blackred

In the third quarter of 2022, 24 new insight papers have been published in the IHS Markit Asia Pacific Integrated service, apart from the regular updated reports. This research highlight summarized the key impact papers and provides an overview the market signposts in Q3. Links to select reports are provided below.

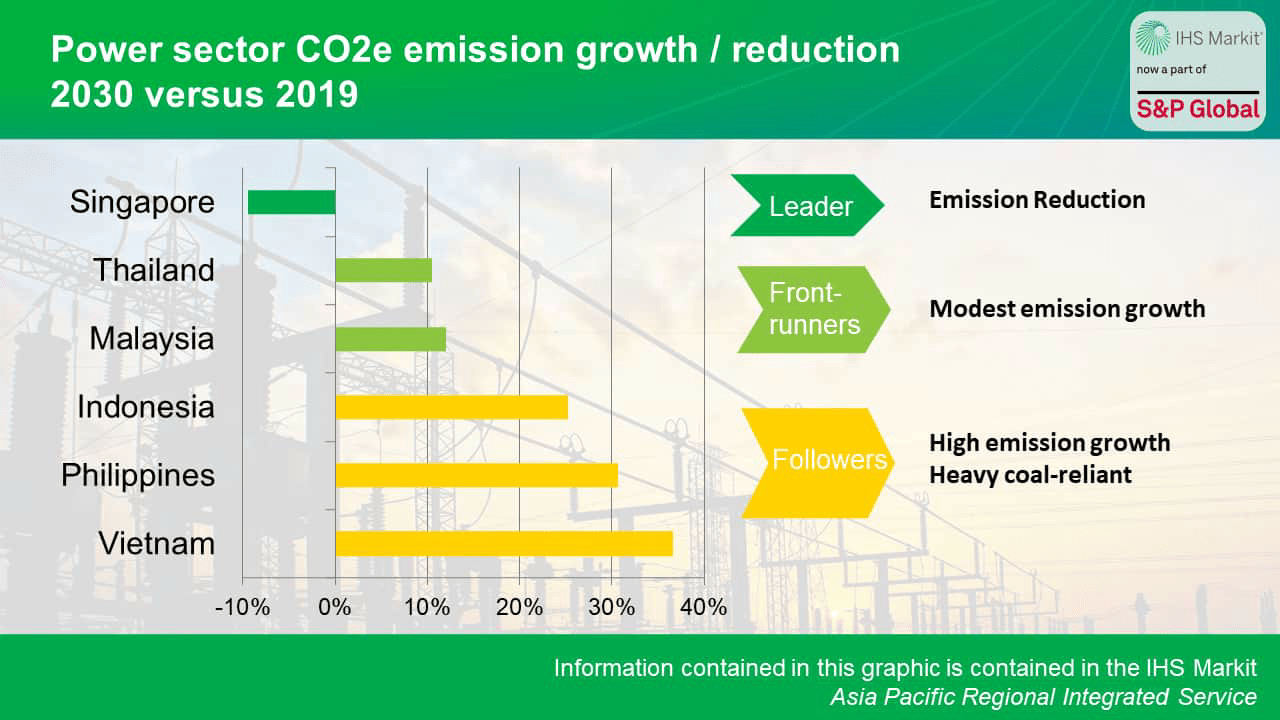

The graphic of the quarter is selected from “Which ASEAN countries will be the front-runners to decarbonize their power sectors?”, showing power sector emissions outlook for southeast Asia markets.

Carbon dioxide (CO2) emissions from the Association of Southeast Asian Nations (ASEAN) power sector will peak in 2029 in the current forecast. The decarbonization progress appears slow, as most countries have not yet developed firm measures to help them achieve the announced net-zero targets. Nine countries have announced national targets to achieve net-zero greenhouse gas (GHG) emissions or to become carbon neutral. However, this is not yet reflected in the region’s prevailing power development plans (PDPs). Therefore, if the countries do not revise their PDPs to incorporate the targets, the region’s power sector emissions will stay high in the next 10-20 years, in particular for these coal-reliant countries: Indonesia, Vietnam, and the Philippines.

