.

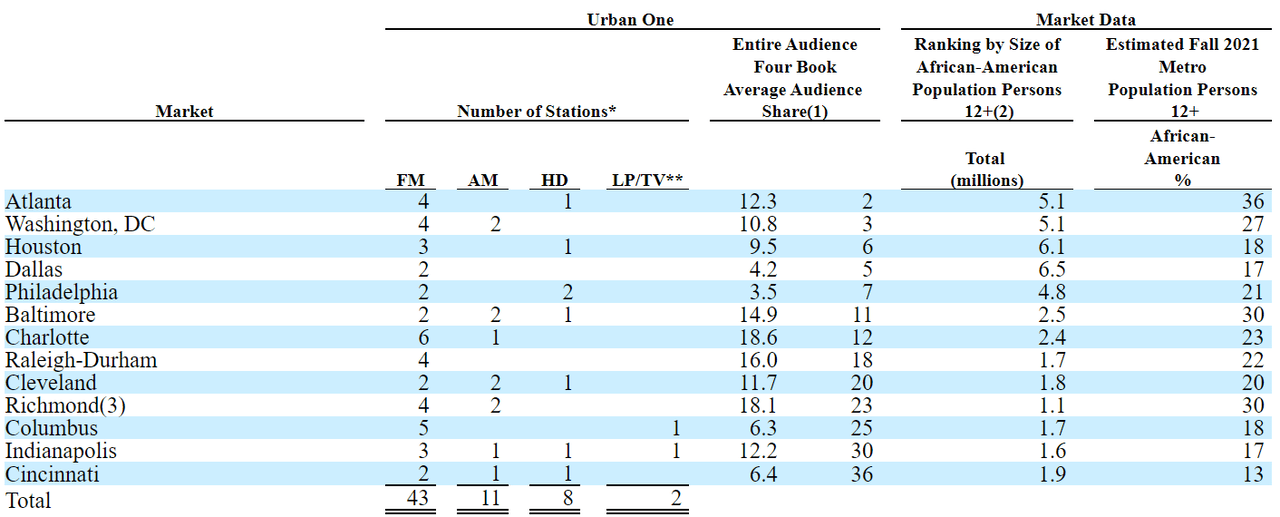

I believe that the company is worth having a look only because of its portfolio of stations all over the country. UONE has the ability to reach a significant number of people in the United States.

Source: 10-k

I also believe that it is a great time to review UONE’s expectations. In the last quarterly report, management noted that political advertising could enhance revenue growth at the end of 2022. In my view, an increase in revenue growth may generate demand for the stock, and could bring the stock price up:

Given our diversified mix of assets, I still anticipate consolidated net revenues to grow in Q3, and we remain well positioned for political advertising later in the year. (Source: Press Release)

With that, I believe that some investors may remain cautious about the stock considering its total amount of debt. Let’s hope that management successfully maintains its net leverage, or continuous to reduce its debt as positive free cash flow comes out:

We will continue to be disciplined with capital allocation decisions and our cash position remains strong. We finished the quarter with net leverage below 4.0x, in line with our goal to continue to reduce leverage over time.

