piranka

Tenable (NASDAQ:TENB) recently reported a strong Q2 with revenue and profitability coming in ahead of consensus expectations. Revenue grew 26% yoy and came in $1 million above estimates and in addition, Tenable continues to expand with larger enterprise accounts, which tend to be stickier and more recurring.

While 2022 guidance was pretty similar to expectations, management did note that the macro environment has caused them to be a little more cautious. However, with the underlying demand environment remaining strong, I believe the company could set up well for a beat-and-raise result next quarter, and ongoing success in 2023.

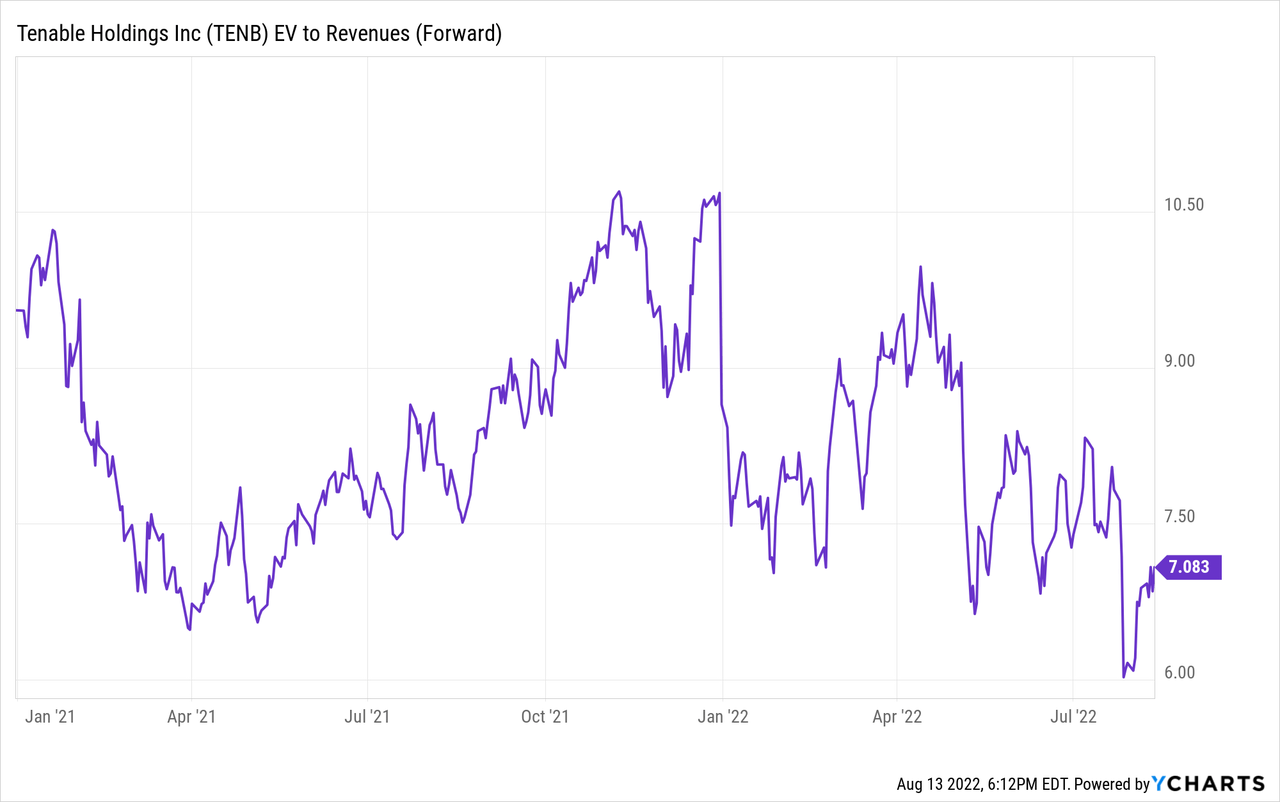

Currently, the company trades at around 7x forward revenue with the stock down over 15% year to date. This is not overly surprising given the relative weakness seen throughout the technology sector, however, the stock is also currently trading near the low-end of their historical 6-10.5x forward revenue range.

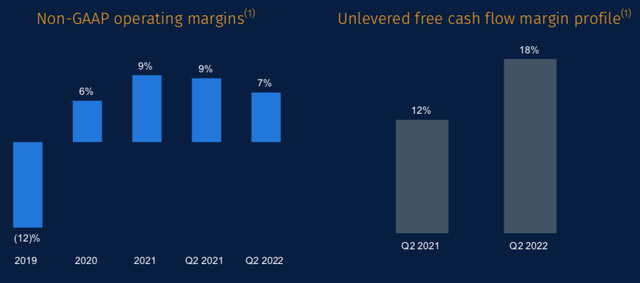

Given the recent pullback and conservative guidance for the remainder of the year, I believe long-term investors could find this as an attractive buying opportunity. In addition, the company’s margin profile continues to improve, with a FCF margin of 18% during Q2, up from 12% in the year-ago quarter.

