Sundry Photography/iStock Editorial via Getty Images

Elevator Pitch

I retain a Hold investment rating for Twitter, Inc. (NYSE:TWTR). I last wrote about TWTR in an article published on February 18, 2022, where I reviewed its Q4 2021 earnings. With my latest update, I evaluate Twitter’s 2022 share price outlook in view of two key developments. The first is Elon Musk’s proposed takeover of TWTR announced on April 14; the second is a preview of the company’s upcoming Q1 2022 earnings release on April 28.

I am rating Twitter’s shares as a Hold, as I see TWTR’s shares heading nowhere (i.e. range bound) for the rest of 2022. Twitter is unlikely to deliver a substantial revenue beat for Q1 2022; and Elon Musk’s buyout offer needs to cross significant hurdles to have a decent chance of being successful. As such, a Hold rating or a Neutral view for TWTR is appropriate.

Is Twitter Stock Expected To Rise?

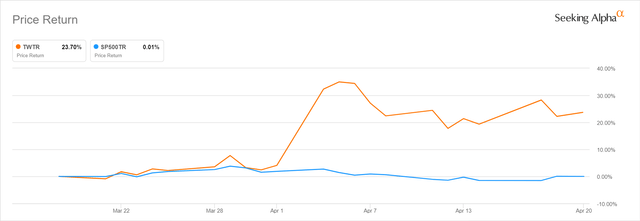

Twitter’s share price has outperformed the S&P 500 by a significant margin in the last one month as per the chart below. This is largely attributable to the actions of Elon Musk, who is also likely determine whether TWTR’s stock price will continue to rise going forward.

TWTR’s Stock Price Performance For The Past One Month

Seeking Alpha

Elon Musk revealed that he had a 9.2% equity interest in Twitter with a 13G filing on Monday April 4, 2022, and this led TWTR’s shares to rise +27% from $39.31 as of April 1, 2022 to $49.97 at the end of the day itself.

At that point in time, there were huge expectations that Elon Musk could possibly take a board seat and play a key role in driving positive change at Twitter in areas like user monetization, content moderation policies and new product innovation. In my February update, I had noted that “Twitter’s Q4 2021 earnings failed to meet market expectations” which “didn’t give the market sufficient confidence that the company will succeed in achieving its 2023 revenue and user growth targets (which I will touch on in greater detail later in the article).”

But TWTR’s shares pulled back to close at $47.01 as of April 11, 2022, after it was reported that Elon Musk won’t become a board member of Twitter. On April 14, 2022, Elon Musk disclosed with a 13D/A filing that he is proposing to acquire all of the shares in TWTR at a offer price of $54.20. Twitter’s shares last traded at $46.72 as of April 20, 2022, which implies that TWTR is trading at a 14% discount to Elon Musk’s offer price.

In other words, the success or failure of Elon Musk’s bid to take over the company will be the key factor that impacts Twitter’s stock price outlook this year. The key questions to ask are whether Elon Musk has the financing required to fulfill his buyout offer and if the company’s board of directors and shareholders are in favor of this proposed deal.

With respect to deal financing, The New York Times highlighted in a recent April 19, 2022 article that “Morgan Stanley (MS), the investment bank working with Mr. Musk on the potential deal, has been calling banks and other potential investors to shore up financing for the ($43 billion) offer” according to its sources.

At the same time, there has been mixed news about whether private equity players will be keen to finance the acquisition of Twitter by Elon Musk or other potential bidders. Based on a Wall Street Journal report cited by Seeking Alpha News, Apollo Global (NYSE:APO) on April 18, 2022 “could provide Elon Musk or another PE bidder with equity or debt for a bid.” But another April 19, 2022 Seeking Alpha News article quoting a report from The Financial Times suggested that “several large PE firms don’t want to participate in Elon Musk’s $43 billion takeover.”

