NeilLockhart

While the S&P 500 Index (SP500) has seen a 28% peak-to-trough correction in what has been a relatively run-of-the-mill cyclical bear market, the real bear market has occurred in the gold sector. This is evidenced by a 60% decline in the VanEck Vectors Junior Gold Miners ETF (GDXJ) from peak to trough, with corrections of this magnitude offering a fertile hunting ground for investors willing to be contrarians. However, it’s not as easy as simply being contrarian in a sector where management teams often fail to deliver, many projects/mines are marginal, and smaller-cap companies can’t fund their ambitious plans even if they have projects of sufficient caliber to justify heading into production.

Consequently, investor diversification in the gold sector often results in “di-worsification” and a shotgun approach is rarely ideal. Fortunately, for investors looking for quality there are still opportunities out there with severe valuation disconnects. One of these is i-80 Gold Corp. (NYSE:IAUX). Not only does the company have management with high insider ownership/aggressive insider buying that’s aligned with shareholders, but the team continues to deliver and their rigorous due diligence has led them to make what look to be two of the best acquisitions in recent memory. Given the combination of a Tier-1 jurisdiction, an industry-leading growth rate, and a new bonanza-grade discovery, I-80 remains undervalued even after its recent rally.

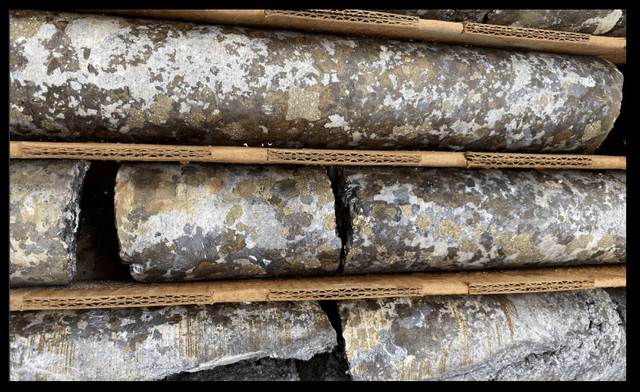

Hilltop Mineralization (Company Presentation)

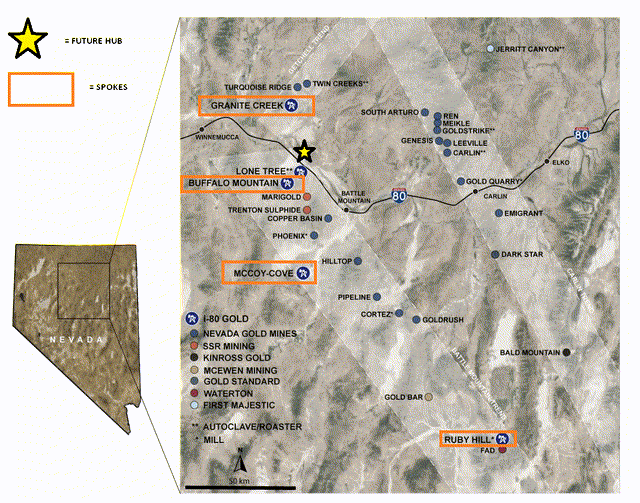

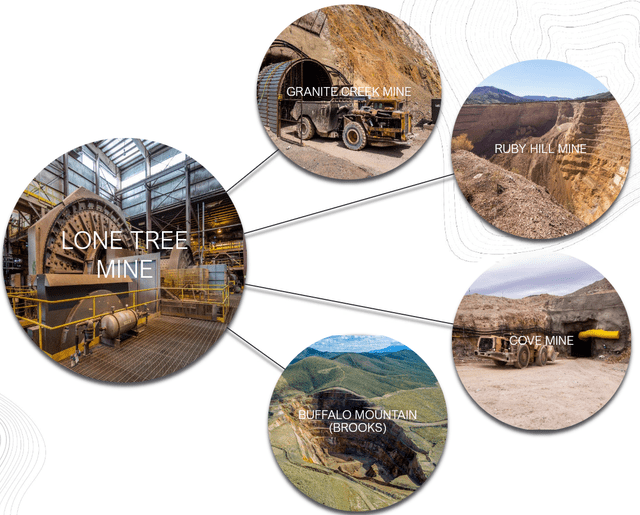

To avoid confusion, I would recommend reading this primer article: “i-80 Gold: An Overlooked Story With Triple-Digit Return Potential.” One can also refer to the below map, which shows the company’s projects (Granite Creek, Ruby Hill, McCoy Cove) and its Lone Tree project, which has an autoclave, heap leach pads, and other existing infrastructure.

I-80 Gold Future Hub & Spoke Model (Company Presentation, Author’s Drawing/Notes)

A Junior Producer With A Portfolio Built For A Major

As mentioned above, just over a month ago, I wrote about i-80 Gold Corp., a junior producer in Nevada with a portfolio of some of the highest-grade projects in North America. It was created as a spin-out from the acquisition of Premier Gold by Equinox (EQX). The update highlighted why i-80 Gold was arguably the most attractive opportunity in the small-cap gold space, given that the team had brilliantly secured infrastructure so that it could control its own destiny. It recent drill success suggested that a lift in grades and resources was likely at its Granite Creek and Ruby Hill Projects. This is because the company had made a new discovery at Granite Creek (South Pacific Zone) and was hitting well-above-resource grades at Ruby Deeps.

