bjdlzx

Conservatively run Evolution Petroleum (NYSE:EPM) has been on a shopping spree with some impressive results. Management has already repaid much of the debt incurred for that shopping spree. More importantly, the purchases have stopped because robust commodity prices are causing buyers to upgrade their prices.

Even though there are deals to be made in the current environment, there is a danger that such deals can turn out to be a burden as Occidental Petroleum (OXY) found out very quickly. Not all companies are confident enough to take the risk that Occidental took. Some of those that do take the risk will not survive the next commodity price decline cycle because the due diligence process was not thorough or conservative enough.

There is nothing wrong with stopping the “shopping spree” early to rebuild the balance sheet. The next cyclical downturn has a way of coming unannounced when many least expect it. Usually, they start as the usual volatile price swing, but the expected price recovery “next week” never comes. For many investors, the continuous waiting for a price recovery that does not happen can be a scary event.

The way to avoid sleepless nights, especially with smaller companies, is to always look for a strong balance sheet with conservative financial ratios. One mistake often made with younger companies is to find that strong balance sheet. But some investors often skip the conservative financial ratios. That often leads to expensive results.

The Debt

Evolution Petroleum did take on debt, but the company is deleveraging very fast.

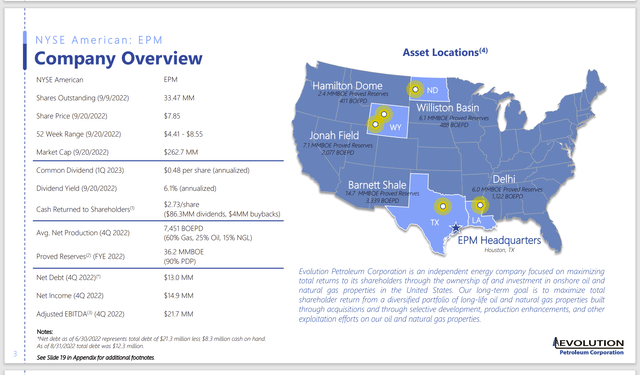

Evolution Petroleum Company Summary And Debt Progress (Evolution Petroleum Fourth Quarter 2022, Corporate Presentation)

Management mentions in several places both in the company presentation and in the earnings press release that they repaid another $9 million of debt after the fourth quarter ended to get to a far lower net debt figure than was reported at yearend. Not many companies have that kind of focus.

Management continued this focus in the first quarter. Net debt (which is long-term debt minus cash) declined to $1.5 million. Management used cash to repay most of the debt outstanding after the first quarter ended and now has a goal to repay all debt. Rebuilding cash will then have a high priority, even though management raised the dividend and announced a share repurchase program.

More importantly, the acquisitions made were made using conservative figures. This company (in past fiscal years before 2022 ended in October) reported closer to $4 million in EBITDA or less in the past. The balance sheet was debt free with a large cash balance (historically).

Therefore, the idea of spending that cash while adding debt was quite a move for this company. Management shows every sign of going back to the debt-free balance sheet with a decent cash balance. Purchases in the future will remain disciplined and bargained. But a massive growth with debt that happened is very unlikely in the future. That is going to put this company in an excellent position to grow in the future in a countercyclical fashion.

Earnings Power

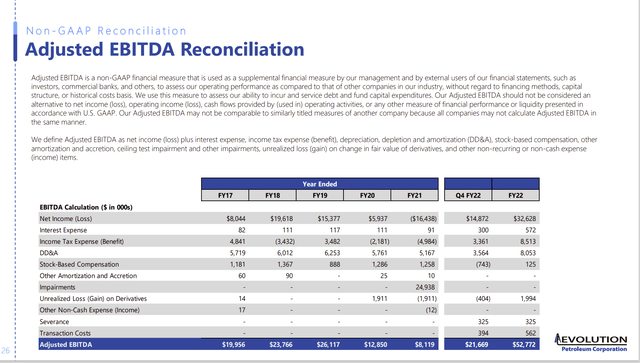

The proof as to how conservative this shopping spree turns out to be is shown by the company EBITDA comparison:

Evolution Petroleum EBITDA Comparison (Evolution Petroleum Fourth Quarter 2022, Corporate Earnings Presentation)

The comparison above shows that the company made as much EBITDA in the fourth quarter as they made in full years (or more than some years). More importantly, the remaining debt approaches about half of what was earned in that fourth quarter. That should mean the remaining debt is now low enough to not threaten the company future under most industry downturn environments.

