AerialPerspective Works/E+ via Getty Images

Investment Thesis

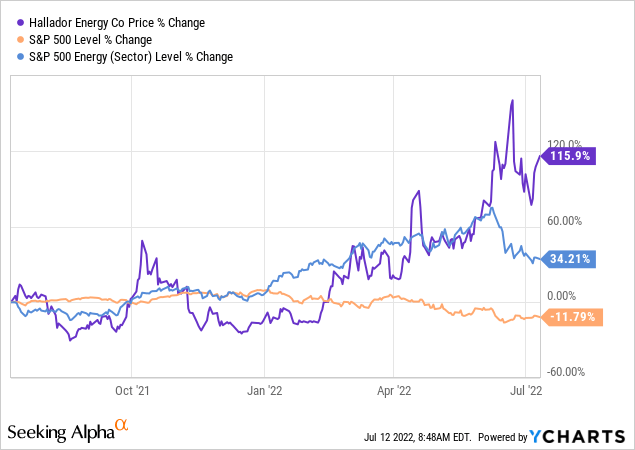

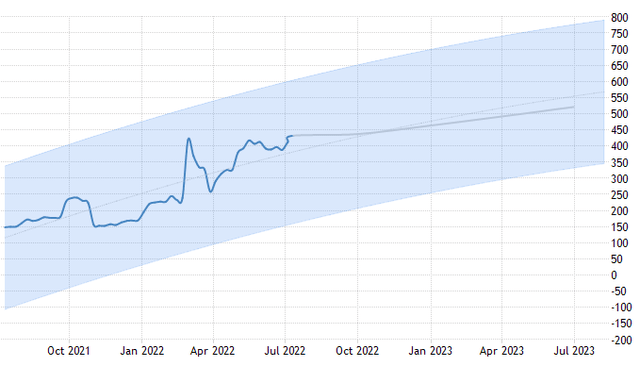

Hallador Energy Company (NASDAQ:HNRG) mines and sells coal to electric power producers through its 3 mines in Oaktown and near Clay City, Indiana. The company has significantly benefitted from the rising coal price and the high coal demand from Europe as Russia has threatened to curb its gas supply. It has gained about 153% in market cap YTD, outpacing the energy industry’s 34% gain and the market’s over 19% decline.

Even though the general sentiment regarding the utility-coal market seems to be negative because of the stringent sustainability regulations and aggressive perceived substitution by renewable energy sources, the industry isn’t going anywhere for at least the next 2 to 3 decades.

For instance, the EIA reports that solar power accounted for about 4% of total energy sources in 2021, expected to reach 5% in 2022, about 14% in 2035, and 20% in 2050, despite the aggressive investments. In contrast, coal-powered plants already account for over 20% of electricity production in the U.S and will expectedly retire a little less than 30% of capacity by 2035.

EIA

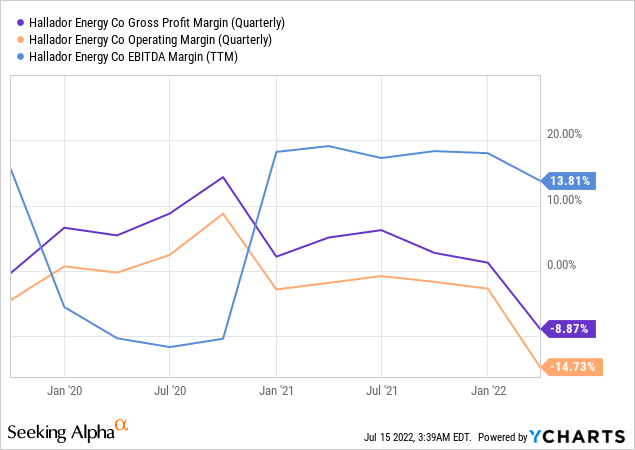

However, despite the industry’s positive signs, Hallador doesn’t sport the best financial health status right now and needs to exhibit prominent improvement markers to muster investor confidence. The company’s balance sheet and profitability need to show quantifiable augmented results in the current quarter to sustain the upward stock price momentum. Its valuation metrics also aren’t appealing enough and offer an unfavorable risk-reward investment dynamic partly because of the recent share price surge.

The company does have the potential to generate positive investment returns down the road, especially as it has lined up a much more advantageous sales position from 2023.

Still, the risks outweigh the rewards right now, and I wouldn’t dive in unless it offers a favorable valuation dynamic by either shedding off the recent share price gains or improving its financial statements.

Hallador and the Coal Industry

Coal prices have surged almost 200% in the previous 52 weeks, reaching near record-high levels amid concerns of global supply-chain shortages. In 2022, the global coal supply investment is expected to rise by 10% to counter the tight supply. In addition to other macroeconomic factors, this further solidifies the bull case for coal prices and the World Bank’s projection of coal prices rising more than 80% in Europe from 2021 levels in 2022.

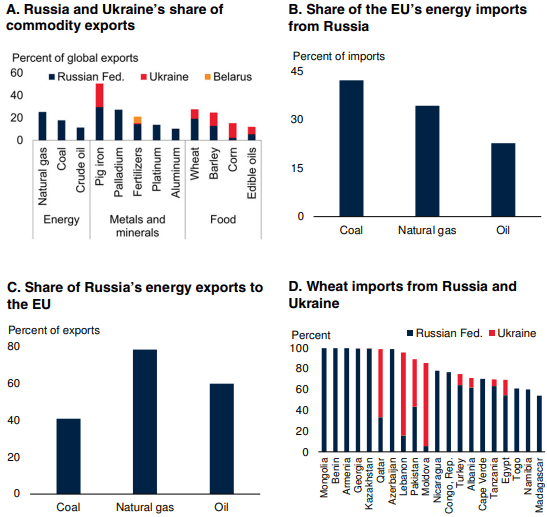

Demand for coal surged 6% in 2021 due to a rebounding economy and high natural gas prices in H2 2021. Coal consumption for electricity generation has risen by 12% in China and 11% in India, and 9% globally. At the same time, Europe heavily depends on Russia to fulfill its energy requirements, with coal accounting for over 40% of its total energy imports from Russia.

In April, the EU announced a ban on Russian coal imports and a two-thirds reduction of Russian gas imports starting in August 2022 because of the ongoing war. This will further strain the global supply, facilitating the rising commodity prices and leading to the EU seeking alternative sources of supply, including Australia, South Africa, Colombia, Indonesia, and the United States.

The World Bank

The EIA reports 289 million short tons (MMst) of coal production in the U.S. during the first half of 2022, up 2% YoY. The projection for the full year is 595 MMst, 3% higher than 2021. Meanwhile, coal consumption has decreased during the current year, leading to a decline in coal export projections from the US to 3% growth in 2022, as an estimated 12.6-gigawatt coal-fired capacity is expected to retire in 2022 amid an unpredictable detritus of the Russian invasion.

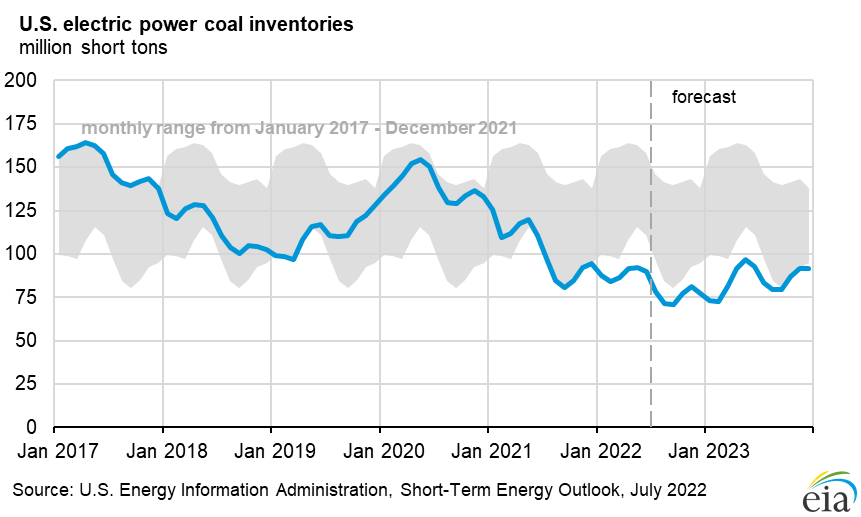

S&P Global

As of January 2022, there were about 240 coal-powered electricity generation plants in the U.S, which account for about 22% of the electricity production in the country. However, EIA forecasts electric power sector coal inventories to decline to 77 MMst by the year-end, 18% less than 2021 levels, with natural-gas-powered plants picking up on the lost share. The 9% coal production hike in 2021 in the U.S was primarily driven by strong export demand, which hiked 23%, increasing its exports-to-production ratio to 15%.

EIA

Coal consumption for electricity generation has been declining in the US for decades. In the last 2 decades, it has more than halved, with the 2022 consumption till April accounting for about 20.5% of the total electricity production in the country, compared to about 51% of the total production in 2001. This decline is predominantly driven by the global “Green Revolution,” which has resulted in stringent regulations on power plants. Consequently, the U.S has not added any coal power plants for a decade and is expected to retire 59 GW of operating coal-fired capacity by 2035.

EIA

This means that almost 152 GW of coal-powered capacity will still operate halfway through the next decade. On average, the 42 states that still house these plants will be operating a little over 3 GW per state per annum capacity even 13 years down the road.

This indicates that even if the prospects of the commodity are bleak over the next few decades, the company can still secure its decades-long future by leveraging the favorable market situation, which seems to have revived the interest in power-producing coal, by generating significant profits and cash flows for at least the next 2 decades and using them to invest in long-term sustainable revenue-generating activities, such as the acquisition of the Hoosier Energy’s 1-Gigawatt Merom Generating Station, which is expected to close in the current quarter, and translating higher price-driven revenues into cash, which have already resulted in an almost 75% levered FCF growth in the MRQ, with the levered FCF margin double its peers.

Hallador’s profitability has been faltering recently, with the company missing its EPS targets for 10 consecutive quarters, leading to a violation of one of its financial covenants in Q1 2022, which has recently been sorted out with the financier. However, the commodity pricing advantage, cost improvements caused by the 20% productivity increase in its production, an upward revision of its contracts, and the M&A transaction are expected to substantially improve the company’s profitability starting this quarter.

Valuation

Hallador’s TTM based and forward EV-to-sales and P/S ratios indicate an approximately 39% undervaluation. Still, because of the recent term violations caused by the lower-than-expected EBITDA of the company, the metric is of severe relevance and importance in valuing the stock right now.

With an enterprise value of about $319.6 million and an EBITDA of $28.3 million in the trailing twelve months, Hallador’s EV-to-EBITDA stands at 11.3x, which is almost 30% higher than that of its peers.

The company has recently revised its guidance for 2023, raising the EBITDA estimate to $160 million, which will substantially bring the ratio down, given the current circumstances. However, it hasn’t demonstrated any quantifiable steps towards achieving said targets.

Even though the stock isn’t ludicrously priced despite 6-months gains of over 130%, the risks surrounding the stock demand a much cheaper price tag to make the investment opportunity worthwhile.

Conclusion

Despite the smudgy past financial performance, if the company delivers strong financial results in the current quarter, it will have paved a path toward exceeding its pre-pandemic share prices. However, unless I see those results, I am skeptical of the company’s optimistic guidance. The company’s risk profile is very demanding and will need exceptional operating performance to sustain its current rally and avoid a steep share price decline.

For instance, one of the major concerns about the company’s sustainability stems from the fact that it derived 95% of its revenue from 5 customers in 2021, with most of the revenue originating from Indiana. Such concentration means that a loss of any single customer could result in a substantial loss of revenue for Hallador.

Because of the contrasting plane between the company’s past performance and the future guidance, I am neutral on the stock and will take a strong Q2 earnings report as a signal to open a position on the stock if the valuation metrics haven’t surged to an unreasonable level.

Be the first to comment