Elon Musk is speculated to have “less than $2 billion of cash on hand” according to an April 14, 2022 Forbes article, and he is unlikely to sell his Tesla (TSLA) shares to finance the buyout of Twitter. This suggests that the success of recent discussions on financing as reported in the media will make or break the Elon Musk deal.

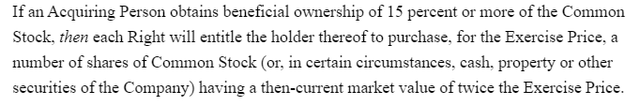

Separately, Elon Musk’s buyout offer hasn’t been well received by Twitter’s board of directors. On April 15, 2022, Seeking Alpha News reported that Twitter’s board of directors “adopted a shareholder rights plan” that is “exercisable if any one entity acquires beneficial ownership of 15% or more of Twitter common stock in a transaction unapproved by the board.” The key clause of the shareholder rights plan is the “flip-in trigger” as highlighted below. If Elon Musk does cross the 15% mark with respect to his shareholdings in TWTR, Twitter’s other shareholders excluding Musk have the option of buying shares in the company at a huge discount thereby potentially diluting Elon Musk’s stake.

Flip-In Trigger Clause Of Twitter’s Shareholder Rights Plan

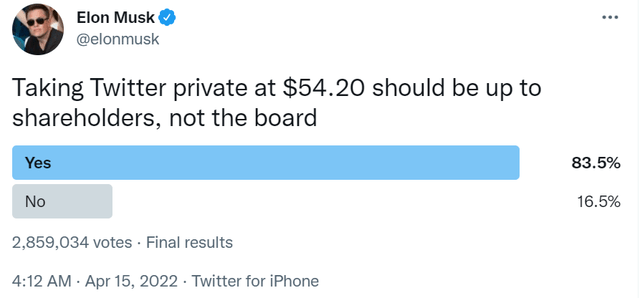

On the other hand, Elon Musk conducted a poll on Twitter, where 83.5% of approximately 2.8 million votes were in favor of his view that “shareholders, not the board” should decide on the TWTR buyout offer. It is uncertain how many of the people who voted on this poll are shareholders of Twitter, but it does indicate that not everyone has a favorable view of the Twitter board’s “poison pill defense.”

Elon Musk’s Poll On Twitter

Separately, Saudi Arabian investor Prince Alwaleed bin Talal, who claims to have a 5.2% equity interest in TWTR via his investment company, is of the opinion that the $54.20 offer does not value Twitter fairly.

Saudi Arabian Investor Prince Alwaleed bin Talal’s Tweet In Response To Elon Musk’s Offer

In conclusion, I don’t expect Twitter’s stock price to rise significantly in the near-term, because of my skepticism that the proposed TWTR offer will be successful. Elon Musk’s takeover offer is challenging considering the substantial financing needed for the deal and the board’s shareholder rights plan. More importantly, the considerable spread (14%) between TWTR’s current stock price and Elon Musk’s offer price is a reflection that the market does not believe that this transaction will go through.

In the next section, I discuss Twitter’s target price and valuations, which also provide some clues about whether Elon Musk’s buyout offer will succeed.

What Is The Target Price For Twitter Stock?

In the preceding section, one of TWTR’s shareholders, Saudi Arabian investor Prince Alwaleed bin Talal, thinks that Twitter’s stock is worth more than the $54.20 per share offer made by Elon Musk. But Twitter’s consensus sell-side price target tells a different story.

The current average Wall Street price target for Twitter is $44.79, which is -4% and -17% below TWTR’s last traded share price and Elon Musk’s buyout offer price, respectively. Notably, the most bullish sell-side analyst covering TWTR’s shares has a $60.40 target price for Twitter, which only translates to a +11% upside as compared to Musk’s takeover offer of $54.20.

In other words, the sell-side analysts in general don’t see Twitter’s shares being worth much more than $54.20. This also implies that it is less probable that Elon Musk will raise his offer price for TWTR, and this in turn lowers the probability of a new revised offer at a higher price that could be favored by the board and certain shareholders.