The Balance Sheet Looks Quite Stable

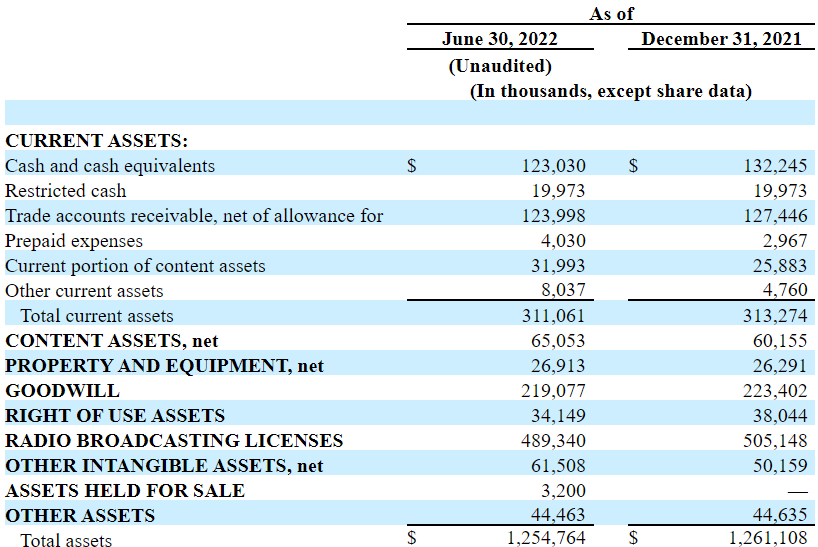

I believe that UONE has both liquidity to acquire new targets and expertise in the M&A markets. Keep in mind that as of March 31, 2022, the company reported cash worth $123 million with total current assets worth $311 million and goodwill of $219 million. With that, the most valuable are the company’s radio broadcasting licenses worth $489 million, which are worth two times the company’s current amount of market capitalization.

10-Q

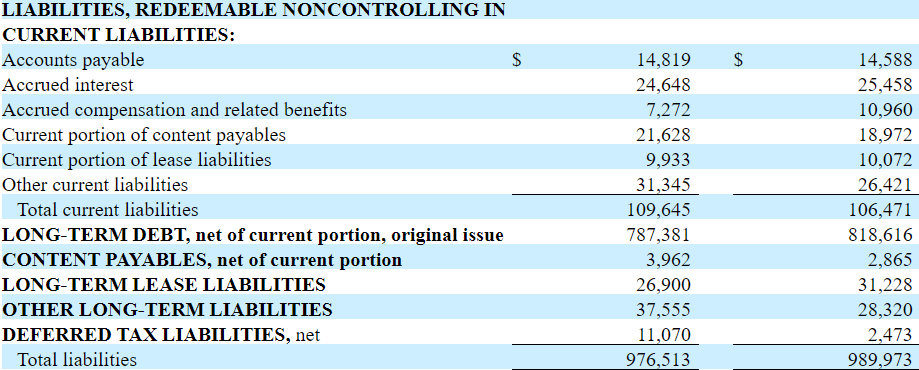

The list of liabilities is not small. Accounts payable were $14 million, in addition to accrued compensation and related benefits worth $7 million. The long-term debts were $787 million, and the total liabilities obtained were $976 million. The total amount of debt would stand at more than 9x future free cash flow, which may be worrying for certain investors. In my view, if management continues to report table free cash flow margins, the debt does not have to represent a problem.

10-Q

I studied the company’s debt to understand the financial risk. UONE pays close to 7.375% interest, and the debt is payable in 2028. I believe that in six years UONE may accumulate sufficient free cash flow to negotiate new debt with debt investors.

The 2028 Notes mature on February 1, 2028 and interest on the Notes accrues and is payable semi-annually in arrears on February 1 and August 1 of each year, commencing on August 1, 2021 at the rate of 7.375% per annum. (Source: 10-k)

Source: 10-k

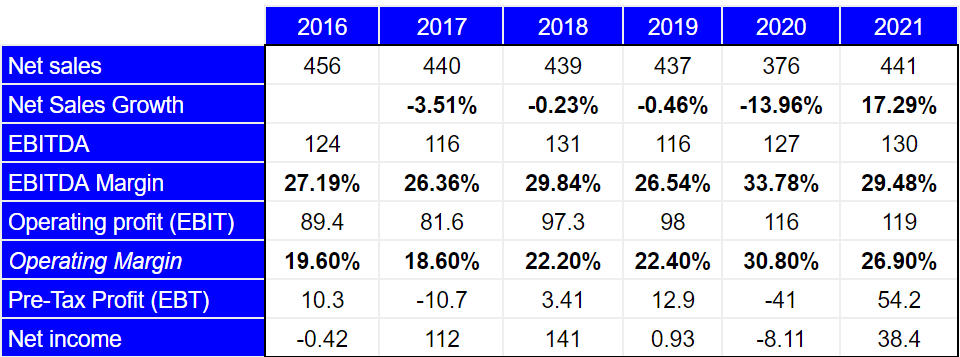

In The Past, Net Income Was Often Positive, And The EBITDA Margin Remain Elevated At Close To 26%-33%

The company’s figures are relatively stable with double digit EBITDA margin and often positive net income. It is a pity that we don’t have a lot of financial analysts offering revenue forecasts. With that, having a look at the past is never better than nothing.