To ensure the long-term success, the focus now should be the medium-term carbon reduction. By moving the emissions peak years earlier, countries could win more time to achieve their ultimate net-zero goals. ASEAN countries mostly are highly reliant on coal, except Singapore, which is almost exclusively reliant on gas. Accordingly, the key medium-term decarbonization actions for most countries are to phase out coal and deploy renewables, accompanied by lowering energy intensity by increasing efficiency and enhancing the grid network and pricing on carbon. In addition, each country also seeks unique measures in accordance with their specific resources and weaknesses, such as green power imports in Singapore, renewable auctions in Thailand and Malaysia, encouraging wide foreigner involvement in Vietnam, and rolling out biomass co-blending in Indonesia.

In the next decade, Singapore is undoubtedly positioned to be the leader in decarbonizing its power sector, followed by two front-runners—Malaysia and Thailand—that are able to cap power sector emissions in eight years. The remaining countries, including Indonesia, Vietnam, and the Philippines, will likely lag owing to heavy dependence on coal-fired power and reliance on external funding to support projects to decarbonize the sector. That said, Vietnam could still be the dark horse as it has two wild cards: the two big offshore gas blocks and the support from the Energy Transition Mechanism (ETM) that is under development. Both would have a huge impact on Vietnam’s power fuel mix within 10 years if the decision is made now.

Following the release of mainland China’s 14th Five-Year Plan (FYP) on the overall energy sector, the National Development and Reform Commission (NDRC) announced mainland China’s 14th FYP on renewables in June 2022. The announced plan not only covers capacity targets, general guidelines, and regulatory framework but also includes plant-level details and measures to support renewables consumption that are critical for the plan implementation during 2021-25.

Mainland China’s renewables surge will exceed the government 2025 targets and achieve one of the 2030 nationally determined contribution (NDC) goals five years earlier. The national government target indicates a doubling of renewables generation from the end-2020 level. However, provincial targets and project pipeline dynamics reflect a far more aggressive deployment pace, indicating the 2030 capacity target of 1,200 GW to be met by 2025.

Megabase and distributed renewables projects will drive most of the renewables capacity growth during the 14th FYP period. Ten renewable megabases will contribute to nearly 70% of gross additions in the next four years. Capacity potentials of distributed renewables will increase remarkably owing to policy incentives and approvals of more land available for renewables sites.

Increasing investments in flexible power and transmission will help to address high penetration of renewable energy in the long term. The government made a massive push for flexible power to increase the power system’s readiness to accommodate more intermittent renewable energy. Meanwhile, the inflated budgets from grid companies will mitigate the capacity bottlenecks in the current transmission and distribution network.

However, renewables growth may face short-term headwinds of inadequate system flexibility, transmission bottlenecks, and declining margins. Uncertainties may lie in the adequacy of flexible capacity and the timeline of transmission network expansion. Market participation may also add pressure to the utility-scale renewable project margins, especially in the inland regions with high curtailment risk.

These reports provide an overview of the levelized cost of electricity (LCOE) for conventional and renewable power generation sources in 2022 and the outlook to 2050 for South Asia. Five reports include a combined South Asia report comparing the levelized cost of generation across four major markets in the region (India, Pakistan, Bangladesh, and Sri Lanka) and individual market reports providing the LCOE analysis and the sensitivities to major input assumptions and drivers.

The LCOE for conventional technologies—coal, gas, hydro, and nuclear—varies in the range of $50-120/MWh and is primarily driven by capital costs, fuel prices, and utilization rates. The LCOEs for conventional non-fossil fuel technologies (hydro and nuclear) are expected to increase by 2050, in comparison with 2022 levels. The increase is driven by the surge in capital costs for hydro and nuclear owing to growing environmental, social, and security concerns. The LCOE of coal-fired projects across South Asia ranges between $35/MWh and $90/MWh, primarily driven by the differences in costs of domestic versus imported fuel, local supply chains, and the financing costs.

Renewables will continue to benefit from a range of drivers for further cost reduction despite the short-term cost increases owing to global supply chain disruption. In the long term, the solar LCOE continues to reduce over the long term by an average of 2.2-3.9% annually, driven by technology improvements, improving economies of scale, and adoption of best practices across the region. In our outlook, the LCOE in 2022 for onshore wind and solar photovoltaic (PV) ranges between $40/MWh and $120/MWh across the four South Asian markets included in our analysis and decreases by about 45-65% by 2050. Challenges because of the rising trade barriers with increasing focus on local content and the increase in soft costs including land and labor costs are expected to become increasingly important.

