iprogressman/iStock via Getty Images

It’s always a great thing to buy into a stock that ends up appreciating in value. But it’s even better when that company sees upside at a time when the broader market is down. One example of this that plays in the food space, through the sale of produce such as bananas, avocados, pineapples, and more, is Fresh Del Monte Produce (NYSE:FDP). Recent financial performance on the company’s bottom line has been a bit weak, but sales do continue to grow. Although the company is not as cheap as it once looked, shares are still affordable from a cash flow perspective. I would make the case that there might be better opportunities out there to be had at this time. But for investors who want a player in this market, and who don’t mind paying a premium relative to similar firms, Fresh Del Monte Produce might be worth the look.

Not as tasty as it once was

The last time I wrote an article about Fresh Del Monte Produce was in the middle of March of this year. In that article, I said that the company had been on a wild ride over the prior few months, with shares falling even more than with the broader market had seen. I also said that the company was far from being an ideal prospect, but that the cheapness of the stock made it a worthwhile prospect. At the end of the day, the affordability of FDP stock led me to rate it a ‘buy’, reflecting my belief that the company would likely outperform the broader market for the foreseeable future. So far, that call has proven to be pretty good. While the S&P 500 is down by 11%, shares of Fresh Del Monte Produce have generated a return of 1.7%.

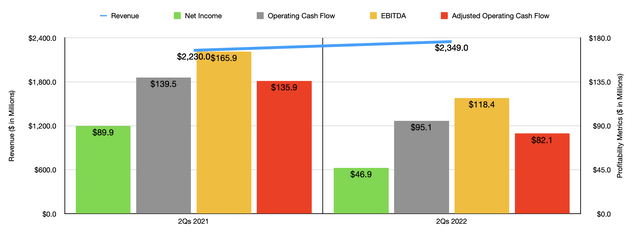

Whether or not this return disparity is warranted depends on what you prioritize most. If you prioritize revenue over profitability, then you could argue that the increase in price has been completely justified. I say this because, in the first half of the 2022 fiscal year, sales for the company came in at $2.35 billion. This represents an increase of 5.3% over the $2.23 billion the company generated in sales one year earlier. This increase in revenue came even as revenue associated with the bananas the company sells dropped, falling from $844.9 million to $827.6 million. Management attributed this decline to lower sales volume throughout North America and Asia, with sales in Asia negatively impacted by foreign currency fluctuations.

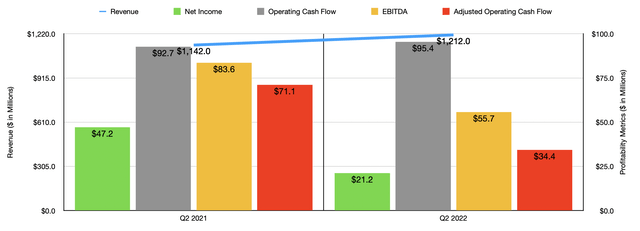

Meanwhile, revenue associated with fresh and value-added products jumped by 7.7% from $1.31 billion to $1.41 billion. This rise, management said, came mostly from higher pricing in most of its product categories. Despite this rise in price, sales volumes were virtually flat. Revenue growth associated with all of the company’s other products and services was even more impressive at 45.3%, but the base on which sales grew was quite small, with revenue climbing from $80 million to $116.2 million. This, management said, was because of higher net sales of third-party freight services. Basically, the company was able to use its fleet of vessels and higher shipping rates to its advantage. It should be noted that sales growth remained strong in the second quarter of the year alone. Revenue of $1.21 billion came in 6.1% higher than the $1.14 billion generated one year earlier. The same kind of trend that we saw for the first half of the year as a whole was present in the second quarter alone as well.

When it comes to profitability, things aren’t looking quite as good. Consider net income. For the first half of the 2022 fiscal year, net profits totaled $46.9 million. That’s almost half the $89.9 million generated the same time one year earlier. A big pain for the company was a decrease in its gross margin from 9.6% to 7.3%. With the exception of the other products and services that I highlighted already, gross margin was down across the board. For bananas, the pain involved not only higher costs, but also lower sales volume. And for the fresh and value-added products category, the problem was multifaceted, with non-tropical fruit being hit by a lack of availability of third-party shipping capacity, volatility in the avocados market, and higher costs associated with melons. Inclement weather also resulted in certain charge-offs associated with produce in Chile and the Middle East. Once again, this pain was across both quarters. In the second quarter of the 2022 fiscal year, net profits came in at $21.2 million. That’s less than half the $47.2 million experienced one year earlier.

Naturally, these pains also had repercussions when it came to other profitability metrics. Operating cash flow, for instance, fell from $139.5 million in the first half of 2021 to $95.1 million the same time this year. If we adjust for changes in working capital, cash flow would have fallen from $135.9 million to $82.1 million. Meanwhile, EBITDA for the company also took a beating, dropping from $165.9 million to $118.4 million. With the exception of operating cash flow, these pains were all consistent in the second quarter alone as well. Operating cash flow during the quarter came in at $95.4 million. That’s up from the $92.7 million seen one year earlier. But again, on an adjusted basis, the company continued to see pain.

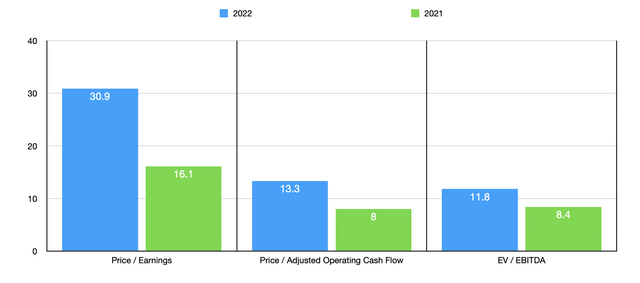

At this point in time, it’s really difficult to know what to expect for the future. Clearly, this year is slated to be a worse year for the company from a profitability perspective than it was last year. If we were to annualize results experienced so far for the year, we would get estimated net profits of $41.7 million, adjusted operating cash flow of $96.8 million, and EBITDA of $147.6 million. Given these numbers, we can see that the company is trading at a forward price-to-earnings multiple of 30.9. The price to adjusted operating cash flow multiple should be 13.3, while the EV to EBITDA multiple should come in at 11.8. These numbers compare to the 16.1, 8, and 8.4, that we get using 2021’s results. As part of my analysis, I also compared the company to the pricing of five other firms on a forward basis. On a price-to-earnings basis, these companies ranged from a low of 8 to a high of 14.2. When it comes to the price to operating cash flow approach, the range is from 11.7 to 12.7. But in that case, only three of the companies had positive results. In both scenarios, Fresh Del Monte Produce was the most expensive of the group. Meanwhile, using the EV to EBITDA approach, the ranges from 7.3 to 29. In this scenario, four of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Fresh Del Monte Produce | 30.9 | 13.3 | 11.8 |

| Alico (ALCO) | 8.0 | N/A | 29.0 |

| Archer-Daniels-Midland (ADM) | 13.2 | 12.7 | 9.8 |

| Darling Ingredients (DAR) | 14.2 | 11.7 | 9.2 |

| Ingredion (INGR) | 12.3 | 12.7 | 7.8 |

| Bunge (BG) | 8.9 | N/A | 7.3 |

Takeaway

Based on all the data provided, I understand that Fresh Del Monte Produce has experienced some pain. Short term, the company could certainly continue to feel that pain. But at the end of the day, shares do still look cheap, especially should the business revert back to the kind of results achieved in 2021. At some point, inflation will break and that will give the firm the opportunity it needs to get there. On top of this, the company is also actively working to optimize its portfolio. This began in the 2020 fiscal year and, since then, the firm has received cash proceeds of $63.3 million associated with asset sales. They have a further $36.7 million worth of proceeds that they are anticipating in the future. Given all of these facts, and in spite of the fact that the stock does look rather pricey compared to similar firms, I would make the case that it could still be a sensible prospect for long-term, value-oriented investors. And as such, I’ve decided to rate it a ‘buy’ at this time.

Be the first to comment