Separately, Twitter’s current valuations appear to be fair putting Musk’s offer aside.

The market now values TWTR at a consensus forward fiscal 2023 EV/EBITDA multiple of 17.1 times as per S&P Capital IQ and based on its last done stock price of $46.72 as of April 20, 2022.

In contrast, its peer Meta Platforms (FB) currently trades at a much lower 7.2 times forward FY 2023 EV/EBITDA. TWTR’s consensus forward FY 2022-2025 revenue CAGR of +18% is higher than FB’s top line CAGR of +14% during the forecast period, and Meta Platforms’ Q1 2022 financial performance might disappoint the market based on a recent report published by Cleveland Research that Seeking Alpha News cited. This justifies TWTR’s valuation premium over FB.

Another one of Twitter’s peers, Snap (SNAP) is valued by the market at a forward FY 2023 EV/EBITDA multiple of 28.7 times, but this is reasonable based on an assessment of the two companies’ respective growth prospects. Twitter’s consensus forward FY 2022-2025 annualized top line growth is substantially lower than SNAP’s expected sales CAGR of +36% over the same period.

In summary, Twitter seems to be at a fair valuation now, taking into account consensus target prices and its peer valuation comparison.

TWTR Stock Key Metrics

I made reference to Twitter’s goal of “of achieving 315 million in mDAU (Monetizable Daily Active Usage) by end-2023 and $7.5 billion of revenue in 2023” in my earlier February 2022 article. Assuming that Elon Musk’s offer is not successful (which is my base case), Twitter’s 2022 stock price outlook will be dependent on investors’ judgment of whether TWTR can achieve its 2023 financial targets, and Twitter’s upcoming Q1 2022 earnings (to be announced on April 28) will provide an indication of the company’s progress in this respect.

I noted in my prior update that “analysts don’t think the company can grow its top line as fast as it guided for (implied FY22-23 revenue CAGR of +21.5%) in the next two years” and highlighted that “TWTR’s 2021 mDAU growth of +13% was significantly below the +20.5% CAGR implied by its 2023 mDAU target.” My views have remained unchanged, and I think that Twitter’s Q1 2022 results will not offer any significant positive surprises.

The current consensus numbers sourced from S&P Capital IQ suggest that Twitter’s revenue will expand by +18% YoY in Q1 2022 (as compared with +22% in Q4 2021), and I think that TWTR’s actual first-quarter sales will be largely in line with market expectations.

The expectations for Twitter’s Q1 2022 top line expansion are supported by specific metrics. An April 5, 2022 report (not publicly available) titled “1Q22 Internet App Data Analysis” published by Raymond James (RJF) found that TWTR’s “user growth was flat in the U.S. at 9% while worldwide growth decelerated slightly to 11% y/y (vs. 12% in 4Q)” based on analysis of mobile app data. Separately, Piper Sandler issued a report (not publicly available) on April 13, 2022 titled “Temperature Checks” based on channel checks with “a digital marketer with $500MM+ in digital ad spend” whose spending on Twitter “declined q/q to +11% y/y in 1Q (2022) from +15% in 4Q21.” These metrics point to a moderation in TWTR’s sales growth for Q1 2022 vis-a-vis Q4 2021, which is aligned with market consensus.

A high-teens revenue growth rate for TWTR in Q1 2022 will reinforce market expectations that it is less probable that Twitter will be able to deliver the company’s targeted +21.5% top line CAGR for the FY 2022-2023 period.

Is TWTR Stock A Buy, Sell, or Hold?

TWTR stock is a Hold. Twitter’s shares are already down by -31% in the last year factoring in slower growth and the relatively low likelihood of meeting its 2023 financial guidance. A successful buyout by Elon Musk based on the current offer price of $54.20 will translate into a +16% upside, but I don’t think Musk’s offer will come through considering the various challenges highlighted in this article. Twitter’s current valuations are fair based on sell-side price targets and comparison with peers, justifying my Hold rating.

Be the first to comment