The battery storage levelized cost is higher by more than 10% since 2021 owing to a rise in raw material costs and supply chain challenges. In the long term, the levelized cost of storage is expected to continue to fall at an annual average of more than 2%. An eight-hour battery will be competitive (including charging cost) versus other flexible sources of electricity, such as combined-cycle gas turbines, by the early 2030s. Meanwhile, the LCOE of hybrid projects will depend on the project size and the optimal resource mix, including wind, solar, and battery storage.

The European Parliament and the Council of the European Union (the Council) have approved the fundamental modality of the carbon border adjustment mechanism (CBAM) proposed by the European Commission, although some technical and administrative details are still open to “trialogue” negotiations. CBAM is essentially an “import levy” on the gap of carbon pricing systems between the exporting country and the European Union. As mainland China is one of the European Union’s biggest trade partners, it will be worth looking at how the implementation of the proposed CBAM might affect mainland China’s overall trade with the European Union as well as export-oriented manufacturers.

The direct impact of CBAM on mainland China’s trade with the European Union will be limited, especially before 2030. CBAM-covered products, which may incur additional carbon costs once CBAM comes into force, will only take up a relatively small share of mainland China’s total exports to the European Union. Moreover, the overall cost adjustment obligations will be limited by a relatively high share of free allowances on the side of the EU Emissions Trading System (ETS) before 2030.

Chinese exporters will be encouraged to increase renewable power consumption to lower their indirect emissions should the European Union decide to include indirect emissions under CBAM. Chinese exporters will not be particularly competitive in this regard, as the average carbon intensity of grid power will still be relatively high owing to mainland China’s reliance on coal for power generation.

Mainland China will continue developing its national ETS to complement command-and-control measures for emissions reduction. The completion of new sector inclusion in the Chinese ETS will largely coincide with the implementation of CBAM, making the ETS coverage basically aligned with that of CBAM. However, the Chinese government’s strong tendency to rely on command-and-control measures means that many of the emissions reduction efforts will not necessarily happen through ETS or get manifested in domestic carbon prices.

In September 2021, the Indian central regulator published the draft deviation settlement mechanism (DSM) regulations, which proposed linking deviation charges primarily to market prices. After detailed deliberations with various stakeholders, the new DSM regulations were published in March 2022 by the Central Electricity Regulatory Commission (CERC). Although the regulations have been published, they have not been implemented yet because of several changes proposed.

The new regulations link deviation charges to market prices. Apart from tightening the deviation bands, the new regulation no longer links deviation charges to grid frequency. Deviation charges have been linked to variable components of the power purchase agreement (PPA) price or price in the day-ahead market (DAM) or the maximum of the price discovered in the DAM, real-time market (RTM), and ancillary services market (ASM).

Existing wind plants may become unviable as their cost of deviation is expected to increase. The new regulations have been made applicable to all plants, including the existing renewable capacity. Tightening deviation bands and linking deviation penalties to market prices have a varied impact on different plants. For existing wind plants, the cost of deviations could potentially increase to 5-6% of the total revenue. To avoid this impact, they will be required to invest in better forecasting technologies or install battery storage systems. This additional cost will cut directly into the project internal rates of return (IRRs) and returns on equity (ROEs).

The central regulator adopts a two-pronged approach to improve the system’s potential to integrate renewable capacity. As the power system is adding more and more renewable capacity, the importance of improved forecasting, real-time scheduling, and forward markets is being felt. The Indian regulator continues to adopt a twin approach of modifying the market designs to the needs of the renewable generators and forcing renewable generators to improve their dispatchability.

The full rollout of the new DSM may be delayed as it requires interlinking of different market segments and upgrading existing infrastructure of power plants. Further, the renewable lobby is opposing the notified regulations to exempt existing plants.

Dual extremes led to severe power shortage in Sichuan, China

A strong heat wave and drought swept across the southwestern regions in mainland China in July and August. In Sichuan, the most affected province and the home of mainland China’s largest hydropower fleet, industrial power users were instructed to halt production for more than a week to ensure adequate power supply to the prioritized residential sector. What triggered the current power supply tension and how long will it last?

