AsiaVision/E+ via Getty Images

A Quick Take On Corebridge Financial

Corebridge Financial (CRBG) has filed to raise $1.8 billion in gross proceeds from the sale of its common stock in an IPO, according to an amended registration statement.

The company provides U.S. policyholders with insurance services and retirement investment solutions.

CRBG represents a potential bargain that will provide investors with a 4% dividend yield from a company that is growing quickly.

My outlook on the Corebridge IPO is a Buy at up to $22.50 per share.

Corebridge Overview

Houston, Texas-based Corebridge was founded (originally, SAFG) as part of insurance giant AIG to provide consumers with retirement solutions and insurance products.

Management is headed by Chief Executive Officer, Kevin Hogan, who has been with the firm since December 2014 and previously held a variety of positions at AIG or Zurich Insurance Group since 1984.

The company’s primary offerings include:

-

Individual Retirement

-

Group Retirement

-

Life Insurance

-

Institutional Markets

SAFG has booked fair market value investment of $8 billion as of June 30, 2022 from parent firm AIG.

Corebridge – Customer Acquisition

The company provides various annuity and other retirement products through distribution relationships with financial advisors, insurance plan sponsors, insurance agents, both externally and through its direct-to-consumer platform.

Recently, the firm has announced a strategic partnership with Blackstone to manage a portion of its investable assets.

General operating expenses as a percentage of total revenue have trended higher as revenues have increased, as the figures below indicate:

|

General Operating |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended June 30, 2022 |

7.4% |

|

2021 |

9.0% |

|

2020 |

1.3% |

(Source – SEC)

The general operating efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of general operating spend, was stable at 4.0x in the most recent reporting period, per the table below:

|

General Operating |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended June 30, 2022 |

4.0 |

|

2021 |

4.0 |

(Source – SEC)

Corebridge’s Market & Competition

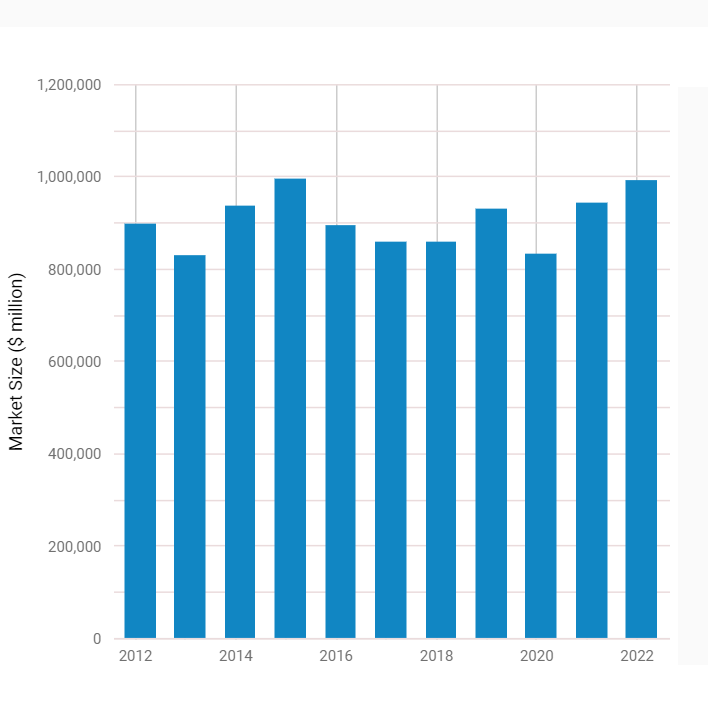

According to a 2022 market research report by IBISWorld, the U.S. market for life insurance and annuities is expected to reach $995 billion in 2022.

This represents an annual growth of 5.1% from 2022.

The average annual five-year growth rate is an estimated 2.9% from 2017 to 2022.

Also, below is a chart showing the historical and projected growth trajectory of the U.S. life insurance and annuity market:

U.S. Life Insurance & Annuities Market (IBISWorld)

Major competitive or other industry participants include:

-

John Hancock

-

Lincoln Financial Group

-

MetLife

-

Nationwide

-

New York Life

-

Prudential

-

TIAA-CREF

Corebridge’s Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growth in topline revenue

-

Increasing net profits

-

Reduced net margin

-

Reduced cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$ 15,669,000,000 |

42.1% |

|

2021 |

$ 23,390,000,000 |

55.3% |

|

2020 |

$ 15,062,000,000 |

|

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Six Mos. Ended June 30, 2022 |

$ 6,364,000,000 |

40.6% |

|

2021 |

$ 7,355,000,000 |

46.9% |

|

2020 |

$ 642,000,000 |

4.1% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended June 30, 2022 |

$ 569,000,000 |

|

|

2021 |

$ 2,461,000,000 |

|

|

2020 |

$ 3,327,000,000 |

|

(Source – SEC)

As of June 30, 2022, SAFG had $167.4 billion in cash, equivalents and bonds for sale and $355 billion in total liabilities.

Free cash flow during the twelve months ended June 30, 2022 was $1.6 billion.

Corebridge’s IPO Details

CRBG intends to sell 80.0 million shares of common stock at a proposed midpoint price of $22.50 per share for gross proceeds of approximately $1.8 billion, not including the sale of customary underwriter options.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $29.6 billion.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 12.4%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, the IPO proceeds will go to Corebridge’s parent firm AIG and Corebridge will receive no proceeds.

Management’s presentation of the company roadshow is available here until the IPO is completed.

Regarding outstanding legal proceedings, the firm is subject to various financial guarantees and indemnity commitments: ‘We are unable to develop a reasonable estimate of the maximum potential payout under some of these arrangements. Overall, we believe the likelihood that we will have to make any material payments under these arrangements is remote.’

The listed bookrunners of the IPO are J.P. Morgan, Morgan Stanley, Piper Sandler and numerous other investment banks.

Valuation Metrics For Corebridge

Below is a table of the firm’s capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

|

Measure (TTM) |

Amount |

|

Market Capitalization at IPO |

$14,512,500,000 |

|

Enterprise Value |

$29,614,500,000 |

|

Price/Sales |

0.52 |

|

EV/Revenue |

1.06 |

|

Earnings Per Share |

$16.60 |

|

Net Margin |

38.91% |

|

Float To Outstanding Shares Ratio |

12.40% |

|

Proposed IPO Midpoint Price per Share |

$22.50 |

|

Net Free Cash Flow |

$1,601,000,000 |

|

Free Cash Flow Yield Per Share |

11.03% |

|

Revenue Growth Rate |

42.06% |

(Source – SEC)

Commentary About Corebridge

CRBG is seeking to go public as it spins out of parent firm AIG.

The company’s financials have produced growth in topline revenue, higher net profits but lowered net margin and less cash flow from operations.

General & operating expenses as a percentage of total revenue have trended higher as revenue has increased, and its general & operating efficiency multiple was stable at 4.0x in the most recent reporting period.

The firm currently plans to pay quarterly dividends of $0.23 per share ($0.92 annually) starting in Q3 2022 on its capital stock.

Based on the proposed midpoint of the IPO share price of $22.50, this would result in an annual dividend yield of around 4%.

The market opportunity for providing retirement and insurance policies to U.S. persons is large and expected to grow at a relatively modest rate of growth, although there are a large number of ‘baby boomers’ retiring each day as the population ages.

J.P. Morgan is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (31.0%) since their IPO. This is a lower-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is fluctuating interest rates which may impact the firm’s ability to generate returns to pay its expected liabilities.

As for valuation, a basket of publicly-held insurance companies compiled in January 2022 by noted valuation expert Aswath Damodaran produced an EV/Sales multiple of 1.35; CRBG’s proposed valuation of 1.06x would represent a significant discount to this comparable basket.

In my view, CRBG represents a potential bargain that will provide investors with a 4% dividend yield from a company that is growing quickly.

My outlook on the Corebridge IPO is a Buy at around $22.50 per share.

Expected IPO Pricing Date: September 14, 2022.

Be the first to comment