The combination of continued revenue growth and improving profitability should give long-term investors confidence with valuation pulling back to historic lows.

Tenable provides cloud-based vulnerability management services to help customers protect both their network and web applications. With companies constantly needing to manage and measure their cybersecurity risk, the global pandemic actually accelerated demand in this environment.

Financial Review and Guidance

Revenue during the quarter grew 26% yoy to $164.3 million, beating expectations by just over $1 million. Given that 95% of the revenue is recurring, it’s no surprise that the company continues to beat expectations and grow revenue above 20%.

In addition, current billings were $174 million, growing 27% yoy. Billings are a good leading indicator of future revenue, so the similar growth in billings and revenue should be viewed as a positive.

Not surprisingly, non-GAAP gross margins continue to remain healthy, coming in at 81% during the quarter. Given the software subscription operating model, the company has historically held very high gross margins, and this should be expected to continue long-term.

Non-GAAP operating margin came in a 7% during the quarter, and while this was down from 9% in the year-ago period, the current macro environment is more challenged, especially with high wage inflation.

However, while operating margins contracted a bit compared to last year, the company’s free cash flow margin expanded 600bps to 18%. I believe this is an important financial aspect for the company, especially as investors look for more recession-proof companies.

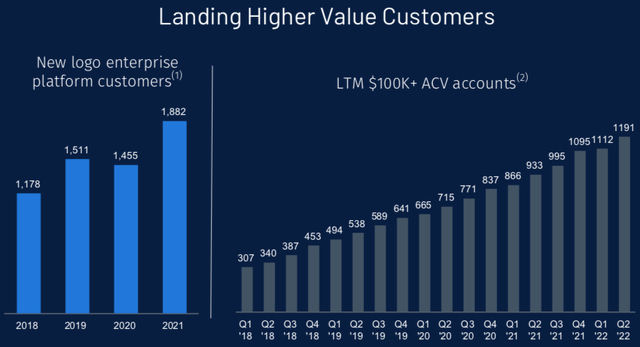

Tenable also continues to do a great job expanding their larger enterprise accounts, with the company having nearly 1.2k accounts with LTM annual contract value of >$100k.

I believe this continues to be a great area of opportunity for the company, as larger accounts tend to be stickier and more recurring. Thus, as Tenable increases their enterprise account base, this could help them in the event the economy does slow down. Typically, the smaller accounts have higher churn, thus as Tenable increases their mix more towards larger accounts, the company could fare off better in a downturn.

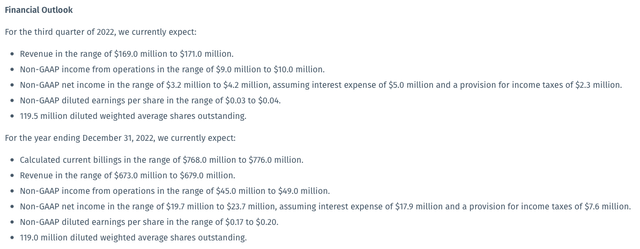

For Q3, the company is expecting revenue of $169-171 million, which was a little light of consensus expectations for $171 million. In addition, non-GAAP EPS is expected to be $0.03-0.04, which was pretty similar to expectations of $0.04.

For the full year, the company is expecting revenue of $673-679 million, with the midpoint being right around consensus expectations for $677 million. Management also talked about the macro environment on the Q2 call, with the company being a little more cautious.

In terms of the topline growth, our guidance reflects a continuation of the trends we experienced in the back half of the second quarter. Specifically, we expect the fundamentals of our business and the demand for our Cyber Exposure solutions to remain strong. However, given the current macro environment, we think it’s prudent to expect a similar level of review and scrutiny on some deals that we experienced in Q2.

While I believe the company took the right approach in being conservative for the remainder of the year, the company’s historical beat-and-raise pattern set a difficult precedent to achieve. The combination of strong underlying trends in the company’s business as noted by management and the cautious guidance tone could set up the company for a beat and raise next quarter.

Valuation

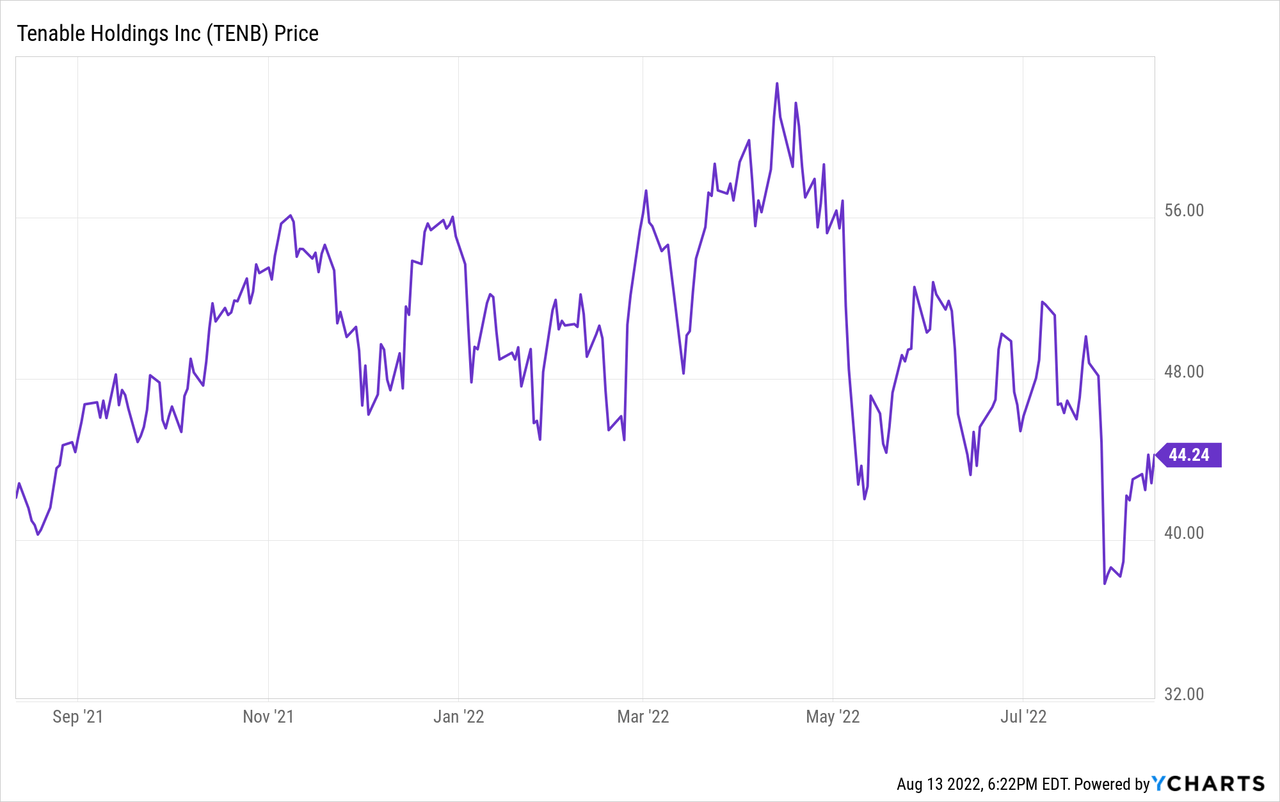

While the company’s stock initially fell around 15% after reporting earnings, the stock has since found some footing and has slowly recovered since, now down only a few percentage points from pre-earnings levels.

Year to date, the stock is only down 17%, which is only mildly worse than the broader market and much better than a majority of technology stocks.

Despite the premium valuation, the company continues to generate revenue growth above 25% and with profitability metrics improving, there is still a lot to like longer-term.

Since the start of 2021, the stock has traded in a pretty tight range of ~6-10.5x forward revenue. The current macro environment continues to be difficult, with rising interest rates, high wage inflation, fears around a potential recession, and investors focusing more on highly profitable companies.

While Tenable continues to operationally perform well, it’s not overly surprising to see the stock currently trading around 7x forward revenue, near the low-end of the historical trading range.

With a current market cap ~$5 billion and ~$500 million of net cash, the company has a current enterprise value of ~$4.5 billion. Revenue guidance for 2022 is $673-679 million, which implies a 2022 revenue multiple of ~6.7x.

However, Tenable has continued to generate revenue growth above 25% and with their mix shifting more in favor of larger, stickier enterprise relationships, revenue growth could remain above 20% for the next few years. Assuming a 20% growth, 2023 revenue could be ~$810 million, implying a 2023 revenue multiple of ~5.5x.

Longer-term, the company’s demand environment remains strong and with an improving margin profile, I believe the recent pullback and weakness year to date set up a good long-term buying opportunity.

Be the first to comment