Kativ/E+ via Getty Images

Alto Ingredients, Inc. (NASDAQ:ALTO) intends to build a customer-centric business model, which may boost revenue growth. Management is also trying to increase the product offering through M&A operations. I do see some risks from rising inventory and production capacity of fuel-grade ethanol. However, the current stock price fails to represent the potential future free cash flow. In my view, ALTO is a buy.

The Largest Producer Of Specialty Alcohols In The U.S. That Grows Through Acquisitions

Alto Ingredients produces and sells alcohols and essential ingredients, and presents itself as the largest producer of specialty alcohols in the United States. The company operates five production facilities and has a production capacity of 350 million gallons.

I have been following Alto Ingredients for some time, but it was very recently when I decided to acquire some shares. Among the different reasons, there is the fact that management is heavily investing in new capacity, and expanding its operations and its protein strategy. In my view, more capacity will likely lead to revenue growth in the future:

During 2021, we invested in capacity, expanded our protein strategy, optimized assets, and secured valuable certifications. As a result, net sales reached $1.2 billion, up 35% over 2020, reflecting the solid specialty alcohol and essential ingredients business throughout the year and exceptional renewable fuel margins in the fourth quarter of 2021. Source: Alto Ingredients, Inc. Reports Fourth Quarter and Full Year 2021 Results

The recent acquisition of small-package distributor Eagle Alcohol is another clear indication of revenue growth. In my view, if management continues to enhance its distillation process as well as to optimize the company’s production capabilities, both the EBITDA margin and free cash flow will likely trend north:

In January 2022, we completed a downstream integration by acquiring a small-package distributor, Eagle Alcohol. Eagle fits perfectly into our strategic roadmap as we continue to raise the quality of our production to the highest grades of grain neutral spirits by further enhancing our distillation process, optimizing our production capabilities and integrating Eagle’s strong distribution and sales services. Source: Alto Ingredients, Inc. Reports Fourth Quarter and Full Year 2021 Results

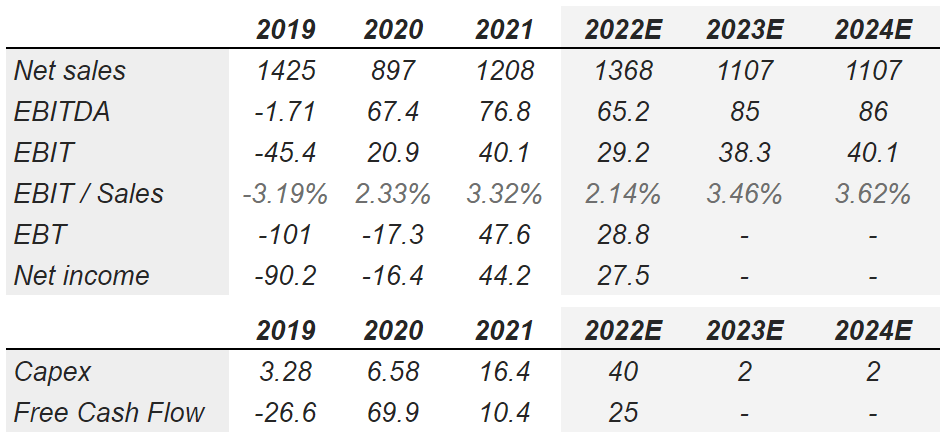

Analysts Expect Sales Growth And Stable Operating Margins

Analysts expect a significant sales growth increase in 2022, operating margin growth from 2022 to 2024, and 2024 EBITDA of $86 million. The company would also report positive free cash flow in 2022. In my view, even taking into consideration the small decline in revenue in 2023 and 2024, it is quite beneficial that the EBIT will likely continue to trend north:

MarketScreener.com

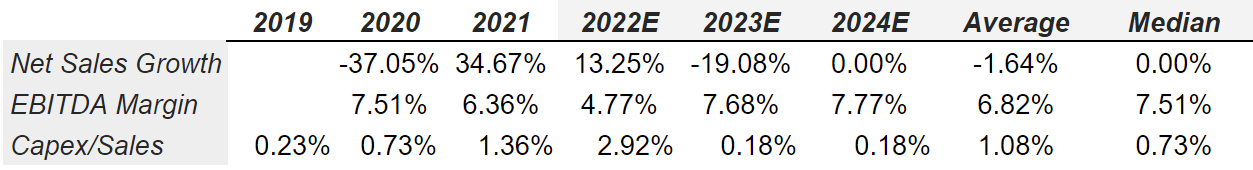

I obtained certain financial stats from estimates and previous financial results. The median EBITDA margin was close to 7.51%, the capex/sales ratio was equal to 0.73%, and the average net sales growth was equal to -1.64%.

MarketScreener.com

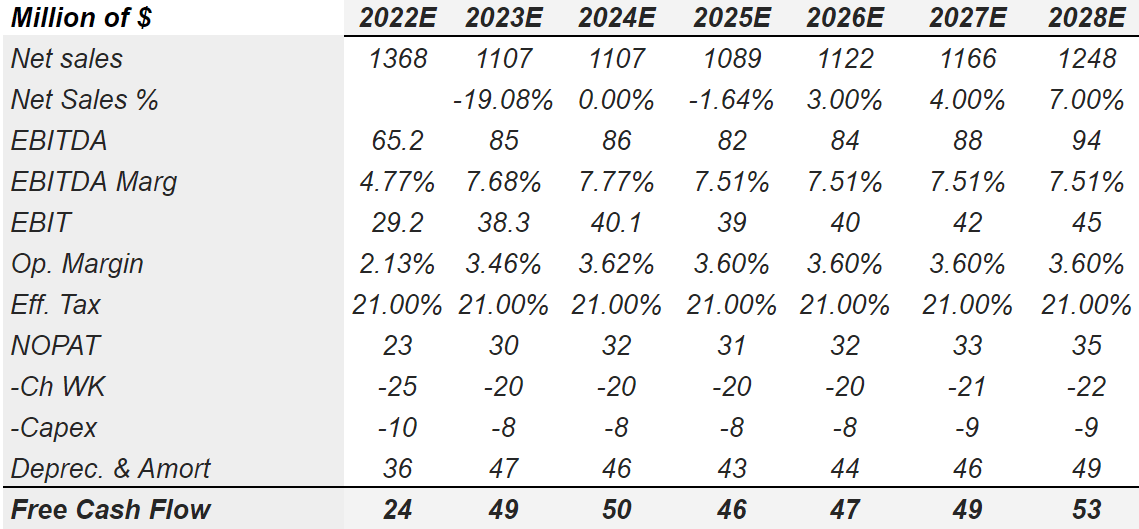

Base-Case Scenario Includes More Products And Higher-Margins

Under normal conditions, I expect that management will successfully transform Alto Ingredients into a more customer-centric business with higher-margin products. As a result, I will be expecting free cash flow generation from 2022 to 2028:

We strive to make our business ever more customer-centric to enable our premium services to support premium prices and new differentiated and higher-margin products. Source: 10-K

I also expect revenue generation and diversification as the company enlarges its product offerings. Besides, the company’s new certifications will most likely lead to more recognition from clients and partners. In my view, management is really going in the right direction:

We are pursuing initiatives to broaden our product offerings to appeal to a wider range of customers and uses in our key markets. For example, we have secured ISO 9001, ICH Q7 and EXCiPACT certifications at all of our Pekin Campus production facilities. Source: 10-k

