Feverpitched

This is one of my favorite topics to discuss on Seeking Alpha.

I have written so many articles on this topic that some of you may even get tired of it. But there are just so many different angles to cover and, believe it or not, I still haven’t covered all of them.

One that I haven’t discussed yet is the topic of valuation, and as I will explain in this article, it is a very important one to consider. Real estate investment trusts (“REITs”) are today priced at much lower valuations than private properties and, therefore, it makes little sense to invest in rental properties.

But before we go into the topic of valuation, here is a short recap of why I quit investing in rental properties to invest in REITs instead.

It really comes down to what I call “risk-and-hassle-adjusted returns.” REITs allow me to earn superior returns with less risk, no effort, and complete freedom.

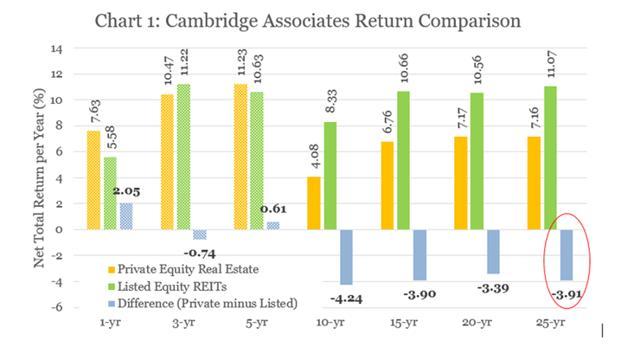

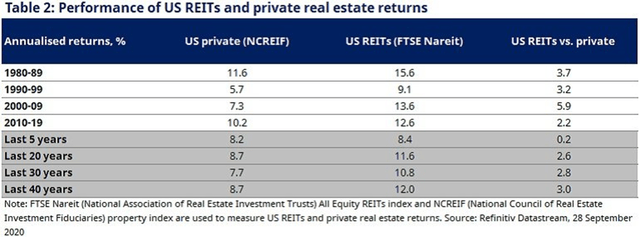

Several studies have proven that REITs are more rewarding than rental properties in most cases. Generally, they earn 2-4% higher annual returns because:

-

REITs enjoy significant economies of scale.

-

REITs have more bargaining power with their tenants.

-

REITs can afford to hire the best talent.

-

REITs are also able to develop their assets to earn higher returns.

-

REITs have better access to capital at a lower cost.

-

REITs can do spread investing to boost their growth rates.

-

REITs can enter other real estate-related businesses to boost profits.

-

REITs use less leverage, which results in higher returns over full cycles.

-

REITs focus on Class A properties in most cases which enjoy faster growth.

-

REITs do sale and leaseback transactions to eliminate brokerage fees.

Here are three of those studies:

But these higher returns are not the result of higher risk. On the contrary, REITs are a lot safer than rental properties because:

-

Your liability is limited from any risk.

-

You don’t sign on any of the loans with your personal name.

-

You don’t need to deal with angry tenants.

-

REITs are diversified.

-

REITs are liquid.

-

REITs are professionally managed.

-

REITs use less leverage than most private investors.

-

REITs have better access to capital during downturns.

-

REITs are scrutinized by the SEC and lots of analysts.

-

REITs do a better job at mitigating conflicts of interest.

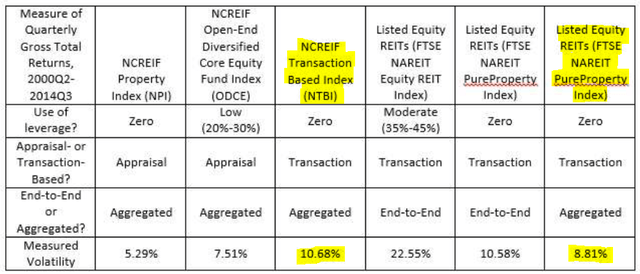

You may argue that “REITs are more volatile” but even that isn’t necessarily true. Private real estate gives you a false sense of safety because you don’t see a daily quote, but if you made the right adjustments, you would find that private real estate is more volatile than REITs according to a study by Brad Case, PhD, CFA:

“Is it believable that public real estate is actually less volatile than private real estate? It’s not just believable, it’s to be expected. Volatility is a measured of uncertainty regarding asset values. Think of a crisis: people trade assets at lots of different values because they have so much uncertainty regarding the factors that determine the asset values: the future stream of earnings, and the appropriate discount rate. A market in which more transactions give investors greater information about those underlying factors-that is, a market that is liquid and information-efficient, such as the stock market in which listed equity REIT stocks trade-SHOULD be less volatile than an illiquid, information-inefficient market such as the market for properties or (worst!) the market for private equity fund shares.”

And finally, you get to earn these superior risk-adjusted returns without actually having to do any work yourself.

Sure, you need to select the right REITs and then monitor them to make sure your thesis is still valid. Beyond that, however, there is no managerial work and you retain complete freedom over your time and geographic location.

