Justin Sullivan

Today, I will be providing an update on Nvidia (NASDAQ:NVDA) after their recent Q3 earnings report. Therein, I will discuss how the company has been in this position before, delve into their recent earnings, analyze the potential direction of the company and its various business segments going forwards, and more.

Note: All dollar values mentioned herein are in millions of USD.

Let’s get started

“Mechanical things can go in a straight line. Time moves ahead continuously. So can a machine when it’s adequately powered. But processes in fields like history and economics involve people, and when people are involved, the results are variable and cyclical.” – Howard Marks

There is something inherently beautiful about cyclicality. Booms and busts, highs and lows, euphoria and despair; these feelings are directly connected with the human condition, and creep their way into the institutions and complex systems that make up the very fabric of the world we inhabit today. These phenomena directly impact society and economies at large, and have repeated countless amounts of time throughout history. There is no doubt that as we exit an environment impacted by pandemic-fueled market euphoria, and as the “easy-money era” of QE comes to an end, we are entering into hard times, an inevitability given the cyclical nature of markets. With inflationary pressures rearing their ugly head, shortages turning into gluts, and the deterioration of stability creeping its way into a variety of our systems, many companies that were putting up record numbers a few months prior to now are now struggling to deal with a plethora of headwinds.

NVDA is one of those companies – but this is a place that they’ve been before…

In April of 1993 three young electrical engineers, Chris Malachowsky, Curtis Priem, and the now-CEO, Jen-Hsun Huang, decided to start a company that would create specialized chips in a San Jose Denny’s. With the benefit of hindsight, it is amazing that a company that now stands at the forefront of computing had such humble beginnings. Being that as it may, the journey to that point was not without its ups and downs.

