bankrx/iStock via Getty Images

MicroVision Inc. (NASDAQ:MVIS) has been consistently reporting losses and is a hype-driven stock that should be avoided right now. If you already own the stock, you should cash out now and consider reallocating your money elsewhere. Analysts expect a breakeven to be achieved in 2024,; however, being so heavily shorted, this view is met with skepticism due to the lack of fundamentals or real prospects. With growth linked exclusively to the hype, and nothing fundamental to support it, MVIS is a gambler’s stock that is difficult to win with.

Company Overview

MicroVision is a developer of lidar sensors, a crucial component of autonomous and self-driving vehicles. Through its specialization in laser beam technologies, microelectronic systems, and optomechanics, MicroVision has also made huge strides in the augmented reality sector. With its use of micro-display systems and AR headsets, MicroVision has gained a significant hold in the interactive display and smart speaker domains.

MVIS has been under the spotlight since 2021, especially as it was one of Reddit’s favorite shorted “meme” stocks. As a result, the stock has gone through explosive growth spurts throughout last year, despite generating losses with an almost non-existent revenue. Previously a penny stock, these meme-led Reddit frenzies saw MVIS shoot up from $0.18 to $20.50 from March 2020 to March 2021. Being in the spotlight for its almost legendary growth tale, analysts have extensively covered MVIS and assessed how the stock has fared against global disruptions.

As with any meme stock, MVIS is a risky investment option, as its price trajectory is divorced from any fundamentals linked to the company and is based on internet hype alone. Traders choosing to chase their luck and be part of this frenzy are setting themselves up for failure, as will be elaborated below.

The MVIS Story Revealed in its Historical Price Movements

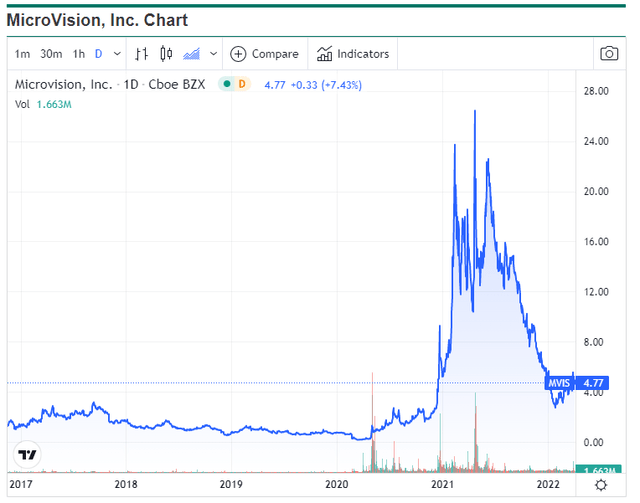

The best approach to take, that would tell the tale of MVIS would be a look at its historical price movement, as well as the growth trajectory it has taken. MVIS had fallen to the penny-stock category since mid-2019 and was on a persistent bearish tumble until hitting an all-time low of $0.18 in March 2020. However, following this dip, spurred about by the coronavirus pandemic, MVIS has seen a growth spurt that is nearly unprecedented in the market, with the stock gaining by a staggering 11,300% by March 2021. For a small-cap lidar tech company, the size of these swings has been substantial, and one that has been making the news cycles throughout 2021. The core reason the stock has seen such a staggering price trajectory has been due to its Reddit-led frenzy of 2021.

The latter half of 2021 saw a steady deflation of the MVIS balloon, with stock prices currently trading above the $4 figure. Most of the frenzy-led gains had eventually been reversed by early 2022, as the stock plummeted from the $20 mark since June 2021. MVIS briefly rose to a three-month high in March 2022, with the stock hitting $5.55. In the fall from its all-time high of $21.50 in June 2021, to $4.50 at present, several investors had lost a substantial degree of their capital amount invested.

How the Reddit Frenzy Turned the MVIS Fate Around

The main reason why a simple penny stock trading below 20 cents shot up to 20 dollars in a year, is due to the infamous Reddit frenzy of 2021. Reddit forums last year sought to drive up supposedly undervalued stocks, that Wall Street players had heavily shorted. MVIS had found itself, along with GameStop Corp. (GME), AMC Entertainment Holdings Inc (AMC), and Koss Corporation (KOSS), as being part of a classic “Reddit Raid” that saw the stock getting dramatically short squeezed.

The hype, as all meme frenzies typically are, was based on pure speculation, where Redditors suggested that MVIS may be a potential candidate for acquisition by Nvidia (NVDA). This assumption was driven by the fact that Nvidia was working on its strategy of delivering an all-in-one package for self-driving, of which lidar sensors are critical. However, market participants remained cautious of this frenzy, expecting a sudden collapse without a moment’s notice, given MicroVision’s weak financial fundamentals, which it still has not been able to turn around as of yet.

However, even as MVIS stock soared, and investors rallied to execute the short squeeze, several investors continued to take short positions on the stock, betting on its fall. This was based on the assumption that owing to the lack of fundamentals, such a growth spurt cannot be sustained. Even at present, MVIS has a short float of 23.44%, indicating that almost a quarter of all shares belong to investors betting on the fall of the stock. This short float remains despite the fall from $21 to the $4 mark already being realized.

Low MVIS Potential Beyond the Reddit Frenzy

Despite MVIS being known as a typical meme stock, the company’s management has increasingly been trying to keep an outflow of information and updates to keep this growth trend sustained for a longer period. The movement of a meme stock such as MVIS is highly sensitive to announcements, with frenzy-investors latching on to any piece of information they can. Moreover, in the case of Reddit favorites, traders are eager to short squeeze highly shorted stocks such as MicroVision.

Towards the end of March 2022, MVIS saw a price surge exceeding 30% following a major announcement by the company. MicroVision had secured a crucial patent from the U.S. Patent and Trademark Office. The patent essentially covered a mechanically resonant device that would ensure an “alteration of resonant mode frequency response.” As is intrinsic to the MVIS stock, this surge was purely speculative, as the patent acquisition is a highly early-stage move in the development lifecycle, with a high level of risk and no strategic association to company objectives. It comes as no surprise as the growth could not be sustained, continuing its fall beyond 20% following this surge, less than two weeks after the news.

Moreover, the lidar technology sector is highly saturated and extremely competitive. Across a web of innovation and fast-paced development, patent acquisition alone, without a track record of development does not instill much hope in traders assessing MVIS beyond its hype alone.

Similarly, early April saw another brief climb in MVIS of over 5%. This was linked to the hiring of a new board member, Jeffrey Herbst who has skills and expertise acquired during his tenure at Nvidia. The fact that an addition of a director to MicroVision’s board of directors has caused a brief jump in price, points to how meme traders are grasping any straw they can find to continue their short squeeze. This points to the brief and unsustainable nature of growth spurts the MVIS trajectory is laden with, making it a poor choice for serious investors looking to enhance their overall portfolios.

MicroVision Earnings and Financial Outlook

Perhaps the clearest indicator of why MVIS is a stock that should be avoided can be found in taking a look at its recent earnings report. What is of particular interest is MicroVision’s financial performance trend across the years, and whether or not its stock price trajectory matches up with this.

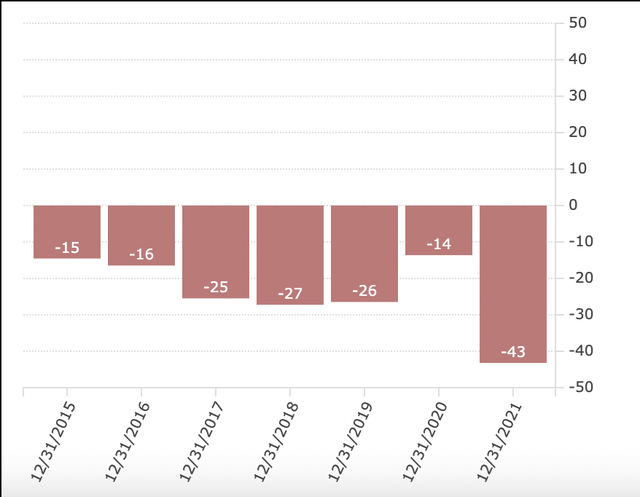

Total revenue has been plummeting since 2018 when it reported a revenue total of $17.61 million, now down to $2.50 million in 2021. Similarly, net loss has consistently increased during the years, despite increasing equity offerings throughout the years. MVIS has a poor record of earning power, which worsens with time:

Whilst the company has managed to stay afloat through both debt and equity financing, its diminishing revenue, and worsening net losses make its business model unsustainable and bound for failure. The company’s cash burn rate is further concerning, which it fails to translate into value for its shareholders.

The Dangers of Investing in MVIS

In ordinary circumstances, deciding when to sell a stock is a complex decision that entails several factors to be considered. Calculations and news from the market are typically factored into sell decisions, once it is determined the stock is overvalued. In the case of MVIS, which has a price boosted by hype alone, investors will never know when the right time is to sell. This becomes near impossible in the case of MVIS because relative to an ordinary non-meme stock, fundamentals and figures do not apply. Growth spurts take place despite the stock being overvalued, which can make price plummets spontaneous. For this reason, a standard “buy and hold” strategy is not applicable, which makes MVIS a poor investment choice, despite the hype surrounding it.

Secondly, meme stocks such as MVIS are market anomalies, the prices of which do not reflect the market’s valuation of the business but are more like lottery tickets. Traders are impressed with the sky-high gains and end up losing a substantial portion of their capital, in trying to chase their luck. Just as growth spurts have unexpectedly taken place in its historical price graph, so have sudden collapses. There is no way of knowing how to optimally time investment in a stock like MVIS, as a fall to its intrinsic value is always more likely than a spontaneous growth spurt. This explains why the stock is so heavily shorted. MVIS is an overpriced stock, given its rising price trend over the last 10 years, and worsening financial fundamentals. Investors are better off steering clear of this stock.

Conclusion

MVIS is a stock that investors must actively avoid including in their portfolios. Its hype is completely divorced from its worsening fundamentals over the years, making it a high-risk gamble stock, bound to plummet. This is due to its price being artificially driven up en masse by hype. With investors unable to refer to fundamentals for their timing decisions, conventional buy and hold strategies are not applicable with MVIS, making substantial losses highly probable. The growth spurts seen with MVIS are not anchored to actual prospective updates, with meme traders seemingly grasping at straws to execute their short squeeze strategy. These spurts are brief and readily corrected with frequent price collapses.

Be the first to comment