ibreakstock

Most of us have the good or bad fortune of seeing our lives fall apart so slowly we barely notice. – Carlos Ruiz Zafón

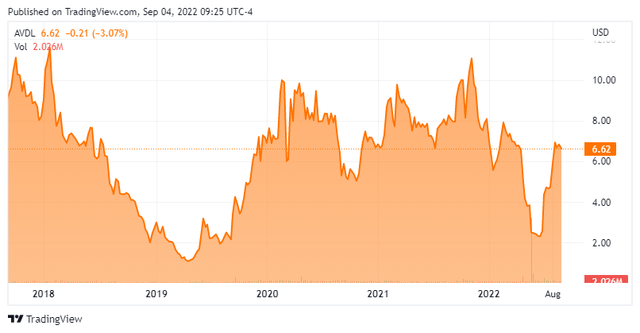

Today, we take a look at Avadel Pharmaceuticals (NASDAQ:AVDL). This biopharma concern is currently moving through a period of uncertainty, but hopes to have its flagship product fully approved within the next year. An analysis of the company’s prospects follows.

Company Overview:

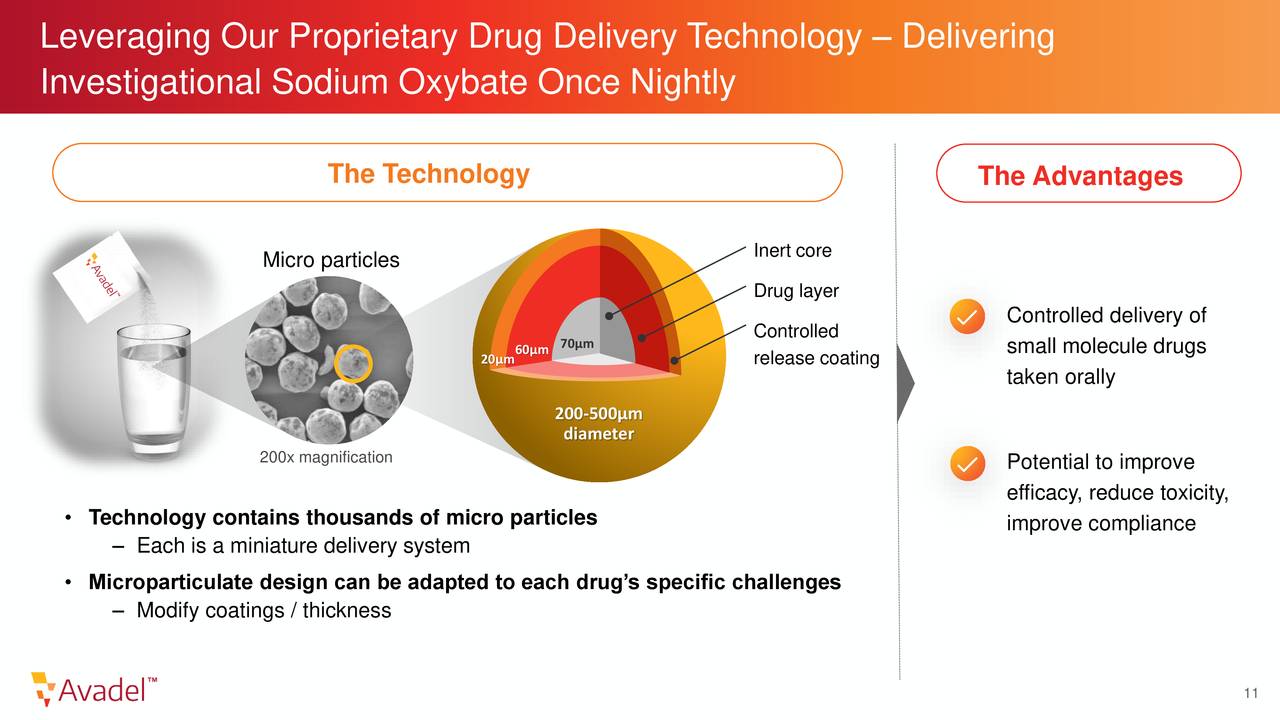

Company Presentation

Avadel Pharmaceuticals is a specialty pharmaceutical company based in Dublin, Ireland. The company’s key asset is a compound called FT218 also known by its brand name LUMRYZ. This is a once nightly formulation of sodium oxybate for the treatment of excessive daytime sleepiness and cataplexy in patients with narcolepsy. The stock currently trades just above $6.50 a share and sports an approximate market cap of $400 million.

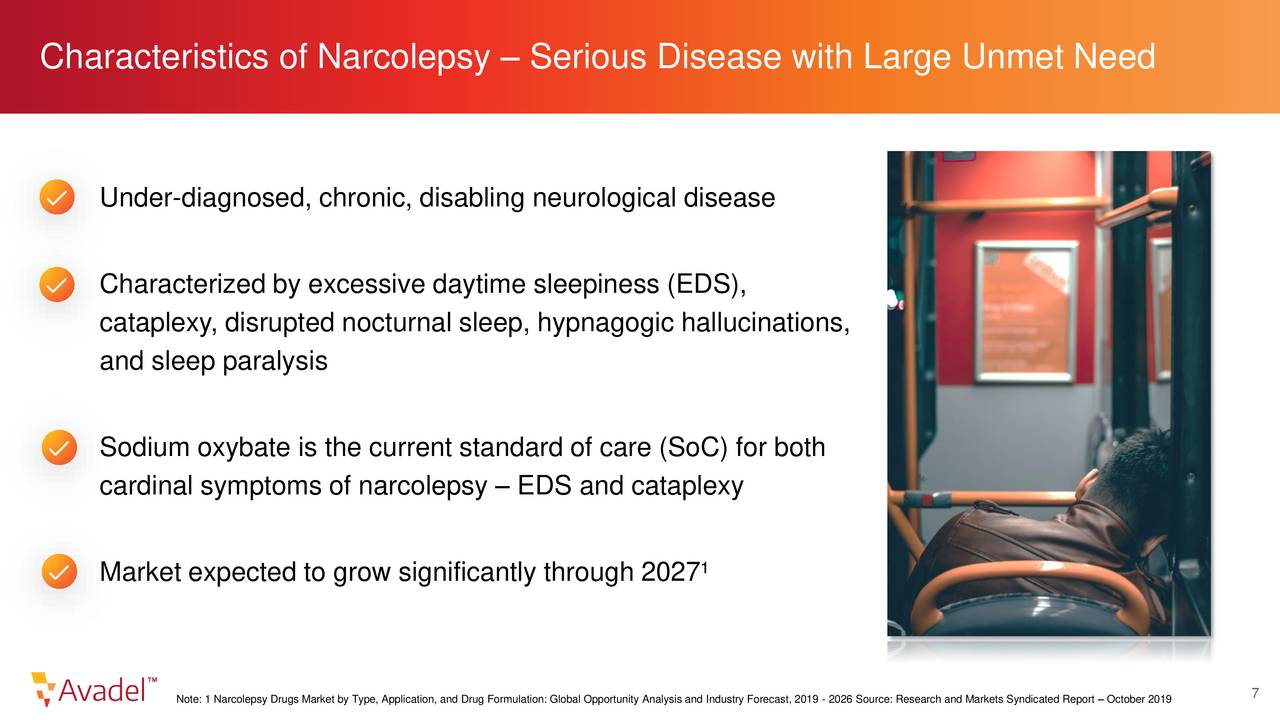

Company Presentation

In mid-July, the FDA gave its ‘tentative‘ approval to LUMRYZ for the treatment of excessive daytime sleepiness or cataplexy in adults with narcolepsy. This nod from the government agency validated the clinical and safety profile of LUMRYZ. I also would seem to confirm that LUMRYZ is approvable as a one dose only at bedtime therapy for eligible patients living with narcolepsy once the company removes the last obstacle to that full approval.

Since the product by its nature can be used as a ‘date rape‘ compound, it must go through Risk Evaluation and Mitigation Strategy or REMS, of which competitor Jazz Pharmaceuticals (JAZZ) has one for its competing narcolepsy product Xyrem. That patent is due to expire in June of next year. Now Avadel could make a deal with Jazz, which looks unlikely. The company is in active pursuit of additional legal and regulatory strategies to accelerate a final FDA decision for LUMRYZ. A granular article was put out in mid-June on Seeking Alpha around this issue, so I will not rehash it in this piece. Bottom line, is LUMRYZ is likely to get full approval next June if the company cannot find another avenue for a faster approval.

Analyst Commentary & Balance Sheet:

The analyst community is mixed on Avadel’s prospects at the moment. Over the past month, both Jefferies ($8 price target) and Stifel Nicolaus ($6 price target) have maintained Hold ratings on the equity. Meanwhile, four analyst firms including Needham and H.C. Wainwright have reissued Buy ratings. Price targets proffered were in the $9 to $14 a share range.

Several insiders bought approximately $400,000 worth of stock in aggregate in late May. That has been the only insider activity in the shares so far in 2022. Just over 10% of the outstanding float is currently held short. The company ended the second quarter with just under $105 million in cash and marketable securities on its balance sheet. Management should be done with a workforce reduction plan this quarter that will bring down quarterly cash burn to $12 million to $14 million a quarter once it is completed. The company recently filed the prospectus for a $500 million mixed shelf offering.

Verdict:

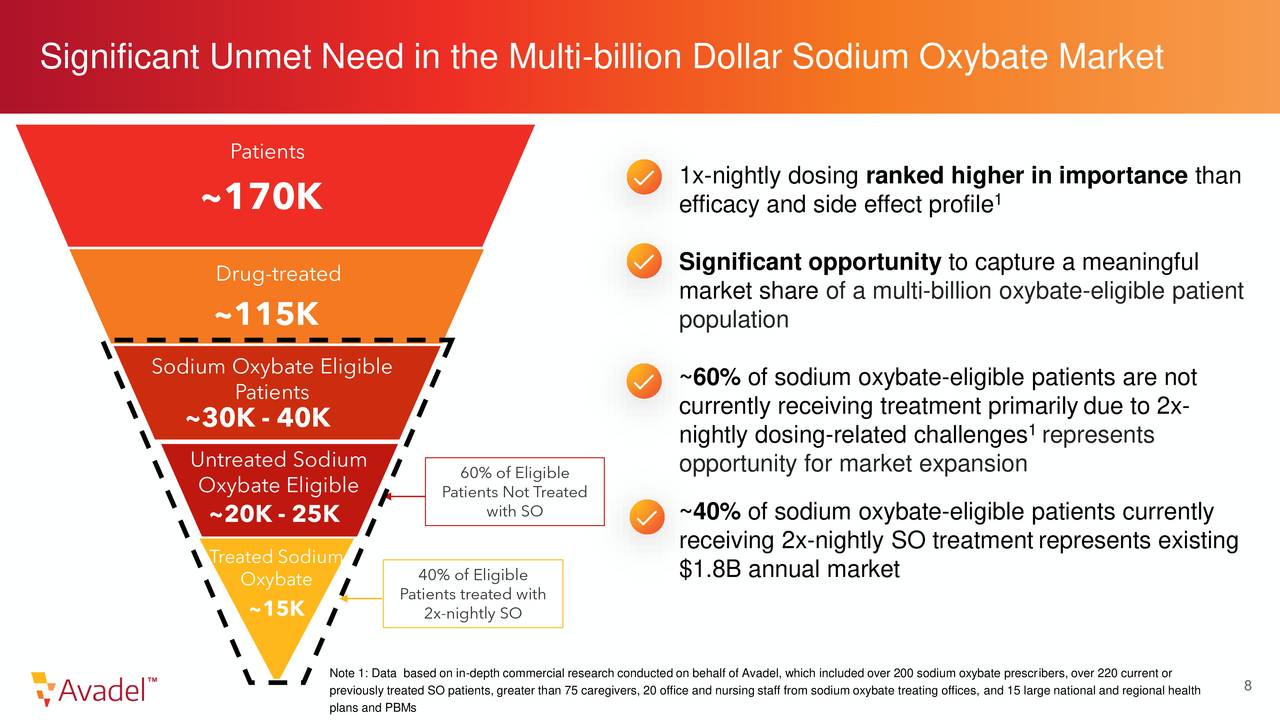

Company Presentation

The company is targeting a large market and will be the only approved treatment for narcolepsy that only has to be taken once a day, a significant advantage in this market. Once the company settles this current patent issue, it already has intellectual property in place to protect LUMRYZ’s exclusivity until mid-2037.

The challenge of trying to value Avadel right now is complicated. The patent issue will be resolved. If that can happen before June of 2023 is a somewhat difficult thing to pin down. In addition, my guess is that once LUMRYZ is fully approved, the company does a capital raise to support the rollout of this drug. It might be forced to do sooner and on what terms is hard to project right now. Avadel would also seem to be a logical buyout candidate by a larger player with an established salesforce and plenty of funding in place to wait out the REMS expiration. That is just some speculation on my behalf at this point in time.

Finally, the early parts of commercialization almost always prove challenging to small cap concerns as they established their sales operations.

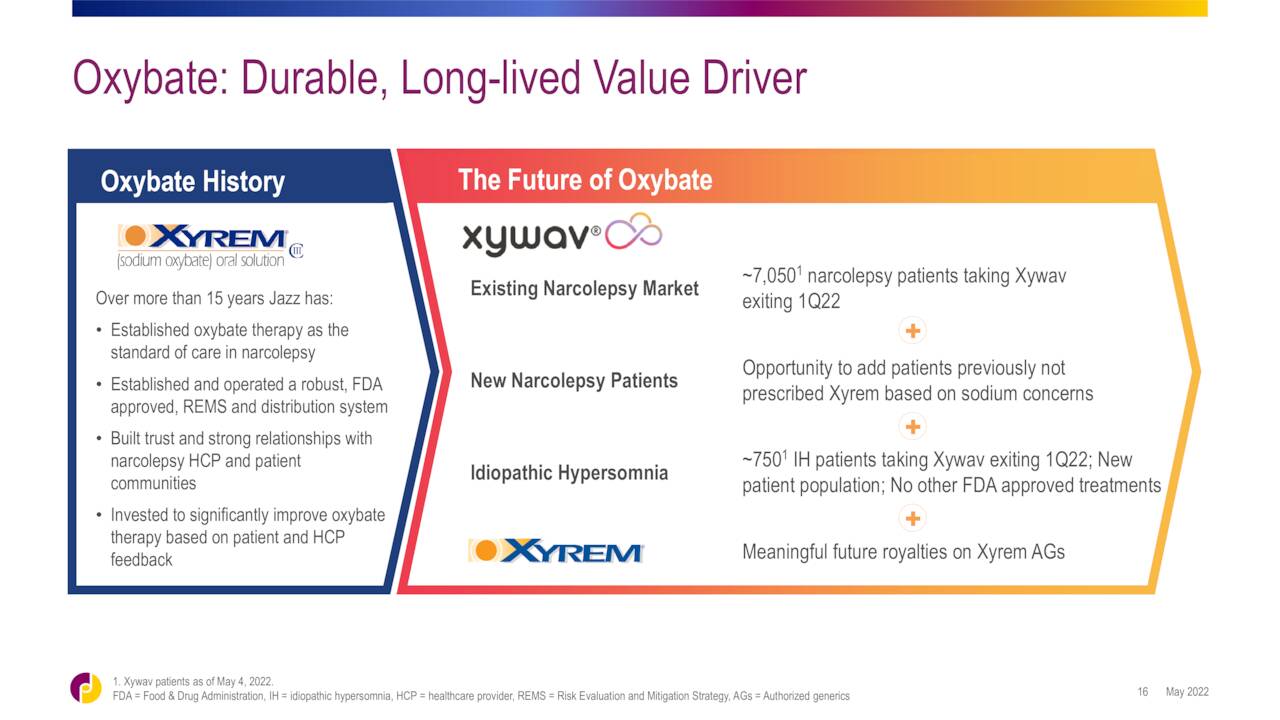

Jazz Pharmaceuticals June Company Presentation

Jazz Pharmaceuticals recently launched a lower sodium version of Xyrem called Xywav, but it is not a single dose a night product. Jazz believes its oxybate franchise can do $2 billion in annual sales by FY2025. Therefore, I do think AVDL deserves a small ‘watch item‘ holding given LUMRYZ’s potential. Options are available against this equity, and they are liquid with good premiums. Therefore, I will continue to hold my shares in AVDL with covered call positions.

The crowning fortune of a man is to be born to some pursuit which finds him employment and happiness, whether it be to make baskets, or broadswords, or canals, or statues, or songs. – Ralph Waldo Emerson

Be the first to comment