Editor’s note: Seeking Alpha is proud to welcome TUB Investing as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

MoMo Productions/DigitalVision via Getty Images

Investment Thesis

Digital Turbine’s (NASDAQ:APPS) business model, strong revenue growth, increasing potential of SingleTap, acquisitions, strategic engagement with Google (GOOG), and network effects in their telecom/OEM agreements have all been covered extensively.

There is undoubtedly much more that we can explore in depth. But I’d want to draw attention to three aspects that were not actively highlighted when Digital Turbine was mentioned.

By understanding these 3 points, you will be able to appreciate the growth trajectory that Digital Turbine is on – which makes it a strong buy at its current share price.

1 – Moat Around The Device

To comprehend Digital Turbine’s Moat, you must first comprehend its first product, the Ignite On-Device platform.

Ignite On-Device platform has been installed on over 800 million devices with over 60 million added every quarter thanks to their partnership with over 35 telecom/OEM partners across the world.

As per website, it’s a one-stop platform with integrated on-device technology that allows for tailored app distribution as well as better-targeted app discovery for end users.

Once activated, Digital Turbine will have their own identification on the device. As a result, a moat has been built around the device, as well as the capacity to tap into the device’s first-party data.

At the recent ROTH Conference, CEO Bill Stone emphasized on this moat as well:

Number 1 is our software’s directly on the device. And once we put our software into device, whether it’s a Verizon device, a Samsung device, an AT&T device, or what have you, there’s no competition. We have a moat around that device.

He also explained extensively about the first-party data on device during the conference:

I think a really important point here is everything we do is on device and what Google and Apple (AAPL) and others are really concerned about is when you take data off the device, you put it in the cloud and then it gets shared around and it follows you around the internet. Everything we do is local on device. We’re not doing anything around that third-party sharing. Everything we do is first party data on the device. So I think that’s a really, really important point about what our business is versus some other businesses that may be more reliant upon third-party data.

Therefore, with Ignite On-Device creating a moat surrounding the device and their own identifiers resulting in access to first-party data, Digital Turbine, unlike other AdTech, does not need to worry about the removal of third-party cookies and other privacy issues.

2 – Capital Allocation Machine

No one will associate Digital Turbine as a Capital Allocation Machine. But do hear me out.

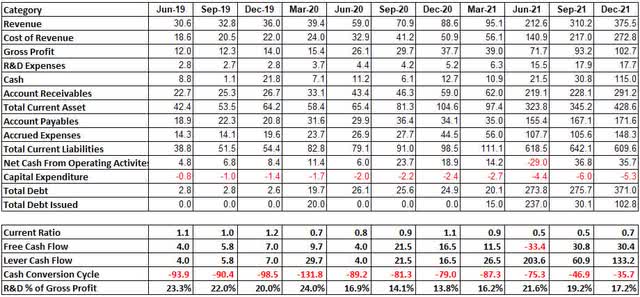

Abstract of Digital Turbine Quarterly Financials (Seeking Alpha)

Based on the quarterly financials in the table above, Digital Turbine’s Current Ratio was above 1. It was only in Mar 2020, after the acquisition of Mobile Posse, that the company’s current ratio fall below 1. Subsequently, the current ratio has briefly went above 1 in Dec 2020. But it fell below 1 again after Digital Turbine went on an acquisition spree, acquiring Adcolony in Feb 2021, Appreciate in Mar 2021 and Fyber in May 2021. Without excess cash, the company went on to use their debt facility to complete the acquisitions.

On a deeper dive, Digital Turbine is able to support company’s operation despite not having a current ratio of 1 is due to:

(1) The ability to generate free cash flow consistently (other than Jun 2021, where significant debt was utilized).

Digital Turbine’s capital expenditure remains low over the years, which allows the company to keep most of the cash generated from the business.

(2) The usage of debt at critical timing

Debt was only issued to support the business when acquisitions were involved.

Moreover, as quoted from the latest 10Q, interest rate on the facility were low:

Amounts outstanding under the New Credit Agreement accrue interest at an annual rate equal to, at the Company’s election, (i) London Inter-Bank Offered Rate (“LIBOR”) plus between 1.50% and 2.25%, based on the Company’s consolidated leverage ratio, or a base rate based upon the highest of (A) the federal funds rate plus 0.50%, BoA’s prime rate, or LIBOR plus 1.00% plus between 0.50% and 1.25%, based on the Company’s consolidated leverage ratio. Additionally, the New Credit Agreement is subject to an unused line of credit fee between 0.15% and 0.35% per annum, based on the Company’s consolidated leverage ratio. As of December 31, 2021, the interest rate was 1.99% and the unused line of credit fee was 0.30%.

(3) A negative cash conversion cycle

In order to understand a negative cash conversion cycle, we can refer to this article by L&F Capital Management, which explains about Amazon (AMZN) negative cash conversion cycle.

As quoted from the article:

Amazon’s cash conversion cycle is negative, meaning it is generating revenue from customers before it has to pay its suppliers for inventory, among other things.

A negative cash conversion cycle is simply an interest free way to finance operations through borrowing from suppliers.

In addition to the points above, Digital Turbine held almost no cash across the 11 quarters shown (other than in Dec 2021*), and spent an average of 18% of their Gross Profit on R&D expenses.

*As per latest 10Q, the cash on hand and additional debt issued were used to pay off the earn-out payment to Adcolony on 15 Jan 2022.

To summarize, Digital Turbine made excellent use of its cash and borrowing capabilities to grow the firm, either through acquisition or internal development, resulting in spectacular revenue growth of 311% and EBITDA growth of 172% over the last 9 months year on year, all without the need for a secondary offering.

This can also be attributed to a great management team perfectly executing their plans over the last 2 years.

3 – New Business Model

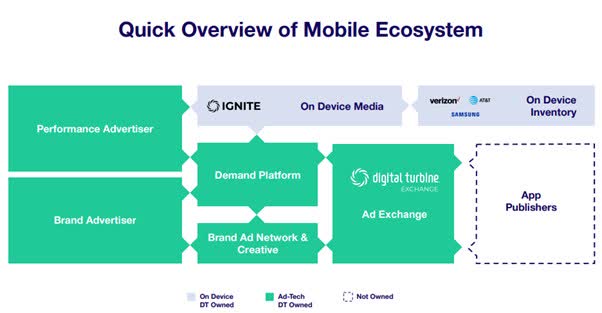

Since Analyst Day in Nov 2021, Digital Turbine has established that it has two revenue streams – the On-Device Media and the new AdTech Segment (through the acquired Adcolony and Fyber).

Existing Business Model of Digital Turbine (Analyst Day Slide)

In addition, the company also announced that they will be working with publishers, mainly social media platforms, by licensing the SingleTap technology out to them.

This was further emphasized during the Oppenheimer 5G Summit and as mention in the Greenhaven Road Capital Q4 2021 investor letter, as quoted:

At an investor conference in December, management tried to highlight their announcement that Facebook was live-testing SingleTap, which could be a very big deal since Facebook is the second largest distributor of Android apps (Digital Turbine’s priority).

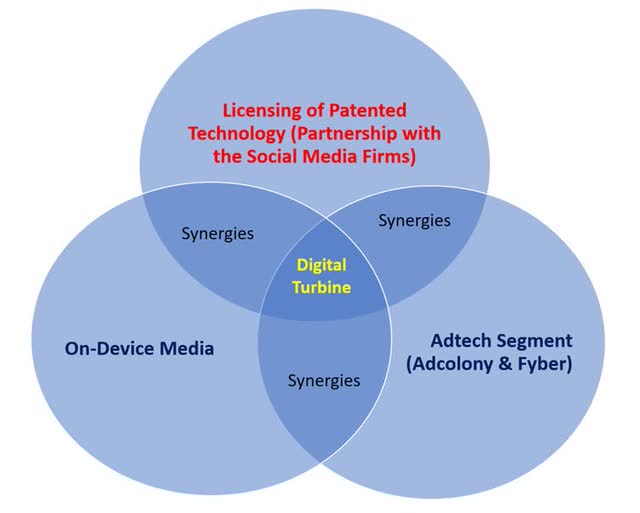

With Digital Turbine licensing SingleTap technology and partnering with social media platforms to expand their network impact to social media platform users, my view of the company’s business strategy is as follows.

My Opinion Of Digital Turbine New Business Model (My Own Understanding)

Firstly, there will be a potential third revenue stream if the licensing business succeeds.

Secondly, the company’s partnership with social media platforms will allow them to tap into the platforms’ users, who weren’t previously part of their TAM, thereby expanding their network effects.

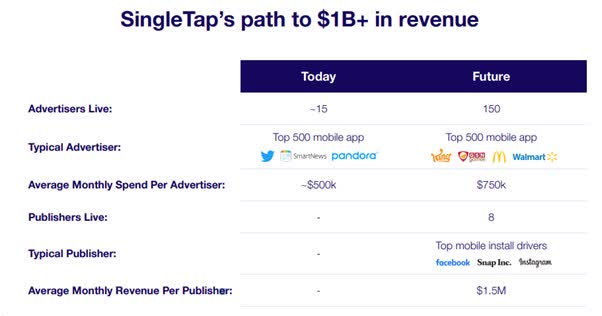

Thirdly, as per the Analyst day presentation below, Digital Turbine has stated that they target to partner with at least 8 different publishers in 3 to 5 years’ time, earning $1.5m monthly per publisher. Licensing agreements tend to provide SaaS style revenue, where most of it goes directly into the bottom line. That could potentially be $18m annually.

Path to $1bn Revenue via SingleTap Technology (Analyst Day Slide)

Thus, if Digital Turbine can license the SingleTap technology to at least one social media platform by 2022 (preferably, Meta Platforms (FB)), it will immediately impact their EBITDA and pave the way for a potential recurring third revenue stream.

Risks to the Thesis

There are two main risks with regards to this thesis.

(1) Failure to integrate SingleTap into the social media platform

With regards to the effective integration of SingleTap into the social media platform, there are undoubtedly some expectations that are reflected into the current share price. Any failure will directly cause the share price to plummet.

Mitigant – My opinion is that the integration with Facebook should be completed very soon, that’s why management released the news during the Oppenheimer 5G Summit.

(2) Increased Interest Payment Affecting Bottom Line

As of Dec 2021, Digital Turbine has a total debt amounting of $371m. Following that, it drew another $179m from its revolving line to fulfill Adcolony’s earn-out cash obligation.

When the next 10K (FY2022) is released, the total debt might exceed $550 million, and the interest payment could be as high as $12.375 million (assuming the interest rate is 2.25%).

The substantial interest payment will have a negative impact over its net profit.

Mitigant – As per the latest 10Q, the company recorded a negative change in fair value of contingent consideration of over $40.2m, which is not recurring in nature. Therefore, there will be a potential for a net positive of $27.8m (40.2-12.375) instead which will make the impact of the increased interest payment towards the bottom line seem non-existent.

Valuation

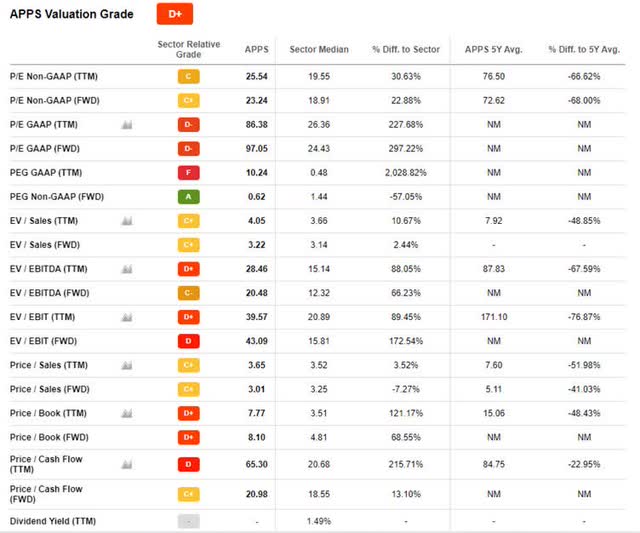

When looking into Digital Turbine on its own, it appeared to be quite costly, with a PE Non-GAAP of over 25x, a PE GAAP of over 86x, a PEG GAAP of over 10x, and a Price to Cash Flow at over 65x and EV/EBIT of over 39x. Digital Turbine was likewise given a “D+” by Seeking Alpha.

Digital Turbine Valuation Metrics (Seeking Alpha)

Digital Turbine appears to be undervalued based on revenue-related factors. However, there has always been dispute regarding using revenue as a metric for valuing Digital Turbine because many individuals believe the revenue presented is Gross Sales rather than Net Revenue because the revenue figure includes the revenue sharing component that is meant to be distributed to the partners.

Therefore, I’ll look at the valuation from the standpoint of EV/EBITDA, because EV/EBITDA is a metric that compares the company’s value, including its loans, to its operational profitability.

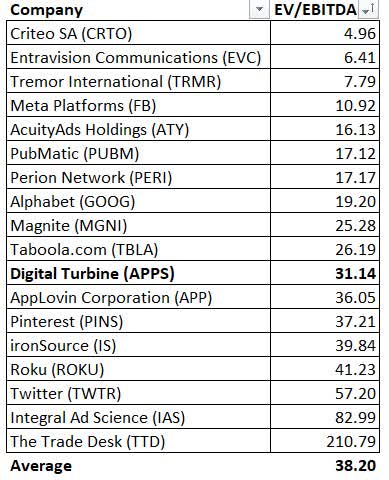

I’ll be comparing Digital Turbine’s EV/EBITDA to the EV/EBITDA average of its peers. This will help to determine what the average EV/EBITDA is and whether Digital Turbine is undervalued when compared to its peers and the selected peers average.

EV/EBITDA as of 7 Apr 22 (Seeking Alpha)

The selected companies in the table above includes almost all the AdTech names that have a positive EV/EBITDA, Social Media Platforms (Since their revenue consist mainly of earnings through advertising) and ironSource (IS)*.

*ironSource has a product, called Aura, which is similar to Ignite. Nevertheless, as per ironSource’s latest annual report, it seems that they only has about 4 partners (Boost (DISH), Orange (ORAN), Vodafone (VOD) and Samsung (OTC:SSNLF), while Digital Turbine has about 35 partners and growing.

The average EV/EBITDA is at 38.20x while for Digital Turbine it stands at 31.14x – which means that Digital Turbine’s current valuation is slightly below average when compared to its peers.

If Digital Turbine is able to reach its EBITDA target of $1bn in 3 to 5 years’ time, this means that the company can achieve a potential EV of $31.14bn and will appear significantly undervalued at the current EV of $3.76bn.

This may have seem as overly optimistic with almost a 10x potential return, but with near-term catalysts, such as the latest partnership with Telefonica (TEF) and expanding relationship with TikTok, as well as the longer-term business model of partnering with social media platforms, I believe Digital Turbine’s revenue and EBITDA will grow and its multiplier will expand, and it will eventually be deemed as “a wonderful company at a fair value”.

Conclusion

The current market instability provides the finest opportunity to invest in high-growth companies that have the potential to grow enormously given their current fair/cheap price. Digital Turbine is one of these companies, and its current value makes it appear very appealing to own a company that is an excellent capital allocator, a monopoly in its own right, and has a long-term path to exponential growth in revenue and EBITDA.

Be the first to comment