CatLane/E+ via Getty Images

Investment Thesis

The healthcare industry has made significant strides in treating and diagnosing disease, but a considerable gap exists in identifying complications before they manifest. With proper patient monitoring, early intervention can be achieved, reducing the need for expensive treatments. Organ transplant rejection is one area where monitoring and early intervention can make a huge difference for patients, payors, and providers. CareDx (NASDAQ:CDNA) a molecular diagnostics company, has developed a non-invasive organ transplant scoring system that predicts the risk of organ rejection within a window of three days to three months after transplant surgery. The company is renewing its emphasis on profitability after a widening loss caused a 14% share decline in August after the Q2 earnings release. Fundamentally, CDNA’s tests are profitable, with a gross margin of an estimated 65%, but have been diluted by aggressive spending on marketing and awareness campaigns necessary for such as nascent industry. Nonetheless, compared to its peers, CDNA is one of the lowest cash burners in the industry, making it easier to calibrate operations into profitability.

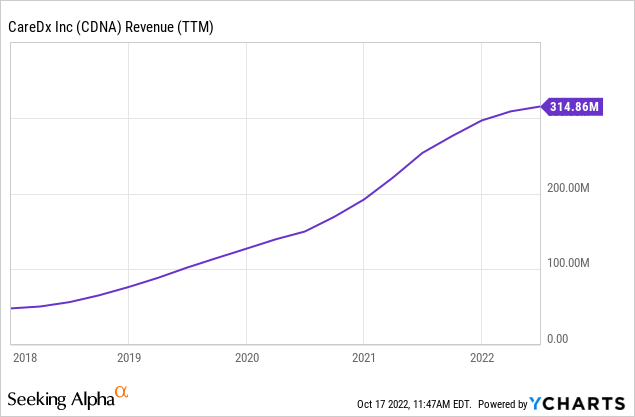

Revenue Trends

CDNA revenue growth accelerated significantly over the last five years, driven by introducing new products and establishing reimbursement pathways with Medicare and, to a lesser extent, M&A. Last month CDNA celebrated its 100,000th organ transplant patient milestone, mirroring the progress (which hasn’t always been smooth) in these three key areas.

Historically, Medicare has been the focus of CDNA’s commercialization efforts, and for a good reason: the public insurer covers 80% of kidney transplant recipients and nearly 50% of heart transplant recipients in the United States. Medicare approved allosure Kidney in 2017 and Allosure Heart in 2020. The public insurer now covers all but one of the company’s testing products, and management has begun to concentrate its marketing efforts on the 250 transplant centers in the United States, with a particular emphasis on the 100 clinics that perform the vast majority of all transplants.

The introduction of new products (such as KidneyCare), as well as the further extension of reimbursement routes, are projected to fuel future growth. Allosure Lung, which is not covered by Medicare but does have contractual partnerships with commercial payers for the coverage of the test, is one example.

From a macro-perspective, the US demographic trends manifested in an aging population offer another revenue tailwind for CareDx. Obviously, these trends are buried under the more abrupt reimbursement and new product catalysts, but they still are, in my view, a favorable backdrop for CDNA’s growth initiatives.

In the past few years, there have also been regulatory changes aiming at enhancing the number of organ donors in an attempt to ease the shortage, as mirrored in the 114,000 people currently on the waiting list for an organ transplant. In 2019, Donald Trump issued an executive order to increase monetary support for donors. In April 2022, the FDA adjusted the regulatory framework for organ procurement, which gave more leeway in harvesting organs after brain death. Nonetheless, all these initiatives bode well for CareDx revenue, which derives 83% of its revenue from organ transplant monitoring tests.

Earlier this year, the FDA also announced it is drawing plans to allow clinical studies for pig organ transplants. There is a growing interest in the field of tissue engineering, where organs are grown inside labs for an organ transplants. The technology is still in the early stages, but there are companies that have recently raised funds through IPOs, such as Miromatrix Medical (MIRO), to fund R&D projects in the field. Although it may be decades before any of this bears fruit, I think it reflects the overall trend in the scientific community to improve organ transplant wait times.

Intellectual Property

The presence of Cell-Free DNA in blood was first discovered in 1948, but CTDNA was not clinically available until recently after advancements in gene sequencing made testing commercially feasible. The test is based on the fact that blood contains a large number of circulating cells that die daily due to various biological processes, including bleeding or cell injury. As these cells are removed from the blood, they release fragments of their DNA into the surrounding fluid. These fragments can then be isolated and analyzed to determine whether the donor’s genes in the blood signal potential organ failure. In my view, neither CDNA nor its peers have a foundational intellectual property claim over the cfDNA test.

Competition

CDNA testing services compete with the current standard of care tests for transplant rejection monitoring, including testing for serum creatinine, glomerular filtration rates, proteinuria, donor-specific antibodies, and, finally, tissue biopsy. The company continues its effort to influence KOL into adopting its tests into care guidelines.

In addition to current Golden Standards, the company competes with other commercial companies marketing their own tests. As mentioned above, cfDNA has been present for decades, and competition is high. One new entrant is Natera (NTRA) which markets Prospera for the same organ transplants as CDNA (Kidney, Heart, and Lung). Obviously, as the first cfDNA monitoring test, CDNA has a commercial lead, but NTRA is not a force to reckon with and an aggressive market player, as discussed in a previous article, and no one knows that more than CDNA, who was a victim of NTRA’s aggressive marketing practices. Earlier this year, CDNA won false advertising against NTRA for making misleading statements about the capabilities of Allosure to providers and was ordered to pay $45 million to CDNA. Although the company scored a favorable litigation outcome, in this case, the lawsuit demonstrates the toughness of the competition. Another player is Eurofins Viracor, which is also a new entrant. Last year, Eurofins received a nod from NY State Department for its Viracor TRAC® Kidney transplant rejection test. OncoCyte (NASDAQ:OCX) is the latest market entrant, announcing the introduction of VitaGraft™ last July.

Financial Position

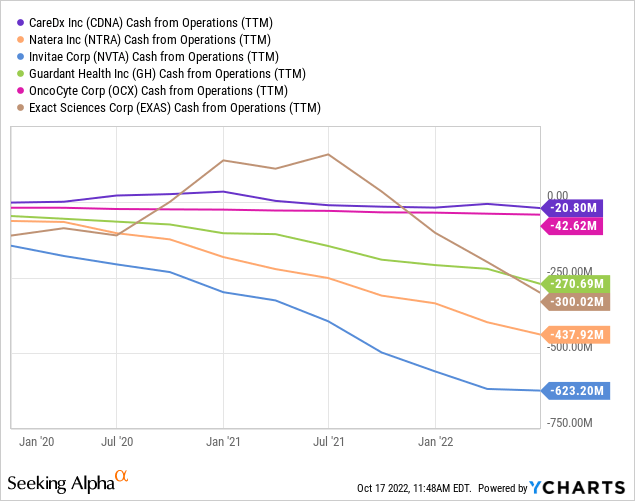

Historically, CDNA has operated near cash neutrality, and I believe it will continue to be able to do so for the foreseeable future as it focuses on optimizing profitability while expanding its product menu. While I believe that the company can achieve this balance, investors should be aware that this is likely not a linear progression but rather a constantly evolving process that will require management’s constant attention and adjustments to ensure that the company is on a successful long-term growth trajectory. Spending too little on Selling and Marketing would enhance cash flow in the short run but, over time, will impact brand awareness at a time when competitors are aggressively marketing their products. On the other hand, an aggressive growth approach could lead to significant share dilution, a strategy that saw the outstanding shares of Invitae (NVTA) and OncoCyte triple since 2019.

CDNA ended Q2 with a healthy cash position with a cash and cash equivalents balance of $375 million and no debt. Operating cash burn stood at $4 million, and adjusted EPS fell below estimates (-$0.13 actual vs. -$0.11 estimate), causing a 14% decline in August, as mentioned above. This $0.02 per share delta between actual v.s consensus estimates translates to about $1 million in unexpected operating loss during the quarter, which doesn’t mirror a fundamental change in operations or outlook. Higher administrative expenses contributed the most to the decline in net income, increasing 55%, or $9 million, from last year to this year, driven by increased legal expenses and, to a lesser extent, management compensation. Marketing expenses also increased by 38% or $7.4 million as the company continued to invest in building its brand and expanding distribution channels. Nonetheless, I believe CDNA management is one of the most conservative in the sector, and the shares still offer an attractive risk/reward profile for investors looking to capitalize on the company’s long-term growth prospects.

Summary

I believe that CDNA suffers from a first-mover disadvantage, where the brunt of new tech introduction expenses falls on the industry pioneer with little benefits given low barriers to entry, stemming from a democratized foundational technology, namely the cfDNA platform, forming the basis of the many gene testing platforms coming to market in recent years. Thus, I am happy to see more market entrants, namely Natera, OncoCyte, and Eurofins Viracor. Financially, CDNA is in a better financial position compared to its peers, with less cash burn, making it easier to tweak operations towards profitability as the cost of money increases.

Finally, most of the company’s products are covered by Medicare, giving it a favorable market position compared to some of its peers, who are still investing in clinical trials to establish the clinical validity necessary to build a reimbursement pathway with the public healthcare payor.

Be the first to comment