In 2021, the company reported net sales of $441 million with a net sales growth of 17.29% and an EBITDA margin of 29.48%. In addition to an operating profit of $119 million and operating margin of 26.90%, net income was equal to $38.4 million. The numbers that I included in my financial model are close to those reported in the most recent history. I tried to be as conservative as possible.

marketscreener.com

Under Normal Circumstances, I Expect A Fair Price Close To $11.73 Per Share

I believe that UONE will continue to benefit from what it does best, offering content and advertising by targeting African-American and urban consumers.

Our strategy is to operate the premier multi-media entertainment and information content platform targeting African-American and urban consumers.

At the same time, in my view, sufficient generation of free cash flow and reduction in the debt may allow new acquisition of media properties. The results of new acquisitions could include benefits from economies of scale, more negotiating power with advertisers, and perhaps free cash flow margin expansion.

Thus, we have diversified our revenue streams by making acquisitions and investments in other complementary media properties.

I would also be very attentive to new content launched by UONE. In 2019, UONE launched CLEO TV in 2019, and may launch new content soon. Finally, under this case scenario, I would also expect that management will successfully reach more agreements with digital media platforms, which is mainly what new generations are viewing these days.

On January 19, 2019, the Company launched CLEO TV, a lifestyle and entertainment network targeting Millennial and Gen X women of color. CLEO TV offers quality content that defies negative and cultural stereotypes of today’s modern women.

Our cable television segment faces emerging competition from other providers of digital media.

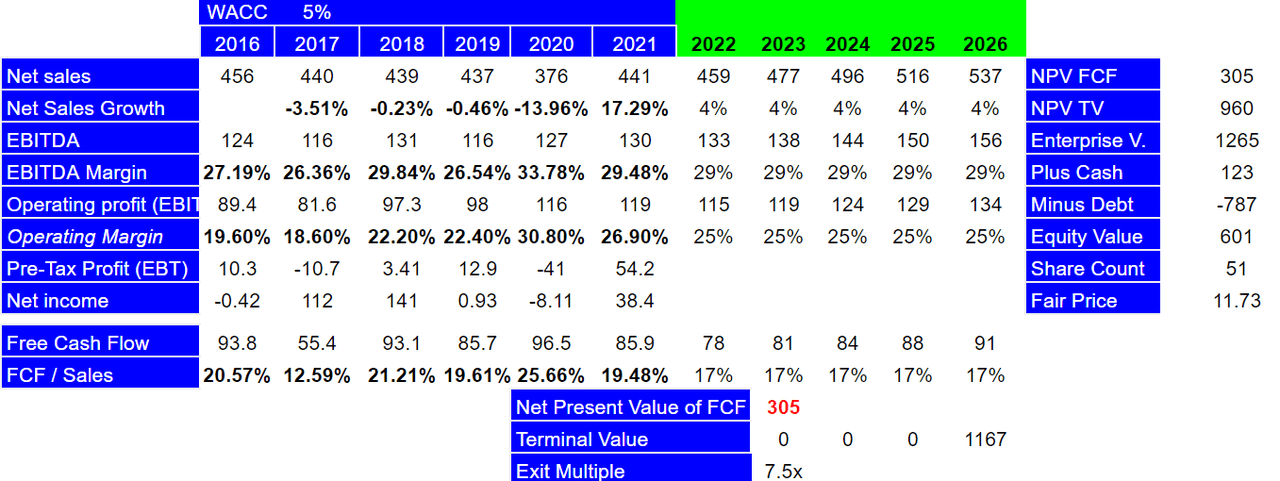

By 2026, I forecasted net sales of $537 million, with a net sales growth of 4%. I also expect an EBITDA of $156 million, with an EBITDA margin of 29%, operating profit of $134 million, and operating margin of 25%.

I also included free cash flow of $91 million, with a FCF/sales ratio of 17%. With a discount at 5%, I would expect a NPV of free cash flow of $305 million and a NPV of terminal value of $960 million. Finally, the enterprise value would stand at $1.2 billion with a fair price close to $11.73 per share.

My DCF Model

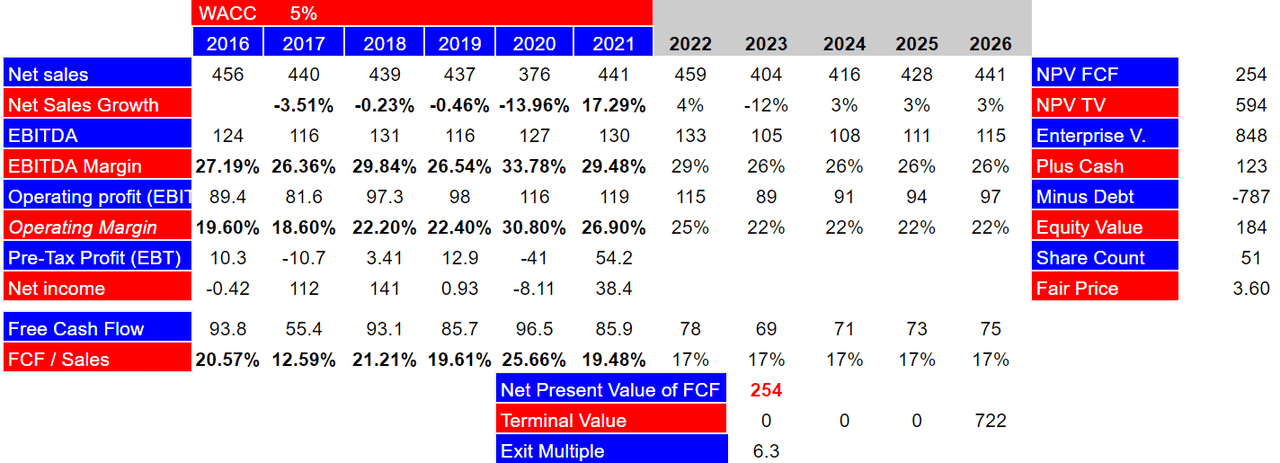

My Worst Case Scenario Implies $3.6 Per Share

Under my worst case scenario, I assumed that UONE may suffer from any issue with some of the agencies that sell UONE’s advertising. In my view, the fact that management does not work with many advertising agencies may cause some trouble one day.

National sales are made primarily by Katz Communications, Inc., a firm specializing in radio advertising sales on the national level. Katz is paid agency commissions on the advertising sold. Approximately 59.2% of our net revenue from our core radio business for the year ended December 31, 2021, was generated from the sale of local advertising and 36.3% from sales to national advertisers, including network/syndication advertising.

UONE may also suffer significantly under a recession. Let’s keep in mind that the company operates in a cyclical industry. If advertisers believe that their ads may not be profitable, they may decide to stop working with UONE for a while. A decline in revenue would likely bring the stock price down.

Advertising expenditures also tend to be cyclical and reflect general economic conditions, both nationally and locally. Because we derive a substantial portion of our revenues from the sale of advertising, a decline or delay in advertising expenditures could reduce our revenues or hinder our ability to increase these revenues.

For 2026, I forecasted net sales of $441 million, with a sales growth close to 3% and an EBITDA margin of 26%. 2026 free cash flow would stand at $75 million, with a FCF/sales ratio of 17%.

My results include a net present value of FCF of $254 million, and with an exit multiple of 6.3x, the NPV of terminal value would be $594 million. Finally, the enterprise value would stand at $848 million with a fair price of $3.6 per share. In my view, this is the worst that can happen to UONE. I don’t think that the share price could go lower than this.

My DCF Model

Conclusion

With management noting that UONE could deliver significant revenue growth at the end of 2022, in my view, the company is worth having a look. In my view, new products like CLEO TV and perhaps agreements with digital platforms could represent beneficial catalysts for revenue generation. Under a conservative case scenario, I obtained a realistic valuation close to $11.73. In my worst case scenario, disagreements with advertising vendors and an eventual decline in revenue due to a recession could bring the fair price close to $3.6 per share. With the current stock price in mind, I believe that shareholders are currently looking at more upside potential than downside risk.

Be the first to comment