adamkaz/iStock via Getty Images

Clearway Energy (NYSE:CWEN.A) has built a 5 GW portfolio of renewable energy generating assets in the United States and now stands to see this materially increase through the Inflation Reduction Act and its partnership with TotalEnergies (TTE). The latter is set to radically increase the rollout of clean energy in the United States and offers a generational opportunity to owners of YieldCos.

Let us be clear, utility-scale solar and wind energy projects were already fast expanding their role in the energy production mix of the United States, the IRA is only set to supercharge this by bringing forward new developments through an unprecedented level of government intervention. The IRA allocates $370 billion over 10 years to decarbonization initiatives and is the largest climate and clean energy investment in US history. It will form a crucial part of the US effort to reduce greenhouse gas emissions to 50% below 2005 levels by 2030.

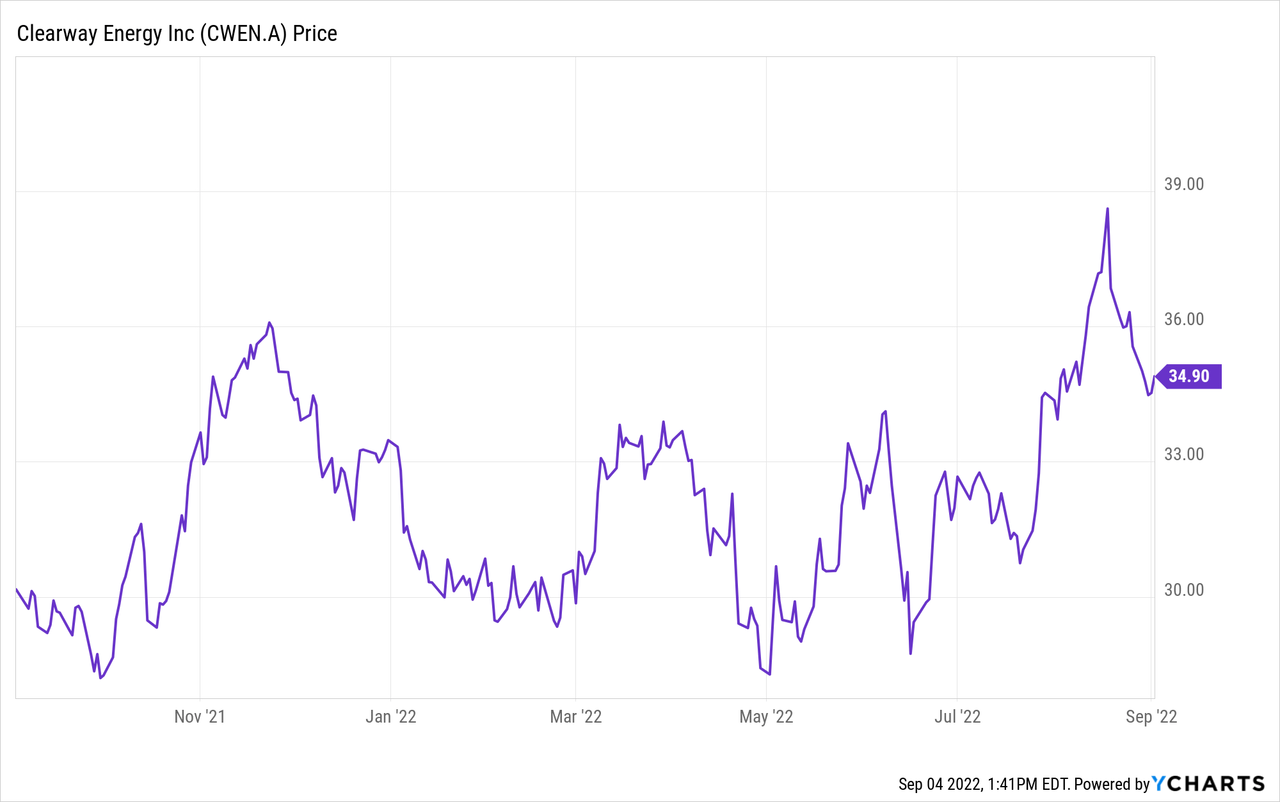

The new macro environment will help support CAFD growth and management’s target for progressive annual dividend increases in a range of around 5% to 8% through 2026. It also comes on the back of TotalEnergies acquiring a 50% stake in Clearway. The partnership should see Clearway given priority access to the farm down of Total’s own clean energy projects as well as the oil major’s power trading capabilities. Further, The deal has created a reference point for current and prospective investors as values Clearway at $35.10 per share.

Largest Piece Of Federal Legislation Ever To Address Climate Change

Clearway’s management has provided insights into the impact of the IRA on operations. The most salient will be the extension of the production tax credit for onshore wind. This extension will drive better value creation for customers and will accelerate Clearway’s development program into mid-decade.

For solar, the PTC will enable Clearway to improve the capital structure used for its projects and will mean that the quantity of capital deployed for solar projects can increase with capitalization being able to come from the project sponsor, a much better model for long-term management. The IRA also helps accelerate utility-scale storage through the availability of a standalone storage investment tax credit. Clearway increased its standalone and paired storage pipeline to approximately 8 GW in anticipation of battery storage becoming an increasingly economically viable resource across the United States.

Further, the partnership with TotalEnergies is set to see Clearway likely enter the offshore wind market with the French company having bid successfully for Wet Energy Area in the New York Bight and in the Carolinas earlier this year to develop offshore wind projects and is actively pushing for floating offshore wind projects off the coast of Oregon.

All this comes against results for the company’s fiscal 2022 second quarter which showed revenue of $368 million, a 3.2% decline from the year-ago quarter and a miss of $52.98 million on consensus estimates. However, CAFD forms the core financial metric to focus on for YieldCos. This came in at $176 million, up 13.5% from $155 million in the year-ago quarter. This increase came on the back of adjusted EBITDA of $366 million.

The company reaffirmed its 2022 financial guidance and raised its pro forma CAFD outlook. The quarterly dividend was also increased by 1.9% from the prior payout to $0.3604 per share, which would provide a 3.84% yield. Clearway also took significant steps during the quarter to enhance its balance sheet through the disposal of its thermal generation business to KKR (KKR), resulting in a net gain of approximately $1.29 billion. Around $335 million of net proceeds were used to pay off bridge financing and a revolving credit facility. The company also acquired the 413 MW Capistrano wind portfolio for a cash consideration of $255 million, albeit with the assumption of $160 million in nonrecourse debt. Clearway expects a levered asset cash available for distribution yield of 10.8% on the portfolio.

Renewable Energy Infrastructure For The New Low-Carbon World

Modelling from Boston Consulting Group has forecasted that the incentives included in the Inflation Reduction Act could increase the deployment of carbon-free energy to up to 80% of electricity production as soon as 2030. This would be up from around 20% of production currently.

Clearway Energy stands to play a part in this as the fifth largest renewable energy developer in the United States. The company’s partnership with TotalEnergies will help drive healthy balance sheet expansion in the years ahead and now forms a core part of its long-term investment case. I continue to own shares in the growing clean energy company and will add to my position. However, the current macro environment likely poses near-term headwinds with the recent decline in shares likely to continue as interest rates rise and the specter of a potentially deep recession looms.

Be the first to comment