Amy Sussman/Getty Images Entertainment

Introduction

During my investing journey, I have focused more and more and compounders that have high profitability metrics and can grow at a steady, yet reliable pace.

Among the ones I researched, one of my 2022 picks has been Church & Dwight (NYSE:CHD).

Summary of previous coverage

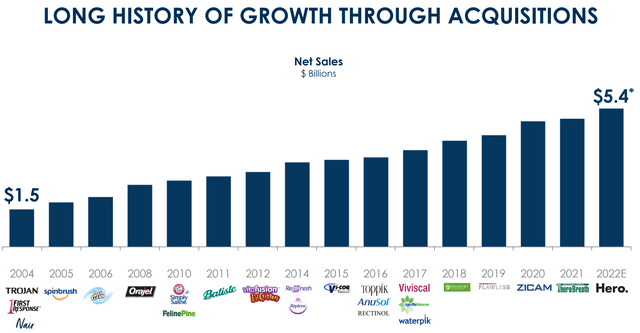

I shared my initial research in the article “Church & Dwight: A Compounder In Action“. Here, I pointed out how the company, founded in 1846, has been able to grow its product portfolio from baking-soda based products to other consumer products that integrate the company’s offering. In the past two decades, Church & Dwight has in fact begun focusing on key acquisitions of brands that are usually number 1 or 2 in their market. This has built up the so-called “power brands” portfolio that made up approximately 80% of the company’s total revenues ($5.2 billion in 2021).

I suggest reading this first article because it focuses on Church & Dwight “Evergreen Business Model” that has enabled the company to own more than 80 brands, focusing on key acquisitions. The company has also made it clear which are the rules that lead to an acquisition.

- Brands with #1 or #2 market share

- Brands with higher growth and higher margin

- Asset light brands

- Brands that can leverage Church & Dwight’s structure of manufacturing, logistics and purchasing

- Brands that can deliver sustainable competitive advantage

In addition to this strategy, the company targets a 3% annual organic sales growth, with a gross margin expansion of 25 bps per year that goes along with a 25 bps reduction of SG&A. This leads to an average EPS growth of 8%.

The company has been executing so well that its business keeps a gross margin above 40% and, though taking on some debt to finance its acquisitions, its debt/EBITDA ratio is 1.79, which shows the company is not overleveraged.

At the time of the article, I still gave a hold rating, thinking that the company was trading a little bit over its fair price.

I then switched my rating to buy when I actually bought some shares after the announcement of the acquisition of Hero, a company focused on acne-patches and acne care. This is the 15th power brand the company owns which make up 85% of total sales. Once I went over the details of the purchase, I decided it was time to jump on this train and I initiated my position, taking advantage of some weakness in a stock that, historically, has always traded at a premium.

CHD Barclays Global Consumer Staples Conference 2022 Presentation

Now, after the guidance the company gave when it announced the Hero acquisition seemed somewhat weak compared to the previously given one. This is what the company wrote two months ago:

Regarding the 2022 outlook we now expect full year reported sales growth of 2% to 4% (previously 4% to 5%), reflecting the incremental growth from Hero offset by continued softness across our more discretionary brands. For Q3, we now expect reported sales to decline -1% (previously growth midpoint of 3%) reflecting lower demand for Waterpik, Vitafusion and Flawless. EPS affirmed at $0.65 (no change to previous outlook).

This is why I was curious to read the Q3 report to see if the company was able to get back on track.

Q3 Results

The first data in the Q3 earnings report I looked at was net sales. I was expecting a decrease, but I actually found that net sales grew overall by 0.4% The company reported that domestic sales were $1.01 billion, a $1.2% increase versus prior year driven by household products sales growth. International net sales were down 3.2% (however FX impacted sales by 7%) at $219.7 million. Specialty Products net sales were $87.2 million, a 1% increase YoY.

Regarding organic sales we have a picture that is a little bit different. Overall they were down 0.7%. Here we see that the domestic division (the most important for the company) decreased by 1.7% due to volume, which went down 9.7%, but thanks to the announced 8% price hike, the company was able to offset most of the impact of the decrease in volume.

What was it that sold less YoY? Church & Dwight stated that there is now less consumption for vitamins and declines in discretionary products such as Waterpik and Flawless. On the other hand, Arm& Hammer detergents and cat litter, Oxiclean stain removers and Batiste dry shampoos experience growth, just like Therabreath, that grew double-digits. Waterpik, Flawless and Vitafusion were impacted by lower consumer spending and, for what concerns the vitamin category, the lapping of high vitamin consumption during the Delta variant. In aggregate, these three categories account for almost 20% of total reported sales and this is why they had a -6% impact on the quarterly results.

We thus see a shift from consumer discretionary products being impacted by lower consumer spending while the brands that benefit from the trade down to value products are holding up fairly well or even increasing market share. In fact, 7 of the power brands gained share and are expected to grow in Q4 too.

However, since the discretionary brands didn’t perform well, inventories are higher for Waterpik, Flawless and Vitamins. This hit the operating cash flow that decreased, for the first nine months of the year, by $119.5 million YoY. Thus the guidance for the full year has been lowered to $800 million compared to the previously given guidance of $900 million.

Gross margin, too, decreased by 250 bps to 41.7%, due to the impact of raw material costs and higher promotional spending. We are still before a very good gross margin, but here the company is not operating accordingly to its business model that aims at growing organic sales by 3% annually and expanding margins by 50 bps per year.

Outlook

Matthew Farrel, Church & Dwight CEO, said during the earnings call that for the full year the company:

still expects reported sales growth to be approximately 3%, the midpoint of our previous range (2-4%). We expect full year organic sales growth to be approximately 1%. We continue to anticipate full year reported gross margin to be down versus 2021, as we expect inflation to outpace pricing and productivity. We now expect adjusted EPS to be in the range of $2.93-$2.972, a decline of 2-3% from 2021 adjusted EPS (previously $2.97, down 2%).

One caveat, the EPS decline will be due mainly to a significantly higher quarterly tax rate (25%) versus an unusually low tax rate in the prior year (3.7%).

Overall, it is not the guidance the company has gotten investors used to. There is no margin expansion, organic sales growth is expected to be just around 1% and EPS growth, which should be somewhere around 8% is actually going to be negative. However, since incentives are tied to the fact that the company achieves its targets set by the Evergreen Business Model, we can expect a favorable impact on SG&A for the upcoming quarter.

My Take

Overall, it seems like the company is somewhat stagnant. However, there are two points worth noticing. First of all, ZICAM, Church & Dwight’s brand in the cold shortening segment, reached a 76% market share in Q3. Therabreth, which was acquired in December of 2021, had a 46% consumption growth during Q3. Its market share grew by 4.3 percentage points to 17.8% of the alcohol-free mouthwash category. These are among the latest acquisitions the company has closed and they prove that once the company acquires a brand, it can leverage its distribution network to rapidly make the newly acquire brand easily available to a larger consumer base. This makes me confident that we will see similar numbers for Hero, too.

Secondly, Church & Dwight has announced that it will increase marketing expenses because it is going to have higher fill rates. This should lead to inventory clearance and higher free cash flow.

With the discretionary brands already hit by reduced spending and the non-discretionary brands holding up well or even gaining market share, I think the company will have easier comparables next year. Furthermore, the company still has almost $500 million in cash, which makes it able to pursue its M&A strategy without taking excessive debt in this rising interest rate environment.

This is why I still rate the company as a buy in the range between $70 and $80. If the share price drops below $70 then the opportunity would become even more interesting and I would probably add to my position.

Be the first to comment