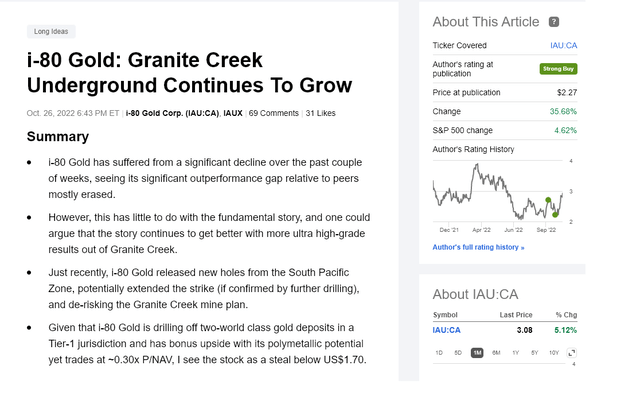

i-80 Gold Article – October 26th (Seeking Alpha Premium)

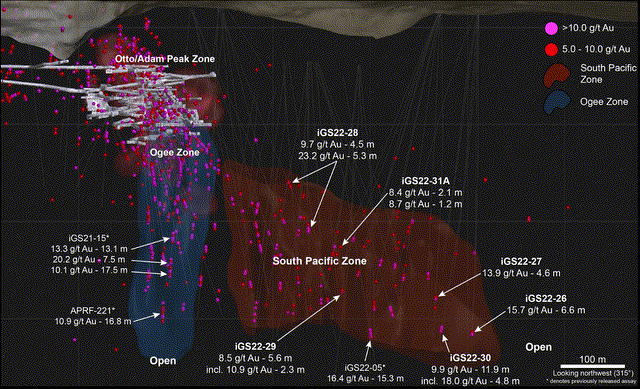

While Granite Creek benefits from being an underexplored property next door to a 20-million-ounce high-grade gold mine, it also boasts infrastructure (metallurgical laboratory, warehouse/shop facility, four mine de-watering wells) and relatively easy access to future mining areas (South Pacific lies just to the north of existing underground workings at depth). In the case of Ruby Hill, it was predominantly drilled for oxides by previous operators, with sulfides and base metal potential largely ignored. In the former case, this looks to be the future of Nevada gold production, with much of the low-hanging oxide “fruit” mined out. In the latter case, the Eureka District has a long history of carbonate replacement deposit (CRD) production and historically-mined grades in the district rank among the highest globally for CRD districts.

- 23.2 meters at 9.7 grams per tonne of gold

- 18.3 meters at 9.0 grams per tonne of gold

- 78.6 meters at 7.1 grams per tonne of gold

- 71.6 meters at 7.0 grams per tonne of gold

- 22.4 meters at 8.2 grams per tonne of gold

- 13.4 meters at 13.9 grams per tonne of gold

- 33.2 meters at 19.8 grams per tonne of gold

- 22.4 meters at 19.8 grams per tonne of gold.

These phenomenal drill intercepts at both properties, in addition to high-grade oxide hits at the Ogee Zone (Granite Creek) and its new 007 Zone discovery (Ruby Hill), upgraded the i-80 Gold story from intriguing to outstanding and made it a must-own name.

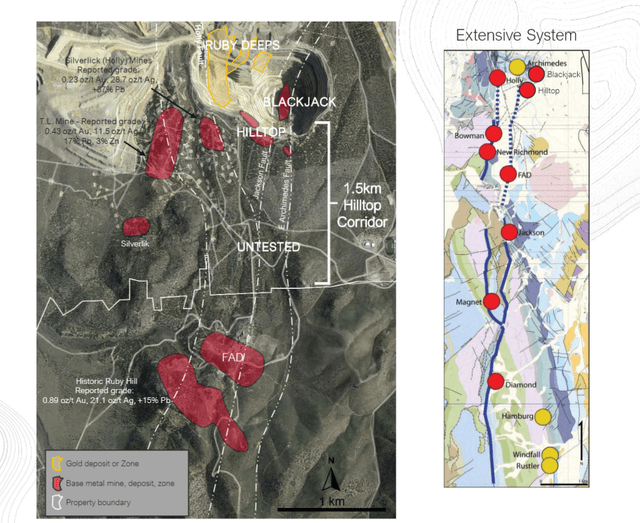

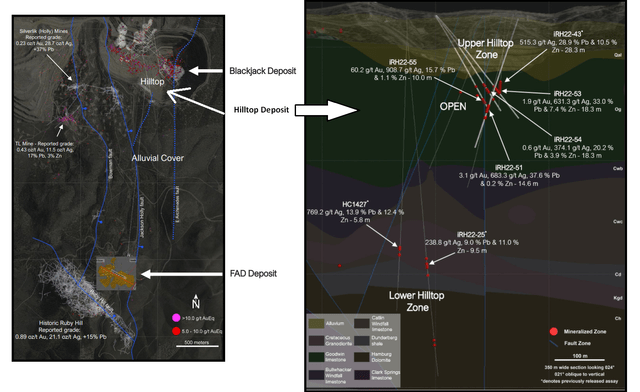

However, the most recent development has blown the story wide open and provided a further major upgrade to the investment thesis. This recent development is the bonanza-grade intercepts coming out of the Hilltop Zone, which is the second polymetallic deposit now being delineated at Ruby Hill. Importantly, the Hilltop Zone lies just south of the mined-out Archimedes Pit, meaning i-80 has relatively easy access to this zone and the already-defined polymetallic Blackjack deposit that lies beneath the Archimedes Pit.

Granite Creek Drilling & South Pacific Zone (Company Presentation)

While Granite Creek benefits from being an underexplored property next door to a 20-million-ounce high-grade gold mine, it also boasts infrastructure (metallurgical laboratory, warehouse/shop facility, four mine de-watering wells) and relatively easy access to future mining areas (South Pacific lies just to the north of existing underground workings at depth). In the case of Ruby Hill, it was predominantly drilled for oxides by previous operators, with sulfides and base metal potential largely ignored. In the former case, this looks to be the future of Nevada gold production, with much of the low-hanging oxide ‘fruit’ mined out. In the latter case, the Eureka District has a long history of carbonate replacement deposit production and historically-mined grades in the district rank among the highest globally for CRD districts.

Fortunately, I-80 has the luxury of being agnostic about which resource it mines – sulfide vs. oxide – as long as it proves highly profitable and is leaving no stone unturned given its extensive infrastructure and the benefit of being in such close proximity to multiple styles of mineralization from a previously mined-out open pit. This willingness to look for what previous owners disregarded has led to the incredible initial intercepts out of the newly uncovered Hilltop Zone, with hits that included the following:

- 0.9 meters at 671 grams per tonne of silver and 34.1% lead/zinc

- 9.4 meters at 238 grams per tonne of silver and 20.0% lead/zinc

- 2.1 meters at 470 grams per tonne of silver and 30% lead/zinc

- 0.9 meters of 1,006 grams per tonne of silver, 38.6% lead/zinc, and 1.6% copper

In addition, a step-out hole 200 meters to the south hit a world-class intercept of 28.3 meters of 515 grams per tonne of silver, 39.4% lead/zinc, and 0.90 grams per tonne of gold. This represented a 600+ gram-meter intercept, with the hole hitting the equivalent of 21.0+ grams per tonne of gold-equivalent grades. However, and remarkably, the most recent drill intercepts have put this highlight hole to shame, with a highlight intercept that came in near 80 grams per tonne gold-equivalent, with it being arguably one of the best intercepts drilled in Nevada in the past two years outside of those coming out of Nevada Gold Mines’ properties, a joint-venture with two companies that have a combined market cap of ~$65 billion. Before digging into the results, it’s worth discussing a little of the Eureka District’s history:

Eureka District History

The Ruby Hill Mining area was first discovered in the 1860s by prospectors with rock containing a silver-lead mixture on Prospect Peak. Shortly after, this led to the beginning of mining operations and the operation of the Ruby Hill Railroad, which was used primarily to deliver ore to smelters in Eureka. The Eureka District has a 100-year history of base-metal (CRD) production and was one of the highest-grade CRD districts globally. The two largest producers in the 1800s were the Richmond Consolidated Mining Company and the Eureka Consolidated Mining Company, with estimated combined production of more than 1.0 million tonnes by both companies from 1873-1916. At its peak, the population of Eureka and Ruby Hill was over 9,000, and it was the second-richest mineral producer in Nevada behind Comstock.

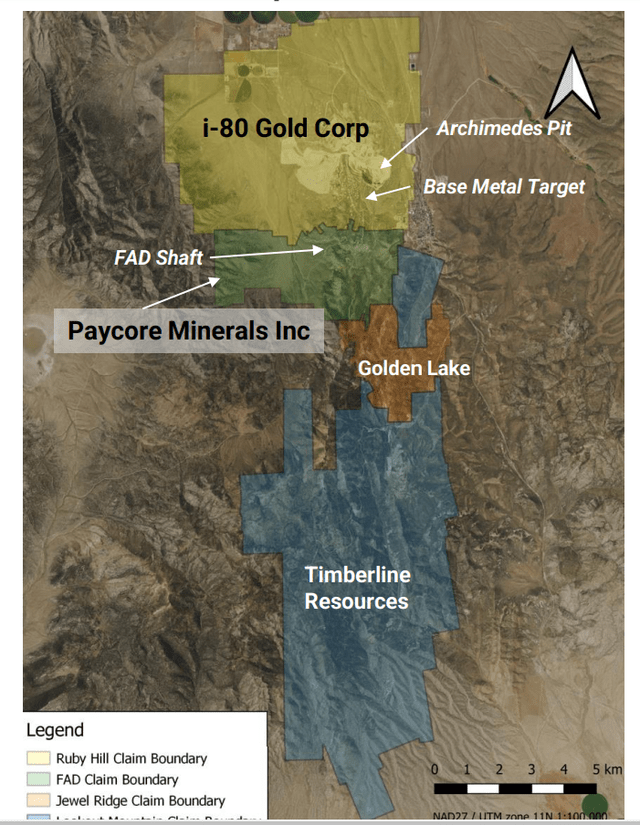

Eureka District Claims (Paycore Minerals Presentation)

In 1905, the two companies were consolidated into the Richmond-Eureka Mining Company, and stope casing and old stope fills were sent to outside smelters. Following sporadic production in the 1920s and 1930s, Thayer Lindsley formed Eureka Corporation and began drilling at the Ruby Hill Property (which sits south of i-80 Gold’s Ruby Hill Project on the above map). As discussed in an account of historic mining, mining in the late 1940s hit a snag:

“A haulage drift towards the ore body was started on the 2250 level, and in March 1948, the drift crossed the Martin fault and penetrated the water bearing Eldorado dolomite formation. At that point, the haulage drift was stopped and a service drift was continued to the Martin fault, where again the water-bearing dolomite was intersected. At this period in time, the installed pumping capacity in the Fad shaft was about 2,500 gpm (gallons per minute), and 1,500 gpm were being pumped. The drift operation was stopped and a water door installed in the service drift. The service drift was then advanced 25 feet in the dolomite, and on March 25, 1948, a drill hole in the face of the drift encountered high-pressure water. The water door was closed, but control of the water was lost when a steel plate that was bolted to a flange on an 18-inch diameter ventilation pipe line failed. Within a few hours the water flow increased to more than 2,000 gallons per minute, which necessitated the abandonment of the 2250 level, and subsequent flooding of the shaft.”

– Walter A Paroni, Eureka Sentinel.

Fortunately, installed diesel power generation and pumping capacity would help remove 5,000 gallons per minute from the shaft, and additional pumping capacity was later added, with 9,000 gallons per minute being pumped in November 1948. The water in the shaft was lowered to within 20 meters of the 2250-level station, but a sudden rush of muddy water flooded the shaft again. Mining operations would restart from the TL Shaft with nearly 30,000 tonnes mined with an average reported grade of ~0.40 ounces per tonne of gold, ~11.0 ounces per tonne of silver, and ~17.5% lead. In 1960, the newly formed Ruby Hill Mining Company continued exploration with additional financing from Newmont (NEM), Cyprus Mines, and Hecla (HL) in 1960. While mineralization was intersected, the decision was made to seal off the water at the 2250 level drift, and little work was completed since Hecla was named operator in 1963.

Eureka District – Polymetallic Targets (Company Presentation)

As shown above, the three historic mining areas were Silverlick (Holly Mines), the Thayer Lindsley [TL] Mine, and the highest-grade Historic Ruby Hill Mine. The respective grades mined at these deposits were as follows:

- Silverlick: 0.23 ounces per ton of gold, 28.7 ounces per ton of silver, and additional lead grades

- TL Mine: 0.43 ounces per ton of gold, 11.5 ounces per ton of silver, 17% lead, and 3% zinc

- Ruby Hill: 0.89 ounces per ton of gold, 21.1 ounces per ton of silver, and 15% lead.

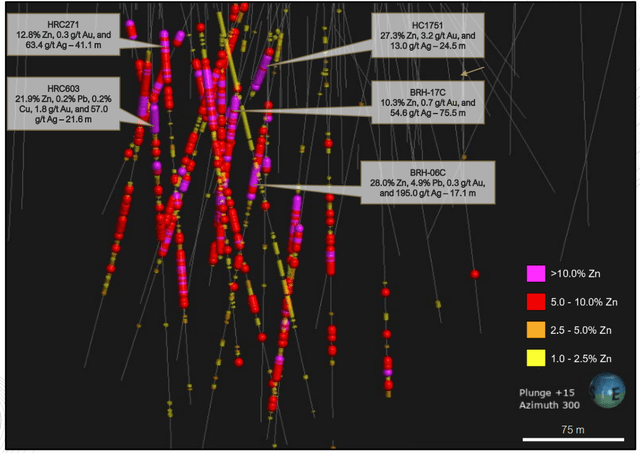

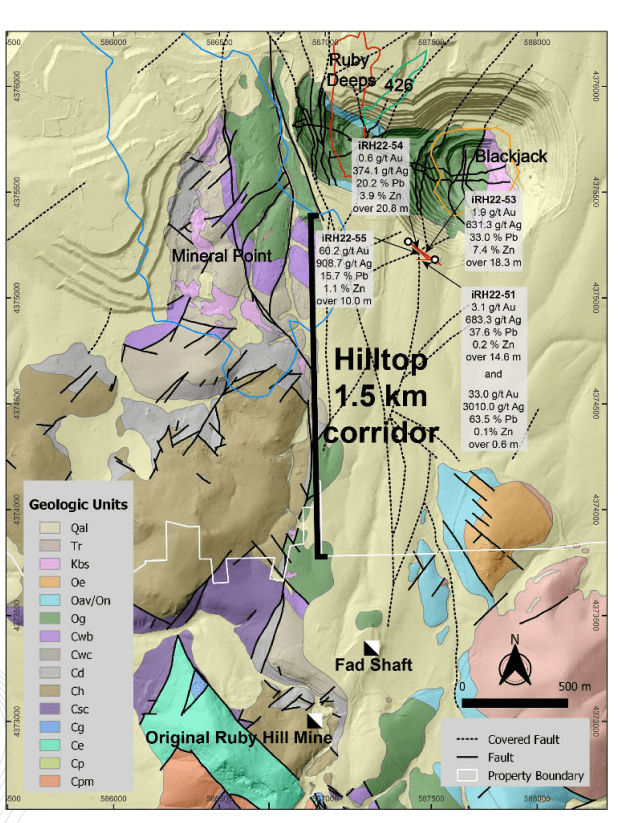

While these grades are exceptional, there are multiple other base metal deposits in the District (FAD to the south and Blackjack/Hilltop on i-80’s property), and i-80 Gold knew about the polymetallic mineralization when it acquired Ruby Hill from Waterton for a song compared to what it’s delineated to date on the property (high-grade oxides, high-grade sulfides, and a new CRD deposit). As discussed in i-80’s Technical Report, the Blackjack Zone measures 150 meters wide, 150 meters long, and 290 meters high. A look at previous drilling and the deposit is shown below, where a resource is planned for next year:

Blackjack Zone (Company Presentation)

Carbonate replacement deposits can be company-makers, as we saw when South32 (OTCPK:SOUHY) acquired Arizona Mining for over $1.0 billion as a development-stage company. However, these deposits typically contain silver, lead, and zinc. What makes the Eureka District special is its Carlin overprint, which has led to the CRD mineralization being complemented by high-grade gold mineralization. The most extreme case is at the historic Ruby Hill Mine, where grades came in at nearly 0.90 ounces per ton of gold. While these bonanza gold grades didn’t show up in the initial drilling at Hilltop with only modest gold grades, they certainly showed up in the most recent drill release. Let’s take a closer look.

Hilltop Zone

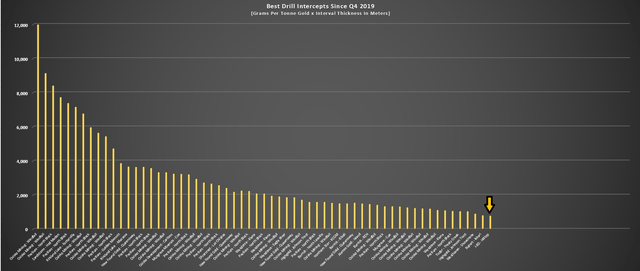

i-80 Gold’s recent drill results out of the Hilltop Zone are among the best results I’ve seen in the sector this year, with the highlight hole hitting an astonishing 10.0 meters of 60.2 grams per tonne of gold, 909 grams per tonne of silver, and 16.8% lead/zinc. This equates to approximately 80 grams per tonne gold-equivalent or ~800 gram-meters, making this one of the best intercepts drilled in the sector year-to-date and a top-75 intercept over the past three years from all companies I track. While a top-75 hole might not seem that significant, it’s worth noting that over 50% of these holes were drilled by Osisko Mining (OTCPK:OBNNF) and Pretium (PVG), with the latter being acquired for well over $2.0 billion, and the former boasting a ~$1.0 billion market cap.

Top Drill Intercepts Since Q4 2019 (Company Filings, Author’s Chart)

If we dig into the data further, another 13 intercepts were drilled by companies with market caps ranging from ~$1.0 billion to $30.0 billion. These projects included REN, North Leeville, Macassa, Fosterville, KCGM, Kibali, Island Gold, and Kiena. So, if we adjust for companies that are clearly not in the same league from a market cap standpoint as i-80 Gold, this drill hole has few peers. Just as importantly, though, it was not the only hole drilled; the others also had very high-grade intercepts. This is unique because while many others report the occasional 1,000+ gram-meter intercept, i-80’s intercepts consistently come in between 200-400 gram-meters across its properties, with the odd hole above 500 gram-meters. The other holes reported were as follows:

- 18.3 meters at 1.9 grams per tonne of gold, 631 grams per tonne of silver, and 40.4% lead/zinc

- 14.6 meters at 3.1 grams per tonne of gold, 683 grams per tonne of silver, and 37.6% lead

- 0.6 meters at 33 grams per tonne of gold, 3,010 grams per tonne of silver, and 63.5% lead

- 20.8 meters at 0.60 grams per tonne of gold, 374.1 grams per tonne of silver, and 20.2% lead

i-80 Gold – Ruby Hill Project (Company Presentation)

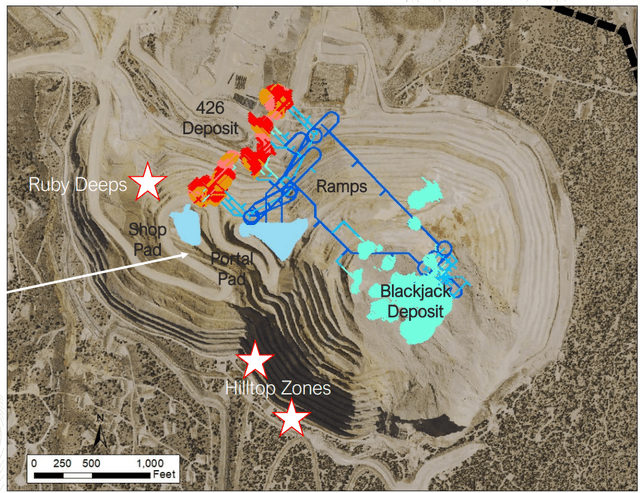

These holes are incredible for blind drilling into a new zone, and the encouraging news that continues to impress me is that the company is not ‘missing’ any of its projects with an exceptional hit rate on its drill results, with nearly all of them hitting high-grade mineralization. However, the real takeaway should be the fact that this Hilltop Zone is located just south of the Archimedes Pit, making it relatively easily accessible. The other major piece of the puzzle is that the company has a CIL plant at its Ruby Hill Project, and the cost to retrofit this to process base metals was estimated at ~$60 million. This means that if i-80 Gold can delineate the tonnes needed to justify a stand-alone operation, it could fund this project itself.

Ruby Hill Map & Hilltop Corridor (Company Presentation)

However, I believe the company may just be scratching the surface here. As noted by management, the 1.5+ kilometer corridor to the south of its Archimedes Pit is untested for base metal mineralization, and the prospectors missed these fault structures due to them being under alluvial cover with no outcroppings, with them not visible due to between 60 to 120 meters of overburden. This represents a massive opportunity for i-80, and it’s becoming clear that there is extremely rich CRD mineralization with high gold credits on the north end of this corridor and extremely rich CRD mineralization at the south end of this corridor on Paycore’s land just past the 1.5-kilometer mark.

The latter’s evidence is that Paycore Minerals (OTCPK:PYCMF) also hit ultra-high-grade mineralization this week, reporting 14.8 meters of 6.3% zinc, 10.3% lead, 376 grams per tonne of silver, and 7.1 grams per tonne of gold in drill-hole PC22-8A. Given what appears to be a 90% plus hit rate to date at Ruby Hill for i-80 Gold at Ruby Deeps, 426, Hilltop, and new targets, and how rich the mineralization at this project is to date, I would be shocked if this mineralization didn’t continue south. This could quickly add tonnes to what’s already turning out to be a very exciting new discovery for i-80 Gold, and this is completely separate from the company’s 250,000-ounce production goal by 2025 from its Hub & Spoke Model.

Ruby Hill Infrastructure (Company Presentation)

As the images above show, i-80 Gold already has significant infrastructure at Ruby Hill and a mined-out open pit that will provide access to Blackjack, the 426 Zone, Ruby Deeps, and Hilltop. This is a huge benefit with the ability to drift into these deposits from underground (Hilltop is proximal to the planned portal) and benefit from already permitted processing facilities compared to other companies that may have made discoveries recently but need to start from scratch and could have difficulty building operations on their own in this inflationary environment. It also helps that the company has a strong balance sheet with ~$80 million in cash to ramp up drilling when it hits the high-grade mineralization that it has been recently.

Ruby Hill Project & Archimedes Pit (Company Presentation)

Given the drilling success, the company has expanded its drill program to continue step-out drilling, and it also noted that recent analysis of geophysical surveys has delineated a large-scale magnetic anomaly below the western portion of the Archimedes Pit that is also associated with a large metamorphic halo, which is distinct from the Blackjack skarn deposit. This anomaly has never been tested and will be a target for the 2023 drill program. The belief is that this could be a relatively high-grade porphyry and adds to the multiple other catalysts that investors can look forward to over the next several months that already include the following:

- Updated resource estimate at Granite Creek

- Updated resource estimate at Ruby Hill

- Blackjack resource estimate

- Continued drill results from multiple properties

- PEA or Pre-Feasibility Study At Ruby Hill

- Underground Feasibility Study at Granite Creek

- ~250% production growth in 2023 (~70,000 ounces vs. ~20,000 ounces).

Putting It All Together

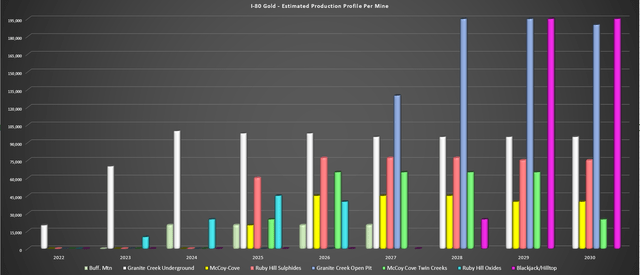

As noted in my previous update, i-80 Gold’s internal goal is 250,000 ounces of gold production in 2025, with sulfide material being trucked from McCoy Cove, Granite Creek, and Ruby Deeps to its Lone Tree Facility and available roaster capacity at one of Nevada Gold Mines LLC’s roasters. In addition to this, the company could see incremental production from Buffalo Mountain (oxide heap-leach opportunity), oxide production from the Ogee Zone and Granite Creek, and the 426 Zone and other oxide targets at Ruby Hill with minimal capex (~$10+ million) to refurbish its existing CIL plant. This suggests the potential for 250,000 – 280,000 ounces of annual production in 2025/2026.

Hub & Spoke Model (Company Presentation)

However, the upside case to this production profile (initial Hub & Spoke model) is bringing Granite Creek Open-Pit online, a project with a planned 11,000 tonne per day throughput rate, ~$150 million in capex (adjusted for inflation), and a first five-year production profile of 195,000+ ounces at sub $900/oz all-in sustaining costs. This operation would be a company-maker on its own for most producers of i-80’s size and market cap, but for i-80, this is an incremental and relatively low-capex opportunity to push annual production above the 425,000-ounce mark. However, with Hilltop morphing into a potential monster with world-class grades and base metal resources set to be moved to NI-43-101 status at Blackjack (giving this base metal opportunity critical mass), there’s additional upside from a polymetallic standpoint.

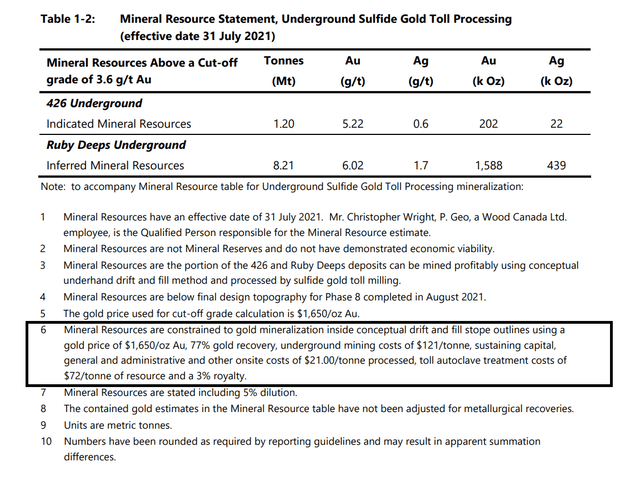

Current Underground Mineral Resource & Mining Costs – Ruby Hill (Company Technical Report)

The important takeaway here is that the rock value at Hilltop could dwarf anything i-80 has in its portfolio currently, with its initial drill results from Hilltop having rock values north of $900/ton and highlight holes having values of $1,000/ton to nearly $4,000/ton. If we assume a blended rock value of ~$625/ton and a 1,200-ton-per-day throughput rate and compare this to estimated mining costs of ~$190/ton costs to be conservative, this would be an extremely high-margin operation and a cash-flow machine. Based on a gold-equivalent grade of 12.25 grams per tonne, a 1,200-ton-per-day throughput rate, and an 80% recovery rate, this would translate to the production of ~125,000 gold-equivalent ounces per annum [GEOs].

However, if this project can grow to a 7.0 – 10.0 million-ton resource that would justify a throughput rate of 2,000+ tons per day, and assuming the same rock value ($625/ton), we could see annual production of ~210,000 GEOs per annum. Looking at an upside case and assuming a $725/ton rock value, which I don’t think is that much of a stretch even if grades drop off from their current average reported to date, and using the same 2,000 ton per day rate, this would represent a ~240,000 GEO production profile. To summarize, this opportunity could be as big as the Hub & Spoke model it’s looking to employ, and it looks like it would be at a higher margin. In my view, this is a game-changer.

Granite Creek (Company Presentation)

Obviously, much work must be done to prove this potential at Ruby Hill, and it’s still very early days. Still, I believe a ~250,000-ounce producer in Nevada with a project in the wings (Granite Creek Open Pit) and further optionality can easily command a $1.80 billion market cap. Even assuming a conservative share count of ~300 million shares (~240 million shares currently), this translates to a fair value of US$6.00 per share. In terms of a more near-term 18-month target price and based on an estimated net asset value of US$1.47 billion, and a 1.0x P/NAV multiple, I see a fair value of US$4.90. This represents a 115% upside from current levels, even after the recent rally.

However, this valuation does not factor in continued success with the company’s polymetallic opportunity. In the case that i-80 continues to hit world-class intercepts, I believe the target on its back grows a lot larger from a takeover standpoint. In an upside-case scenario that it can prove up over 6.0+ million tons at 12+ gram per ton gold-equivalent, I would argue that i-80 Gold’s current market cap of ~$550 million (~240 million shares at US$2.30) can be justified by the CRD potential alone, with investors getting the sunk costs of an autoclave, a CIL plant, considerable heap leach capacity and three high-grade mines for free.

The below chart shows a conceptual production profile for the company, but the timing of Granite Creek Open Pit (light blue bar) vs. Hilltop/Blackjack will likely depend on which offers the most attractive economics. I would expect them to be sequenced, not built at the same, hence why I have staggered them by nearly two years apart.

i-80 Gold – Conceptual Production Profile Per Mine (Company Filings, Author’s Chart)

While these targets already point to considerable potential, they don’t do the long-term potential of the story justice, which is the possibility that i-80 Gold could become a 500,000-ounce plus producer and one of the largest producers in Nevada, only behind Nevada Gold Mines LLC. I believe a company of this size in a top-3 mining jurisdiction with mines of these grades could command a market cap of $2.8+ billion (US$8.50 fair value), with one mid-tier producer trading at a valuation north of this today with only 70% of production from Tier-1 jurisdictions with a Canada/Mexico portfolio ($3.4 billion market cap). Obviously, a lot needs to go right for this to occur, but to date, this team is executing flawlessly, and I don’t think a ~500,000-ounce production profile is as much of a stretch as some investors might assume.

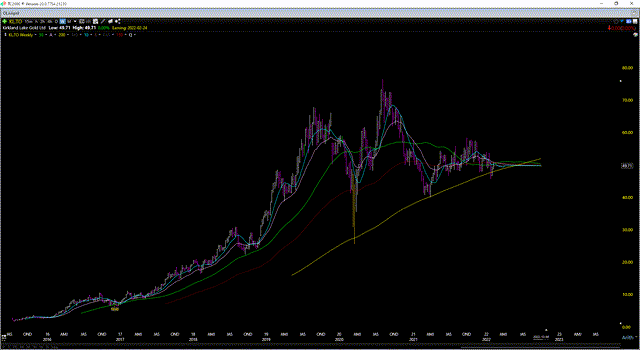

Kirkland Lake Gold Weekly Chart (TC2000.com)

Normally, I wouldn’t even entertain targets this high, which is by no means a short-term target. Still, I am simply pointing out the upside case here if the company can continue to deliver like it is, which to date is well above my expectations. In fact, it’s refreshing to see a team in the junior space (sub $1.0 billion market cap) that is hitting its targets on schedule, has already made brilliant and transformative acquisitions, and it’s added considerable value to these properties. This is quite reminiscent of Kirkland Lake Gold when it made its bold acquisition of Fosterville, which ended up being a company-maker that would propel the stock 650% higher post-acquisition in a period when the GDX went essentially nowhere (see above chart).

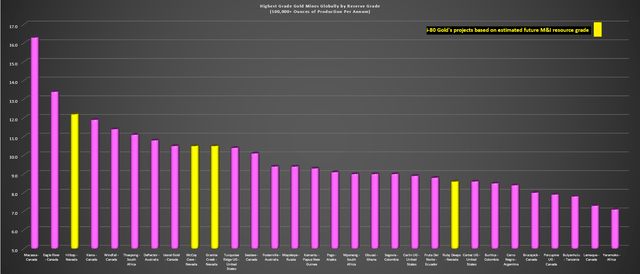

i-80 Gold Future Grade Potential At Existing Deposits vs. Highest Grade Gold Mines Globally (Company Filings, Author’s Chart)

Some investors will argue that these long-term valuations targets are a stretch and unlikely, but I would respectfully disagree. As shown above, and based on where i-80 Gold’s measured & indicated grades could head based on drilling success at Granite Creek Underground and Ruby Deeps plus polymetallic potential, i-80 Gold could own four of the top-25 mines by grades globally (McCoy Cove, 12.0+ gram per ton gold-equivalent CRD, Granite Creek Underground, Ruby Deeps). A company with three to four of the highest-grade mines in a top-3 mining jurisdiction with industry-leading margins typically commands a premium valuation, just as we saw from Kirkland Lake Gold, Wesdome (OTCQX:WDOFF), which nearly hit a $2.0 billion market cap, and others.

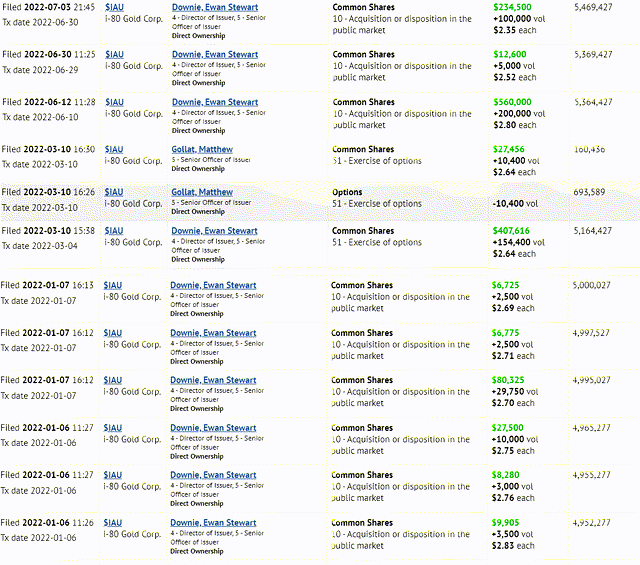

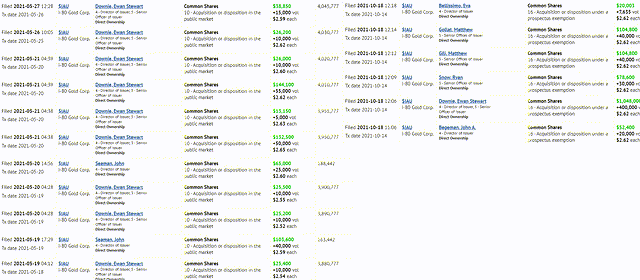

i-80 Gold – Insider Buying (SEDI Insider Filings) i-80 Gold – Insider Buying (SEDI Insider Filings)

The last point worth noting is that management is genuinely aligned with shareholders with aggressive insider buying over the past 18 months and with CEO Ewan Downie purchasing roughly ~1.0 million shares since May of last year at prices ranging from C$2.00 to C$2.83. We’ve also seen buying from the Chief Financial Officer, Ryan Snow (30,000 shares), and the Chief Operating Officer, Matt Gili, with 40,000 shares purchased, as well as purchases from board members and Executive Vice President, Business & Corporate Development, Matt Gollat. This alignment with shareholders is rare for the sector and suggests that the company will likely do everything in its power not to dilute and find creative ways to finance its aggressive growth plans.

Summary

i-80-Gold is a rare breed with a mix of multiple high-grade projects, the processing infrastructure to control its destiny in a state where most juniors don’t have this luxury, and it’s assembled this portfolio by paying a disciplined price for these assets. In my view, there is simply no reason to own a gold producer unless it is growing production because its earnings/cash flow is at the mercy of the gold price’s fluctuations.

i-80 Gold clearly fits this bill with an industry-leading growth rate (70%+ CAGR). However, more importantly, a gold producer should be growing cash flow, reserves, and production per share, and given i-80’s drilling success, I see continued growth in these categories as highly likely. Hence, I see i-80 Gold Corp. as one of the best opportunities sector-wide and a top-3 name in the gold sector.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment