Alex Wong

Everyone now knows FTX (FTT-USD) unraveled. The resulting liquidations, fear and justified contagion worries quickly spread to other participants and exchanges in the crypto space. The panic selling on Tuesday the 8th alone drove Bitcoin (BTC-USD) down 11% and Ethereum (ETH-USD) down 16%. All twenty of the largest altcoins were negative, with fifteen facing double digit declines on the day. Solana (SOL-USD), with its large connections to FTX, and Dogecoin (DOGE-USD) led the losers. Both were off 23%. Wednesday was worse for the most part.

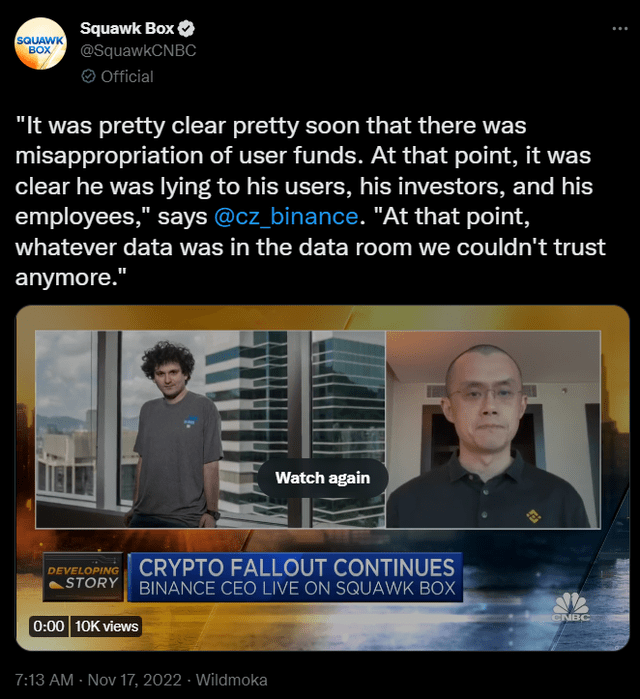

However, important questions remain about the details and remarkable story behind FTX’s unacceptable liquidity issue and bankruptcy. Beyond just those with frozen funds, retail and institutional users across the sector have now lost confidence from the bankruptcy filing and irreparable damage has been done to sentiment. At its heart, the FTX drama is about broken trust. Binance (BNB-USD) CEO Changpeng Zhao described to CNBC what he learned from his team’s due diligence during acquisition talks just prior to the bankruptcy filing. Note that the “he” referenced is former FTX CEO Sam Bankman-Fried.

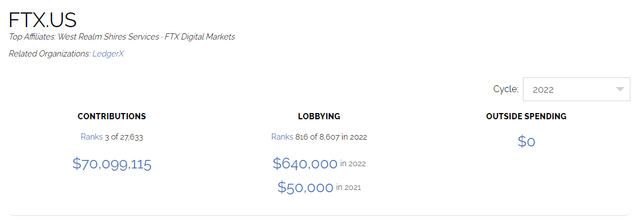

There are also weighty implications for both U.S. and overseas regulations. As will be discussed, FTX was a leader in the crypto regulatory process and an ultra top-tier political donor in Washington. Most interestingly, a regulatory related spat was the purported match that lit the pyre at FTX. Even if FTX is eventually successfully rehabilitated like the Mt. Gox exchange, its failure is a serious blow to the crypto industry because of its prior prominence and reputation.

But somewhat counterintuitively, the FTX story is not a direct indictment of the larger-cap, trustless digital assets like Bitcoin, or the trustless, on-chain DeFi seen on the Ethereum network. This is because traditional finance and centralized exchanges like FTX are intermediaries that do necessarily operate on user trust. Here that trust was obviously able to be broken. So to some degree, FTX’s bankruptcy is not entirely a condemnation of crypto or of decentralized, trustless, permissionless finance, but rather a recommendation for its values.

In the light of the current headlines, the idea above is rightly lost to the media and the larger market. However, it is key to recall that Bitcoin itself is a reaction to the 2007-2008 financial and monetary crisis whose hardships spurred a lack of trust in the banking system. Though now a fading memory, millions of Americans lost their homes and the crisis caused double digit unemployment in the U.S. in the following years. The negative effects of the contagion on worldwide social, economic and health security can’t be overstated.

The 2008 crisis finally climaxed with the bankruptcy of Lehman Brothers in September of 2008, and by October the Bitcoin Whitepaper had come out. In December Bernie Madoff, the onetime chairman and leading market maker of the NASDAQ, was arrested for a years-long Ponzi scheme that was exposed by the crisis. And the Genesis block of the Bitcoin blockchain was mined in January the following year. There was now a nascent, but soon expanding, alternative to routine trust in banking, traditional finance and centralized monetary policies.

Did Binance Accidently Tank FTX and Crypto?

In 2017 Zhao, or “CZ”, founded Binance, the world’s largest digital asset marketplace. In 2019 Bankman-Fried, or “SBF”, founded FTX, which was likely the world’s second largest digital asset marketplace until this month. Initially Binance invested in and worked closely with FTX. In 2017 SBF also founded Alameda Research, which was a crypto trading firm. As discussed below, Alameda is a sister entity to FTX, entangled with the exchange and part of the bankruptcy filed earlier in the month. Prior to his recent notoriety, SBF was well known in the crypto sector for his philanthropy, advocacy and financial backing of other blockchain associated enterprises. For perspective, the FTX brand is now literally everywhere. They are in a strategic partnership with GameStop (GME), prominent FTX ambassadors included Gisele Bündchen and Tom Brady, and you may have noticed during the Word Series that FTX is an official partner of MLB.

In a first-of-its-kind partnership between a global sports league and a cryptocurrency exchange, the FTX patch worn by MLB umpires debuted at the ’21 All-Star game and will be worn by all umpires at MLB regular season and post-season games.

Source: ftx.us

For some brevity, the whole history between the exchanges is not recounted here, but in 2021 Binance divested from FTX. Binance purportedly received a $2 billion mix of FTX tokens and some of their own utility and/or stable coins as payment. As an aside and for perspective, Binance’s associated BNB utility token is the world’s largest altcoin in terms of market cap at $45 billion, near a third the size of Ethereum. And their Paxos-issued, fully dollar-backed Binance USD (BUSD-USD) is the third largest stablecoin. It is complicated, but for reference, FTX’s FTT circulating supply was worth about $3.3 billion last month.

Over the past year Binance held the FTT from the divestiture, as is their general practice with most coins and tokens they have acquired. Binance held even though relations between the two exchanges may have been increasingly strained. My understanding, this strain related to the dynamic political and regulatory environment the crypto industry faces in multiple jurisdictions.

FTX.US and Alameda research were both top 20 donators to Biden 2020. SBF testified on Capitol Hill this year and FTX actively lobbied and was a mega donor to the 2022 cycle, see graphic just below. Crazily, SBF floated the idea of donating a billion dollars in the 2024 cycle.

In October, SBF and FTX presented plans for regulation that conflicted in part with some of the traditional core values of the crypto sector like permissionlessness and universal access to DeFi. A number of industry insiders criticized SBF and some began to distanced themselves from him and FTX.

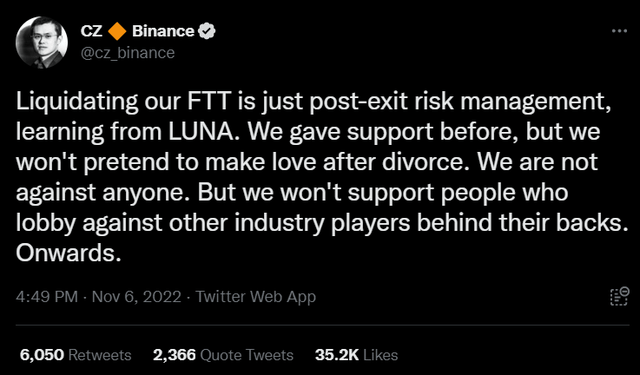

Importantly, CZ apparently thought SBF was secretly lobbying against Binance in Washington. CZ tweeted, “But we won’t support people who lobby against other industry players behind their backs”. And reportedly SBF has joked on Twitter that CZ may not be able to come to Washington for regulation talks. The unspoken implication being CZ is persona non grata either for money laundering or his ties to China.

On November 2nd CoinDesk reported on the blurred division of SBF’s companies, specifically Alameda and the FTX exchange. Speaking about Alameda, CoinDesk emphasized:

That balance sheet is full of FTX – specifically, the FTT token issued by the exchange that grants holders a discount on trading fees on its marketplace. While there is nothing per se untoward or wrong about that, it shows Bankman-Fried’s trading giant Alameda rests on a foundation largely made up of a coin that a sister company invented, not an independent asset like a fiat currency or another crypto. The situation adds to evidence that the ties between FTX and Alameda are unusually close.

Divisions…, coindesk.com, 11/2/2022

The simplified upshot, without discussing the FTT distribution regime, is that Alameda/FTX were using billions of dollars of illiquid FTT tokens as collateral for borrowings. Further, a number of high profile crypto insiders have speculated to media that Alameda was “borrowing” from FTX user assets for its own trading and investing. This would make sense and explain why there would be an ongoing and protracted liquidity crunch and indicative that there was not assessable 1:1 holdings by FTX.

As an aside, FTX users and other FTT holders were also using the tokens as collateral. Analyst predictions of possible insolvency for Alameda and FTX quickly grew following the CoinDesk article. Four days following the article CZ indicated he would sell Binance’s FTT tokens to reduce risk, but would do it slowly as to not adversely affect FTT prices. Over $500 million worth of FTT was moved onto Binance in preparation.

Alameda offered to buy the FTT from Binance over-the-counter at $22 each so as to not effect market pricing, though this deal never materialized. It has obviously been suggested CZ knew this would lead to a collapse of FTT, create liquidity issues for Alameda and possibly lead to a run on other assets at FTX. In my opinion this is unlikely and it has been disclaimed by CZ. Though not conclusive, note that CZ tweeted before the collapse began that Binance usually just held any acquired tokens and it is actually illogical to take out another exchange.

We usually just hold. It removes any doubt that we would attack a “competitor”. Not financially sensible. We want the industry to grow together. But there is a limit to hold, lol.

Exit…, CZ Binance, twitter.com, 11/6/2022

We did hear some concerns about, you know, him badmouthing us behind our backs in DC… We don’t focus on other smaller exchanges… Focusing our energy there does not give us the best return… Taking customers from them we may grow by 1%… If we help grow the industry we can grow by 5x… We are much more focused on how to grow the industry more.

We never viewed FTX as competition, Zhao, CNBC Television, 11/17/2022

However, note below in the same tweet thread from above how CZ parallels FTT to LUNA (LUNC-USD), which spectacularly imploded in May taking down a number of large, leveraged crypto trading firms. Also note again that CZ seems upset about the FTX lobbying.

In any case the run was sparked and billions of dollars in value were withdrawn from the FTX exchange on the 6th and 7th. The FTT token broke though the $22 defense line late on the 7th and withdrawals on FTX International were for the most part suspended on the 8th.

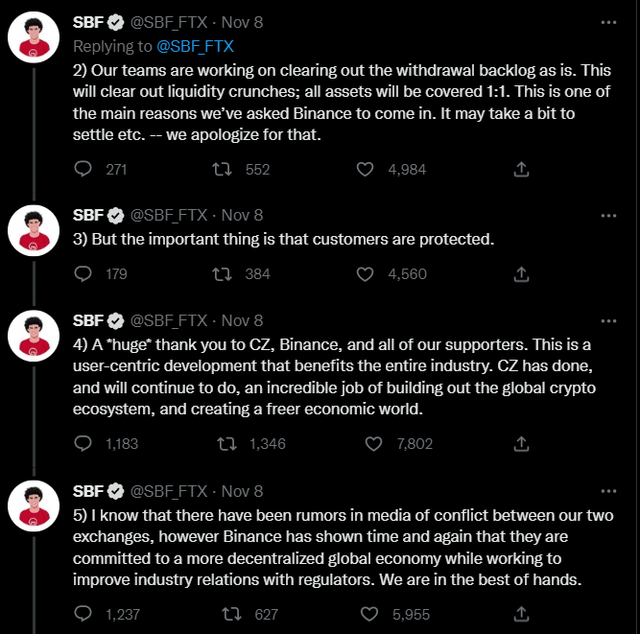

SBF made the following tweet thread highlighting three ideas that now appear unmeaningful: assets would be covered 1:1, surprisingly Binance had been welcomed in as an FTX acquirer and provider of liquidity following any necessary due diligence, and everything was right between him and CZ.

FTX Lesson: Trust But Verify Proof-of-Reserves

After all, you only find out who is swimming naked when the tide goes out.

Warren Buffett, BERKSHIRE HATHAWAY Chairman’s Letter For 2001

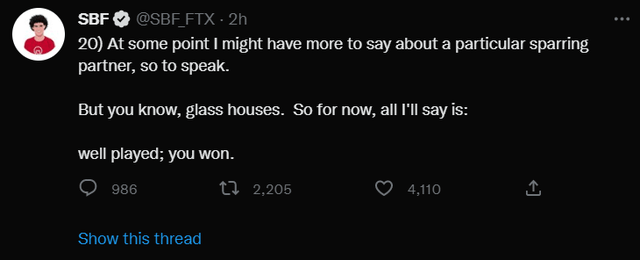

Of course on Wednesday the 9th Binance backed out of the deal, citing reports of mishandled customer funds and U.S. based investigations of FTX. By Friday morning FTX, Alameda and FTX.US jointly filed for bankruptcy. Interestingly, on Thursday SBF returned to Twitter and included a parting shot presumably directed at CZ; SBF wrote, “well played; you won” and indicated he later had a few stones to throw at Binance.

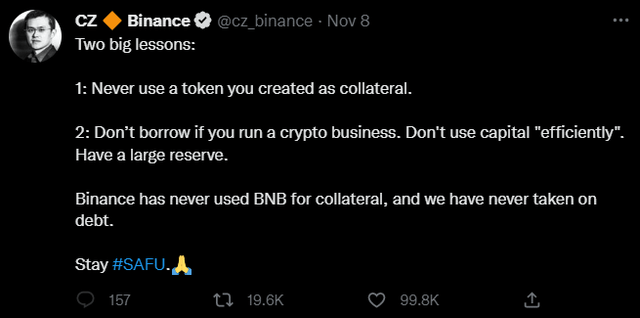

Admittedly, CZ had put out a number of tweets derogatory of how FTX operated, though without mentioning them by name. The tweets center on details of how digital asset marketplaces should approach and verify their reserve system and what investors should know. The idea being that market due diligence, if given transparency, can mitigate the fact exchanges are a necessary point of trust for crypto trading. And this remains true even as investors increasingly feel comfortable with self-custody and self-custody options improve.

CZ is advocating that exchanges provide Merkle tree style proof-of-reserves, allowing transparency and some assurance against their running a fractional reserve system. Binance immediately provided a basic list of their major holdings, including addresses, balances and block heights.

twitter.com twitter.com

CZ also commented that the space should be skeptical of large movements around a proof-of-reserves snapshot, the implication being the assets could be borrowed or shared. For those familiar with Tether (USDT-USD), their initial history contains evidence of similar tactics to inflate audit balances.

CZ suggested that exchanges should not use their own utility tokens as collateral, take on debt, or try to deploy reserve capital for yield.

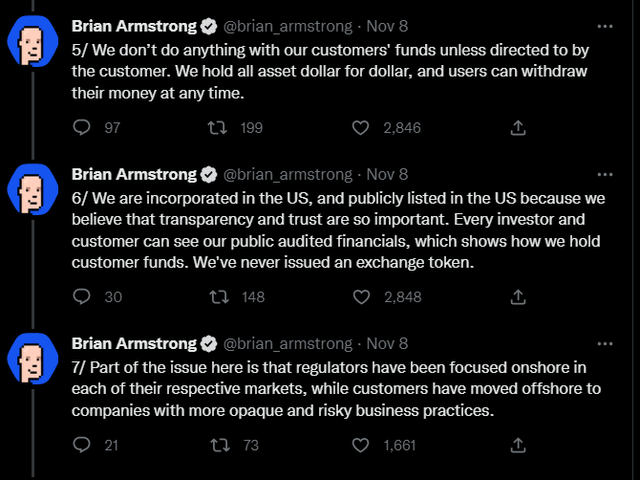

Coinbase (COIN) and its CEO Brian Armstrong basically agree with the Binance positions. They hold all customer assets dollar for dollar and presumably there should never be a need for a withdrawal suspension due to liquidity concerns. It should be noted that Coinbase did seek to offer a yield program for users to lend their crypto, though it was preemptively rejected during discussions with the SEC. If interested, I have an article from last October describing the program and how the Howey and Reves tests could be applied to it; it can be found here.

Coinbase has higher fees and less offerings than their offshore peers. But the added level of comfort provided by their U.S. incorporation, public company listing, and longstanding focus on security and trust will drive user adoption during the next crypto bull cycle. And interestingly, they don’t have a low utility exchange token to cause concern. Though I don’t currently have a buy rating on Coinbase, consider reading Coinbase: Be Convinced But Be Patient or Coinbase: Darkest Before The Dawn where the company’s troubled revenue stream is weighed against its expense profile improvements and fortress balance sheet.

The proof-of-reserves ideas Binance is suggesting and public audits Coinbase supports should provide the sector needed transparency into the exchange intermediaries sitting between traditional finance and decentralized digital assets. These practices can provide some insight into who is swimming naked, even during the high tide of the next bull cycle. Stablecoin legislation may possibly still be addressed first and separately in the U.S. Congress. But then look for a more omnibus crypto bill, including regulations covering centralized exchanges, to follow later next year. One focus will likely surround proof-of-reserves and liabilities and custody reporting for these marketplaces.

Two Final Thoughts On FTX

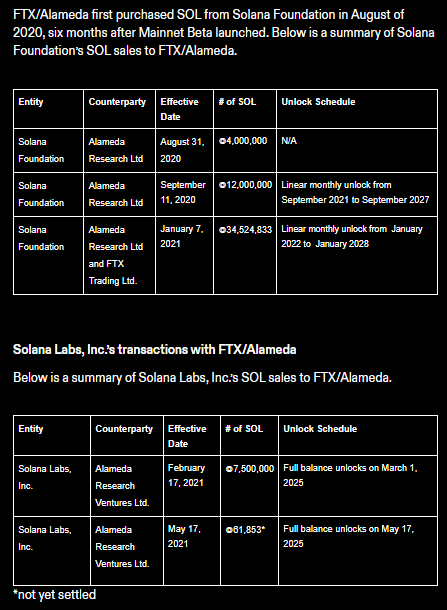

Of the majors, Solana has been the biggest loser from the FTX fallout, down by over half. A week ago Friday Seeking Alpha contributor Mike Fay had a comprehensive piece discussing the FTX connections to Solana and general concerns about the total value locked on the blockchain. The Solana Foundation also provided a detailed blog of their connections to FTX and Alameda. Most concerning is the uncertainty caused by the relatively large amount of currently locked coins associated with Alameda. How in the coming years these unlocking coins will affect both price and the staking mechanism needs to be further scrutinized and gamed out.

solana.com

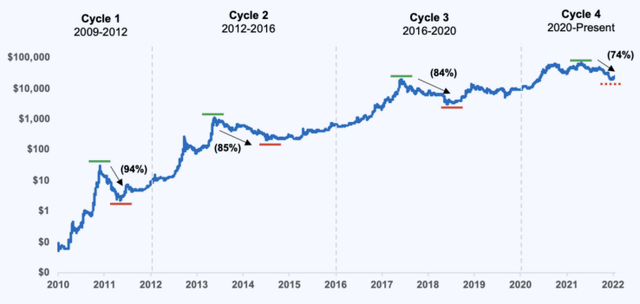

Beyond the main points concerning trust and proof-of-reserves, or the details of how FTX specifically affects different projects like Solana, my final takeaway is more broad. Depending on one’s risk profile and allocation strategy, now may be an opportune time to be averaging into the stronger networks and platforms leading the decentralization and blockchain technology revolution. Today is kind of the opposite of a FOMO moment, a moment of true fear in the sector. And based on timing of previous cycles, the coming months should find a bottom and stabilization of prices.

BTC Price – Log Scale

When asked about his $500 million loss in the ’87 crash, Walmart (WMT) founder Sam Walton famously opined, “Its paper anyway….” The idea being his stores would still open, his trucks would still run, and his team and customers had not really changed in proportion to the loss.

Bitcoin’s total network hash rate remains near all time highs, over 260 EH/s. This is indicative of low efficiency miners remaining “cost of goods” profitable or at least break-even. So from a security perspective the Bitcoin network and ledger still appear strong at current pricing and with 17 months between now and the next point of stress from the halving event.

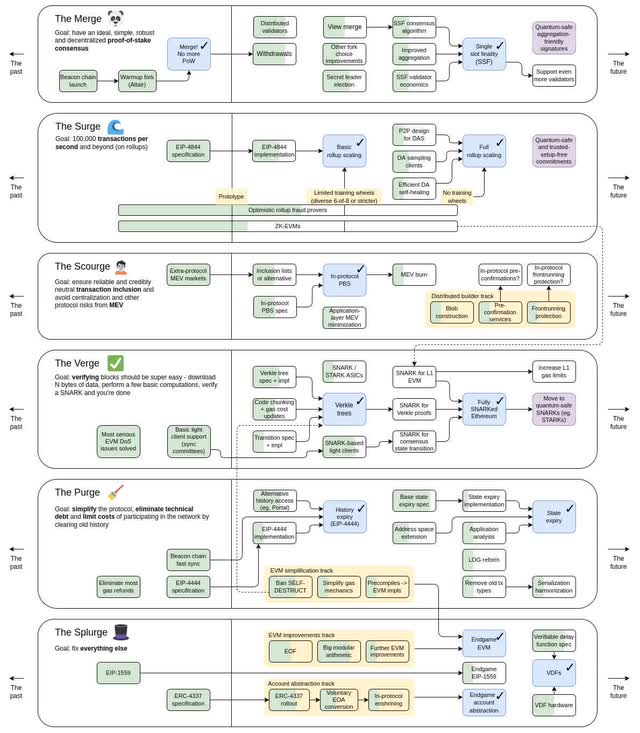

Development on the Ethereum platform continues and core contributors have recently revised the roadmap (see above), including a new upgrade line called “The Scourge” that addresses growing centralization and censorship issues. The promise of trustless, permissionless smart contracts is healthy. This seems especially true when also looking at the larger-cap altcoins that were somewhat siloed from FTX, such as Cardano (ADA-USD). Cardano developments, like the Vasil upgrade and next year’s USDA stablecoin launch, should empower growing participation in its smart contracts.

Despite the FTX damage, the show goes on.

My new marketplace service is coming soon. Complete Crypto Analytics is launching in the near future and will provide model allocations for Bitcoin, Ethereum, XRP, Cardano and crypto adjacent names like Coinbase. Please keep reading my articles here for updates so you can reserve your spot as a Legacy Discount Member. Thank you for following my work.

Be the first to comment