pictafolio

Investment Thesis

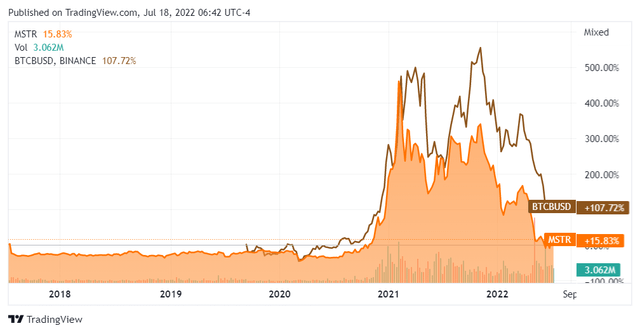

MicroStrategy (NASDAQ:MSTR) has long been linked to Bitcoin (BTC-USD), since its CEO took an aggressive position with the king of cryptocurrency in 2020. By FQ1’22, MSTR owned 129.2K Bitcoins with a total market value of $5.9B and YTD, 129.69K Bitcoins. Therefore, it is not a coincidence that MSTR’s price chart looks awfully similar to BTC-USD’s, especially given the recent notorious crypto winter that occurred recently.

5Y Correlation Between MSTR and BTC-USD’s Prices

Seeking Alpha

Since the historical crypto winter in 2018 lasted for two years, we expect another cyclical behavior this time round as well. In addition, MSTR’s stock decline is also partially attributed to its poorer financial performance in the past four consecutive quarters, significantly worsened by the macro issues, rising inflation, and potential recession. Therefore, we are not hopeful for stock price recovery in the short term and intermediate term.

MSTR’s Financial Performance Has Been Under-Whelming Thus Far

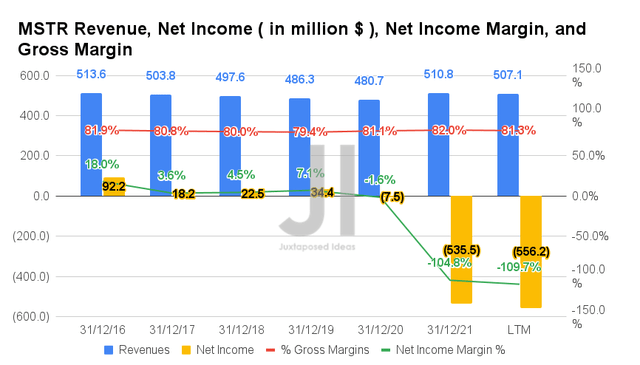

S&P Capital IQ

From the chart above, it is easy to see that MSTR has not performed well, with declining revenue and net income growth in the past few years. By the LTM, the company reported revenues of $507.1M and gross margins of 81.3%, representing minimal growth of 5.4% and 0.2 percentage points from FY2020 levels, respectively.

In addition, MSTR reported massive net losses of -$556.2M and net income margins of -109.7% in the LTM, representing an enormous decline of 7416% and 102.2 percentage points from FY2020 levels, respectively. It is important to note that the losses are mainly attributed to the Bitcoin impairment charges recorded in the past seven quarters, with even more coming in FQ2’22 given the -58% decline in Bitcoin then. Painful indeed – since MSTR’s stock price will continually be impacted moving forward if the price of Bitcoin does not recover.

S&P Capital IQ

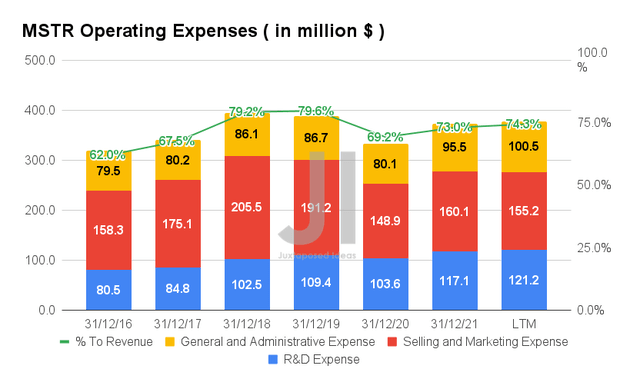

Despite its minimal revenue growth, MSTR has been consistently increasing its operating expenses in the past few years. By the LTM, the company reported a total of $376.9M, representing an increase of 13.3% from FY2020 levels. Thereby, increasing the ratio to its revenues by 5.1 percentage points to 74.3% in the LTM.

S&P Capital IQ

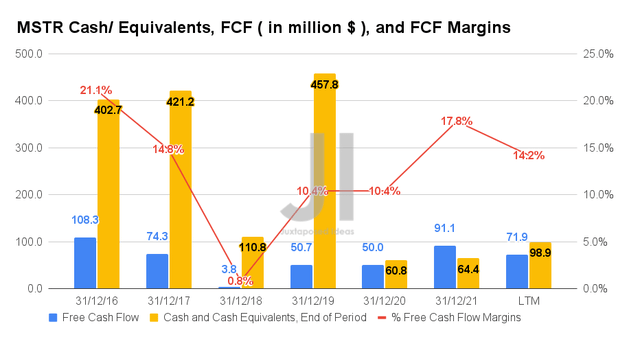

Nonetheless, the bright point for MSTR is that it has been reporting positive Free Cash Flow (“FCF”) thus far, lending strength to its balance sheet for now. By the LTM, the company reported an FCF of $71.9M and an FCF margin of 14.2%, representing notable improvements of 43.8% and 3.8 percentage points from FY2020 levels, respectively. Thereby, improving its cash and equivalents to $98.9M on its balance sheet.

S&P Capital IQ

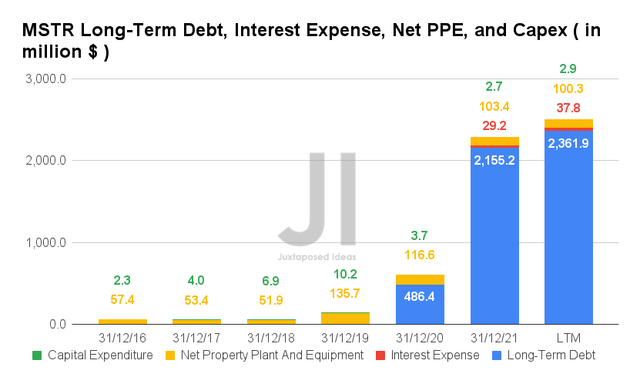

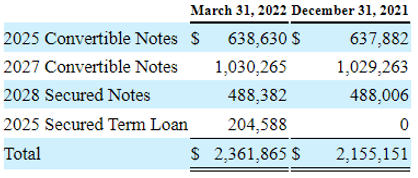

MSTR’s Long-Term Debt Table

S&P Capital IQ

Based on the two tables above, it is evident that MSTR has taken on massive loans in the past two years, with a sum of $2.36B in long-term debts and $37.8M of interest expenses in the LTM. This is mostly attributed to the devastating effects of the COVID-19 pandemic then and its continued investment in Bitcoin. In addition, its CEO continued to load up on Bitcoin in FQ2’22, while raising another $10M in capital for the purchase, therefore highlighting his unwavering conviction on the cryptocurrency.

Nonetheless, given MSTR’s FCF generation of $71.9M in the LTM, it is unlikely that the company would be able to repay the debt of $843.2M by 2025 through FCF alone, barring highly positive ( though unlikely ) earnings for the next two years. The company could potentially pledge some of its nearly $2B worth of unencumbered Bitcoins as collateral, or otherwise, sell some Bitcoins to raise capital. In the meantime, based on the original conversion features, we may also see an alternative share dilutive effect of 1.63M shares for the 2025 Convertible Notes. That would be equivalent to 15.6% of its existing diluted shares outstanding as of FQ1’22 – a somewhat significant sum given the company’s continued stock-based compensation of $50.81M in the LTM. We shall see by 2025.

Fortunately, MSTR practiced prudence in its net PPE assets to $100.3M and capital expenditures to $2.9M by the LTM, indicating a moderation of 29% since FY2019 levels.

S&P Capital IQ

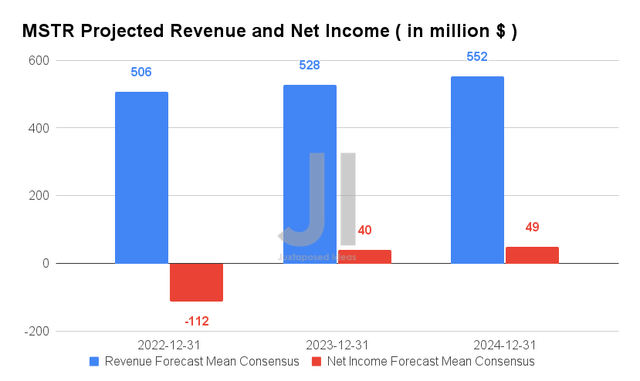

Over the next three years, MSTR is expected to report revenue growth at a CAGR of 2.62%, while also potentially resuming net income profitability from FY2023 onwards. Its net income margins are also expected to improve from 7.1% in FY2019 to 8.8% in FY2024. For FY2022, consensus estimates that MSTR will report revenues of $506M and net incomes of -$112M, representing a YoY decline of 1% though improvement of 79%, respectively.

In the meantime, analysts will be closely watching MSTR’s FQ2’22 performance, with consensus revenue estimates of $123.32M and EPS of -$13.71, indicating YoY growth of -1.62% and 55.37%, respectively. Nonetheless, we are not overly hopeful about its performance, given the historical misses in the past four consecutive quarters.

So, Is MSTR Stock A Buy, Sell, or Hold?

MSTR 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

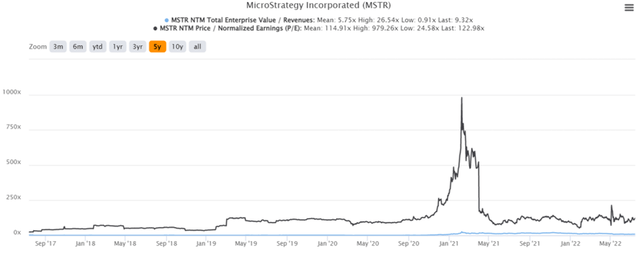

MSTR is currently trading at an EV/NTM Revenue of 9.32x and NTM P/E of 112.98x, higher than its 5Y EV/Revenue mean of 5.75x though relatively in line with its 5Y P/E mean of 114.91x. The stock is also trading at $213.98, down 75.9% from its 52 weeks high of $891.38, though at a premium of 59.5% from its 52 weeks low of $134.09

MSTR 5Y Stock Price

S&P Capital IQ

Therefore, despite consensus estimates strong buy rating with a price target of $701.50, we are not convinced of its 227.83% upside. Even a future Bitcoin recovery would not justify MSTR’s current premium stock valuation, because it fundamentally remains an underperforming company with limited ( projected ) net income and FCF profitability. As a result, we encourage investors to sell off their current holdings and move their capital elsewhere, especially since the time of maximum pain is not here yet, given the rising interest rates, inflation, and potential recession. We potentially see another drastic retracement for MSTR to $100s or less, since the crypto winter may not defrost by 2023 or 2024.

Nonetheless, crypto and MSTR bulls may remain invested, if they are willing to gamble on Bitcoin’s eventual recovery to $40K or more by sometime in 2023 or 2024. That would be a positive catalyst for its future stock recovery, returning some much-needed capital to the highly volatile investment.

However, we are more skeptical since we mirror Dane Bowler’s view on cryptocurrency in general, which you may read more about here: When Bitcoin Collapses It Doesn’t Get Cheap.

Therefore, we rate MSTR stock as a Sell and do not look back, anymore.

Be the first to comment