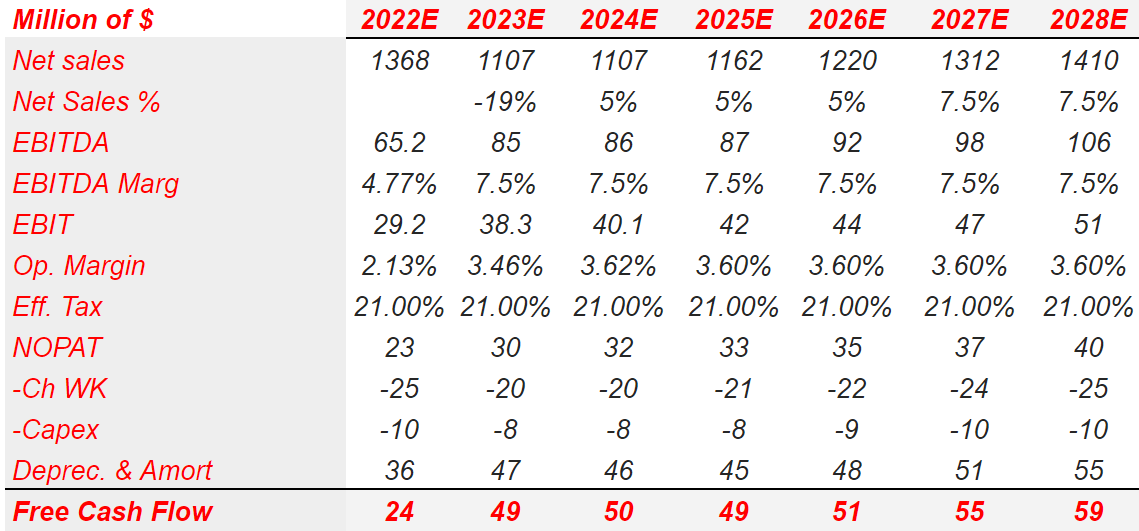

In the base case scenario, I assumed small growth from 2024 to 2028, an EBITDA margin of around 7.51%, and an operating margin of 3.6%. Also, with an effective tax of 21%, from 2022 to 2028, the free cash flow should be close to $24-$53 million.

Author’s Compilations

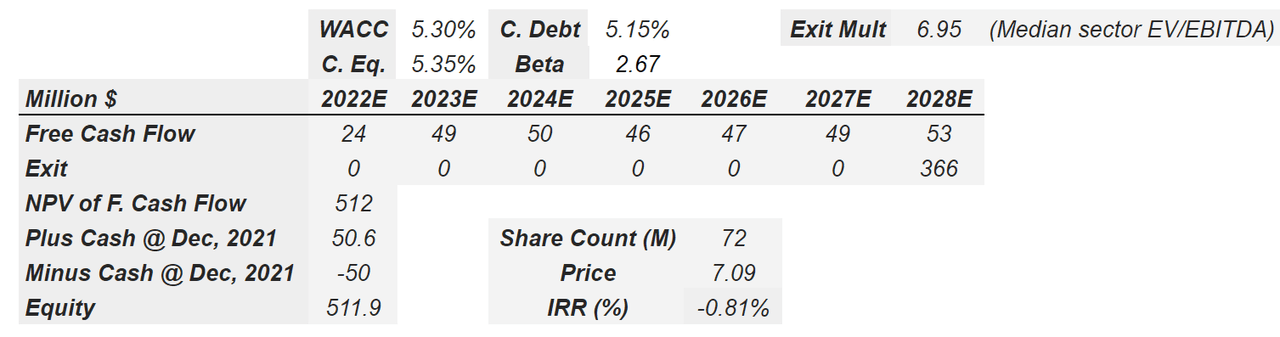

I assumed the capital asset pricing model reported by other analysts, which includes a cost of debt of 5.1%, a cost of equity of 5.35%, and a beta of 2.67. If we also use an exit multiple of 6.95x, the implied stock price should stay close to $7.09:

Author’s Compilations

Best-Case Scenario With Sales Growth Close To 5% And An EBITDA Margin Of 7.5%

Under the best-case scenario, Alto Ingredients will enlarge its product offering, and increase its margins. Management will also continue to acquire other competitors. In my opinion, if the acquisition of Eagle Alcohol is successful, management will likely try to acquire other small peers. As a result, management will not only acquire know-how but also a larger distribution network of specialty alcohols:

Through our acquisition of Eagle Alcohol, we plan to further diversify our business to focus on break bulk distribution of specialty alcohols. With the specialty alcohols we produce and purchase from other suppliers, we now can store, denature, package and resell alcohol in smaller sizes, including tank trucks, totes and drums, that garner a premium price to bulk specialty alcohols. Source: 10-K

Let’s mention that M&A was listed as one of the strategies noted by Alto Ingredients in its annual report:

We are examining opportunities to expand our business such as joint ventures, strategic partnerships, synergistic acquisitions and other opportunities. We intend to pursue these opportunities as financial resources and business prospects make these opportunities desirable. Source: 10-K

Under the previous conditions, I assumed sales growth of 5%, an EBITDA margin of 7.5%, and operating margin close to 3.5%. If we also include changes in working capital of around $25 million, capital expenditures of around $10 million, and depreciation and amortization close to $45-$55 million, 2025 free cash flow should stay at $55 million:

Author’s Compilations

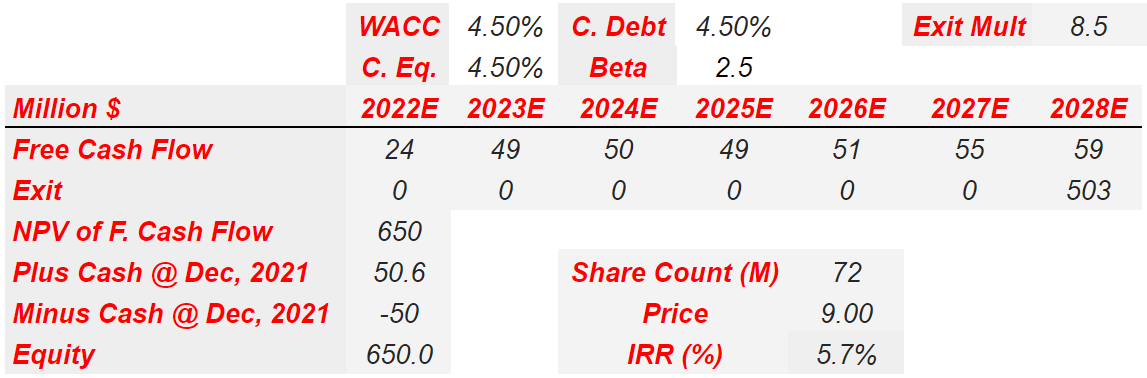

My capital asset pricing model, in this case, includes a lower cost of debt and cost of equity than that in the previous cases because Alto Ingredients’ financial figures are much better. I also assumed an exit multiple of 8.5x, which implied a stock price of $9:

Author’s Compilations

The Worst-Case Scenario Would Include A Decrease In The Price Of Fuel-Grade Ethanol And Supply Chain Risks

In the worst-case scenario, I believe that Alto Ingredients could suffer a decrease in the price of fuel-grade ethanol as inventory and production capacity increase. As a result, management may suffer from a significant decrease in revenue, which may lead to drastic reductions in the share price:

We believe that the most significant factor influencing the price of fuel-grade ethanol has been the substantial increase in production. According to the Renewable Fuels Association, domestic fuel-grade ethanol production capacity increased from an annualized rate of 1.5 billion gallons per year in January 1999 to a record 16.1 billion gallons in 2018. In addition, if fuel-grade ethanol production margins improve, we anticipate that owners of production facilities operating at below capacity, or owners of idled production facilities, will increase production levels, thereby resulting in more abundant fuel-grade ethanol supplies and inventories. Increases in the supply of alcohols and essential ingredients may not be commensurate with increases in demand for alcohols and essential ingredients, thus leading to lower prices. Source: 10-K

Any supply chain issue related to natural gas, energy, electricity, or transportation could be very detrimental for the company’s business model. The company disclosed very clearly this risk in the most recent annual report:

Our business depends on the continuing availability of rail, road, port, storage and distribution infrastructure. In particular, due to limited storage capacity at our production facilities and other considerations related to production efficiencies, our facilities depend on just-in-time delivery of corn. The production of alcohols also requires a significant and uninterrupted supply of other raw materials and energy, primarily water, electricity and natural gas. Source: 10-K