Surging cooling demand and low hydro generation led to the power shortage in Sichuan. Cooling demand soared to 40-50% of total power consumption in peak hours, from a usual share of 20-25%, pushing the peak load in Sichuan to reach a six-decade high. Meanwhile, the region experienced multiyear low precipitation, dramatically depressing the output from the hydropower fleet, which accounts for nearly 80% of the power capacity mix in the province.

The power shortage will ease in September and October if the heat wave comes to an end. However, the risk is still high in the coming winter amid the second annual load spike. Peak load is expected to fall by 23-33% in the autumn with less use of cooling appliances. Yet even with power imports from other provinces, it remains uncertain whether Sichuan could cope with the winter peak load, especially given that the lower-than-average storage levels at the reservoirs owing to the drought in the summer may constrain hydropower output.

Gas-fired power, interprovincial power exchange, and demand response will be strengthened during the 14th FYP to mitigate the risk of power shortage. According to the 14th FYP for energy planning, Sichuan will make a combination of extra efforts to enhance the power system’s reliability and resilience to extreme climate conditions, including a pipeline of 4.6 GW of gas power, three ultrahigh-voltage (UHV) lines for seasonal exchange, and demand response.

China’s gas supply mix outlook: Will new pipeline import commitment accelerate?

After a 13% growth in 2021, mainland China’s natural gas demand fell 1% in the first seven months of 2022. The dynamic “zero-COVID” policy and the weak economic growth that followed and relentlessly high commodity prices are the key factors contributing to this decline. The supply mix has changed drastically as well with the share of LNG imports falling by 6 percentage points in the total supply mix. Record-high spot prices and term contracts’ pricing structure and flexibility led to LNG imports declining 20% year on year (y/y), while domestic production and pipeline imports rose 6% and 11%, respectively.

Despite the short-term headwinds, mainland China’s gas demand will almost double the current level by 2040. The abovementioned factors contributing to curbing gas demand growth will fade in the next several years. Meanwhile, mainland China’s long-term carbon goals—peaking carbon emissions by 2030 and reaching carbon neutrality by 2060—are firmly committed, with natural gas playing an important role to achieve them.

Mainland China will continue to look for LNG term supply to avoid reliance on the spot market, but competition is rising. Although new LNG projects are plentiful, Europe’s much higher LNG demand than what was previously expected will generally drive up prices for new term contracts.

Mainland China may choose to accelerate new pipeline import procurement, with significant impact on LNG import demand. We expect that Russian Power of Siberia 2 (up to 50 Bcm/y) will deliver first gas to mainland China in the early 2030s and Central Asia Gas Pipeline Line D (up to 30 Bcm/y) is not needed. However, both pipeline options are still on the table. If mainland China accelerates one pipeline import agreement or even signs up for two new pipeline import contracts instead of one, its LNG imports will be heavily affected.

Australian government considers activating LNG export controls to ensure domestic supply

On 1 August 2022, Australia’s minister for resources announced the start of a process that could lead to the government invoking the Australian Domestic Gas Security Mechanism (ADGSM), which would allow it to restrict LNG exports to ensure domestic needs are met. This came in response to a regulatory assessment projecting a potential shortfall of 56 petajoules (PJ) (1.4 Bcm, 1.0 million metric tons [MMt]) in eastern Australia in 2023.

The new government is taking a new approach. Since taking office after its May 2022 election victory, the Labor government has been more assertive about ensuring domestic gas supply. The ADGSM—which was set to expire on 1 January 2023—has been renewed through 2030, and a process of reforming the mechanism has begun.

A voluntary arrangement with LNG exporters in Queensland is likely to avert the activation of the ADGSM. In parallel to the ADGSM process, the government has begun negotiations with LNG exporters; these talks are likely to result in commitments for domestic supply that are sufficient to obviate the need for mandatory measures.

Meeting demand in eastern Australia means LNG exporters will forgo a small amount of lucrative spot sales of LNG. A domestic supply shortfall would only materialize if the three LNG operators in Queensland were to maximize their spot sales of LNG above and beyond their contracted export volumes. Whether through a voluntary arrangement (as we predict) or a mandate under the ADGSM, these exporters will need to forgo some of this spot sales revenue.