Each comparison that comes out in the future will show decreasing dramatic comparisons as more acquisitions are included in the previous quarterly comparison. Do not get me wrong, robust commodity pricing added to the dramatic comparison. However, production increased in the hundreds of percents from those acquisitions. By the end of the new fiscal year, that will decline to a “normal” comparison.

Many of the past quarterly comparisons over the years showed lumpy, if any, growth because these are largely mature fields. Therefore, any growth was due to a large project (like flooding) as drilling new wells in a typical upstream style was generally out of the question.

Still, this is a high-cost operator. As such, this management is well aware that high costs and debt just do not get along. That is one of the reasons for a very conservative view of the balance sheet and financial ratios.

Secondary recovery is by nature a higher-cost business than is the typical upstream operation. But there is decent money to be made as long as one does not take unnecessary risks. This management appears to understand that.

The Purchases

There are a lot of upstream operators that develop a property and then move on when the property has aged to the point that operating costs are a good deal higher than is acceptable for a lot of upstream reporting.

A specialist like Evolution Petroleum comes in and buys a nonoperating interest with an established operator for the remaining production for maximum cash flow. Well-chosen properties often keep producing well beyond expected lifespans because technology advances allow for the recovery of more oil in place.

Sometimes, as in the case of the Austin Chalk, the play is completely revitalized to the acceptability of traditional upstream operators due to technology advances. Far more often, a company like Evolution Petroleum continues to be able to produce through secondary recovery techniques for a very long time.

Cost Structure And Growth

Evolution is a specialist in a market that has less competition than the main upstream market.

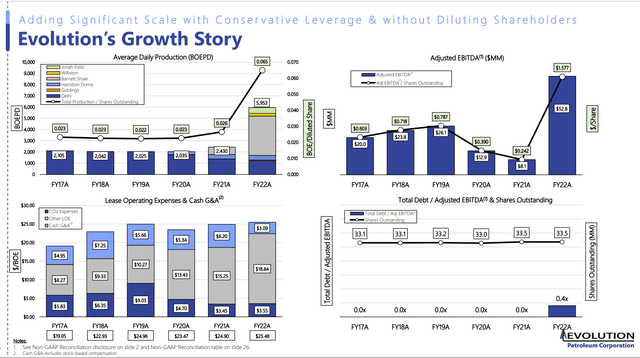

Evolution Petroleum Significant Historical Trends (Evolution Petroleum Fourth Quarter 2022, Earnings Conference Call Slides)

Average daily production will likely be maintained somewhere near the exit level of fourth quarter 2022. But that makes for some easy comparisons to the coming quarterly reports. Growth is large enough to make up for some significantly lower commodity prices with the resulting narrower margins.

The dividend can be maintained under a wide variety of corporate scenarios. When combined with the now larger operations, the dividend can be maintained under all but some very extreme circumstances.

Still, this company is best looked at as a variable distribution entity. Not many of us saw the challenges of 2008 and 2020 ahead of time. A company like this one would prioritize the balance sheet over maintaining the dividend. That needs to be considered by income investors.

Still, the earnings power is considerable under most likely future scenarios. The current dividend yield offers a return just short of what most investors would report on average in the long run. So, waiting for another accretive acquisition does not cost much. The strong balance sheet lowers investment risk more.

The cost structure shown above is far higher than is the case for a typical upstream company. But that cost structure works with conservative debt ratios. Companies that historically keep large cash balances have the option of hedging when it is necessary so that production can be shut-in until a commodity price recovery is underway.

The Future

This company invests in minority positions of non-operators in the secondary recovery business. This is not a real popular place to operate. But management has been successful in this niche. Purchase prices tend to remain low because this particular market is not well served. That can make cyclical profitability high enough to offset market downturn effects of typical high-cost operators.

Management has had to deal with the Denbury (DEN) bankruptcy and the issues that led to the bankruptcy. Management has done that and far more while maintaining a debt-free balance sheet.

Now the company is reducing its dependence on any one operator. That diversification will help smooth out results in the future.

Future growth will likely remain “lumpy” because the company is so small. Still, there are seldom companies with the management experience of this one. Combine that with a well-covered dividend and a solid balance sheet. The result is a safety level seldom seen in companies of this size providing a double-digit annual return over time.

Be the first to comment