krblokhin

With Altria Group (NYSE:MO)’s shares going through a rough patch right now, anxiety about the firm’s almost 9% yield is growing, and some investors may be asking if the dividend itself might be at risk. I believe dividend risks are greatly overblown right now because Altria has paid a dividend for decades and the company paid out less than 80% of its adjusted earnings per share between FY 2017 and FY 2021. Altria also has the option to reduce its stock buybacks if EPS comes under pressure!

JUUL investment

Altria is going to submit its second-quarter earnings card soon – earnings are scheduled for July 28 – so investors will likely get an update about the company’s strategy for fighting the FDA’s initial ban of JUUL’s e-cigarettes. Altria may also report a devaluation of its equity investment in JUUL Labs, the vape brand that has been the subject of the FDA ban last month. Altria valued JUUL Labs at $1.6B last quarter, and investors must expect the company to write down the carrying value of its equity investment in JUUL to $0 over the longer term. Writing down the investment value of JUUL to $0 would not affect Altria’s cash flow, however, but it could result in lower EPS estimates for Altria going forward.

While I see EPS risks for Altria related to its e-cigarette business, it is highly unlikely that the cigarette company is going to significantly cut or suspend its dividend payments to shareholders. Altria’s adjusted earnings are growing and support the firm’s dividend.

A look at Altria’s historical payout ratios or why I believe Altria’s dividend risks are greatly overblown

Altria targets a long-term payout ratio of 80% of adjusted diluted earnings. However, in practice, the company paid out less than 80% of EPS between FY 2017 and FY 2021: in effect, Altria paid between 75-78% of its adjusted EPS as dividends in the last five-year period. Although the firm’s EPS growth has slowed down lately, the dividend as such is very, very safe.

|

FY 2017 |

FY 2018 |

FY 2019 |

FY 2020 |

FY 2021 |

|

|

Adjusted EPS |

$3.39 |

$3.99 |

$4.21 |

$4.36 |

$4.61 |

|

Dividends Paid That Year |

$2.54 |

$3.00 |

$3.28 |

$3.40 |

$3.52 |

|

Dividend Growth Y/Y |

– |

18.1% |

9.3% |

3.7% |

3.5% |

|

% Of Adj. EPS Paid Out |

74.9% |

75.2% |

77.9% |

78.0% |

76.4% |

(Source: Author)

For FY 2022, I estimate Altria will ultimately pay a total dividend ranging between $3.64-3.68, depending on how much the firm raises its dividend in the second half of the year. I believe a $0.02-0.04 per-share increase in the dividend is realistic. Working with these dividend assumptions, Altria’s estimated payout ratio in FY 2022 will likely be between 75% and 76% which is perfectly aligned with past payout ratios.

Altria is more likely to reduce stock buybacks than cut its dividend

Even if Altria’s EPS growth prospects – because of a potential e-cigarette ban in the U.S. – deteriorated to such an extent that management would have to consider a dividend reset, the company has a much better option to cutting its dividend: it could just slightly reduce its share buybacks and thereby sustain its dividend payments.

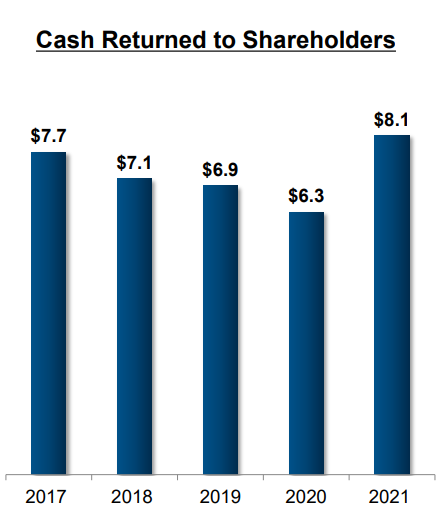

Altria spends serious money on buybacks: between FY 2017 and FY 2021, the company invested an average of $1.4B annually in buying back shares. Stock buybacks represented about 19% of all capital returns during this 5-year period. If push comes to shove, Altria could just slightly scale back its stock buybacks and save cash that way to maintain its dividend.

In total, Altria spent $36.1B on its dividend and on stock buybacks between FY 2017 and FY 2021. I believe maintaining and growing the dividend will be a much bigger priority for management than stock buybacks.

Altria

EPS is expected to grow

Consensus EPS predictions show that Altria will continue to grow its earnings. Based on company guidance, Altria expects 4.0-7.0% adjusted EPS growth in FY 2022 and EPS of $4.79-4.93. Between FY 2022 and FY 2024, the tobacco firm is projected to grow its EPS each year at least at a 4% rate.

Between FY 2017 and FY 2021, Altria generated 7.9% adjusted EPS growth. Although adjusted EPS growth is moderating, the company should still be able to finance its dividend for shareholders with relative ease.

|

Actuals |

Altria Guidance |

Estimates |

||||

|

FY 2020 |

FY 2021 |

FY 2022 Guidance |

FY 2022 |

FY 2023 |

FY 2024 |

|

|

Adjusted EPS |

$4.36 |

$4.61 |

$4.79 to $4.93 |

$4.84 |

$5.10 |

$5.32 |

|

YoY Growth |

3.6% |

5.7% |

4.0-7.0% |

5.0% |

5.3% |

4.3% |

|

P-E Ratio |

– |

– |

8.4 X – 8.7 X |

8.6 X |

8.2 X |

7.8 X |

(Source: Author)

Risks with Altria

Altria has risks like any other stock, but dividend risk is likely not one of them, at least not right now. What I see as a bigger risk (but also as an opportunity) is a continual decline in the share of cigarette smokers. It is a risk because it affects Altria’s top line and EPS growth prospects, but it also represents Altria with an opportunity to reinvent its business and make strategic investments in alternative tobacco products such as nicotine pouches. Government regulation is a challenge for Altria going forward as well. What would change my mind about Altria is if the tobacco company drastically cut its EPS guidance and margins declined.

Final thoughts

This is the final word: Altria’s dividend is not at risk. Altria has consistently paid out less than 80% of its adjusted EPS between FY 2017 and FY 2021 which was key to ensuring dividend growth. Estimates also indicate that the company will continue to grow, but I am happy to admit that EPS risks have risen lately. Even if EPS prospects were to deteriorate because of an enforced e-cigarette ban, management could simply adjust its stock buybacks to protect Altria’s strong yield. I don’t believe that Altria’s 9% dividend is a value trap but that investors are getting a very sweet deal here!

Be the first to comment