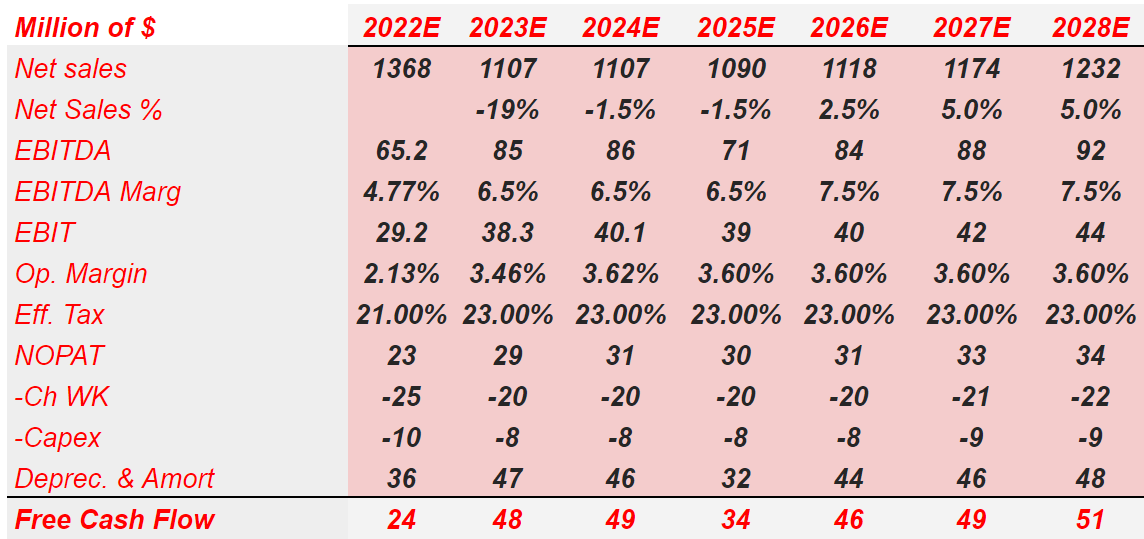

Under the previous conditions, I assumed sales growth of -1.5% in 2024 and 2025, and an EBITDA margin of 6.5% from 2023 to 2025. The effective tax should also stay close to 23%, and 2028 free cash flow should stay close to $50 million:

Author’s Compilations

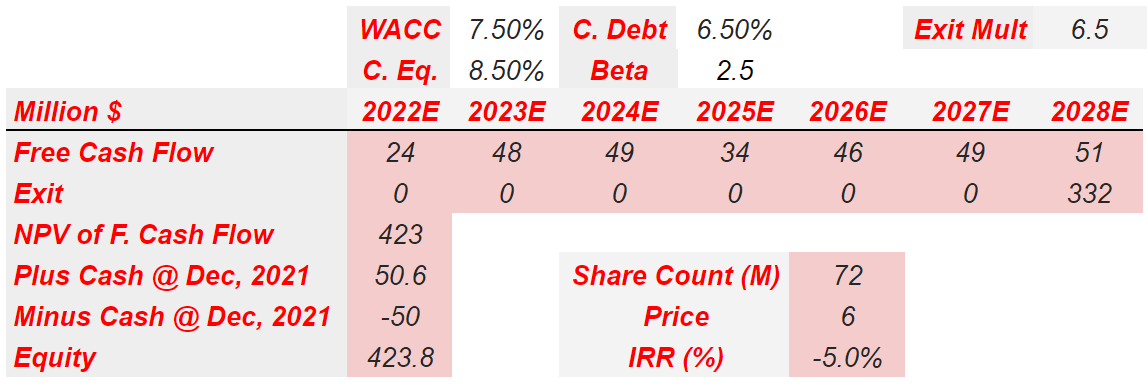

With a weighted average cost of capital of 7.5% and exit multiple of 6.5x, the net present value of future cash flows would imply an equity valuation of around $423.1 million. The implied fair price should be $6:

Author’s Compilations

Alto Ingredients Reports Tons Of Cash And A Small Amount Of Debt

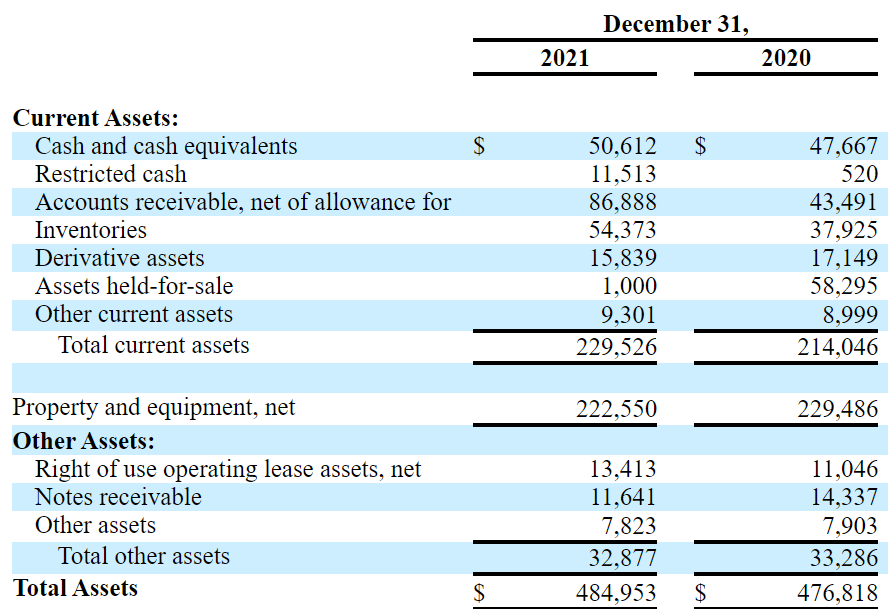

With $50 million in cash and an asset/liability ratio of 3x-4x, in my view, the company’s balance sheet seems prepared to finance further expansion:

10-K

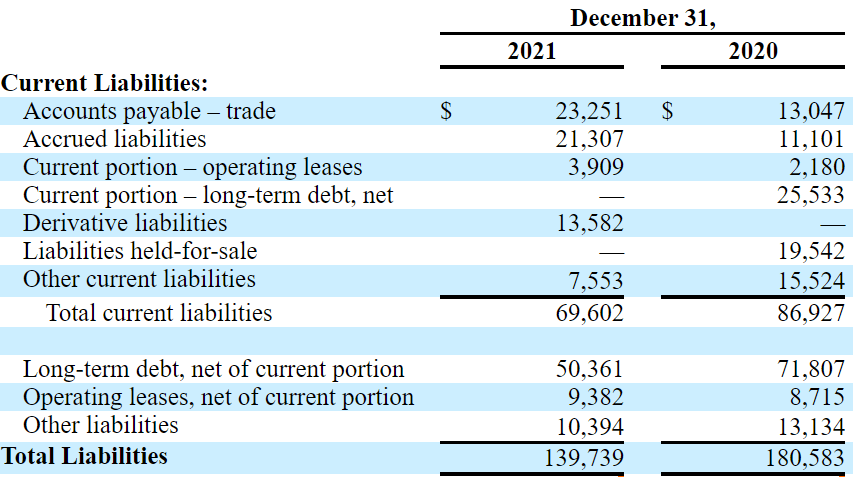

The company’s long-term debt is equal to $50 million, so the net debt is almost close to zero. With properties, free cash flow, and positive net income, in my view, Alto Ingredients will likely receive further debts from banks if necessary:

10-K

Conclusion

If Alto Ingredients develops a more customer-centric business with higher-margin products, its free cash flow will probably trend north. Besides, with cash in hand, Alto Ingredients may try to acquire other peers to boost growth as well as to increase the product offering. Yes, there are some risks from a rising inventory of fuel-grade ethanol. However, the company looks like a buy at the current price mark. In my view, the upside potential appears larger than the downside risk.

Be the first to comment