Rental properties, on the other hand, are work-intensive investments that will drain all your time, energy, and freedom away. You’ll have to work hard just to find the right property, finance it, negotiate it, repair it, and market it before you even start to earn rental income. And after all of that, you’ll likely still earn lower returns in the long run…

Quick side note: before you comment that “rentals allow me to use leverage” or that “rentals have tax advantages,” please note that I have already covered this point in another article that you can read by clicking here. In short, REITs are also leveraged and they also enjoy major tax benefits so this does not change the comparison.

Therefore, in most cases, I think that REITs are better investments than rental properties.

And this is especially true today because current valuations clearly favor REITs over private real estate.

An interesting thing about REITs is that since they are publicly listed, they will often trade like the rest of the stock market, whether it makes sense or not.

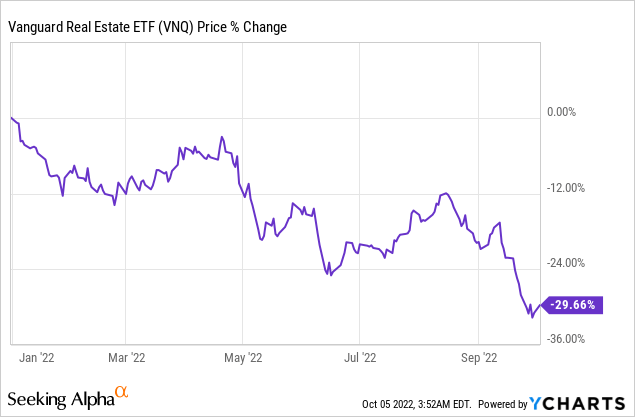

When liquidity runs out, everything becomes closely correlated, and prices drop across the board. 2022 is a good example of that as REITs and other stocks have dropped heavily:

On average, the REIT sector is down 30% year-to-date, and there are a lot of smaller and lesser known REITs that are down closer to 50% from their recent highs.

That’s despite the fact that REIT fundamentals are solid and property values have been more or less stable in 2022. Leverage is at an all-time low at 35% on average and rents are growing the fastest in years. REITs have actually been hiking dividends in 2022, which clearly shows that there has been a disconnect between the market and the fundamentals.

As a result, REITs are now priced at their lowest valuations in years. It is estimated that they trade on average at a 20% discount relative to the value of the real estate that they own, net of debt, which essentially means that you are paying 80 cents on the dollar and you then get the added benefits of liquidity, diversification and professional management for free on top of that.

And that’s not all.

The 20% discount is just the average. It is not uncommon to find REITs trading at discounts as large as 30, 40, 50, or even 60%!

As recently as last week, I held a call with Whitestone REIT’s (WSR) management team and we briefly discussed their current valuation.

Their normalized forward NOI run-rate is about $100 million annually, which would be worth $1.67 billion at a 6% cap rate, and if you remove their debt, it would leave you a bit over $1 billion of net asset value. Yet, their current market cap is just $420 million, which prices them at a ~9% implied cap rate.

You could never get such a deal in the private market. A portfolio of high-quality, service-oriented strip centers in sunbelt markets would simply not trade at such a high cap rate. You would pay a price that’s about 2x higher for similar assets in the private market and you would take much greater risks and it would require a lot more effort to earn a lower return in the long run.

So why would you do it?

REITs are so much cheaper than private real estate that it really makes no sense to buy private real estate these days.

Even the major private equity firms like Blackstone (BX) are loading up on REITs instead of private real estate. They have bought ~$30 billion worth of REITs in 2022 and recently explained in their conference call that they are seeing the best opportunities in the REIT sector right now:

“The best opportunities today are clearly in the public markets on the screen and that’s where we’re spending a lot of time.” COO of Blackstone

That’s coming from a company that owns $100s of billions worth of private real estate. Clearly, they could buy more private real estate and they still do, but even they understand that REITs offer better value at this time and they have been buying a lot of them.

You may think that something must be wrong with Whitestone REIT and that it is an exception, but that’s not the case.

There are countless similar opportunities in the REIT market right now.

The most extreme example that comes to my mind is Vonovia (VNA/OTCPK:VONOY). It is the largest apartment landlord in Germany and it is currently priced at just 1/3 of its net asset value. Its net asset value is €65 per share, but it currently trades at €22 per share. Its net asset value, cash flow and dividends have all risen in 2022. Its growth has actually even accelerated due to the high inflation. But its share price has collapsed due to fears of the energy crisis in Europe. But if you are long-term oriented, this is just a temporary crisis, and this is why the value of the underlying assets haven’t changed materially.

This is one of the most extreme examples that I know, but even the bluest blue-chip apartment REITs in the U.S. now trade at large discounts. AvalonBay (AVB), Prologis (PLD), Mid-America (MAA) all trade at 20-30% discounts to their net asset value.

So again, why would you buy private assets, pay a premium, and then have to deal with greater risks to earn lower returns over time?

It just doesn’t make sense, and this is why I am favoring REITs for my real estate investments.

Be the first to comment