lechatnoir

Outfront Media, Inc. (NYSE:OUT) is one of the largest providers of advertising space on outdoor advertising structures across the U.S. and Canada. This scale includes positions in all the top 25 largest markets in the U.S. High profile sites around New York’s Grand Central Station and Times Square provide the company’s customers with access to some of the world’s most heavily trafficked cities to address their marketing objectives.

Outfront advertising provides numerous advantages not available in alternatives. For one, the displays are always viewable and cannot be turned off, skipped, blocked, or fast-forwarded. Additionally, it is a more cost-effective option for advertisers. In an operating environment where rising costs are at the top of every meeting agenda, outdoor advertising is the least likely to be cut from company budgets relative to other forms of advertising.

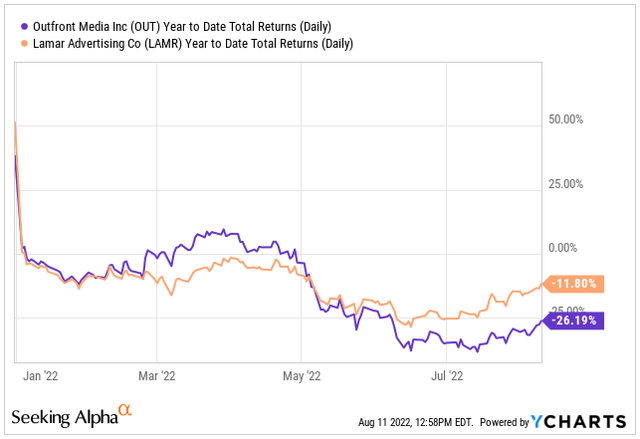

YTD, shares are down nearly 30%. This is considerably worse than the performance of related peer, Lamar Advertising (LAMR), who is down about 12%.

YCharts – Comparison of YTD Returns of OUT and LAMR

Coming off strong earnings that reiterated strength in the core business, OUT appears due for a significant rebound. While exposure to the New York City and Los Angeles markets resulted in greater downside during the height of the COVID-19 pandemic, these markets are likely to experience faster growth rates in coming periods as tourism continues to ramp higher. This will drive travel-related ad spend, which is already growing at significant rates. With upside of nearly 30%, OUT is an opportunity worth an advertisement.

Demand For Advertising Remains Robust

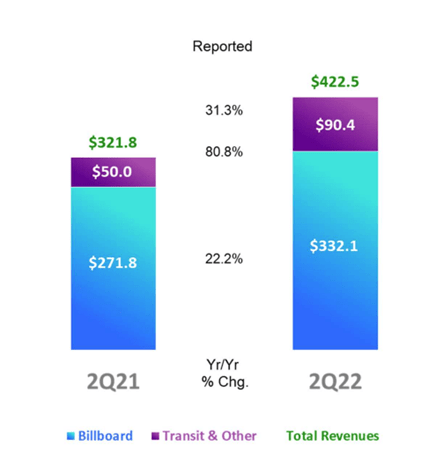

Despite some concerns regarding the outlook for advertising, demand in OUT’s markets remains strong. In the most recent quarterly filing period ended June 30, 2022, OUT reported total revenues of +$450.2M. This was up 32% from the same period last year and about +$4.5M better than expected. Growth in revenues was driven by record Q2 billboard yields and strength in both the U.S. and Canadian market, as business continues its strong recovery from pandemic-related restrictions.

Within the U.S., revenues were up 31.3%, aided in part by a significant boost in transit revenue, which was up 81% from last year. While the business continues to face headwinds from lower ridership, transit revenue is recovering more quickly than ridership when compared to pre-pandemic activity. Continued recovery in this space is likely to provide enhanced opportunities for earnings growth in subsequent periods.

In billboards, nearly every category was up YOY, with significant strength noted in travel, up 72%, and retail, up 40%. Additionally, both entertainment and technology were each up 36%. With travel demand on the rise, billboard revenues attributable to this space should see continuing strength as the year progresses.

Q2FY22 Earnings Presentation – Breakout of U.S. Media Revenue Growth

Overall expenses were up 20% YOY due to increases in variable and performance-related costs associated with higher revenues. On the transit side, expenses were up 40%, driven by increases in revenue share expenses, in addition to contractual step-ups in the minimum annual guarantee (“MAG”) payments to the New York Metropolitan Authority (“MTA”).

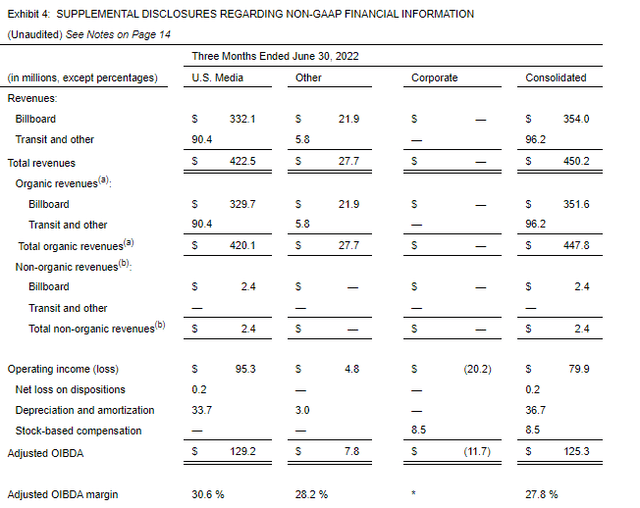

Despite the increase in expenses, adjusted OIBDA was up nearly 80% from last year. Furthermore, margins came in at 27.8%. This is over 700 basis points (“bps”) greater than 2021. Leading the charge higher were margins on billboards, which were 39%, up 360bps due to the relatively fixed cost nature of the leases.

Q2FY22 Earnings Release – Summary of Adjusted OIBDA

In addition to strong growth in OIBDA, adjusted funds from operations (“FFO”) was also up +$54M YOY. Looking ahead to the full year, management is expecting adjusted FFO to be up 60%. And this would be despite higher interest rates that have grown significantly faster than anticipated. Following a strong first half of the year, growth expectations are certainly moderating. Yet the operating environment is clearly not as weak as one may have originally expected.

Capable Fundamentals Support The Dividend

As of June 30, 2022, OUT had total assets of +$5.9B and total liabilities of +$4.6B, comprised principally of net long-term debt of +$2.6B and operating lease liabilities of +$1.3B. As a multiple of the last twelve months (“LTM”) consolidated EBITDA, period end net leverage stood at 4.9x, which is down from the 5x reported in Q1 and the 6x reported at the end of 2021. Given EBITDA growth expectations, leverage is likely to decrease further through the remainder of the year.

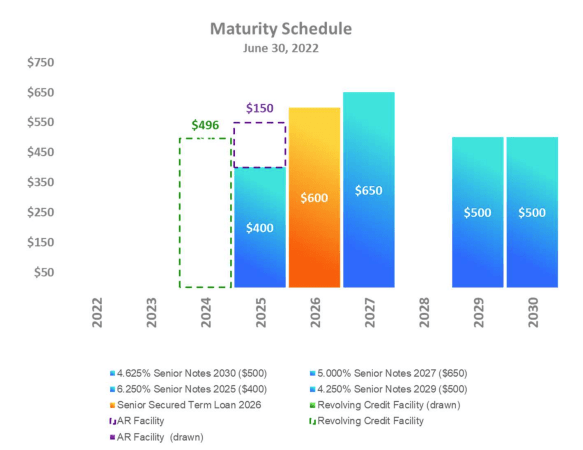

A favorable debt maturity ladder also provides OUT with near-term liquidity advantages. Currently, the company doesn’t have any material maturities until mid-2025. As such, there are no near-medium term repayment risks.

Q2FY22 Earnings Presentation – Debt Maturity Schedule

In addition, less than a quarter of total debt is subject to floating rates. In a rising rate environment, this proves advantageous. While their current weighted average cost of debt of 4.6% seems a bit high, they don’t appear to be having any issues covering their interest obligations. Their quarterly adjusted OIBDA, for example, exceeded their total interest expense by nearly 4x. This is enough cushion to weather any higher reset in rates that may occur.

Further supporting the company’s financial position is strong liquidity of +$760M, which includes over +$100M in cash and availability on their credit facility and their recently reactivated accounts receivable program.

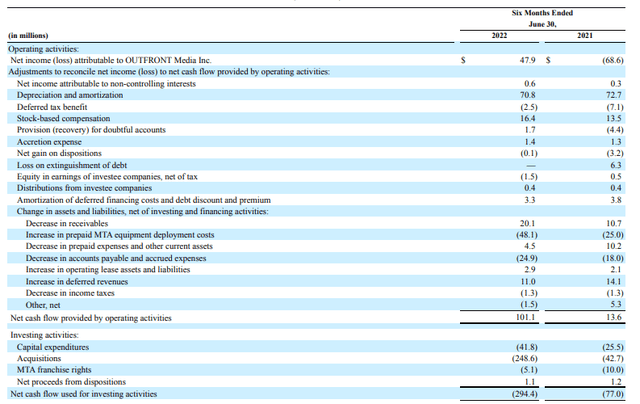

OUT also is generating positive cash from operations. Through the first half of the year, they generated +$101.1M in operating cash and +$59.3M in free cash flow. They did spend nearly +$250M in acquisitions, which required the use of existing liquidity. But these acquisitions are expected to contribute to favorable earnings growth in future periods. This will largely negate the current period outflow.

Q2FY22 Form 10-Q – Partial Cash Flow Statement

OUT also paid out over 100% of operating cash in dividends during the period, resulting in an overall net use of cash during the quarter. However, this doesn’t mean the payout wasn’t covered. At $0.30/share, the quarterly dividend represented just over 50% of quarterly adjusted FFO/share and 40% of adjusted OIBDA/share. This implies adequate coverage.

And with continued earnings growth, a return to a $0.38/share quarterly payout is not out of the question. At current yields, the payout is already yielding over 6%. A return to a $0.38/share payout would suggest a yield of nearly 8% at current pricing.

Some Risks To Consider

Since OUT’s revenues are derived from providing advertising space to customers, their business is sensitive to economic developments that are largely out of their control. A decline in the economic prospects of advertisers, the economy in general, or any of their major local markets, specifically the New York and Los Angeles metropolitan areas, could have a negative impact on OUT’s results of operations. Additionally, pullbacks in advertising from the entertainment, health/medical, and retail industries could also disproportionally affect the company’s future earnings potential.

In recent periods, companies such as Walmart (WMT) have issued profit warnings relating to pullbacks in consumer spending. Warnings such as this could lead to decreased spending on advertising, as that is one of the first costs that are cut as companies look to build cash reserves. Warner Bros. Discovery (WBD) is an example of a company that had cut their outlook in part because of a slowdown in advertising. Others, such as the New York Times (NYT) and the USA Today, have also said their ad revenue was under pressure during the latest quarter.

OUT is also exposed to risks related to their transit advertising business, which requires the company to obtain and renew contracts with municipalities and other governmental entities. These contracts all have fixed terms and have terms that are generally favorable to the governmental entity, such as an easy ability to terminate the agreement and built-in revenue share agreements that provide for a percentage of revenue and/or a guaranteed annual payment. Upon expiration of these contracts, OUT has to engage in a highly competitive bidding process in order to obtain the new contract. Failure to renew with larger entities, such as the MTA, could have a material effect on the company’s results of operations.

30% Upside, In Addition to 6% Dividend Yield

OUT’s recent earnings results suggest demand for advertising remains robust, particularly in certain areas such as travel and entertainment. As one of the largest providers of advertising space on outdoor advertising structures, OUT is uniquely positioned to benefit from the continuing strength in its core business. Improving transit ridership should also provide complementary support to future earnings growth.

The ability to continue converting traditional static billboards to digital is another significant growth opportunity that will lead to higher revenue and EBITDA in future periods. While the costs for digital advertising are higher for OUT’s customers, a digital billboard provides them with crucial advantages not available on their static counterparts, namely the ease of making changes and providing the ability to run multiple ad campaigns.

OUT does face competition in the space. LAMR is a larger peer that trades at 21x forward FFO. While LAMR owns and derives more revenues from billboards, OUT has a greater share of revenues attributable to other mixes, such as transit. Prior to the pandemic, both companies were generating equivalent returns on invested capital, with OUT even outpacing LAMR on U.S. growth.

Applying a 20x multiple on the company’s 2023 earnings estimate is not unreasonable, especially considering peer valuation. This would suggest share price upside potential of over 30%. In addition, investors would receive a current dividend yielding over 6%. Potential returns such as this are certainly worth advertising.

Be the first to comment