Viorika

I am constantly seeking out high-yielding investments and funds, and recently wrote articles reviewing the Pimco Dynamic Income Fund (PDI) and the Simplify Volatility Premium ETF (SVOL). This article reviews the merits of the Tekla World Healthcare Fund (NYSE:THW).

While I find the 9% current distribution yield attractive, I would personally stay away from the Tekla World Healthcare Fund. As a sector fund, its total return lags peers such as the XLV ETF. The strategies employed by THW to generate income may limit upside while exacerbating downside.

Fund Overview

The Tekla World Healthcare Fund is a sector focused Closed End Fund (“CEF”) that invests primarily in the healthcare sector with $580 million in net assets. The fund seeks to generate current income and long-term capital gains through investments in equity and debt securities of companies engaged in the healthcare industry.

Strategy

The Tekla World Healthcare Fund employs a combination of growth and income investment strategies to achieve its mandate. It invests across all healthcare subsectors (pharma, services, medical devices, lifesciences, biotech, etc.) and across a company’s capital structure. THW invests at least 40% of the fund in non-US companies or those companies with substantial non-US revenues.

Some of the strategies employed by the Tekla team includes investing up to 20% of the managed assets in non-convertible debt securities of healthcare companies, up to 20% of the managed assets in healthcare REITs, and up to 30% of managed assets in convertible securities (warrants or convertible debt). The Fund may also invest a portion of assets in restricted securities (i.e. private placements). To generate additional income, the Tekla World Healthcare Fund also sells (or writes) calls against a portion of the portfolio (usually less than 20% of managed assets). Finally, the fund may employ up to 20% leverage to enhance returns.

Management Team

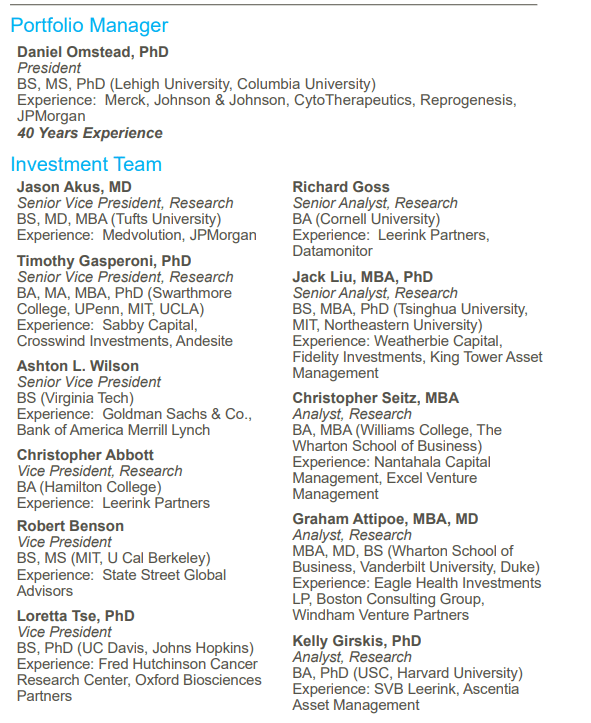

THW is led by Dr. Daniel Omstead, formerly President and CEO of Reprogenesis, Inc., a development stage biotech company that was merged into Curis, Inc. (CRIS) in 2000. Prior to Reprogenesis, Dr. Omstead was the Senior VP of R&D for Cytotherapeutics. Dr. Omstead also has research experience with Merck and Johnson & Johnson. In addition to Dr. Omstead, the investment team of THW includes two medical doctors and four PhDs (Figure 1).

Figure 1 – THW investment team (THW factsheet)

Dividend & Yield

THW is a high yielding fund, with a current yield of 9%, based on a monthly distribution of $0.1167 / sh and a current unit price of $15.52. Impressively, the fund has paid the same $0.1167 / sh distribution since it began paying distributions in October 2015.

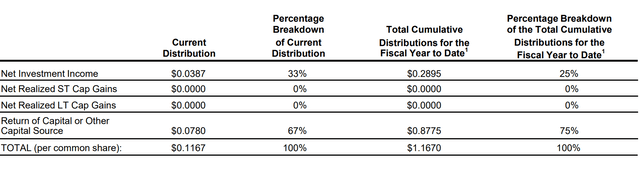

However, if we look at the dividend closely, only 1/3 of the distribution is from net investment income, according to its latest disclosure (Figure 2). In past disclosures, return of capital or other sources has been as high as 100%.

Figure 2 – Distribution is not covered by net investment income (THW Section 19(a) notice)

Portfolio Composition

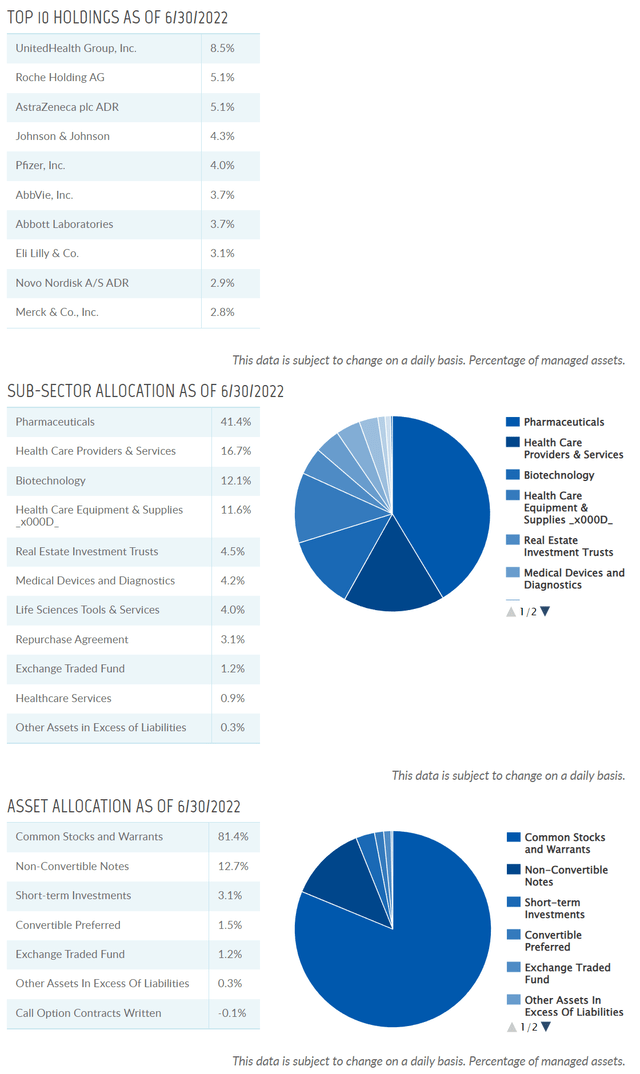

The Tekla World Healthcare Fund has a pretty comprehensive summary of its holdings on its website. As of June 30, 2022, the fund’s top ten holdings are shown in Figure 3 and make up 43% of the fund. In terms of sector allocation, we can see 41% of managed assets are allocated to pharmaceuticals, 17% in service providers, 12% in biotech, 12% in healthcare equipment and supplies, and 8% are in medical devices and life science tools. As of June 30, 2022, the fund has $615 million in managed assets and $120 million in debt, for a leverage ratio of 19.5%.

Figure 3 – THW portfolio composition (THW website)

Fund Returns

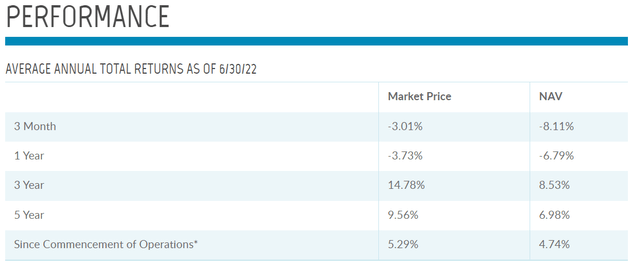

On an absolute basis, the fund returns have been decent with a 3-Year and 5-Year average return of 8.5% and 7.0% per annum respectively (Figure 4).

Figure 4 – THW Returns (THW website)

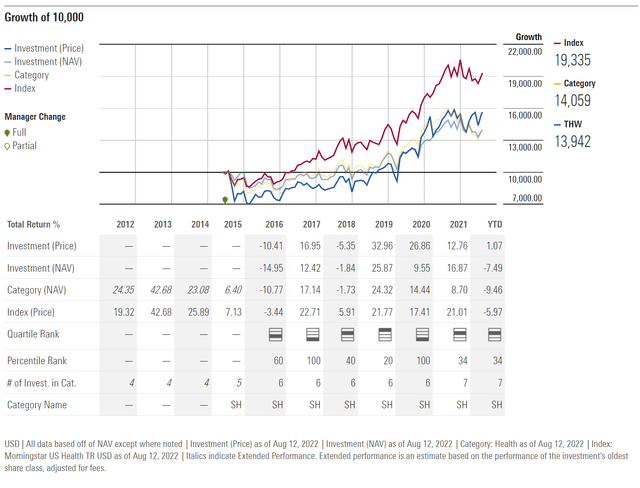

However, when compared to peers (Closed End Healthcare funds as defined by Morningstar), the fund is generally 2nd or 3rd quartile (Figure 5). It has also generally underperforms the index, Morningstar US Health Total Return.

Figure 5 – THW returns against peers (morningstar.com)

Furthermore, we can compare the Tekla World Healthcare Fund to the Health Care Select Sector SPDR ETF, which has returned 15.3% and 12.5% annualized on a 3 and 5-year basis (Figure 5). (Note dates are not exactly comparable, as THW’s returns are to June 30, 2022).

Figure 6 – XLV returns (ssga.com)

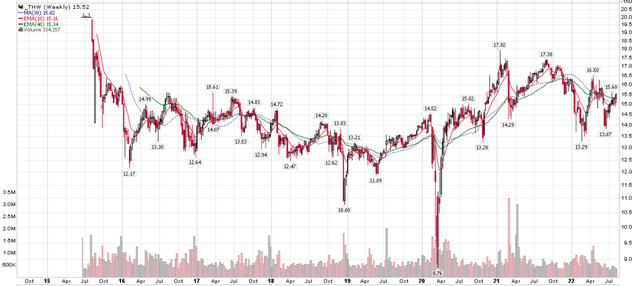

When we consider that the fund has consistently paid $1.40 per year in distributions with current yields varying between 8% (price peaked $17.92 in early 2021) to 16% (price bottomed at $8.76 during COVID-19 pandemic), it appears most of the historical returns have come in the form of distributions. This is confirmed by the price chart, which has not shown much capital appreciation in the 7 years since the fund began operations.

Figure 7 – THW price chart excluding dividends (stockcharts.com)

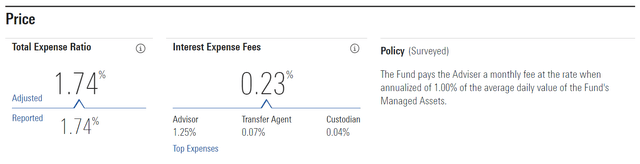

Fees

Management Fees for the Tekla World Healthcare Fund is fairly high, at an annualized 1% of average daily NAV of the fund. All-in, total expenses run at 1.74%. For comparison, the XLV ETF has a net expense ratio of 0.1%.

Figure 8 – THW fees (morningstar.com)

Investors Should Look Beyond Current Income And At Total Return

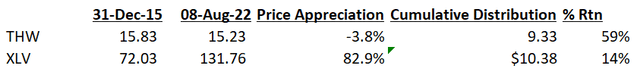

THW looks attractive to investors seeking current income, with almost 7 years of unbroken $1.40 per annum distributions and a current distribution yield of 9%. However, I think investors should look beyond the current yield and consider total returns. On that basis, investors may be better off investing in the lower cost XLV ETF.

For example, assume investors had invested in THW on December 31, 2015 at $15.83 per unit. After investing in the fund for almost 7 years, THW’s price on August 8, 2022 was $15.20. So on a price basis, investors have lost 3.8%. THW paid cumulative distributions of $9.33 over the 7 years, or 59% return. However, if investors had bought XLV on the same date, they would have achieved 83% cumulative return in price and 14% cumulative return in distributions (Figure 8).

Said differently, investors could have invested in the XLV and monetized a portion of their portfolio monthly to mimic the cash flows of THW and ended up ahead.

Figure 9 – THW and XLV total return (Author created with price data from stockcharts.com)

THW Strategies Trade Off Upside For Yield

I believe the number one reason for THW’s underperformance is the trade off the manager has to make in order to generate high current yield. Recall in the strategy section above, we mentioned THW writes covered calls to generate current income. This means that generally in rising markets, THW gives up some of the ‘upside’ in its portfolio.

For example, in 2020 and 2021, the Morningstar US Health Total Return index returned 17.4% and 21.0% respectively but THW only returned 9.6% and 16.9% respectively (based on NAV).

However, downside capture may be exacerbated by THW’s leverage. THW returned -15.0% in 2016 when the index was down 3.4%, and THW returned -1.8% in 2018 when the index was up 5.9%.

Key Risks

The biggest risk for a high yielding fund like THW is a potential cut to the distribution. From figure 2 above, we know that the majority of the distribution is from return of capital or other sources, which make it potentially less sustainable. To management’s credit, the source of distribution from return of capital and other sources has been as high as 100% in prior months and this has not deterred the fund from paying its $1.40 per annum distribution.

Another risk to the fund is its sector focus. As healthcare is generally a defensive sector, this risk is somewhat mitigated. However, it does expose the fund to single sector risk, for example, potential healthcare reform.

Finally, the fund employs moderate amounts of leverage. Leverage can enhance returns both positively and negatively.

Conclusion

In conclusion, while I find the 9% current distribution yield attractive, I would personally stay away from the Tekla World Healthcare Fund. As a sector fund, it’s total return lags peers such as the XLV ETF. The strategies employed by THW to generate income may limit upside while exacerbating downside.

Be the first to comment