KanawatTH/iStock via Getty Images

For the last few years, “high yield” has almost been a dirty word. Quality companies traded at high multiples to close out 2021 which necessarily meant fairly low yields even in dividend sectors like REITs and utilities. Most of the stocks that remained with yields greater than 6% were shaky at best. There were a select few outliers that were both quality and high yield, but the opportunities were few and far between. Fast forward to today and the market selloff has created a vast array of great dividend opportunities.

The group of high yield stocks I am most interested in is what are called the accidental high yielders – companies that are high-quality growth engines that just so happen to have high yield due to undervalued stock prices.

Here are 5 stocks that have been unfairly beaten up and as a result have high yields along with strong capital gain potential:

- Global Medical REIT (GMRE) – 6.5% yield

- Gladstone Commercial (GOOD) – 7.4% yield

- Postal Realty (PSTL) – 5.8% yield

- Medical Properties Trust (MPW) – 6.3% yield

- Weyerhaeuser (WY) – 6.8% yield (trailing)

Yields ranging from 5.8%-7.4% are somewhat high, but there are dozens of companies that have this kind of yield.

The key factor that differentiates these particular 5 is the quality. Each of these companies is fundamentally strong and growing earnings. It is the combination of value, growth and dividends that makes these overall strong holdings which I think will significantly outperform the market.

Let us dig into the specifics of each.

GMRE

The opportunity in this medical office REIT is really a price thing. GMRE has had the same story for many years:

- Accretive growth fueled by above-market cap rate acquisitions

- Steady revenues from long term contracts with medical office tenants

- 5.0X tenant coverage of rent

Due to these factors, they have been growing, and I suspect they will continue to grow FFO/share.

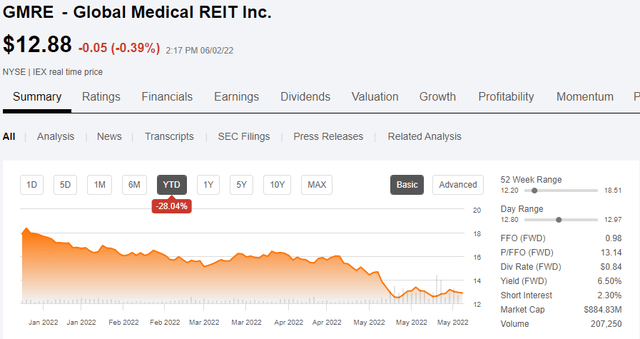

The only thing that has changed with their story is that now one can get into this growth stock at a value price. For unclear reasons, GMRE has been particularly clobbered in the market sell-off, down 28% YTD.

Fundamentally, they just keep chugging along. The acquisition pipeline remains open at accretive cap rates. They had a slight beat on 1Q22 revenues and raised the dividend 2 cents per year.

There has been a paucity of news on GMRE specifically, and the medical office industry is doing just fine. The other MOB REITs have had market-beating performances this year.

I think this is simply the case of a small-cap like GMRE getting swept up in the market sell-off, and there aren’t enough analysts following such a small company to induce price discovery.

GMRE is just cheaper than it should be. This kind of quality and growth is not typically available at a 13X multiple on FFO or a 6.5% yield. I am happy to scoop up shares here.

GOOD

Prima facie, triple net REIT Gladstone Commercial is a stagnant source of yield as its dividend is nearly unchanged for decades. As a monthly dividend stock, much of its appeal has been to dividend-focused investors. Seeing the dividend unchanged for so long, the market has come to view it as almost a perpetuity of the given payout, but with risk more akin to an equity than a true perpetuity.

With interest rates rising, the market has rendered its verdict that the appropriate yield for this kind of instrument is 7.4%.

If GOOD was just a flat dividend payer, I would agree with this valuation.

However, the market’s myopic focus on the lack of historical dividend growth misses what has been going on at a deeper level. GOOD has improved internally in so many ways:

- Substantially lowered debt.

- Improved portfolio composition, now consisting of half industrial split between manufacturing and logistics.

- Better payout ratio. GOOD used to payout over 100% of FFO, but the dividend is now comfortably covered.

These internal improvements pave the way for dividend growth in the future. So rather than looking at its long history of flat dividends and doing straight-line extrapolation, I look at the fundamentals as the guide of future dividends.

I think it will be slow growth, but slow growth is plenty when the going in yield is 7.4%

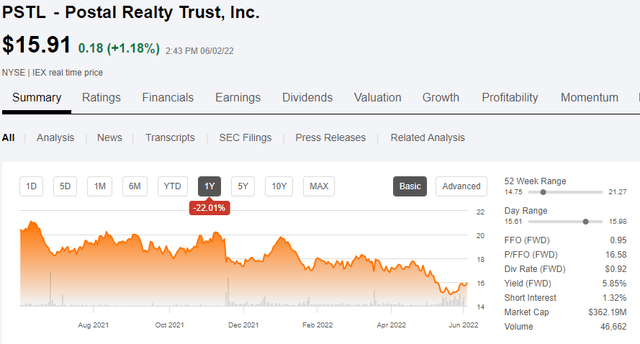

PSTL

Postal is a niche growth company enjoying the accretive 6%-8% cap rates on its pipeline of post office acquisitions. Fundamentally, it is particularly well-positioned for this environment for 3 reasons:

- Government tenant is almost certain to pay rent owed.

- United States Post Office is committed to fulfilling its task and PSTL’s real estate is essential to this function.

- Inflation should bump up leases as they get renewed.

It is a tough macro environment to anticipate. I have no clue whether it will be a soft landing or a recession, but PSTL’s earnings are defensive in nature, so it should perform in either case.

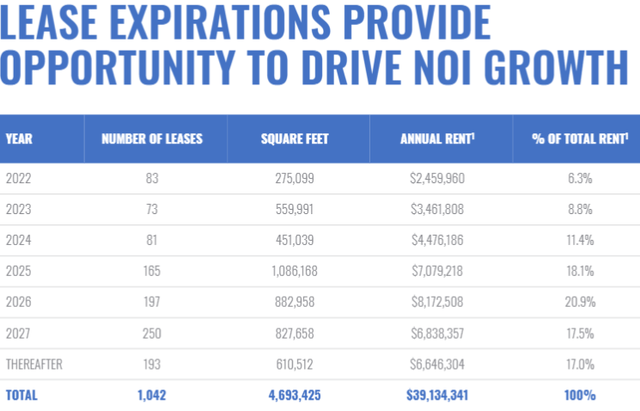

In 2022 6.3% of leases are up for renewal and 8.8% in 2023. These were 5 year flat leases signed 4 and 5 years ago. Historically, rent increases on renewal have kept up with or beaten inflation so as these renew I anticipate their rental income will roll up 10-15% (2-3% per year X 5).

The 2024 and beyond rolls should be even stronger due to the currently high inflation rate.

On the flip side, PSTL’s cost structure is quite unchanged as nearly all of its debt is fixed rate.

Organic revenue growth, flat expenses, and accretive external growth sum to significantly improving FFO/share.

For a while, the market understood this growth story and Postal traded at a respectable multiple. In the 2022 selloff, however, it fell indiscriminately with everything else.

This leaves it at an opportunistic price for a strong current yield and nice upside to fair value.

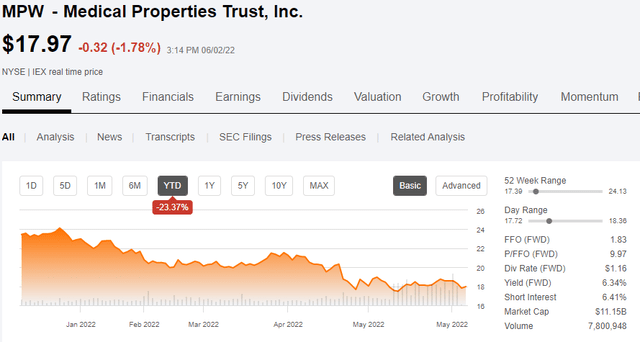

MPW

Healthcare has been a pariah since COVID hit. First, the pandemic itself shut down elective procedures which tend to be the highest margin. Then regulations and new safety procedures increased operating costs. Finally, the supply chain reverberations created labor shortages which forced operators to go to temp agencies to get workers which brought an untenable cost increase. A whopping 88% of hospitals had to go through temp agencies.

It was tough for the operators, and it may continue to be tough for some time, although the environment is improving.

MPW’s stock has been punished as if it were an operator struggling with the environment.

However, as you know, MPW is not an operator. They are a REIT that simply leases their hospitals to the operators.

When COVID first hit, there was understandably a question as to whether the operators would be able to pay their rent. It was admittedly tight for a while, but now, midway through 2022, that question has been answered – tenants overwhelmingly paid their rent.

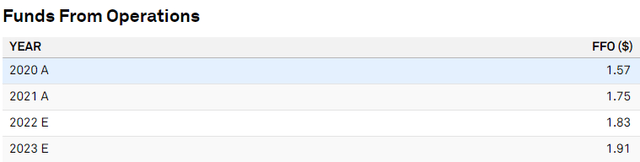

As such, MPW’s revenues were almost untouched by the challenges, and in fact, they have continued to grow the bottom line. FFO grew in 2020 and 2021. It is expected to continue growing in 2022 and 2023.

S&P Global Market Intelligence

Operators are now on much more solid footing and MPW’s operators are particularly strong with average EBITDAR coverage of rent of 3X.

REITs, through long-term rental contracts, enjoy a layer of protection that most operating companies don’t have. There was certainly smoke and maybe even a bit of fire in the operator space, but it didn’t actually trickle through to MPW.

In trading MPW as if it were an operator, the market has brought it to a highly opportunistic price.

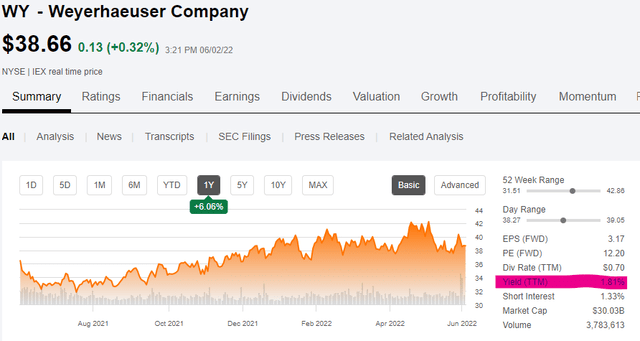

WY

Weyerhaeuser is not typically thought of as a dividend stock. If you look it up, the stated dividend yield is 1.8% which is okay, but nothing special.

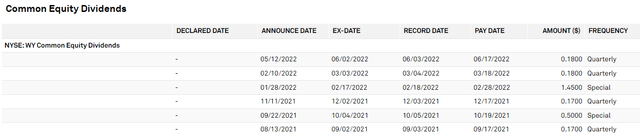

This is because WY has an unusual dividend schedule. It pays $0.18 quarterly which is what shows up in the 1.81% calculated yield. On top of that, it pays special dividends in order to meet the legal requirements for a REIT to pay out 90% of taxable income.

Well, income was high in 2021 resulting in massive special dividends which can be seen below.

S&P Global Market Intelligence

These sum to $2.65 in dividends over the past 12 months which is a trailing 6.8% yield at current price.

2022 has also been an extremely profitable year, so I think there will be more special dividends coming at the end of this year.

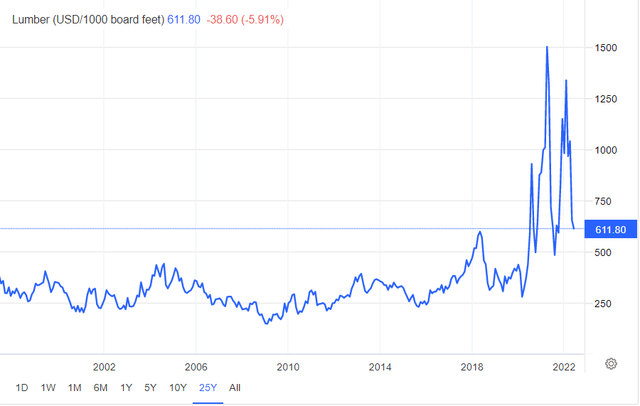

Some degree of pessimism has hit WY’s stock with headlines suggesting lumber prices are down 50% or even 60% depending on the time frame measured. Sure, I suppose that is factually true if one picks the peak and the trough.

However, what is missing from the mainstream discourse is a longer-term perspective of where prices sit today.

$611 per thousand board feet is an excellent price. It might not be the $1500 that it hit briefly, but it doesn’t need to be. Lumber has historically fluctuated closer to $300, so we are still at double historical pricing.

WY is the most efficient lumber producer and is built to have a healthy profit margin with lumber at $300. I don’t know where lumber prices will eventually stabilize, but at the current $611, times are good. Full year 2022 will likely be strong as the profits already booked should be enough to fuel an ample special dividend.

The Bottom Line

One no longer needs to sacrifice quality to get a high yield. Thanks to the freshly cheap market and mispricing in individual securities, there is ample opportunity to simultaneously get quality, high income and growth.

Be the first to comment