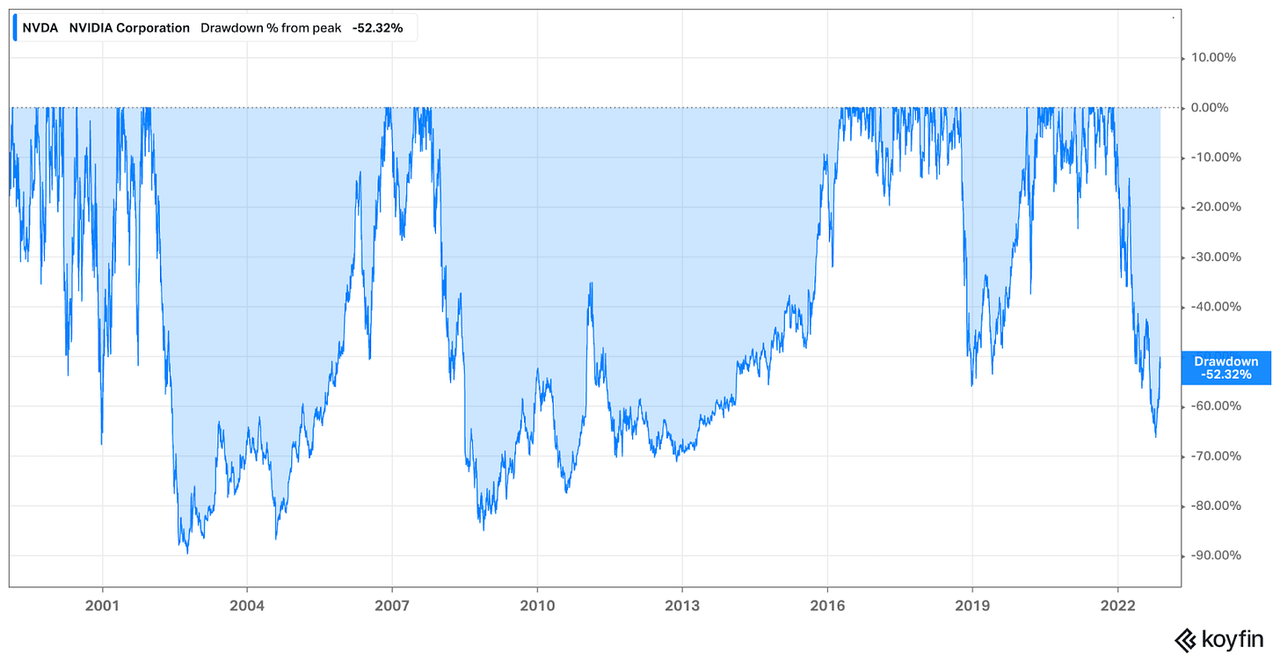

Take the launch of their first chip as an example. In 1995, the company went to market with their NV1 product, an effort that proved to be disastrous, resulting in a $10M loss and a layoff of half their then 80 person team, actions deemed essential to avoid imminent bankruptcy. Scattered throughout the remainder of NVDA’s history are situations where the company seemed to be quickly approaching destruction. As outlined in my original NVDA deep-dive, the rocky roads experienced of late aren’t even the worst drawdowns that NVDA shareholders have experienced:

Over the course of its short lifespan, NVDA has had to reinvent itself three times. The company started off focused on PC graphics, pivoted to a centricity around programmable shaders, and now finds itself benefitting from a boom in parallel processing computing, bolstering several specialities ranging from visual computing, energy efficient programming, the go-to hardware choice at the forefront of the rapidly expanding data center and the AI applications therein, and more. Despite the plethora of opportunities the company has in front of it, NVDA finds itself, yet again, at a cross-road. With no end in sight to the downturn we find ourself in, it begs the question – will NVDA come out from this reinvented or will the weights on their shoulders continue to increase for the foreseeable future?

Let’s dig into their most recent earnings to find out

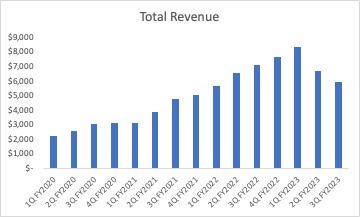

Starting off with revenues, overall top-line beat by 2.2%, coming in at approximately $5.931B vs. the consensus estimates of $5.805B, a decent surprise given the doom & gloom that has been surrounding the company of late but still a noticeable decline YoY, decelerating 16.5%:

Despite this clear deceleration, how exactly have each of the business segments of NVDA been performing? NVDA exists as a full-stack company (i.e., with both software and hardware expertise), and as described in-depth in my NVDA deep-dive, primarily operates in four different business segments: Data Center, Gaming, Professional Visualization, Automotive.

Data Center is primarily focused on providing hardware and software solutions for a variety of use cases ranging from AI to HPC, geared at hyperscalers, enterprise clients, research institutions, etc., as the end-users. Gaming is relatively self-explanatory and includes the company offering their graphical processing units for gaming PCs and laptops, in addition to a few other smaller bets such as the cloud gaming offering and multimedia devices, which understandably take a back-seat to the aforementioned gaming hardware, and are not something I expect to be hugely rewarding to shareholders going forward. Professional visualization encompasses a host of functionality but can be loosely defined as solutions aimed at 3D rendering, which work in conjunction with the company’s GPU architectures and associated computing languages, including the likes of Iray, Mental Ray, MDL, DesignWorks, etc. These products allow customers to create custom rendering applications, are tied to the company’s omniverse activities, etc. Automotive encompasses a series of hardware, software and infrastructure offerings such as the DRIVE supercomputing platform, software that leverages bundles of data gathered with hardware to assist with companies creating autonomous driving capabilities, as well as offerings tiered to data center and launchpad that allow customers to create AI and accelerated computing procedures related to autonomous vehicles.

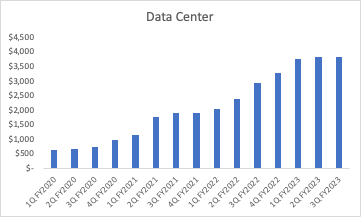

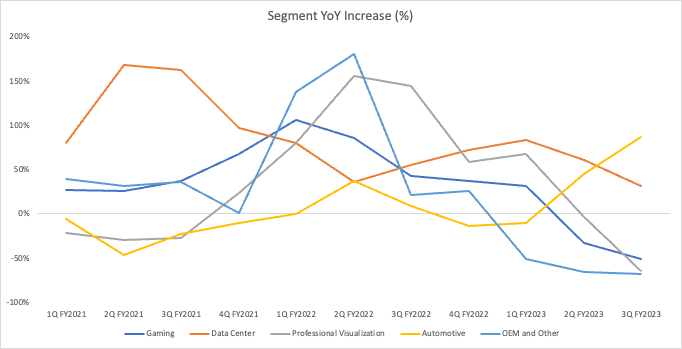

Starting off with Data Center, this segment generated record numbers, increasing 31% YoY to come in at approximately $3.8B.

The data center segment, as outlined on the conference call, benefitted from heightened demand from US cloud providers and consumer internet companies. In addition, management also illustrated how they stand to benefit from increased instances of, and a desire for, accelerative computing, deep-recommender systems and large language models, as well as generative AI going forwards. The company is obviously at the forefront of some exciting developments, but heading into a recessionary environment we will have to monitor if spend in these area deteriorates as customers tighten the belt of spend associated with innovative computing efforts.

Notably, per management, the company has supposedly been able to navigate recent crises relatively well. As has been the hot topic of debate lately, NVDA was directly impacted by various parameters of the recent chip ban, of which ensures that integrated circuits with certain technical parameters were not able to be shipped to China. Put simply, the highest performing pieces of integrated circuitry were essentially prevented from making their way into the country, a direct attack on the country’s abilities to garner top-tier AI capabilities. As such, this dampened the company’s ability to export A100 and H100 products to China.

In response, NVDA came out with the A800 product as an alternative, a piece of hardware that abides to the US government export regulations and is unable to be programmed to exceed them. As a result, management outlined that these changes were able to largely offset the weakness associated with the restrictions, citing the fact that weakness in China overall, a phenomenon that was alluded to pre-restrictions, was the more noticeable deterrent of performance. Although the accuracy of these statements is up in the air, it will be interesting to see if A800s are able to be sufficient enough to be a full-on alternative, or if this will result in Chinese companies creating their own hardware and CUDA-like-alternative that ends up displacing the moat that NVDA currently finds themselves benefitting from. Only time will tell.

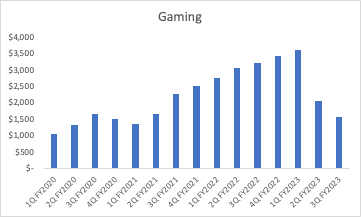

Moving on, it was no surprise that gaming came in weak, dwindling 51% YoY to come in at $1.574B in revenue for the quarter.

NVDA mentioned the fact that they expect normalization and slight sequential growth going forwards, a phenomenon that may illustrate they’ve hit a bottom in this segment, but a phenomenon I find unlikely given the high-end ASP associated with their new graphics cards heading into a macroeconomic environment with deteriorating conditions. The pandemic was arguably the largest change we’ve seen to consumer behaviour seen in a very long time, and the pull-forward in associated spending that occurred as a result of lax monetary conditions and ludicrous fiscal stimulus was noticeable. Even despite their new hardware launches, the company is still facing the headwinds associated with inventory challenges, a phenomenon reflected by the lower sell-in they had with partners to help them align channel inventory this quarter, and a myriad of issues such as with crypto-market changes that contributed to an increase in secondhand market supply, as an example. I believe it will be a few quarters at the very least before gaming shows any signs of putting these issues in the rearview.

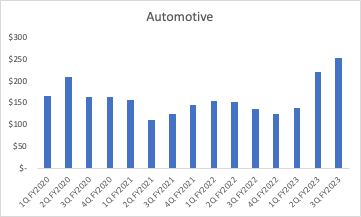

Automotive, though a lower proportion of total revenue, increased 86% YoY, a result of DRIVE orin-based production ramps scaling. NVDA outlined that this segment is likely to experience a sequential increase going forward, and they anticipate this to evolve into their next multi-billion dollar platform. Again given the macro environment it will be interesting to see how that counteracts a cutback in spending that may occur in the next few quarters; although there is no doubt that auto companies are focusing on these endeavours:

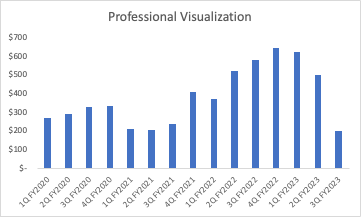

Lastly, professional visualization tanked, decreasing approximately 65% on a YoY basis and coming in at approximately $200M for the quarter. Again management cited these results are attributable to a continuation of the need to work through channel inventory issues, a phenomenon that they don’t anticipate to normalize heading into Q4.

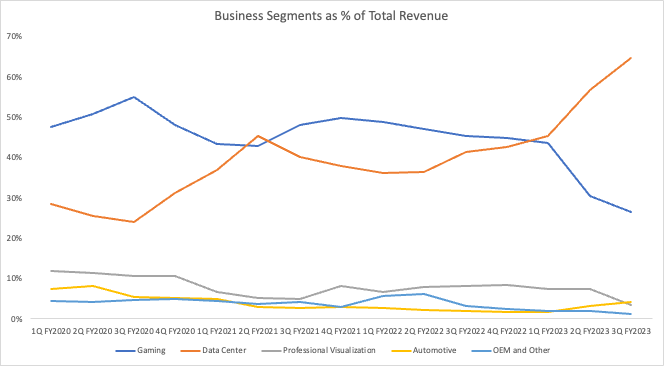

When all of the segments are brought together, here’s how things look

It is clear that there are some business segments, particularly with Data Center and Automotive, that are continuing to reach new heights, whereas Gaming and Professional Visualization continue to work through noticeable issues. Bringing these segments together, it is evident that the company is now severely reliant on the performance of the data center, a phenomenon that is both exciting given the dominant market share they hold in this segment and the high ceiling of growth potential, but also a source of potential fragility given the potential contraction in data center expenditures that may be looming over the horizon.

All segments, spare Automotive are already in or are moving towards deceleration, and when viewed alongside the company’s guidance, this is even more concerning. Revenues are expected to come in at approximately $6B for Q4, with every segment spare professional visualization expected to increase sequentially. Given the small delta that exists between projected Q4 estimates and Q3 numbers ($6B vs. approximately $5.9B) this essentially means that the three segments experiencing QoQ increases will likely increase negligibly. With the company’s still-premium multiple and their behaviour conveying they may be experiencing negligible growth heading into 2023, this may point towards inevitable further compression of their market value going forwards.

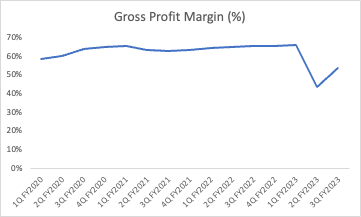

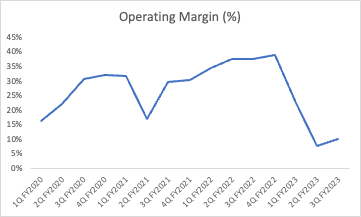

The company’s GAAP margins do not paint any better of a picture. Gross Margins declined YoY from 65% to 54%, feeling the brunt of a $700M charge associated with lower data center demand in China, offset by a warranty benefit of approximately $70M. Operating expenses soared as a % of total revenue, coming in at approximately 43% of top-line compared to approximately 28% last year, primarily attributable to increased compensation and data infrastructure costs. Resultantly, operating margins declined, coming in at 10% for the quarter compared to 38% last year. Although the company’s revenue guide and gross margin guide (63% anticipated) are not horrible, they anticipate operating expenses to remain flat at approximately $2.56B. Performing basic calculations we arrive at the fact that operating margins for Q4 are likely to be approximately 20%, an improvement QoQ but still not indicative of NVDA being out of the woods just yet.

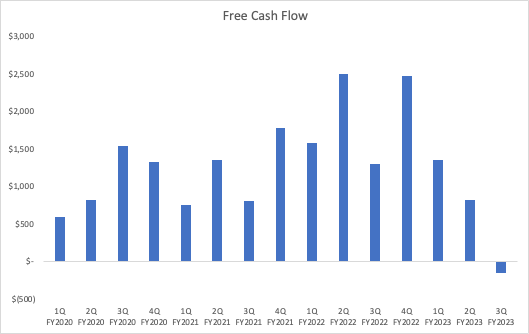

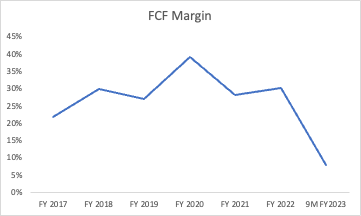

Dwindling margins, combined with a relatively consistent capex profile that matches previous years, resulted in the company’s free cash flow coming in at approximately $(156)M for the quarter, and this is even taking into consideration approximately $745M in SBC included in CFO, highlighting that the company has been creeping into cash burning mode, a phenomenon that will need to be monitored:

Looking at the company’s 9M values and taking into consideration the guidance, we are likely to see the lowest FY FCF margin values in quite some time.

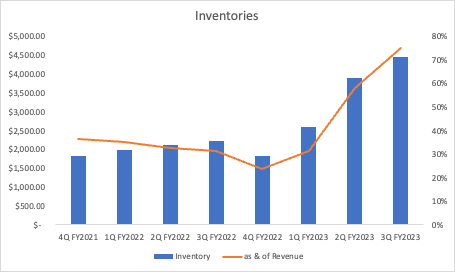

In short, for the time being FCF is declining in a manner that is non-accretive to shareholders. Lastly, it is worth discussing the company’s inventories, of which have bloated up over the course of the last year, increasing to approximately $4.45B for the quarter, 75% of revenue compared to 31% of revenue for the same time last year:

On the conference call, NVDA’s CFO indicated that their inventory on hand was largely due to the upcoming architectures the company has coming to market including ADA, hopper, and other hardware related to their networking business. Although the company says they are always to looking at their inventory levels at the end of each quarter in an anticipatory nature, it is slightly hard to believe that the company’s inventory solely swelled as a result of these actions. In August, and many months prior, it was noted that NVDA was struggling with excess inventory associated with their RTX-3000 series ahead of the RTX-4000 launch. Given the nature of secondary markets at the moment, I find it is unlikely the company was able to normalize the RTX-3000 inventory bloating that quickly, given the state of the environment we are in right now. Inventory looks poor and only time will tell if they are able to normalize this swell heading into an increasingly difficult period.

In short, if I had to give a TLDR on the situation at NVDA at the moment it would be as follows:

-

The company stands at the forefront of arguably some of the most promising subsections of the technology sector today. AI will likely be world-changing and through their data center business segment, NVDA is likely to reap the rewards given their 80%+ recent accelerator market share.

-

Gaming will likely recover as we enter into a more stable macroeconomic environment. This popular entertainment source is going nowhere and is likely to grow above GDP for sometime. NVDA will need to focus on not wilting on ever-growing competitive pressures and weather the aforementioned headwinds before reaping any reward.

-

Automotive is promising and is what the company believes to be their next multi-billion dollar platform. Although it is sustaining commendable growth thus far, only time will tell if customer spend will increase linearly, or if expenditures are reeled back in during economic turmoil due to the far-fetched nature of these engineering developments overall.

-

Similar to gaming, professional visualization will likely normalize heading into a more rosy economic situation, however, short-term inventory headwinds will continue to impact the segment heading into next quarter and likely for some time afterwards.

-

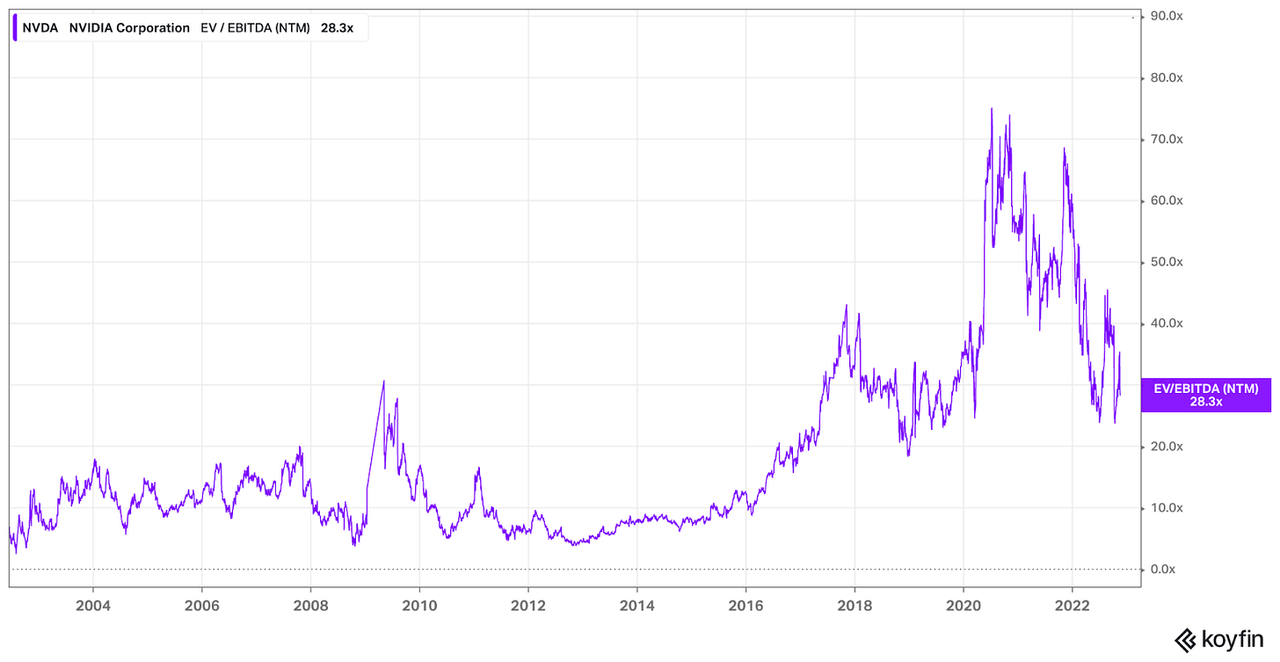

NVDA growth is concerning and with their new guidance it looks like even their best performing business segments are heading to a standstill. We’re at an interesting point in markets at the moment. Despite extreme financial tightness, the economy as a whole hasn’t deteriorated into disastrous areas. As the Fed likely continues to put their foot on the gas, a recession heading into next year is likely in my opinion. Given that, as well as the fact that S&P 500 earnings are still too rosy and have yet to be downgraded to levels seen in previous recessions, I believe there may be further pain in equity markets. General market-based and economic weakness, combined with the fact that NVDA still has a relatively premium multiple and is unlikely to be able to sustain the levels of growth that they’ve been able to in the past, likely warrants further compression in the equity. With margins yet to recover to stable levels, continued relatively egregious SBC, and an unfavourable inventory situation, the amount of FCF made available to shareholders is likely to remain bleak for the next few quarters.

In short, and as I alluded to in my original deep-dive, I believe NVDA is a phenomenal company that has managed to survive a plethora of situations that would have killed most companies. Given the spaces they operate at the forefront of, if they’re able to come out of this environment stronger, they’re likely to reap substantial rewards. Until then, I believe further short-term pain may be inevitable. We saw multiple compression when the company went through hardship at the end of the last decade, and I don’t think it is unreasonable to expect a similar or worse situation heading into a prolonged bear market, or one where a V-shaped recovery isn’t as probable. Time will tell if my hunches are right here.

Thank you for reading my research.

Disclaimer: The information and research contained herein is all my own opinion and should not be used as a substitute for proper due diligence. Please consult your financial advisor and evaluate your financial circumstances before making any investment decisions.

Disclosure (as of November 21, 2022): MT Capital Research holds no position in the securities discussed herein and does not anticipate to initiate a position in the forthcoming five days.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment