Douglas Rissing/iStock via Getty Images

One of the most amazing things to me has been the inflationary expectations that have been built into the U.S. Treasury yield curve over the past year or two.

As policymakers and others have jumped out of their shoes as inflation has jumped to 9.0 percent, to 8.0 percent, and other higher levels over the past six months or so.

What is the Federal Reserve doing about this rise, and what will it do going forward?

This rise in the level of inflation is very dangerous, especially since the Federal Reserve has a policy target of 2.0 percent for the rate of inflation.

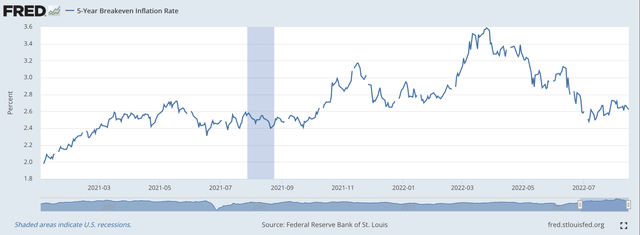

Well, here is a measure of what investors in U.S. Treasury notes seem to believe will happen to inflation over the next five years.

These inflationary expectations are derived from what is called the “breakeven yield” for U.S. Treasury notes. They represent an estimate of the compound rate of inflation for the time period under review.

For example, recently, the yield on the 5-year U.S. Treasury note closed at 3.003 percent. The yield on the 5-year Treasury Inflation Protected note was 0.242. Hence, the breakeven yield was 2.761 percent.

Hence, inflationary expectations for the next five years were expected to be 2.761 percent at an annual compound rate.

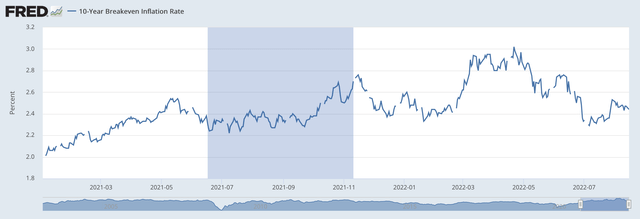

For ten-year inflationary expectations, the numbers came out to be a nominal yield of 2.888 percent, with a yield on the 10-year TIPs of 0.406. Inflationary expectations for the next 10-year time horizon were a compound 2.482 percent.

Here is the picture for the past two years for the 5-year breakeven yield.

5-Year Breakeven Yield (Federal Reserve)

We will say more on this later, but note that the breakeven yield hit a peak of 3.56 percent on March 28, 2022.

For the 10-year breakeven yield.

10-Year Break Even Inflation (Federal Reserve)

The breakeven yield hit a peak of 2.98 percent on April 22, 2022.

The interesting thing in these figures, to me, is that from very early on, the 5-year inflationary expectation exceeded the 10-year inflationary expectations.

What does that show?

Well, it shows that investors were predicting an inverted yield curve from very early in the monetary game.

Usually, an inverted yield curve is associated with a recession coming sometime in the future.

But, although investors did not expect interest rates to go up very high they seemed to believe, fairly early in the game, that a recession was something that was going to happen.

And, these feelings got built into the Treasury yield curve fairly early in the game. In fact, these feelings got built into the Treasury yield curve a little bit before the Federal Reserve began raising its policy rate of interest in the middle of March 2022.

It appears as if investors stuck by what the Federal Reserve was saying and built this narrative into the Treasury yield curve.

Therefore, in recent weeks, the yield curve dropped as the inflationary expectations built into the yield curve fell.

Summary: Investors believe that inflation will not remain very high and will drop off in the near future.

By the end of the next four years, inflation will be back down around the Fed’s 2.00 percent inflation target and will remain at that level for the rest of the decade.

This is what is built into the market’s term structure of interest rates.

It is almost identical to the Fed’s projections of interest rates for the next four years. The Fed’s target rate is the PCE index as released after the June meeting of the FOMC.

Here is what the Fed’s numbers look like for the PCE inflation over the next few years.

Inflation Rate (as %)

2022 5.0-5.3 %

2023 2.4-3.0 %

2024 2.1-2.4 %

Long range 2.0 %

So, the investment community views the future of the rate of inflation just about the same way that the Federal Reserve views the future of the rate of inflation.

Believe it or not.

No wonder these investors are positive about a rising stock market.

Be the first to comment