jetcityimage

Investment Thesis

AT&T (NYSE:T) is investing in 5G mid-band spectrum and fibre networks to provide better connectivity solutions to its customer base which should drive medium to long-term growth. The net additions in postpaid phones and fibre were strong in the second quarter and this strength is likely to continue in Q3 and beyond given customer demand for better connectivity. T is improving its Business Wireline business which is putting near-term pressure on the revenue and EBITDA, however, it is expected to stabilize in the back half of FY24. Given the timing of pricing actions in the Mobility segment, the revenue growth should benefit in the back half of FY22. While concerns around higher interest rates have caused the stock price to correct and investors are still pessimistic, I see light at the end of the tunnel and expect sentiment to improve over the next few months.

AT&T Stock Key Metrics

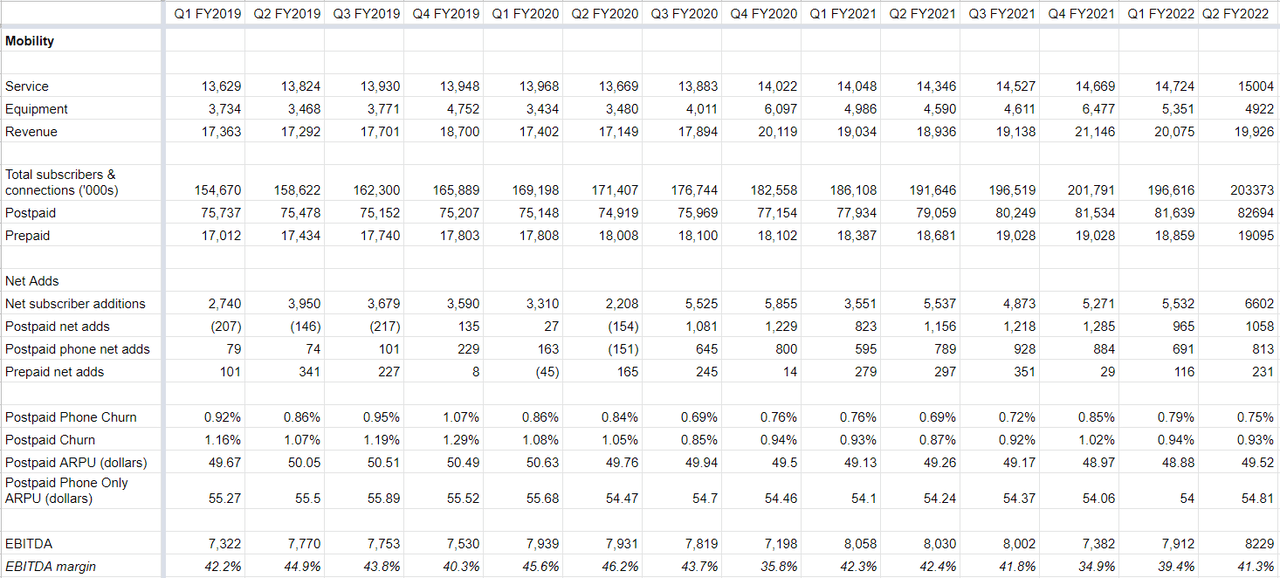

The average revenue per user (ARPU), subscriber and connection growth, churn rate, and EBITDA margin are some of the important metrics for AT&T. The number of subscribers in the mobility segment has risen steadily over the last three years, from 154.7 million in the first quarter of 2019 to 203.4 million in the second quarter of 2022. This was due to an increase in both postpaid and prepaid customer subscriber counts.

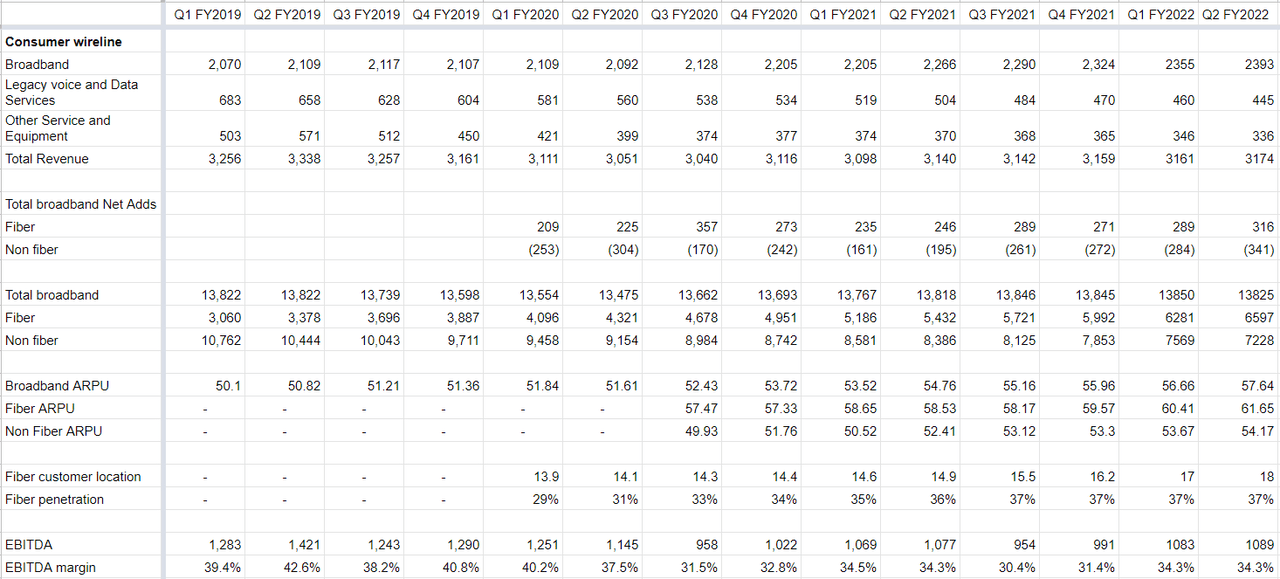

AT&T is improving its infrastructure and expanding its customer base across 5G and fibre networks. The net additions in Q2 FY22 were high due to the solid execution, consistent go-to-market strategy, building of a fibre network, and deployment of mid-band 5G spectrum assets. In Mobility, the postpaid phone net additions were 813,000 in Q2 2022 due to the continued demand momentum from 2021. The Mobility business’ market share increased by one percentage point in the second quarter compared to the same quarter the previous year. In fibre, the company is investing in building a premium network, driving build velocity, and delivering accelerated customer growth through improved penetration rates. The penetration rate in the second quarter was up one percentage point Y/Y at 37%. The increase in fibre net adds in the quarter gives T an opportunity to increase its share of the fibre footprint and convert more IP broadband internet subscribers to fibre subscribers. The fibre net additions in the quarter were 316,000. Since Q3 FY20, T has achieved approximately 6.15 mn postpaid phone net adds and 2.3 mn fibre customers. At the end of the second quarter, the customer locations for the consumer wireline fibre were 18 mn, an increase of 2 mn from the start of FY22. On the 5G side, the company achieved its target of covering 70 mn mid-band PoP in 1H FY22, ahead of its expectations. The company is now targeting 100 mn mid-band PoPs by the end of FY22 and its analyst day target of 200 mn PoPs by the end of FY23.

AT&T’s Mobility Business Key Metrics (Company data, GS Analytics Research)

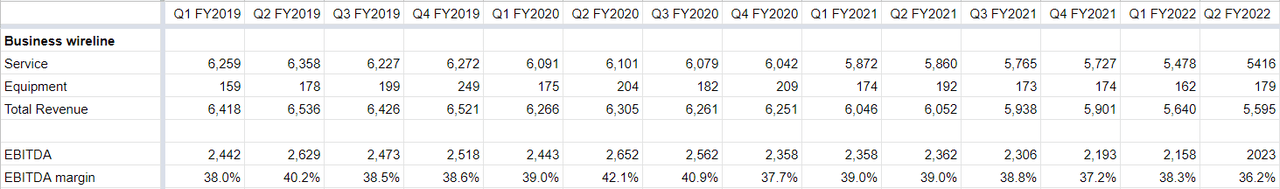

AT&T’s Business Wireline Segment Key Metrics (Company data, GS Analytics Research)

AT&T’s Consumer Wireline Segment Key Metrics (Company Data, GS Analytics Research)

In Mobility, the postpaid ARPU was $54.81 in the second quarter up $0.81 sequentially or 1.1% Y/Y, driven by more customers switching to higher-priced unlimited plans, improved roaming trends, and benefits from the June pricing actions. Given the timing of price increases, pricing actions should be a larger factor in the back half of FY22. In the Consumer Wireline business, the overall fibre ARPU is expected to improve going forward as more customers roll off the promotional pricing. The Business Wireline segment has been in a secular decline as customers are transitioning from legacy voice and data services. Customers are replacing traditional voice services with mobile and other collaboration solutions, whereas on the data front, VPN and legacy transport services are impacted by technology transitions to software-based solutions. Approximately half of the segment’s revenue comes from these types of services. The company is making changes to its Business Wireline business to reduce the headwinds faced by the business. In the Business Wireline business, lower revenue from the government sector and incremental pressure from business transition and portfolio rationalization impacted the revenue in the second quarter. Approximately one-fifth of the Y/Y Business Wireline revenue decline was due to lower government spending impact.

Looking forward, I believe the pricing actions taken in June should benefit the service revenue in 2H FY22 in the Mobility segment. Last quarter, the company increased its guidance for service revenue growth in FY22 from 3% to a guidance range of 4.5% to 5.5%. The portfolio rationalization in the Business Wireline segment underscores the importance of the transition to T’s connectivity services such as 5G and Fiber. This should benefit the business over time. The Consumer Wireline business should benefit from the mix shift to higher-ARPU fibre plans in 2H FY22.

On the margin front, the company is being effective and efficient across its operations to manage the increasing economic pressure without compromising on investment priorities and financial obligations. The company is targeting to achieve more than $4 bn to $6 bn transformation cost savings by the end of FY22. T usually reinvests a part of these savings to fuel growth in the core connectivity business. But even after these reinvestments, these savings are expected to contribute to the bottom line in the back half of FY22. Apart from these cost-saving programs, the company is taking proactive measures such as selective pricing adjustments to offset the inflationary pressures. Even though the company has effectively increased prices, it was not sufficient to cover all the inflationary impacts last quarter. On its previous earnings call, management mentioned that inflationary pressures are running ~$1 bn above its cost expectations.

Looking forward, the cost actions planned by the company in 2H FY22 in the Business Wireline segment should produce more than $300 mn of savings in FY23 compared to FY22. The company’s plans to transform its business by taking out costs and simplifying its product portfolio should mitigate the pressure on the business wireline profitability over time. However, the lower-than-anticipated revenue from government clients and higher wholesale network access costs are expected to weigh on this business’ profitability in the near term. As cost-cutting initiatives continue, the decline in the profitability of the segment should start to stabilize in the back half of 2024. The Mobility segment’s EBITDA is expected to accelerate in 2H FY22 due to the revenue growth and the lapping of 3G shutdown investments that began in 2H FY21. The company’s change in go-to-market strategy by reducing promotional activities two years ago is also benefiting profitability. The EBITDA in the Consumer Wireline business is expected to grow in 2H FY22, driven by continued growth in broadband revenue and the lapping of technology investments that began in 2H FY21.

If we look at the overall company, I am optimistic about its medium to long-term margin prospects given its cost takeouts, pricing increases, and a mix-shift towards higher-priced plans.

Why Has AT&T’s Stock Price Been Dropping?

With a dividend yield of over 7%, AT&T is a favourite of dividend investors. Many retail investors treat it as an alternative to bonds with good yields. When interest rates were hovering near zero post-Covid, the stock looked like an attractive option with a mid-single digits yield at that time. However, in the recent environment when there are talks about the Federal Reserve hiking interest rates to over 4%, the stock has corrected so that its dividend yield is attractive enough in this high-rate environment. (Note: The stock price of a company has to decline if it is going to provide a high yield with the same dividend amount.)

In addition to attractive yield, another important thing for dividend investors is free cash flow. Of late, AT&T’s cash collection cycle has started increasing and returning to more normalized pre-Covid levels. During the last couple of years, consumers benefited from stimulus checks and were paying bills faster. With the drying up of the stimulus money, the cash collection cycle has lengthened. This has impacted income to free cash flow conversion and worried some investors contributing to the decline in stock price. However, I am not too concerned about it as once the cash collection cycle stabilises around pre-Covid levels, this headwind should wane.

Is T’s Stock Fairly Valued?

T is trading at ~6.01x FY22 consensus EPS estimates of 2.55. This is a discount to its 5-year average forward P/E of ~9.15x. On a forward EV/EBITDA basis T stock is trading at 6.79x and it also has a good dividend yield of ~7.4%. The valuation is a discount compared to its peer Verizon (VZ) which is trading at 7.19x FY22 consensus EPS estimates and has a forward EV/EBITDA of 6.91x. So, T looks relatively undervalued.

Is AT&T A Buying Opportunity Now?

I believe T’s stock is a good buying opportunity now. With the negative headlines dominating around inflation and interest rate hikes, there is a good deal of pessimism in the market. However, I have a contrarian view here. If one looks at the U.S. CPI, it was hovering near mid-single-digit percentage growth Y/Y in the middle of 2021 and then it started accelerating from October and reaching high-single-digit percentage increases Y/Y in December 2021. So, if we think about the percentage increase in Y/Y CPI looking forward, it should moderate over the coming months due to tough comparisons. Further, the supply chain constraints, which were one of the main drivers of inflation, are also easing. This should also help bring down the inflation numbers in the coming months. Once concerns around inflation ease, expectations around high-interest rates continuing for a long will also moderate. So, T’s stock, which has seen a good deal of correction as investors required higher dividend yield in the high-interest rate environment, might also start seeing some benefit.

What Is The Long-Term Prediction For AT&T Stock?

I have discussed my long-term growth forecast for T’s stock in a previous article. However, I will reiterate the key points here. AT&T has secular growth prospects in the fibre-wired business with the company adding more customer locations which are helping net subscriber additions. The consumer wireline business is expected to continue benefiting from an increase in broadband revenue and pricing which should more than offset a decline in legacy voice and data services. Winding down legacy voice and data business should also help the company reduce costs. By 2025, the company intends to reduce its copper footprint by 50% and rationalize its $6 bn cost base in the process.

With the spin-off of its media business, the company now has a strong balance sheet to focus on its wireless and 5G business growth. The company is focused on acquiring new customers and lowering churn in its wireless business. It is also aggressively expanding its 5G footprint and plans to deploy more than 200 mn POPs using the mid-band spectrum by the end of 2023. I believe with the continuously increasing demand for high-speed data with low latency, 5G deployment should help drive the company’s ARPU and revenues in the long term.

Is AT&T Stock A Buy, Sell, or Hold?

T stock is available at a reasonable valuation and has a good dividend yield of ~7.40%. It is trading at a discount to its five-year average forward P/E as well as is available at a lower relative valuation compared to its peer Verizon. The company’s near-term revenue should benefit from the pricing actions in the Mobility segment taken and the switch to higher ARPU fibre plans in the Consumer Wireline business. The revenue and EBITDA of the Business Wireline segment are under pressure, but the segment’s revenue and EBITDA decline should stabilize in FY24 as the company’s portfolio rationalization efforts bear fruit. The company’s longer-term story also appears attractive with 5G deployment, cost rationalization and the mix shift towards higher ARPU. The stock has corrected due to interest rate concerns, but I see light at the end of the tunnel as inflation concerns ease and expect the current overly bearish sentiment to wane over the next few months. Hence, I believe the stock is a good buy.

Be the first to comment