Pgiam/iStock via Getty Images

AngloGold Ashanti Limited (NYSE:AU) has been a market laggard in recent years. Nevertheless, conservative capital allocation policies, coupled with broader industry trends toward more prudential capital allocation, have given the company a pathway to sustainable profitability. The company is trading at a low PE multiple and has an attractive FCF yield. With capex expected to decline in 2023, future company returns could beat market returns.

Recent Underperformance in the Stock Market

In the last five years, AngloGold Ashanti has returned nearly 6.7% per year, compared to more than 7.58% for the Russell 1000. In the year-to-date, the stock is down 36.42%, whereas the Russell 1000 is down 22.35%.

Google Finance

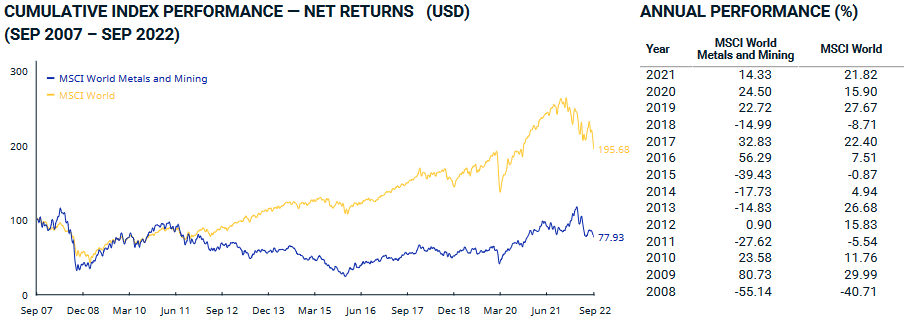

In that time, the MSCI World Metals and Mining Index has gained 7.54% a year, compared to 5.3% for the MSCI World. In the year-to-date, the MSCI World Metals and Mining Index is down 14.17%, while the MSCI World is down 25.42%.

MSCI World Metals and Mining Index

AngloGold Ashanti has not just underperformed the market, it also has underperformed its global peers. In doing so, it has found a path to profitability and laid the groundwork for strong future performance.

The Road to Profitability

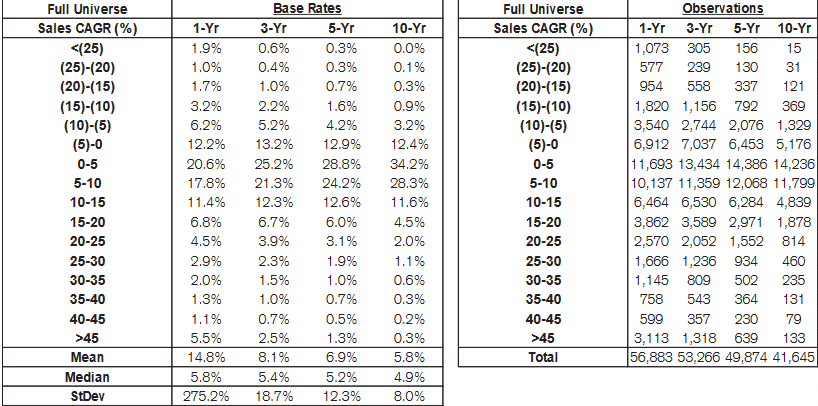

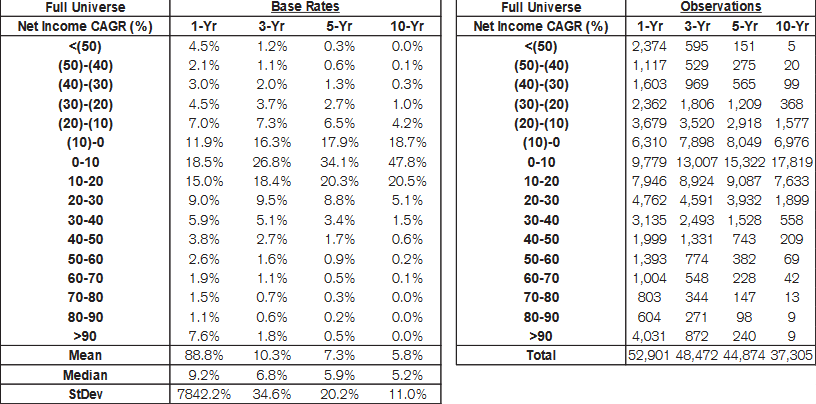

Revenue has declined over the last five years, from $4.543 billion in 2017 to $4.029 billion in 2021, for a 5-year revenue compound annual growth rate (CAGR) of -2.37%. According to Credit Suisse’s The Base Rate Book, 12.9% of businesses had similar levels of revenue decline in the 1950 to 2015 period. In the trailing twelve months (TTM), the company earned revenues of some $4.22 billion.

Credit Suisse

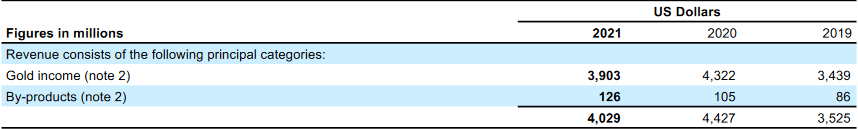

The company’s revenues largely derive from gold, with a miniscule proportion coming from by-products.

AngloGold Ashanti 2021 Annual Report

AngloGold Ashanti’s gross profitability in 2017 was nearly 0.11, which rose to nearly 0.15 in 2021. This is well below the 0.33 threshold that Robert Novy-Marx found marked an attractive company. 0.33 is a very high threshold for a gold miner, but the direction of travel for AngloGold Ashanti has been positive.

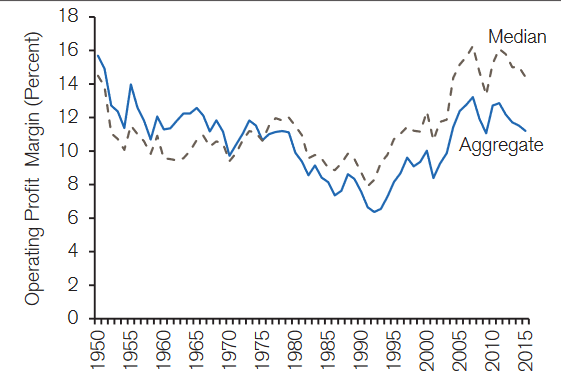

Operating margin in 2017 was 13.7%, which rose to 20.1% in 2021. The company’s operating margin is higher than the median and aggregate operating margin for businesses across the 1950 to 2015 period.

Credit Suisse

The company’s net income rose from -$171 million in 2017, to $646 million in 2021 according to a comparison chart. Given the negative value of the 2017 numbers, the 5-year net income CAGR is obviously unreal, but as for comparison, can be assigned a base rate of more than 0.5%. In the TTM period, net income is $558 million.

Credit Suisse

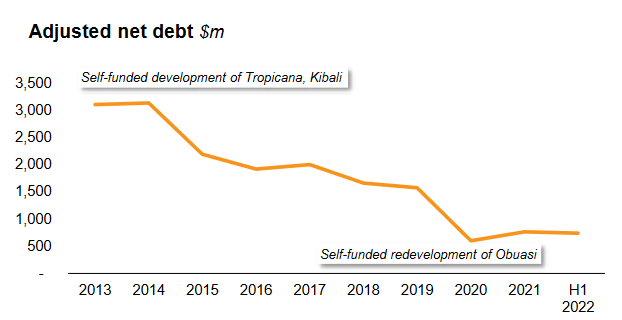

Total assets rose from $7.219 billion in 2017 to $7,967 billion in 2021, at a modest 5-year total assets CAGR of 1.99%. This is important because there is an inverse relationship between asset growth and future returns, what is known as the asset growth effect. Indeed, the company has not issued equity in the last 11 years, which demonstrates the prudence of the firm’s capital allocation policy. Similarly, AngloGold Ashanti has aggressively reduced its adjusted net debt over the years.

AngloGold Ashanti 2022 Interim Results

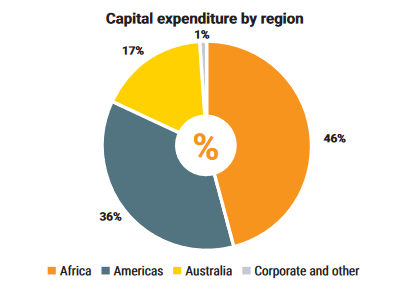

Asset growth has been minimal despite a huge jump in AngloGold Ashanti’s capital expenditure. Capital expenditure rose from $953 million in 2017 to $1.1 billion in 2021, with 46% of that spent in Africa, and 36% in the Americas. The company expects capex for the year to be between $1.050 billion and $1.150 billion. In the first half of the year, capex was $472 million, compared to $461 million for the same period last year.

AngloGold Ashanti 2021 Integrated Report

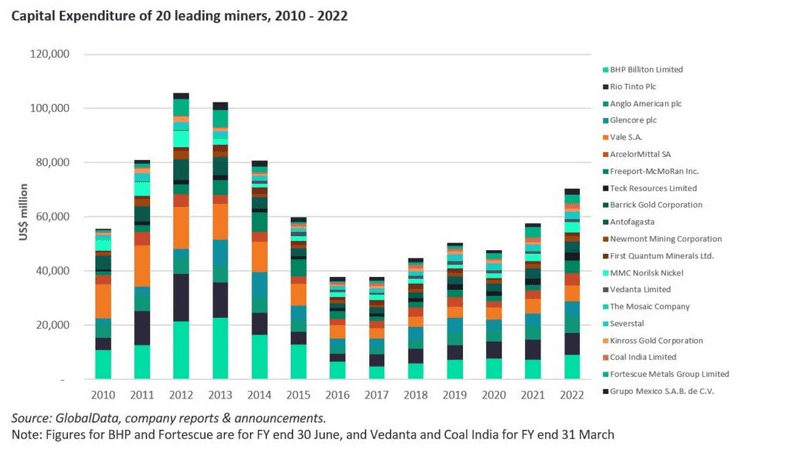

Capex has risen since 2021 across the mining industry, in response to the pandemic. However, capex remains well below the boom era heights of the early part of the last decade. Capex growth is expected to decline in 2023.

Mining Technology

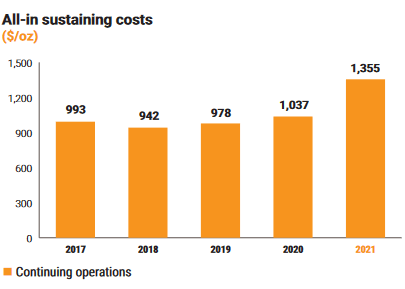

All-in Sustaining Costs (AISC) rose from $972/oz in 2017, to $1,355/oz, in 2021. The company’s guidance for 2022 AISC is $1,295/oz to $1,425/oz. In the first half of the year, AISC was $1,418/oz, compared to $1,068/oz in the same period last year, although in Q3 2022, AISC was $1,284/oz.

AngloGold Ashanti 2021 Integrated Report

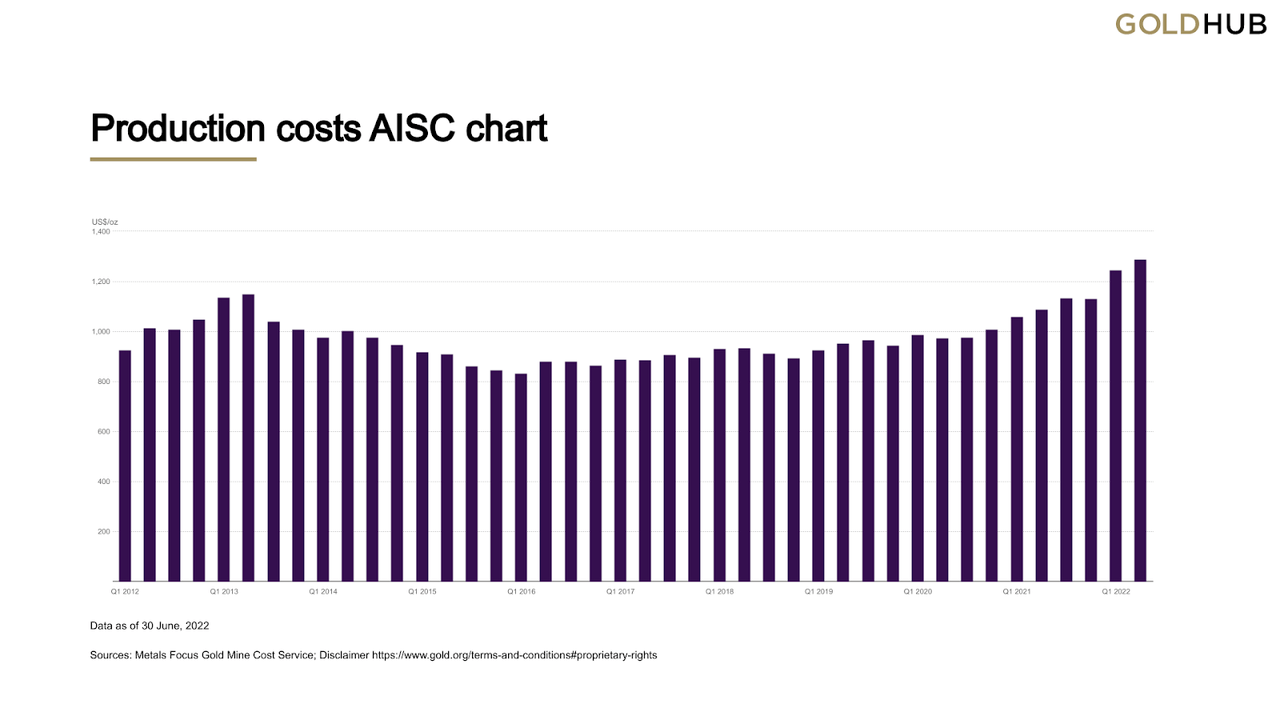

The World Gold Council’s data shows that there has been an industry-wide growth in production costs in recent years. AngloGold Ashanti’s AISC is, however, higher than the industry average.

World Gold Council

Free cash flow (FCF) declined from $125 million in 2017 to $104 million in 2021. In the TTM period, the company has $600 million in FCF, with $471 million of that coming in H1 2022 alone.

Return on invested capital (ROIC) has risen sharply from -0.3% in 2017 to 12.2% in 2021. ROIC is positively correlated with future stock performance, and so, the direction of change is important in predicting where the share price will go in the long run.

Management Interests are Aligned to Shareholder Interests

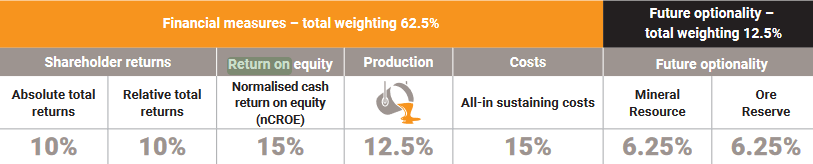

The variable pay component of executive compensation is determined by a number of factors, one of which is cash return on equity (nCROE). nCROE makes up 15% of the variable pay component. While this is an imperfect measure of management’s activities, it does force management to think like a shareholder. This is further bolstered by the shareholder returns component of the executive compensation plan.

AngloGold Ashanti 2021 Integrated Report

Valuation

AngloGold Ashanti’s price-to-earnings ratio is 9.59, compared to 48.19 according to Aswath Damodaran’s data. The Russell 1000 has a PE ratio of 17.28. The company’s FCF yield (TTM FCF/enterprise value) is 9.55%. In comparison, the FCF yield of the 2000 largest firms in the United States is 1.5%, according to New Constructs. We pointed out that the company’s gross profitability is not attractive. So, while the company is certainly attractive, it is “only” a buy and not a strong buy.

Conclusion

AngloGold Ashanti has laid a pathway to sustainable profitability, thanks to a conservative capital allocation policy. Shareholder interests are aligned with those of management, because of the variable pay compensation plan. The industry as a whole has been conservative in recent years, which is steering it toward a less volatile capital cycle. With capex expected to decline in 2023, future returns are likely to beat those of the market. The company is trading at an attractive relative valuation; and mean reversion should be enough for investors to see a positive return going forward.

Be the first to comment