LNG imports are needed in the longer term. Rising domestic demand, constrained production, and LNG export commitments running to the mid-2030s make it very likely that southeastern Australia will require some imports of LNG over time.

Driven by renewed climate targets around the 2021 United Nations Climate Change Conference (COP26), Southeast Asian governments have committed to transition away from coal power, aiming for net zero between 2050 and 2065. As the least carbon-intensive fossil fuel, gas has been forecast to be the transition fuel to provide base-load power to balance the power system while renewables grow.

However, both existing and upcoming LNG importers now face fierce competition for LNG cargoes, driven by the increased European gas needs. With global LNG supply growth expected to remain modest until 2025-26, this competition for cargoes is expected to keep LNG prices high and slow down gas growth in Asia’s emerging markets.

Europe’s quest for LNG to replace Russian pipeline gas will continue to prop international LNG prices until significant tranches of new supply can be brought onstream by 2025‒26. The difficulty in securing LNG volumes at affordable prices means a slowdown in Southeast Asia’s LNG demand growth.

Despite the immediate challenges, Southeast Asian gas and LNG demand is still expected to grow strongly in the long term. Robust electricity demand growth, coal phaseout, the investment and time needed to build out sufficient renewable capacity, and grid capability all point to an increase in gas power generation during the energy transition.

Southeast Asia still has significant domestic gas resources, with the top 10 nonproducing gas projects containing 45 Tcf of recoverable gas. The high commodity price environment and the prospect of the energy transition can help to push governments and national oil companies to overcome the challenges that have hindered the development of most of these projects.

Ultimately, the timely development of gas supply and accompanying infrastructure, for both international and domestic volumes, requires a firmer and more consistent power system planning. Gas and power market pricing schemes must also be reviewed to allow each market to transition to a pricing structure that enables development of domestic resources and provides financial space to kick-start low-carbon solutions such as carbon capture and storage.

Shanghai eyes imports as a potential hydrogen supply source

The city of Shanghai released its hydrogen development plan (the Plan) in June 2022. Consistent with the national development plan released in March 2022, the Plan emphasizes building up low-carbon hydrogen sources along with increasing technology capabilities across supply, midstream, and demand sectors. The city can utilize its high-tech manufacturing base and talent pool to drive forward innovation in the hydrogen technology value chain.

The Plan indicates that imports will play a role in hydrogen supply. The Plan is the first of mainland China’s hydrogen development policies that discusses hydrogen importing capacity. The city casts a wide net for hydrogen supply sources including imports to meet future hydrogen demand. However, the appetite for hydrogen imports will likely remain limited owing to supply security concerns.

The Plan’s proposed international hydrogen trading center will face systemic challenges. The Plan includes a goal for building an international trading center focused on the East Asian market by 2035. Soon after the Plan was released, several entities signed an agreement to cooperate in creating mainland China’s first hydrogen trading center in Shanghai. However, infrastructure and regulatory constraints will continue to hinder establishing a liquid hydrogen trading hub.

Synergies with mainland China’s carbon market operation will help with carbon auditing. The operator of mainland China’s current carbon market is one of the founding members of the proposed hydrogen trading center and could bring along expertise and enable coordination between the two markets.

Additional Insights and Strategic Reports published in third quarter 2022

- Lofty renewable targets in Southeast Asia: How to attract more private investments?

- Provincial renewable 14th Five-Year-Plan: Where are the hot spots for renewable energy?

- Growing pains: What struggles lie ahead for China’s booming renewable-plus-storage market?

- China’s energy policy of relying on domestic coal will not lead to a spike in carbon emissions in 2022

- The costs of technological leapfrogging in the Indian power sector

- China’s lending tool for decarbonization: Creating the room for cheaper renewable loans

- Domestic gas prices in Thailand double as LNG imports rise

- China’s urban gas pipeline plan squeezes citygas profitability

- Supporting the development of ASEAN economies: Understanding the strong power demand growth in the region

- Hong Kong is set to become a new LNG importer, but what is the long-term prospect?

- Green power trading in mainland China spreads nationwide despite uncertainties in practice

- China’s domestically produced LNG: Outcompeting LNG imports

- China’s pumped hydro surge: Deployment poised to quadruple over a decade

- Belated decision: Taiwan finally raised retail electricity tariff

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment