JHVEPhoto

Shares of The Sherwin-Williams Company (NYSE:SHW) have been hard hit this year, falling from $350 to $210 as fears grow around the housing market, input costs, and overseas demand. Even with the steep decline in share price, the stock has a 24x earnings multiple. Given I see ongoing downside risk to estimates, I would still be a seller of shares even recognizing the strong franchises and brand equity the company has.

We began to see signs of weakness in the company’s second quarter results, even as sales rose 9.2% to $5.9 billion. Adjusted EPS came in at $2.41, declining from $2.65 last year even as the top-line rose. Higher input costs are leading to higher end-prices, but this has not been sufficient to cover the cost squeeze. 57% of its business comes from “The Americas Group,” its US and Canadian retail paint operations where it operates over 4,500 stores. Q2 segment profits fell from $727 million to $700 million as margins compressed by 250bp, even as US and Canada same-store revenue rose 6.4%

Its consumer brands group is seeing headwinds outside of North America, leading profits to fall by over one-third to $83 million as margins compressed from 19.7% to 11.2%. The one highlight was that performance coatings revenue rose 15% to $1.79 billion and profits roses to $247 million from $201 million as higher selling prices and volumes in packaging and coil offset higher input costs. Still given the decline in its primary US retail paint business, Sherwin-Williams reduced its EPS guidance to $8.50-$8.80.

This guidance still strikes me as relatively optimistic as it implies about $4.63 in H2 earnings (or a $9.25 annualized pace), representing a material acceleration from H1. This is partly supported by a 10% price increase in The Americas Group that took effect in September. Whether SHW is able to push this much price onto consumers without stifling demand remains to be seen. We do know that last week, PPG (PPG), the leading industrial paint maker, cut guidance as conditions deteriorated during the third quarter. SHW has already said that it is seeing demand pressure in Europe and China alongside higher input costs. If anything, the headwinds in Europe have worsened given natural gas prices that have risen further. As such, I see risk to its consumer and performance coating business. When the company reports third quarter earnings on October 25th, I view a further cut to guidance as relatively likely.

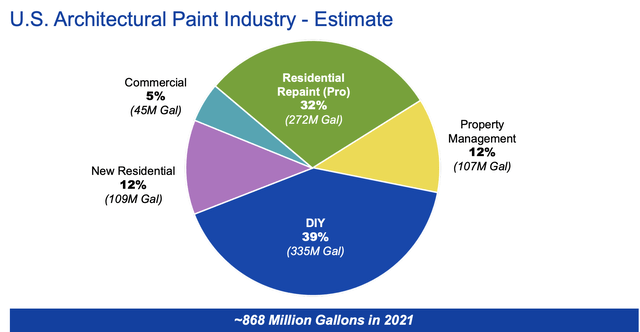

Aside from pressures overseas, there are clear headwinds for its domestic paint business. In Q2, management noted that its professional business was holding up well while its “do it yourself” (DIY) business was starting to weaken. As you can see below, DIY accounts for about 39% of US architectural paint demand, professional 32% and new residential 12%. In a period of squeezed real incomes, consumers will be looking to pare back discretionary spending. Many DIY projects are discretionary; rather than repaint the bedroom this year, one can wait six or nine months when inflation has moderated. The ability to defer many of these projects is a headwind for Sherwin’s business, particularly as it tries to pass on such large price increases.

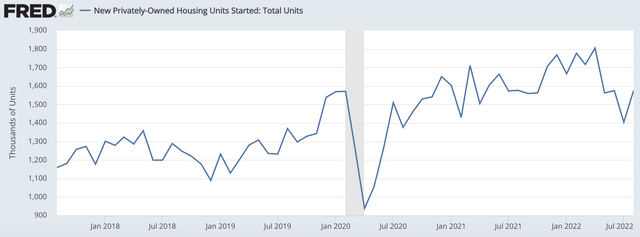

On the new construction side, which is just 12% of paint demand, housing starts have fallen from Q1 levels. Management notes that paint usage tends to lag starts by 3-4 months, so the decline we have seen since April should just now be fully feeding into results. Starts do remain at a relatively robust level vs. pre-COVID, but given ongoing Federal Reserve rate increases, risks do feel skewed to a further decline in construction activity.

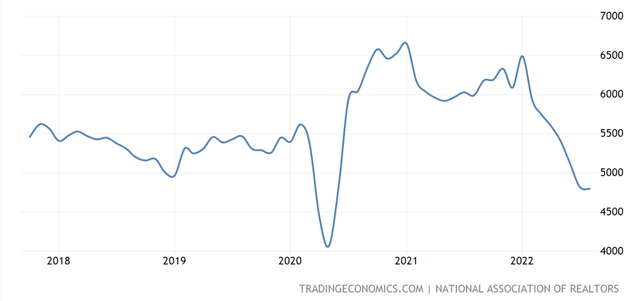

The most notable decline though has been in existing home sales. While consumers will repaint rooms in their own house as they do re-models or just want a change, when someone buys an existing home, that is typically the impetus to do a paint job as there are likely one or two rooms in the house that the new buyer would like a different color. These sales have plunged as higher prices and mortgage rates squeeze affordability. Additionally the surge in existing home sales in late 2020 likely represented a “pull-forward” in demand that is now normalizing. Existing home sales are now running below 2019 levels, and with the Fed continuing to raise interest rates, a significant rebound does not appear likely.

This is a material headwind for Sherwin’s business. It also comes as the company’s inventories have risen 33% over the past year to $2.41 billion. With demand for residential paint likely to fall and inventories bloated, it will be difficult for the company to push all of its input costs through. Over the next twelve months, there is risk of margin contraction alongside volume declines. This combination would point to adjusted EPS below $8 over the next 12 months.

Now even with the headwinds, I would note that SHW has historically been a highly cash-flow generative and shareholder friendly business. In the first half, it generated $404 million in free cash flow, which included a $668 million negative impact from working capital, for a normalized annual run rate of $2 billion. It has bought back $700 million in stock and paid $307 million in dividends so far this year. Of its $11.8 billion in operating cash flow over the past five years, it returned $6.6 billion via buybacks and $2.1 billion via dividends

It has 43 consecutive years of dividend growth, and I expect a 44th next February. While it has consistently grown its dividend, its yield is just 1.19%, which is not particularly exciting. Additionally at a $2 billion normalized free cash flow rate, it has a FCF yield of just 3.8%. Alongside weaker earnings, FCF ex-working capital is also likely to slow.

Now, Sherwin-Williams is admittedly more tied to the existing home sales market than new construction, but when firms like Whirlpool (WHR), Builders FirstSource (BLDR), and Toll Brothers (TOL) trade with single-digit earnings multiples, its 25x earnings multiple using my $8 EPS estimate is extremely expensive. It is also trading at a premium to Home Depot (HD) at 16.5x, which is also more directly exposed to remodeling activity. This is too expensive of a multiple for a company that will likely cut guidance when it reports earnings as higher input costs and weakening US home sales weigh on demand.

Given its asset-light business, shares deserve to trade at a slight premium to a company like Home Depot in my view, but even at 18-20x earnings, it is a $145-160 stock, pointing to about 25% downside. SHW shares have underperformed, but there is further downside. I would sell shares ahead of Q3 earnings when guidance may surprise to the downside.

Be the first to comment