FatCamera

Introduction

NovoCure (NASDAQ:NVCR) is the pioneer in using electric fields to kill and slow the spread of cancerous cells. Having proven commercial viability for brain cancer and lung cancer applications, the company is poised to expand its reach geographically and across new cancer types. The next

Although NovoCure has recently strengthened its position in Germany by securing a qualified Durable Medical Equipment (DME) status, this has led to short-term regrowth in active patients. However, the longer-term benefit to the company’s market share prospects justifies a superior high multiple expansion seen in the stock this year. A conservative valuation of the pipeline potential implies a 54% upside in the stock. This also aligns with bullish technicals, especially relative to the S&P 500, suggesting alpha potential.

Business Brief

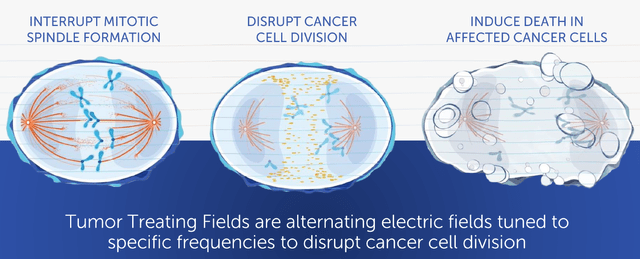

NovoCure sells portable wearable devices called Optune and Optune Lua that use electric fields called Tumor Treating Fields (TTF) to stop and kill the spread of solid tumor-type cancer cells as they split. This is done by disrupting charged proteins in a cell that are responsible for extracting genetic matter from a cell’s nucleus during mitosis, which is a cell division process.

Tumor Treating Fields (TTF) Technology (NovoCure Q2 FY22 Presentation)

The device helps cancer patients extend their life by slowing down the spread of cancer. Currently, their devices have passed the clinical trials and are in the commercialization stage for two rare and deadly cancers; a brain cancer called glioblastoma (GBM), and a lung cancer called mesothelioma.

NovoCure’s devices are not a substitute for usual forms of cancer therapy, such as chemotherapy. Rather, they are an auxiliary addition to other treatments that, when included, increase the effectiveness of overall cancer treatment. Hence, NovoCure does not directly compete with other cancer therapies.

From a financing perspective, unlike many biotechnology companies, NovoCure’s balance sheet is rock solid and it has no cash flow concerns. The current cash and equivalents on the books is $949mn. Assuming the last quarter’s EBITDA loss of $18mn continues, this implies the company has enough liquid reserves to last more than 52 such unprofitable quarters. Also, note that the company has the ability to be cash flow positive, as it has been before. However, it is reinvesting into R&D to rightly prioritize growth in the future.

Having proven the effectiveness of its proprietary TTF technology to two cancers already, the company’s future is focused on the commercialization of other types of brain, lung, pancreas, ovaries, liver, and stomach cancers that are currently at various stages in clinical trials. An attractive characteristic of the business is that when expanding the use-case to new cancers, the core product remains the same besides some modifications. The business has a market penetration of about 40% in the US, Germany, and Japan markets. Increasing this penetration and expanding into new markets such as France will also be growth levers for the future. Thus, the company’s future lies in converting its current investments in sales and R&D into sales growth over the next two to three years.

My Thesis for NovoCure

My bullish view on NovoCure thesis is based on two key thesis points:

- Despite short-term de-growth in active patients, long-term tailwinds to market share justify superior multiple expansion.

- A conservative valuation of the pipeline implies strong value accretion ahead.

I’ll now explain this in more depth below:

Despite short-term de-growth in active patients, long-term tailwinds to market share justify superior multiple expansion

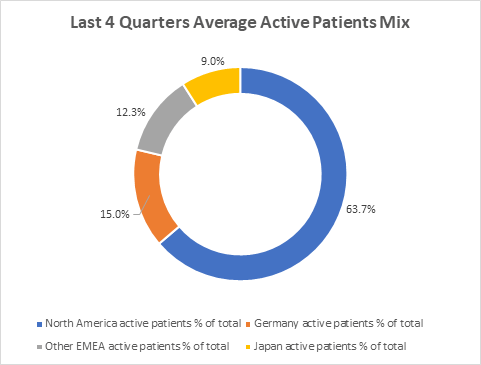

Active patients are a leading indicator of demand for NovoCure. The following shows the average mix of active patients by geography:

Average Active Patients Mix (Company Filings)

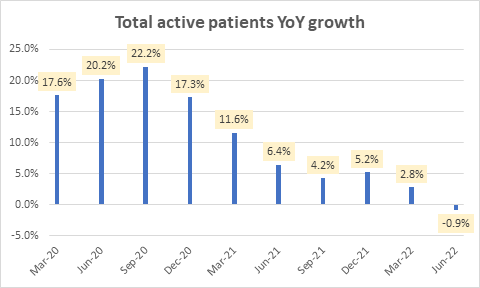

In 2022 so far, active patients growth has been slower:

Total active patients YoY growth (Company Filings)

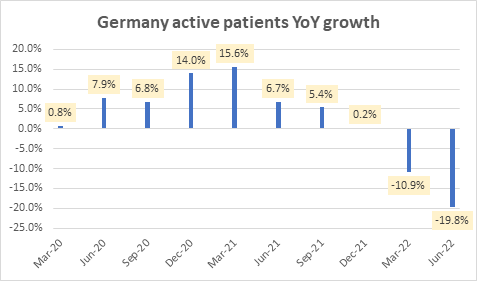

This is mostly due to steep degrowth in Germany’s active patients over the last two quarters:

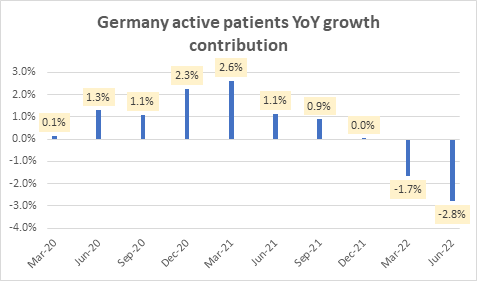

Germany active patients YoY growth (Company Filings)

Although Germany makes up only 15% of the overall active patients mix, it has had a meaningful contribution to the aggregate tepidness in active patients growth in 2022:

Germany active patients YoY growth contribution (Company Filings)

However, this slowdown in Germany’s active patients is a short-term headwind amid a longer-term market share benefit wherein NovoCure gets formal contract terms and qualified durable medical equipment (DME) status in Germany. The quarterly slowdown in active patients is due to a reset of the active patients covered under the new policy. Overall, this change places NovoCure in a more stable position in Germany, aligning with all key compliance requirements. Looking ahead, management expects patient metrics to improve each successive quarter.

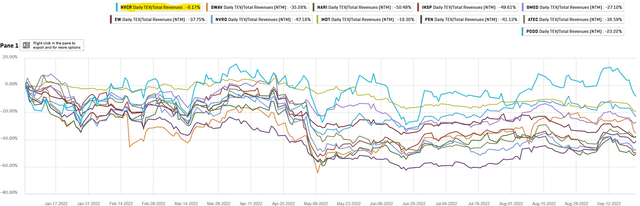

Thus, as the longer-term operational strengths for NovoCure are improving, the company’s superior growth in LTM EV/Revenue multiples compared to its peers seems justified.

Peer Comparison of LTM EV/Revenue Multiples (Own Analysis, Capital IQ)

The chart above shows that since the start of 2022, although NovoCure has seen weakness in active patients growth, its stock has seen the highest growth in LTM EV/Revenue multiples of -8.17% amid overall market weakness.

A conservative valuation of the pipeline implies strong value accretion ahead

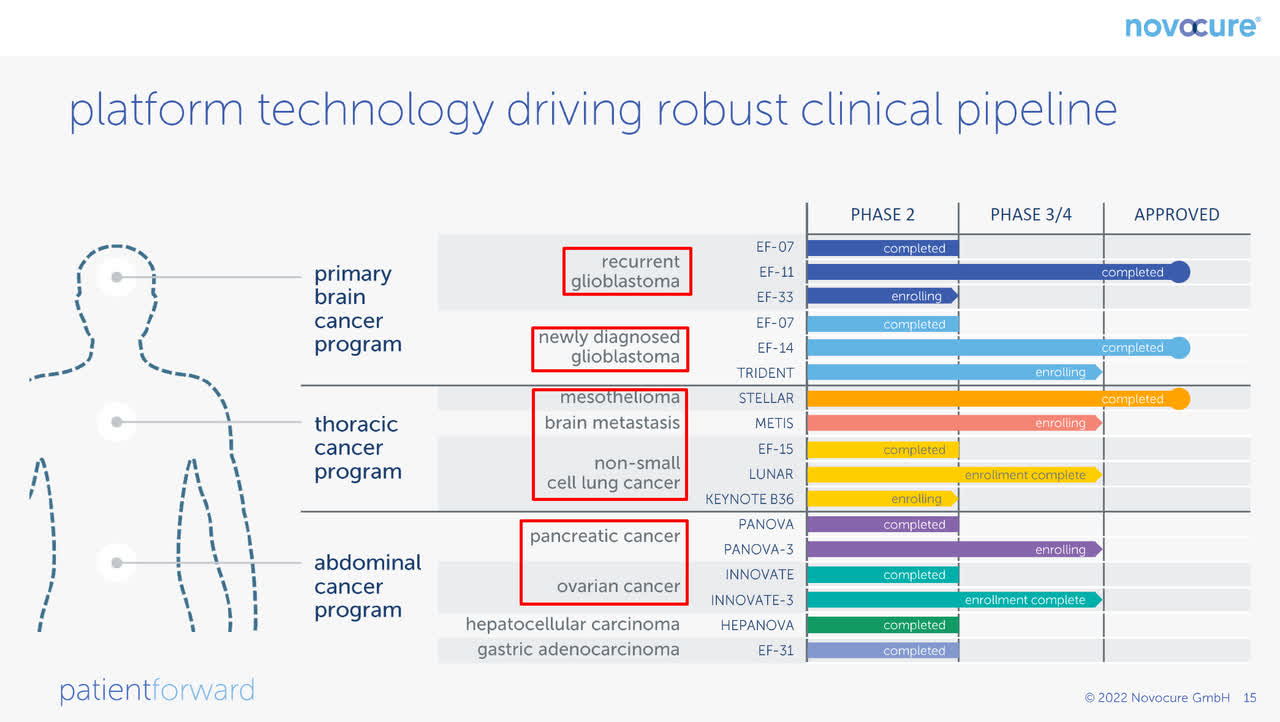

The following shows NovoCure’s pipeline for applying TTF to various cancer therapies:

NovoCure Pipeline (NovoCure Q2 FY22 Investor Presentation)

For each of the approved and phase 3/4 cancers outlined in the red boxes, I have done a simple, conservative valuation, assuming cash flows only until 2030:

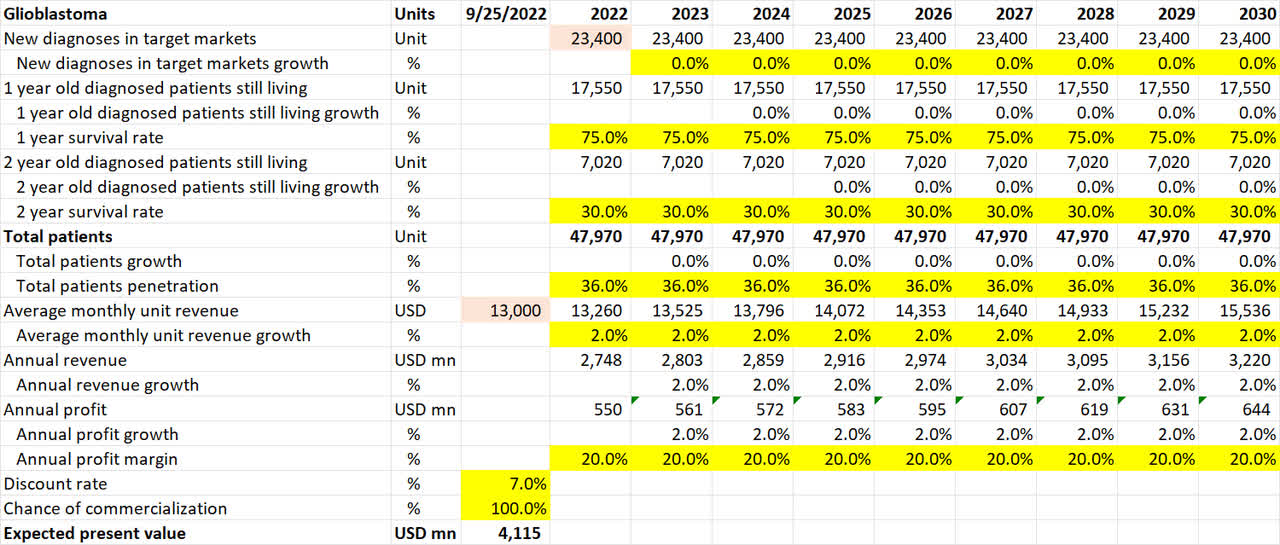

Glioblastoma

Glioblastoma pipeline valuation (Own Analysis)

For the brain cancer glioblastoma, 23,400 new diagnoses are assumed for 2022 in NovoCure’s target markets of US, Germany, Japan, and other active markets. I have assumed no growth in the diagnoses in the future despite likely higher incidences from aging populations in the Western world.

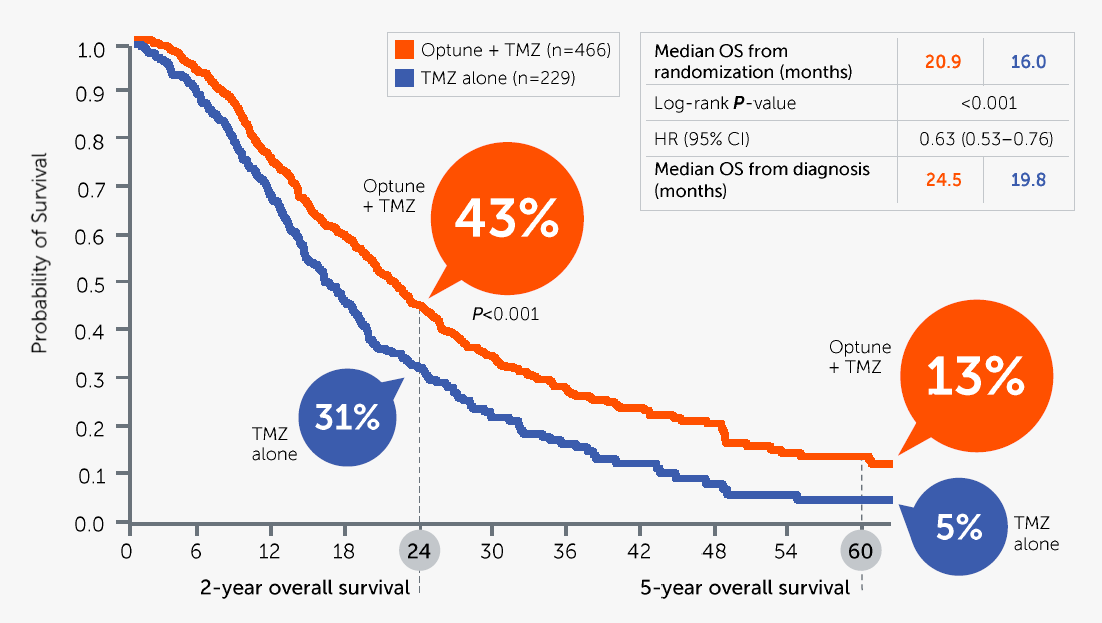

The 1-year and 2-year survival rates of 75% and 30% respectively are conservatively assumed to be without the effects of NovoCure’s Optune device:

Glioblastoma Survival Rate (NovoCure Q2 FY22 Investor Presentation)

In a September 2022 company conference presentation hosted by Wells Fargo, NovoCure’s executive chairman William F. Doyle mentioned that NovoCure is at 40% penetration in their core markets of the US, Germany, and Japan, which altogether make up 90% of overall revenues. Therefore, this implies a minimum penetration of 36% overall, which is what I have conservatively assumed. I have assumed no penetration growth despite management’s optimism in their ability to continue increasing the penetration rate. This adds another layer of conservatism to my estimates.

The implied monthly revenue per active patient over the last 8 quarters is $13,075. From this basis, I have assumed an average monthly unit revenue of $13,000 and a conservative 2% inflation-linked YoY growth rate.

In a steady business state, when the business is not in an investment-heavy stage as it is in currently, I have assumed 20% EBITDA margins, which can be achieved with a gross margin of 75%, SG&A margin of 30%, and an R&D margin of 25%.

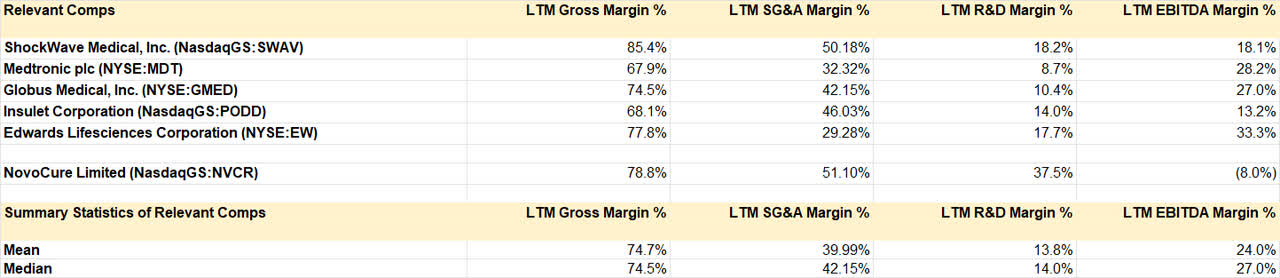

Operating Statistics of Peers (Own Analysis, Capital IQ)

As the table above shows, the operating statistics of some established medical device peers such as ShockWave Medical (SWAV), Medtronic (MDT), Globus Medical (GMED), Insulet Corporation (PODD), and Edwards Lifesciences Corporation (EW) suggest an average EBITDA margin of 25%. Hence, a 20% steady state EBITDA margin makes sense and may even be conservative.

My opportunity cost of capital for my valuations is equal to my expectations of annual returns for the S&P 500 over the long run. I have assumed this figure to be 7%. This is close to the U.S. cost of equity that the “Dean of Valuation” Professor Aswath Damodaran has in his latest datasets.

As glioblastoma is already in the commercialization stage, the chance of commercialization is 100%.

Overall, this math results in an expected present value of $4.12bn of value coming in from the glioblastoma application alone.

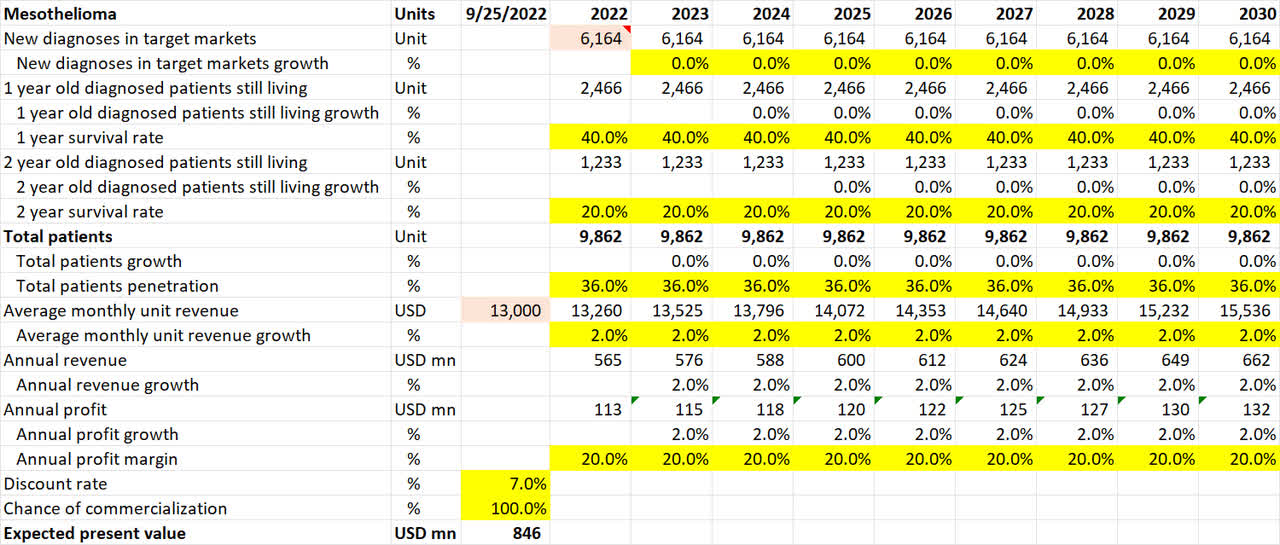

Mesothelioma

Mesothelioma pipeline valuation (Own Analysis)

For the rare lung cancer mesothelioma, 6,164 new diagnoses are assumed for 2022 in NovoCure’s target markets of US and Europe. I have assumed no growth in the diagnoses in future.

The 1-year and 2-year survival rates of 40% and 20% respectively are based on the opinions of Dr. Mark Levin.

For the same reasons as was discussed earlier for glioblastoma, the penetration rate is conservatively assumed to be 36%.

As NovoCure’s core TTF product is the same for different types of cancers, albeit some variations and tweaks, the same average monthly unit revenue of $13,000 is assumed, with a conservative 2% inflation-linked YoY growth rate.

For EBITDA margins, discount rate, and chance of commercialization, the assumptions are no different from what was explained for glioblastoma.

Overall, this math results in an expected present value of $846mn of value coming in from the mesothelioma application alone.

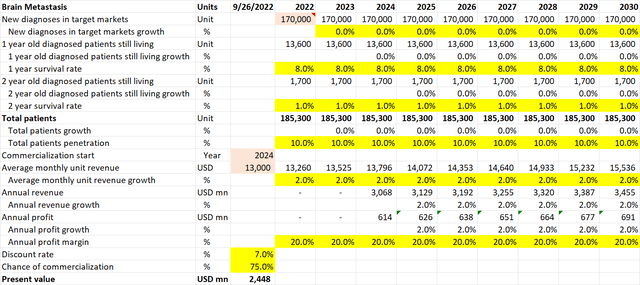

Brain Metastasis

Brain Metastasis pipeline valuation (Own Analysis)

For brain metastasis cancer, NovoCure’s 10-K filing suggests that every year, 170,000 new diagnoses occur in the US. I have assumed no growth in this figure in the future. Neither have I accounted for the incidence of cancers outside of the US.

The 1-year and 2-year survival rates of 8% and 1% respectively are based on a PubMed Central journal that analyzes survival rates of brain metastasis.

Given a 40% penetration in the US already for glioblastoma brain cancer, a flat 10% penetration is assumed for NovoCure for brain metastasis in the US. I believe this is conservative.

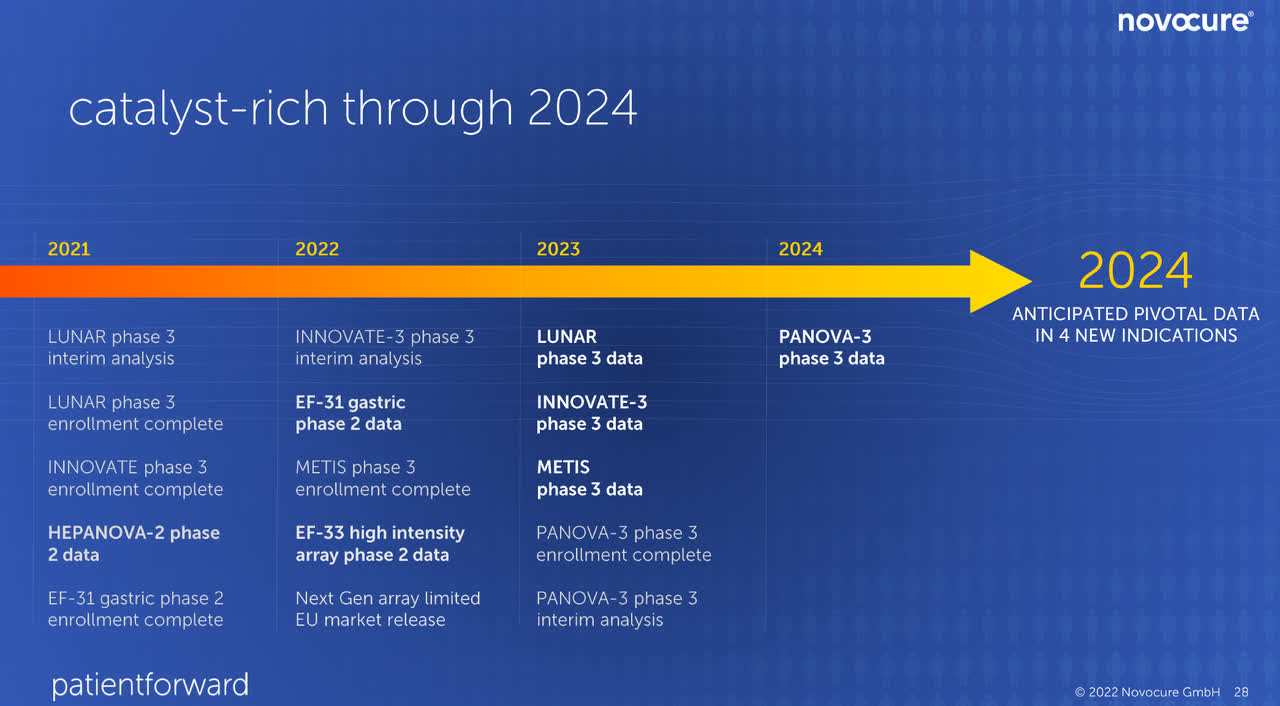

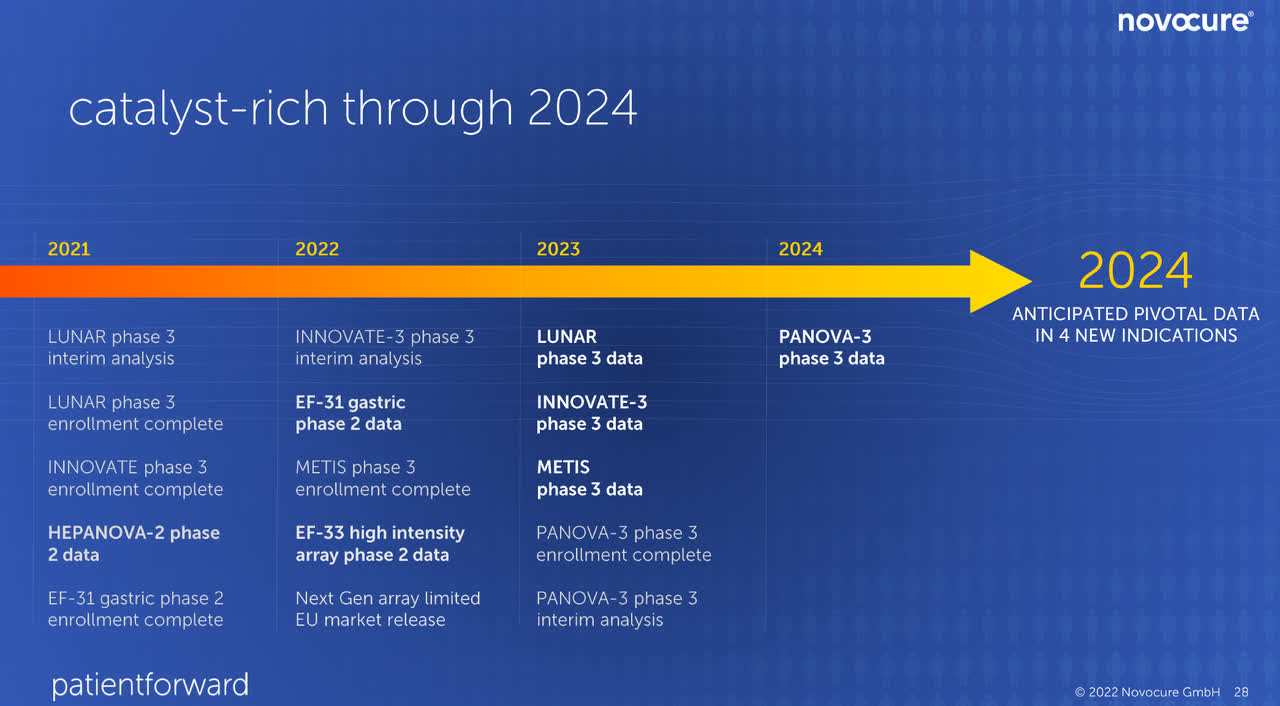

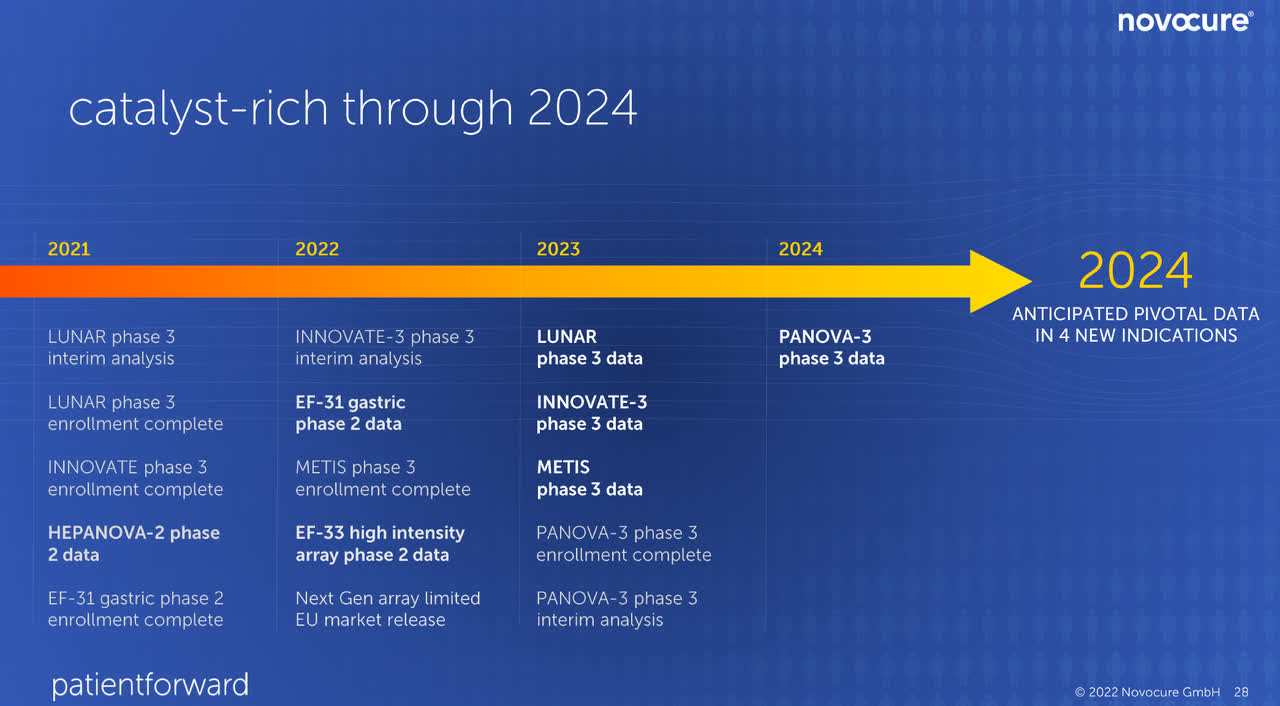

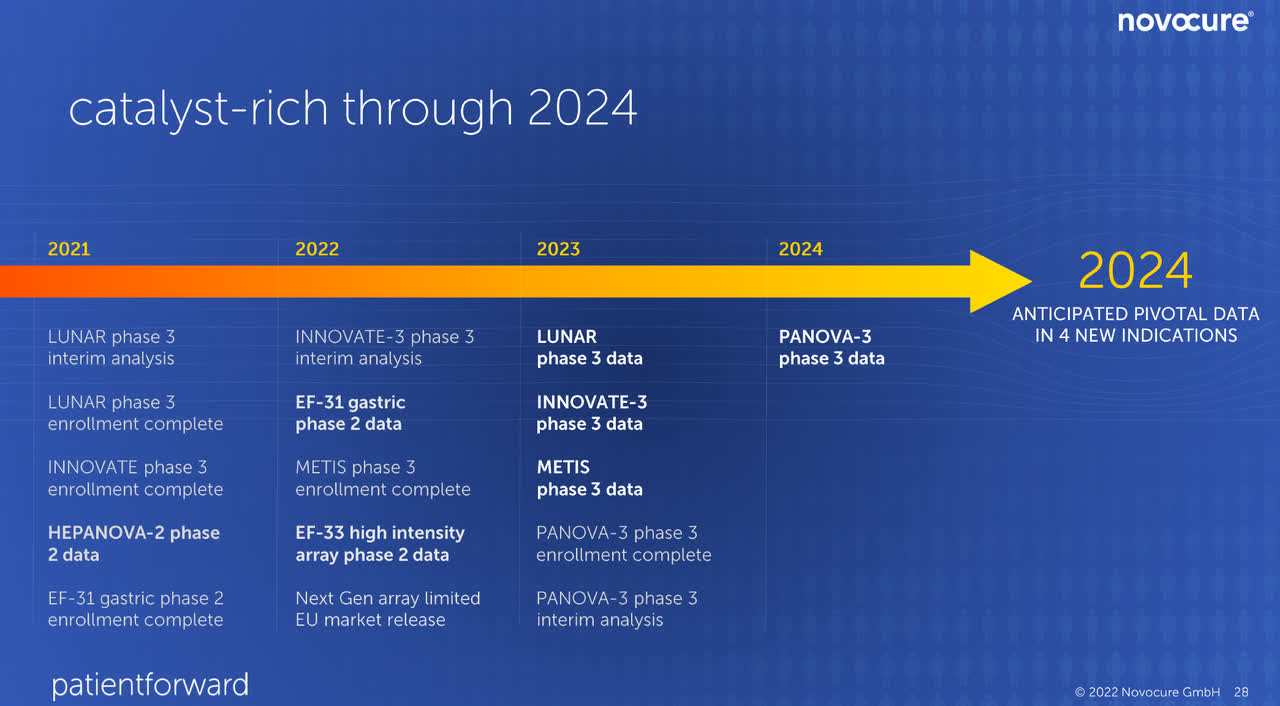

NovoCure Trials Pipeline Timeline (NovoCure Q2 FY22 Investor Presentation)

As brain metastasis (METIS) is expected to publish phase III data in 2023, I have assumed that commercialization, if the phase III trial is successful, will only come in 2024.

As NovoCure’s core TTF product is the same for different types of cancers, albeit with some variations and tweaks, the same average monthly unit revenue of $13,000 is assumed, with a conservative 2% inflation-linked YoY growth rate.

The assumptions for EBITDA margins and the discount rate are no different from what was explained for glioblastoma.

For the chance of commercialization, I note that in the September 2022 company conference presentation, Doyle anticipates a less than 50% chance of a Phase III trial failure due to TTFs being a proven mechanism applied to different areas of the body for different cancers. Considering that for brain metastasis, the TTF device would be fitted over the skull as in the proven case of glioblastoma, I have assumed a 75% chance of Phase III trial success and commercialization.

Overall, this math results in an expected present value of $2.4bn of value coming in from the brain metastasis application alone.

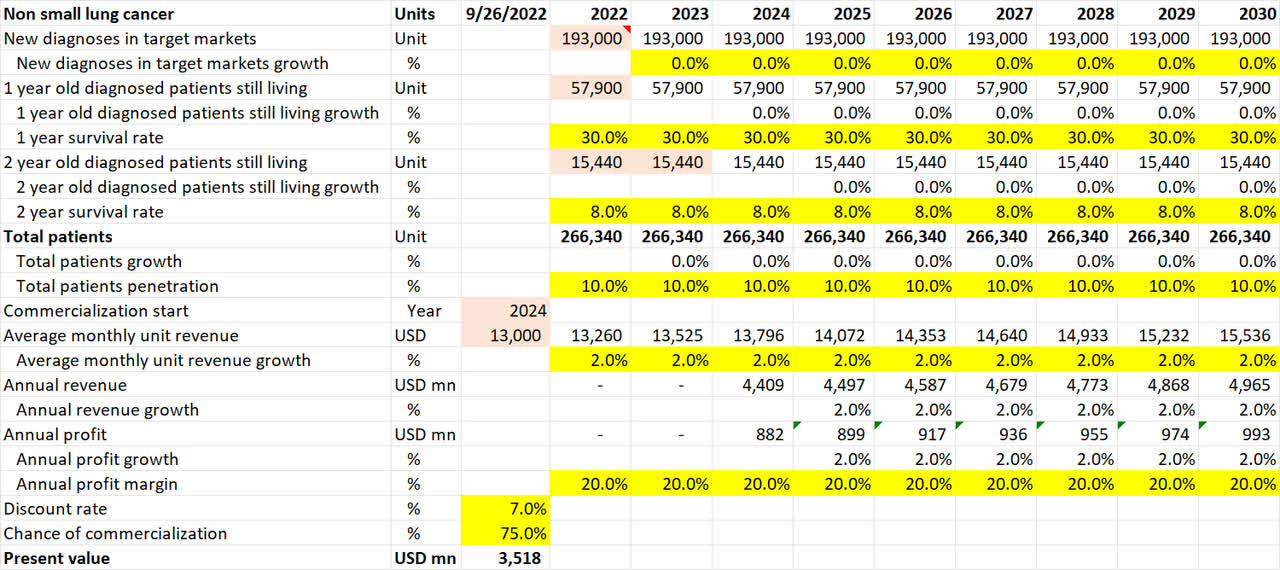

Non-small lung cancer

Non-small lung cancer pipeline valuation (Own Analysis)

For non-small lung cancer, NovoCure’s 10-K filing suggests that 193,000 new diagnoses occur annually in the US. I have assumed no growth in this figure in future. Neither have I accounted for the incidence of cancers outside of the US.

The 1-year and 2-year survival rates of 30% and 8% respectively are based on a PubMed Central journal that analyzes survival rates of non-small lung cancer.

Given a 40% penetration in the US already for mesothelioma lung cancer, a flat 10% penetration is assumed for NovoCure for non-small lung cancer in the US. I believe this is conservative.

NovoCure Trials Pipeline Timeline (NovoCure Q2 FY22 Investor Presentation)

As non-small lung cancer (LUNAR) is expected to publish phase III data in 2023, I have assumed that commercialization, if the phase III trial is successful, will only come in 2024.

As NovoCure’s core TTF product is the same for different types of cancers, albeit with some variations and tweaks, the same average monthly unit revenue of $13,000 is assumed, with a conservative 2% inflation-linked YoY growth rate.

The assumptions for EBITDA margins and the discount rate are no different from what was explained for glioblastoma.

For the chance of commercialization, I note that in the September 2022 company conference presentation, Doyle anticipates a less than 50% chance of a Phase III trial failure due to TTFs being a proven mechanism applied to different areas of the body for different cancers. Considering that for non-small lung cancer, the TTF device application would be similar to the proven case of mesothelioma, I have assumed a 75% chance of Phase III trial success and commercialization.

Overall, this math results in an expected present value of $3.5bn of value coming in from the non-small lung cancer application alone.

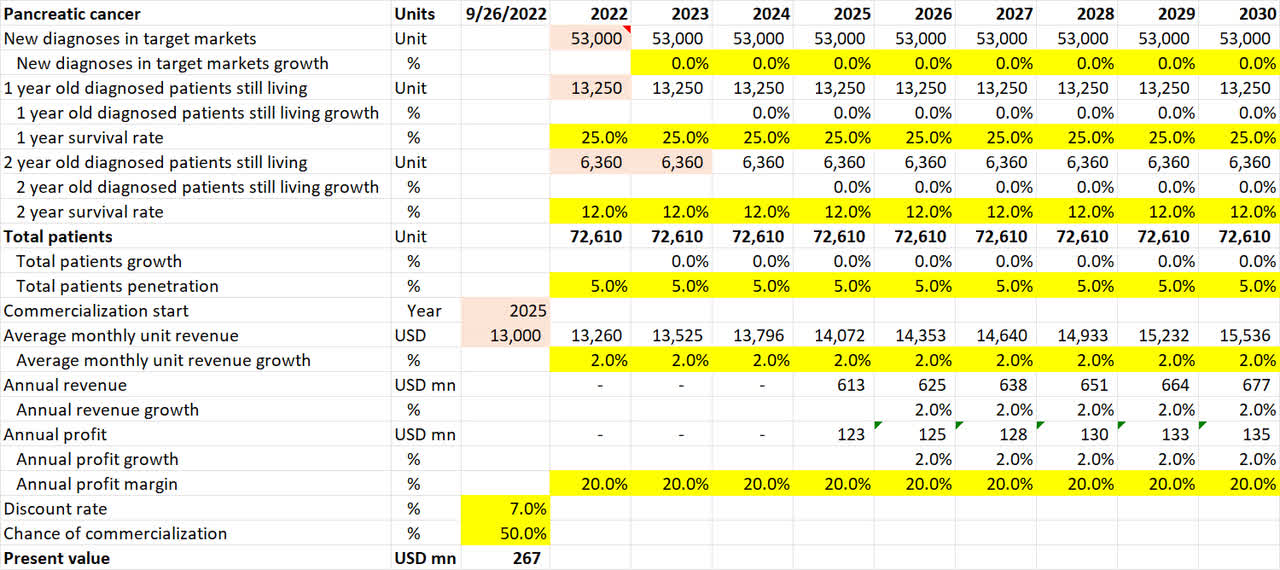

Pancreatic cancer

Pancreatic cancer pipeline valuation (Own Analysis)

For pancreatic cancer, NovoCure’s 10-K filing suggests that 53,000 new diagnoses occur annually in the US. I have assumed no growth in this figure in the future. Neither have I accounted for the incidence of cancers outside of the US.

The 1-year and 2-year survival rates of 25% and 12% respectively are based on statistics from Cancer Research UK.

Given a 40% penetration in the US already for mesothelioma lung cancer, a flat 5% penetration is assumed for NovoCure for pancreatic cancer in the US. This is lower than the 10% assumed for lung and brain cancers, for which there is already successful precedence and hence public confidence for NovoCure’s TTF devices.

NovoCure Trials Pipeline Timeline (NovoCure Q2 FY22 Investor Presentation)

As pancreatic cancer (PANOVA) is expected to publish phase III data in 2024, I have assumed that commercialization, if the phase III trial is successful, will only come in 2025.

As NovoCure’s core TTF product is the same for different types of cancers, albeit, with some variations and tweaks, the same average monthly unit revenue of $13,000 is assumed, with a conservative 2% inflation-linked YoY growth rate.

The assumptions for EBITDA margins and the discount rate are no different from what was explained for glioblastoma.

For the chance of commercialization, I note that in the September 2022 company conference presentation, Doyle anticipates a less than 50% chance of a Phase III trial failure due to TTFs being a proven mechanism applied to different areas of the body for different cancers. Given this, I have conservatively assumed a 50% chance of Phase III trial success and commercialization.

Overall, this math results in an expected present value of $267mn of value coming in from the pancreatic cancer application alone.

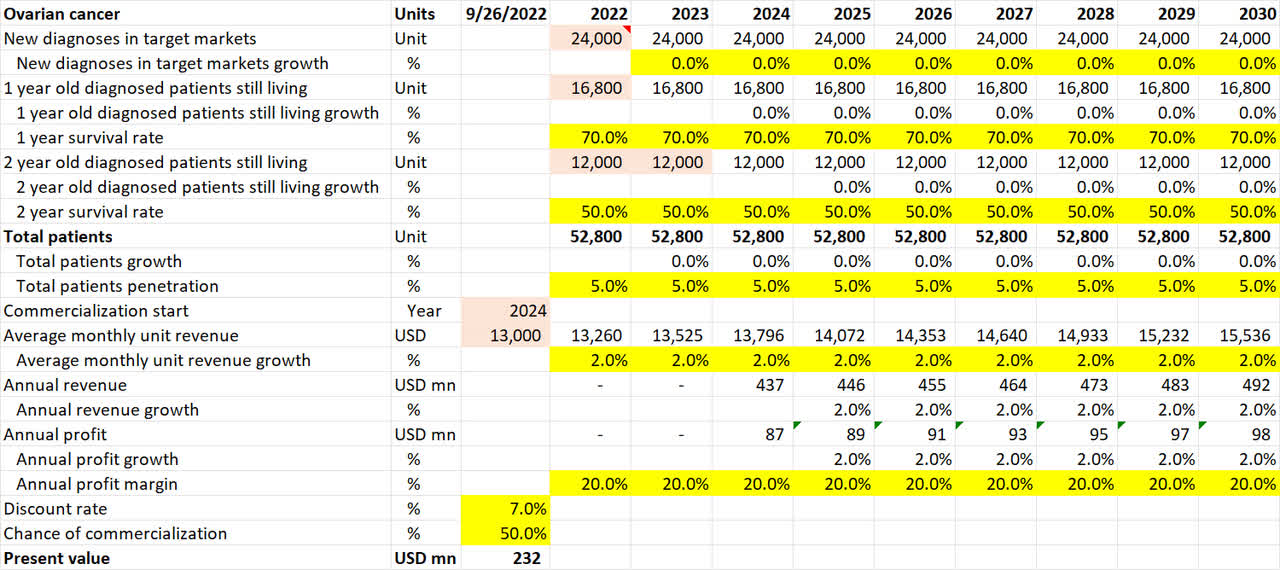

Ovarian cancer

Ovarian cancer pipeline valuation (Own Analysis)

For ovarian cancer, NovoCure’s 10-K filing suggests that 24,000 new diagnoses occur annually in the US. I have assumed no growth in this figure in future. Neither have I accounted for the incidence of cancers outside of the US.

I have assumed 1-year and 2-year survival rates of 70% and 50% respectively based on the Ovarian Cancer Research Alliance statistics.

Given a 40% penetration in the US already for mesothelioma lung cancer, a flat 5% penetration is assumed for NovoCure for ovarian cancer in the US. This is lower than the 10% assumed for lung and brain cancers, for which there is already successful precedence and hence public confidence for NovoCure’s TTF devices.

NovoCure Trials Pipeline Timeline (NovoCure Q2 FY22 Investor Presentation)

As ovarian cancer (INNOVATE) is expected to publish phase III data in 2023, I have assumed that commercialization, if the phase III trial is successful, will only come in 2024.

As NovoCure’s core TTF product is the same for different types of cancers, albeit, with some variations and tweaks, the same average monthly unit revenue of $13,000 is assumed, with a conservative 2% inflation-linked YoY growth rate.

The assumptions for EBITDA margins and the discount rate are no different from what was explained for glioblastoma.

For the chance of commercialization, I note that in the September 2022 company conference presentation, Doyle anticipates a less than 50% chance of a Phase III trial failure due to TTFs being a proven mechanism applied to different areas of the body for different cancers. Given this, I have conservatively assumed a 50% chance of Phase III trial success and commercialization.

Overall, this math results in an expected present value of $232mn of value coming in from the ovarian cancer application alone.

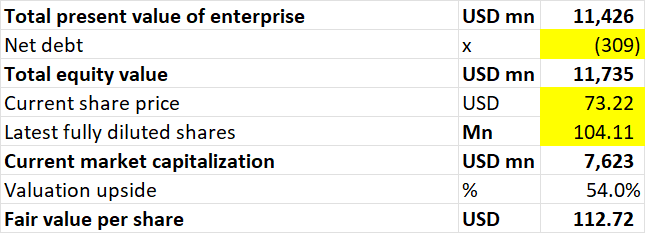

Aggregating these pipeline values together and using that as a conservative proxy for enterprise value, an equity value of $11.7bn is implied. This corresponds to a fair value per share of $112.72, suggesting an upside of 54% from the current price of $73.22:

NovoCure Valuation Summary (Own Analysis)

Thus, a rather conservative valuation of the pipeline potential of NovoCure highlights meaningful value accretion potential over the next 2-3 years.

Technical Analysis

NVCR Technical Analysis (TradingView, Own Annotations)

NovoCure looks to be heading towards monthly support at $53.71. Price is in the accumulation zone, and a move down to the monthly support line could act as the Wyckoff-style spring to launch prices higher to the next key level of monthly resistance at $111.25.

NVCR vs S&P500 Technical Analysis (Trading View, Own Annotations)

Since I am ‘hunting alpha’, I care more about relative outperformance over my opportunity cost (S&P 500) than absolute outperformance. Hence, I place a bit more importance on the relative chart of PINS/S&P 500.

On the monthly NVCR vs. S&P 500 chart, an upward movement indicates NVCR’s outperformance vs. the S&P 500. Conversely, a downward movement indicates PINS’ underperformance vs. the S&P 500. Currently, the monthly relative chart shows some reactionary signs of support. The relative spread looks headed north toward the next monthly resistance zone. I plan to book the alpha (outperformance) generated and exit my positions in NovoCure once it reaches the monthly resistance.

Overall, I believe both the absolute and relative charts of NVCR against the S&P 500 show bullish prospects for NovoCure in the medium term.

Key Risks and Monitorables

Failed Phase III trials are the biggest risks to NovoCure as an investment idea today. Many Phase III trial data release catalysts are lined up from 2023 to 2025. On the operational front, the gradual rebound in Germany’s active patient growth is a key monitorable.

Summary and Positioning

In light of this analysis, I think it is time to see past market myopia and buy the dip on NovoCure. I believe the stock is poised to generate alpha over the S&P 500. Note that I measure myself on alpha, not absolute performance. Hence, I need not have a view of when ‘the bottom is in’ for the market. However, if absolute performance is how you keep score of how you’re doing in the market, it may be prudent to start buying only when you think the market is bottoming.

Be the first to comment