Claudia Nass/iStock via Getty Images

The Invesco S&P SmallCap Value with Momentum ETF (NYSEARCA:XSVM) covers a portfolio of 120 stocks that serve as a subset of the S&P SmallCap 600 Index; the subset in question is the value cohort that has exhibited strong price momentum over a 6-month time frame.

The initial focus here is to pick out suitable value plays within the small-cap space; screens such as a) the book value to price, b) trailing twelve-month EPS to price, and c) trailing twelve-month sales to price are used to arrive at a composite value score. The metrics utilized here should give a reasonable take on the value quotient of these stocks, but I would have preferred a more forward-looking screening mechanism (such as forward earnings, or forward sales), rather than the backward-looking review that XSVM’s tracking index indulges in.

This is particularly pertinent as a lot of these small-caps may have offered decent trailing earnings yields or sales yields in a non-recessionary environment (much of 2021), but with real GDP growth expected to slow to 1.6% in 2022, and 1.3% in 2023, I suspect quite a few of these companies wouldn’t quite be able to maintain or improve the run rate of earnings and sales yields witnessed over the last 12 months.

Nonetheless, after the initial value scores are determined, the relative momentum score of the top 240 securities (by value score) is determined and ranked. This is just a function of the price appreciation of the security relative to the remaining constituents over a semi-annual basis. The 120 highest ranking securities are finally chosen, with weights allotted based on their value scores.

Should You Be Looking To Add XSVM To Your Portfolio?

XSVM has done a reasonable job this year, witnessing only mid-single-digit losses for the year, even as the broader markets have fallen by a figure closer to double digits. This may provide investors with a certain degree of confidence to latch on to XSVM, but I would like to highlight a few themes before you consider getting on board.

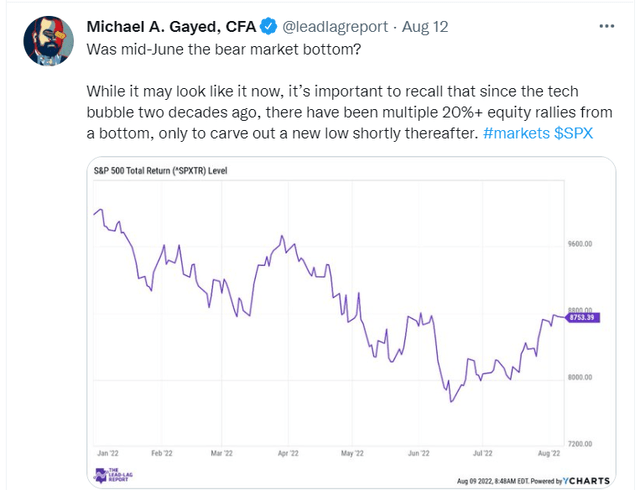

Firstly, I think it’s important that investors ask the question if we’ve truly bottomed out in mid-June, or if there’s a fresh dose of pessimism in store. I say this because history has shown us that the markets can often go on quick rallies of 20%+ from the bottom, only to then retest the lows.

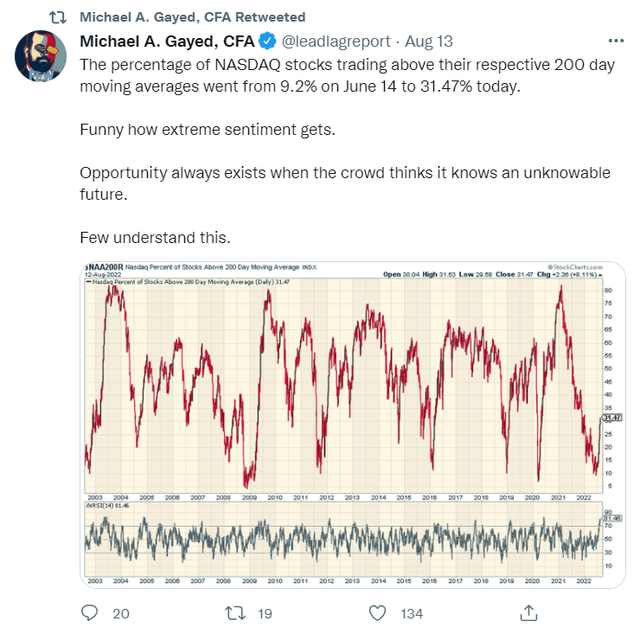

Risk-on sentiment has been a dominant theme in the market these last few weeks, with both my short-term intermarket utilities and treasuries signals backing this up (the long-term 200DMA signal too is not too far away from switching on to risk-on mode). Speaking of the 200DMA, also do consider that close to a third of the high-beta tech stock of the Nasdaq are currently trading above that level; this proportion was only in single-digit terms a couple of months back.

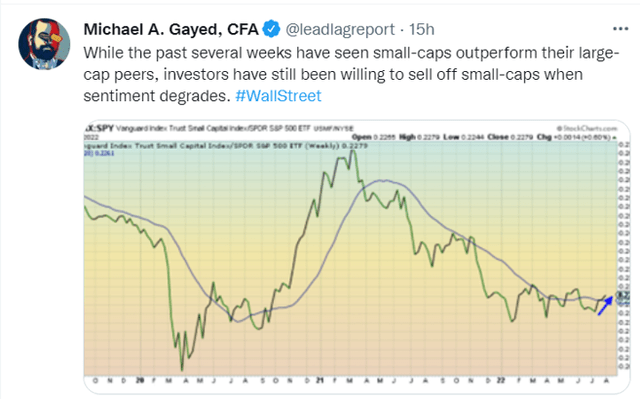

Just like the tech cohort, the small-cap pack too has attracted a lot of attention, but as noted in The Lead-Lag Report, they often serve as fine proxies of risk-on behavior. Conversely, when sentiment turns, they often face the brunt.

What could tilt sentiment? Well, I believe much of the market’s next move will be dictated by what happens with inflation. A lot of market participants appear to be cheering the recent inflation report as they believed that things may have peaked, but I think it would be short-sighted to get carried away with just one reading. Even though there may have been a sequential decline in the YoY rate, taken over a period of months, the numbers are still rather elevated. Also, consider that the core inflation rate, which is a lot stickier, still needs to witness substantial reverse traction to be considered meaningful.

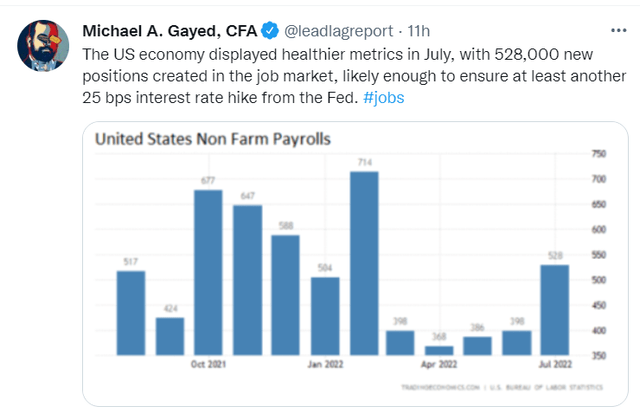

Separately, don’t discount the services side impact on the inflationary picture (too much emphasis has only been placed on the goods side). For instance, as noted in The Lead-Lag Report, the labor market still continues to burn bright and should embolden the Fed to keep up with its rate hiking plans.

If the rate hiking plans were to persist, small-caps could face a difficult outlook as most of them have inordinate levels of debt on their books, and their business models as well are quite unidimensional and heavily reliant on prospects domestically.

Conclusion

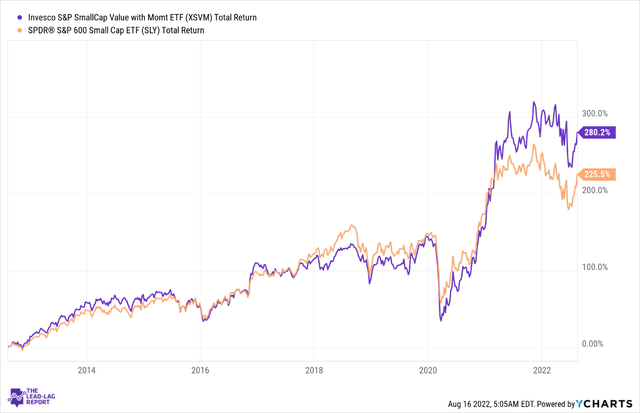

Over the last decade, it’s worth noting that XSVM has proven to be a useful source of alpha for those looking for suitable opportunities in the small-cap universe. Over 10 years, XSVM has delivered aggregate returns of 280% outperforming the S&P SmallCap 600 Index in the process.

Needless to say, considering the emphasis placed on the value quotient of XSVM’s portfolio, its P/E ratio too comes across as inordinately cheap, currently available at a multiple of just 7.2x; that’s a discount of almost 40% relative to the corresponding multiple of the S&P 600 SmallCap Index.

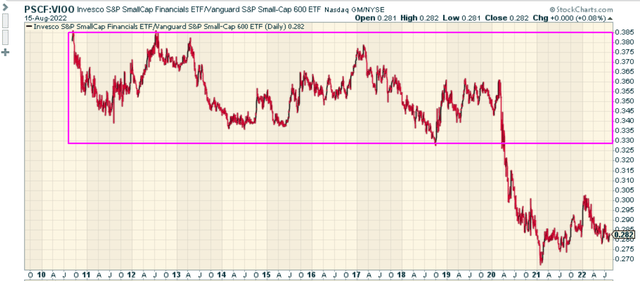

Crucially, also consider that XSVM’s portfolio is currently dominated by small-cap financials (28% of the portfolio and a good 1000 bps higher than the next largest sector) and this segment still has a long way to go to recoup its long-term range. Discerning investors who are looking for good value opportunities in small caps may gravitate towards the financials space, which could work really well for XSVM.

Be the first to comment