buzbuzzer

Kite Realty Group Trust (NYSE:KRG) is a top-five open-air shopping center REIT with an interest in 181 operating retail properties. With 67% of annualized base rent (“ABR”) attributable to the Sunbelt region of the country, KRG has benefitted from the relative strength in the local economies, which includes a stronger rebound from the pandemic and a more accommodative business environment.

KRG’s shopping centers are also comprised of grocery-anchored neighborhood and community centers. Having an “essential” tenant, such as a grocery store, as an anchor tenant provides the company with downside protection against recessionary business cycles. With the risk of anchor losses minimized, the company is modestly insulated against restructurings of existing lease agreements.

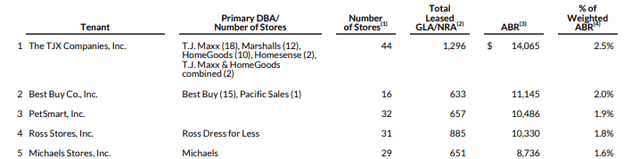

As of the most recent filing period, KRG’s top 25 tenants represented approximately 30% of total ABR, with their top five accounting for about 10%. Notable tenants include The TJX Companies, Inc. (TJX), Best Buy Co., Inc. (BBY), and PetSmart, Inc.

Q1FY22 Investor Supplement – Summary of Top 5 Tenants

Despite uncertainties in the macroeconomic environment, foot traffic, leasing, and earnings growth all remain robust through the current reporting period. Most recently, KRG reported stronger than expected results and double-digit leasing spreads, with a significant backlog of pending occupancies that will contribute meaningfully to future net operating income (“NOI”).

With Q2 earnings set for release at the beginning of August, shares are down about 17% over the last six months and are not far off their 52-week lows. For investors seeking a quality shopping center REIT, KRG presents an affordable option with reasonable upside potential.

Exceeding Expectations Through Acquisition Synergies

In the most recent period ended March 31, 2022, KRG reported total revenues of +$194.4M. This was up over 180% from the same period last year and +$11.2M better than expected. Comparability, however, was affected by the company’s merger with RPAI, which was completed on October 22, 2021.

As a result of the merger, KRG acquired 100 operating retail properties in addition to a few active development projects and land parcels. Of the +$122M total increase in rental revenues, +$120.8M was driven by contributions from the properties acquired during the merger.

Similarly, properties acquired through the merger also contributed to higher total expenses, with an aggregate merger contribution of +$123.5M to total property operating expenses, real estate taxes, and depreciation and amortization.

Though the higher expenses contributed to lower operating income and net earnings, with a net loss per common unit of $(0.08)/share, both funds from operations (“FFO”) and NOI were up 35% and 5.9%, respectively. This beat consensus estimates by $0.05/share. Driving FFO in the current period was the positive impact of +$1.1M in prior period collections, offset by +$900M of merger-related costs.

Robust Leasing Activity and Significant Pipeline of S&O Leases

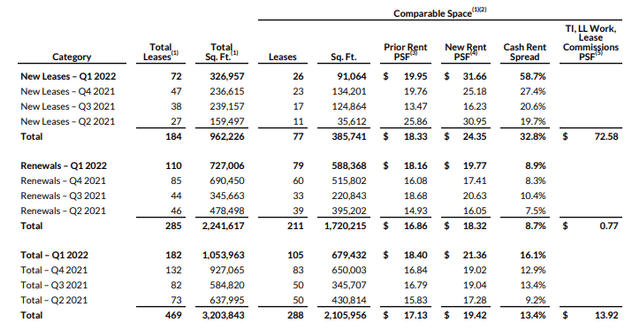

Overall leasing activity during the quarter was robust, with the signing of 182 leases totaling over a million square feet. This includes nine anchor leases. Spreads remained in the double digits, with new rent PSF coming in at $21.36/PSF, which is a 16.1% increase from prior and over 300 basis points better sequentially.

Q1FY22 Investor Supplement – Quarterly Leasing Summary

Excluding the impact of signed but not yet commenced leases (S&O), economic occupancy stood at 90.4%, which is up from 89.7% last year. Additionally, the company was 93.6% leased at period end. The 320-basis point spread between the two is up from 160 basis points last year. This should provide a continued runway for growth in future periods.

The pipeline of S&O leases amounted to approximately +$37M, which represents 7% of the company’s projected future NOI growth. At present, management is expecting these leases to come online during the back half of 2022 and into the first half of 2023. Additionally, active developments and a return to pre-pandemic portfolio leasing levels would contribute another +$31M to NOI over the next several years.

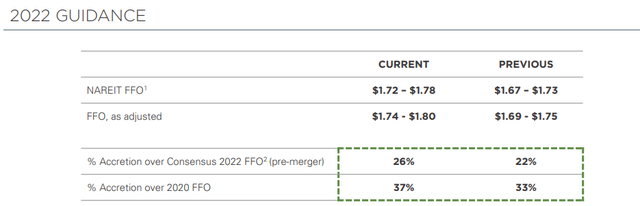

Favorable Revisions to Guidance

Looking ahead, management revised guidance upwards for both FFO and NOI. Adjusted FFO/share is now expected to be $1.77/share at the midpoint while same property NOI is expected to grow 2.25% to 3.25%. While growth is expected to accelerate in the back half of the current year, second quarter same-store results are projected to be muted due to the heightened reserves that were taken during Q1FY21 and subsequently reversed in Q2FY21.

Q1FY22 Investor Presentation – Summary of 2022 Guidance

Lower Leverage Than Peers and Strong Coverage Ratios

As of March 31, 2022, KRG had total assets of +$7.6B and total liabilities of +$3.6B, comprised principally of +$2.8B in fixed-rate debt with a weighted average maturity of 4.4 years.

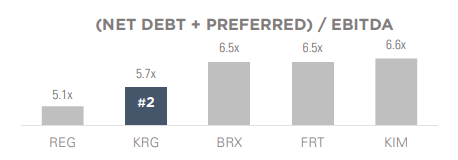

As a multiple of EBITDA, net debt at period end stood at 5.7x. This is down from 6x in the prior quarter. When including the +$37M of S&O, net debt would be even lower at 5.4x. Compared to competitors, this is among the lowest in the peer group, with KRG’s ratio just above Regency Centers Corporation (REG).

Q1FY22 Investor Supplement – Leverage of KRG Compared to Peer Group

Though overall leverage is lower than peers, nearly 30% of total debt is due prior to 2025. In a period of rising rates, this isn’t desirable, as the weighted average interest rate is likely to head higher as the debt is rolled over.

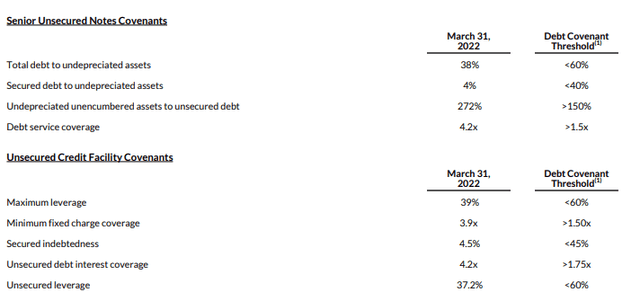

KRG does have adequate cushion, however, to weather higher interest, as evidenced by their debt service coverage ratio and unsecured debt interest coverage, which both stood at 4.2x at period end.

Q1FY22 Investor Supplement – Debt Covenant Compliance Summary

Additionally, the company has an investment grade credit rating and a stable outlook from all three credit agencies. This should ensure readily available access to capital when the time arises.

At present, KRG has total liquidity of $913M, consisting of cash on hand and availability under their unsecured credit facility. As such, continuing cash flows from operations combined with existing liquidity are sufficient to fund the company’s operating needs over the next twelve months and beyond.

Attractive Dividend Supported by Healthy Cash Flows

Robust leasing activity that includes double-digit spreads is one strength that has produced results in excess of expectations. Furthermore, a rebound in portfolio foot traffic that is outpacing 2019 levels also provides a promising outlook to future leasing levels. With a large backlog in the S&O pipeline, cash flows are set to expand towards the latter half of 2022 and into 2023.

In the current period, KRG generated +$49.6M in operating cash flows. Higher CAPEX during the period of +$23.8M did result in an overall net use in cash. But excluding the company’s net investment activity, operating flows were sufficient to cover total distributions by 1.19x.

At present, KRG’s annual dividend yields over 4.75% at current pricing after having been recently increased by 5%. At an AFFO payout ratio of approximately 55%, the payout is lower than the sector median of 73%. Though the payment has been reduced in prior periods, it is slowly returning to more normalized levels, supported in part by the company’s improving fundamental outlook.

The Takeaway

KRG owns and operates a quality portfolio of open-air shopping centers in key regions within the U.S. This includes a significant presence in the highly attractive Sunbelt states of Florida and Texas, which together account for nearly 40% of ABR.

Heading into their Q2 earnings release at the beginning of August, KRG is approaching from a position of strength, with better than expected results and favorable revisions to guidance reported in the prior period. Double-digit renewal spreads and a sizeable backlog of S&O leases expected to come online in the latter half of the year are a few future catalysts for earnings growth.

A slowing retail environment paired with growing macroeconomic concerns are two risks that will need to be addressed. However, the company’s portfolio is over 90% occupied and leasing contracts are generally stickier, regardless of current economic conditions. Furthermore, approximately 30% of ABR is derived from essential retail, such as grocery stores. This provides some degree of downside protection in NOI.

At 9.9x forward FFO and not too far off their 52-week lows, KRG is valued in bargain territory. Kimco Realty Corporation (KIM), for example, is currently trading at 13.10x forward FFO, yet has reported ABR of $19.12/PSF versus KRG’s ABR of $19.57/PSF.

In addition, KRG’s leverage is significantly lower than KIM’s, resulting in greater available cash for dividends and buybacks. While KRG’s ladder of maturities isn’t the most desirable, their nearly +$1B in available liquidity, in addition to their investment grade credit ratings provides confidence on the company’s ability to roll over their debt at the best possible terms.

At 13x forward FFO, shares would be valued between $22.60 and $23.40, which suggests upside of at least 25% at current pricing. In addition, prospective investors would receive an annual dividend payout that is currently yielding over 4.75%. For investors seeking a long-term value addition to their REIT portfolios, KRG provides an opportunity at a reasonable level of risk.

Be the first to comment