oatawa/iStock via Getty Images

In a somewhat surprise move, Elon Musk made a sudden unsolicited offer to acquire Twitter (NYSE:TWTR) only days after deciding to not join the Board of Directors. The market had a mixed reaction due to the lowball price likely to be rejected by the company potentially leading to Musk selling his 9.2% stake. My investment thesis remains Bullish on the social media site as the offer continues to show the vast value here.

Not Such a Big Bid

Prior to the open on April 14, Elon Musk announced he had made an offer for Twitter only days after deciding to not join the Board of Directors. The Tesla (TSLA) CEO made an offer of $54.20 per share in cash to existing shareholders.

Musk didn’t provide any details on how the deal valuing Twitter at over $40 billion would be financed. A NY Post article suggests the plan might include bringing in partners to help finance the deal with a potential partner in private equity firm Silver Lake while Thoma Bravo might provide actually make a competing bid.

Even more details emerged suggesting Musk might issue a tender offer directly to shareholders. Either way, shareholders should be concerned that Musk doesn’t have the specifics of a bid nailed down along with the low bid price.

The Twitter bid is starting to feel a lot like the funding secure bid for Telsa at $420 back in 2018. The stock hit a high of $1,243 only 3 years later suggesting those taking the deal wouldn’t missed out on nearly 200% gains.

In essence, Musk sees Twitter so cheap he just wants to buy the company and take it private despite having done limited legwork on how to finance the deal. What a lot of the media doesn’t understand about the bid is that Musk is offering a lowball offer at only $54.20. Twitter traded as high as $75 back in early 2021 and the stock has seen consistent gains since trading around $15 back in 2016.

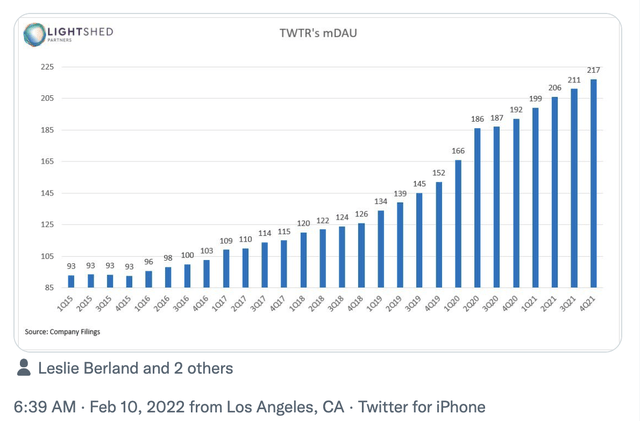

A lot of views suggesting Twitter should sell at these prices look at both the stock price prior to the offer of the mid-$30s and the original IPO price. Neither is the most relevant number to use over the last 4 years when the user base has more than doubled since 2015. The social media company has grown the monetizable daily active users (mDAUs) from 93 million to 217 million to end 2021.

Source: Rich Greenfield LightShed

The most common comment from the uninformed media or analyst is that Twitter “hasn’t grown” in a decade, so naturally the BOD should accept the offer and run. Kevin O’Leary highlighted this view in his CNBC interview.

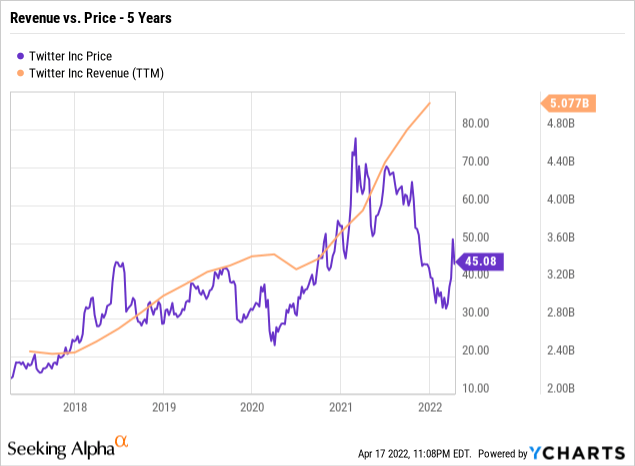

In reality, revenues have followed the user growth over the last 5 years. What hasn’t really followed the growth in these crucial metrics is the stock price. Though, one looking at Twitter over the last 5 years has a far different view of the social media company than one focused on the price since the IPO.

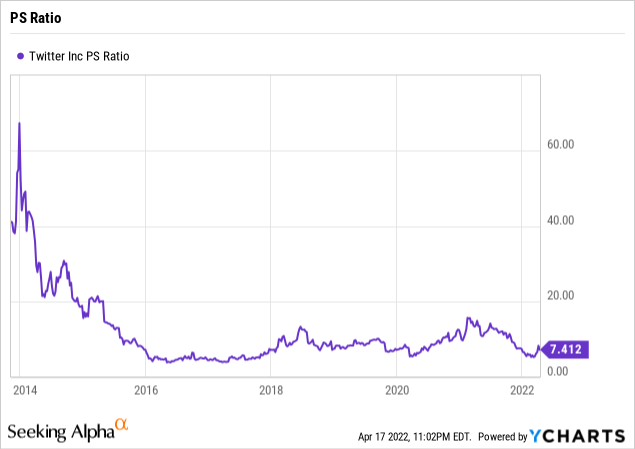

The revenue growth doesn’t suggest a company in dire needs of a deal taking the company private. What shareholders need is an incentive to unload shares and $54.20 isn’t such a price. In fact, the P/S Ratio is now within the normal trends for Twitter since late 2015. Musk isn’t offering any premium to the normal valuation of the stock. What he did was make an offer appear as a premium based on the irrational weakness from the post-covid lows.

Not The Best Corporate Reaction

If anything, shareholders probably like that Musk has shaken up the company and the questionable corporate culture. The employee base appears perplexed by the Musk bid while the co-founders of the company are no longer anywhere running the business.

Musk has successfully built multiple businesses now to become the richest man in the world, so the employee base shouldn’t so quickly reject his desires to return free speech to the platform. The normal reaction should’ve been possibly excitement that he would return the social platform to greatness to compete with against Facebook (FB) more effectively.

In addition, the BOD adopted a shareholder rights plan to keep Elon from grabbing a greater than 15% position in the outstanding shares. The move doesn’t necessarily seem in the best interest of shareholders by keeping an entrenched board and management in charge and blocking an outside party interested in buying shares.

The ideal outcome was for Musk to spend a period of time working with management to improve the site. Musk making an offer within days seems disingenuous as in the best interest of shareholders, as they would be blocked from the potential upside beyond the deal price.

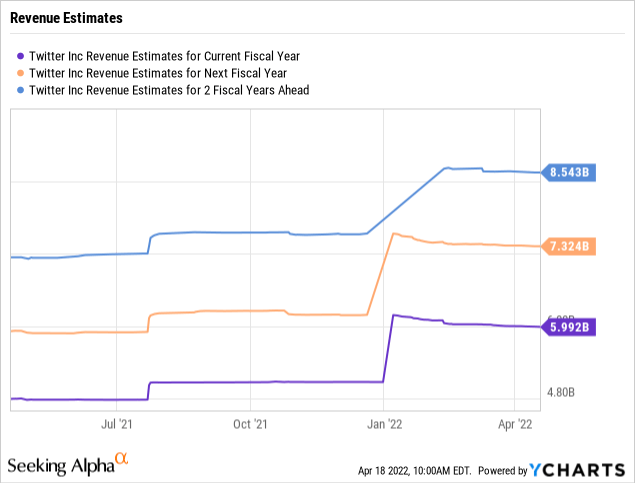

The best outcome for shareholders was management and Musk working together to build a better company and reward shareholders. Twitter already has a plan for reach 2023 targets of 315 million mDAUs and revenues of $7.5 billion for annualized growth in the 20% range.

Until the new CEO has had the opportunity to hit these targets, the BOD shouldn’t accept a lowball bid from Musk. The narrative that Twitter hasn’t grown in the last few years is just false.

Takeaway

The key investor takeaway, in my opinion is that Musk isn’t offering a premium for the growth stock. Twitter has an established growth plan in place and the management team should be judged on reaching these targets and incorporating ideas from Musk on free speech and product enhancements to the platform.

The stock might fall on Musk selling his shares, but the company is growing at a solid clip and is worth far more than the current $46 price over time.

Be the first to comment