mysticenergy

International Petroleum (TSX:IPCO:CA, OTCPK:IPCFF) is an intermediate Canadian E&P company with a track record of operational excellence and good capital allocation. It has a well-diversified international portfolio, with producing assets in Canada (Suffield and Ferguson fields, Onion Lake thermal plant), Malaysia (Bertam field) and France (Paris Basin fields). Production comprises approximately 50% Canadian crude oil, 33% Canadian natural gas, and 17% Brent. The company also has several possibilities for expanding production, via both organic growth and greenfield projects, in particular by developing its oil sands Blackrod field in Alberta. The company has recently released very strong Q3 2022 results, which is why I reiterate my buy rating, following my first take in August.

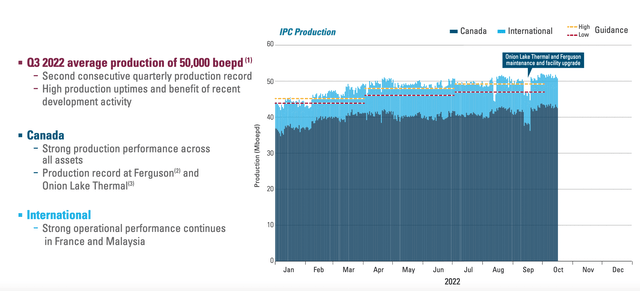

From an operational standpoint, the company achieved record results during Q3 2022. Quarterly production averaged 50 thousand barrels of oil equivalent per day (boepd), which is above the high end of the full-year guidance of 46-48 thousand boepd. At the same time, operating costs came in below expectations, at $15.7 per barrel of oil equivalent (boe). This is also below the low-end of the full-year guidance range of $16-17 per boe.

IPC 2022 production (company’s Q3 2022 presentation)

As a result, International Petroleum continues to print cash. Operating cash flow was $172 million for the quarter. Free cash flow came in at $117 million. The company is now sitting on a comfortable net cash position of $89 million, giving it a very strong balance sheet.

Despite the share price currently being up roughly 7% for the day, the company is still incredibly undervalued. Its enterprise value is around $1.5 billion. This should be measured against its consistent free cash flow generation. For 2022, FCF is projected to be between $425 million and $460 million, a record result in spite of recent headwinds in energy markets. Going forward, the company forecasts cumulative FCF for 2022 to 2026 between $900 million and $1.8 billion (based on Brent oil prices of $65 to $95 per boe). This means an annual FCF yield of 14% to 28%. Such estimates are probably conservative, given the tendency by management to beat expectations.

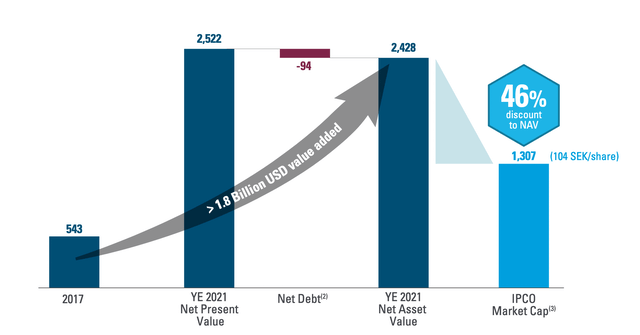

In summary, International Petroleum is a superbly managed company. Over the years, it has been able to steadily grow production, while maintaining high margins, thus creating enormous value for shareholders.

Net asset value (USD millions) (company’s Q3 2022 results)

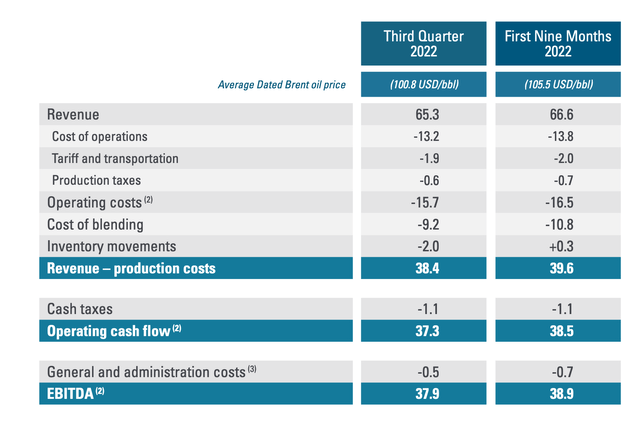

For Q3 2022, netback remained above $35 / boe as the company has managed to keep its operating costs under control, despite inflationary pressures. Its operational excellence is also confirmed by a plethora of indicators, such as its shallow decline rate and high production relative to net acreage.

Netback ($ / boe), first 9 months of 2022 (company’s Q3 2022 presentation)

At the same time, International Petroleum has maintained a disciplined capital allocation strategy. Despite enjoying exceptionally strong cash flow generation, the company has not splurged it on wasteful acquisitions. Rather, the focus has remained on enhancing shareholders’ value, by first prioritizing capital returns and secondly opportunistic expansion.

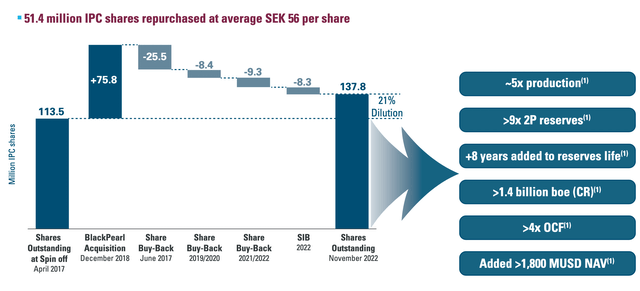

Regarding capital returns, International Petroleum has been buying back shares since 2017, taking advantage of its undervaluation to effectively re-buy barrels of oil on the cheap.

Share Repurchase (company’s Q3 2022 presentation)

In H1 2022, it completed its first Substantial Issuer Bid (SIB) for approximately 8.3 million shares and a total of $100 million. In Q3 2022, it has restarted its Normal Course Issuer Bid (NCIB). According to company’s statements, approximately 9.3 million shares have been repurchased for a total of $76 million since the beginning of the year. This means, in particular, that the shares rebought during Q3 were around 1 million (which is a bit disappointing, since I would have expected the company to take advantage more decisively of the recent price weakness). One should however bear in mind that the NCIB has authorization for only 11.1 million shares, or 7% of the total shares outstanding at the beginning of the year. Combined together, maxing out on the NCIB and SIB equates to a roughly 12% annual yield.

Looking ahead, 2023 is going to bring important news regarding the Blackrod project. The project is currently undergoing Front End Engineering Design (FEED) studies, which are scheduled for completion by Q4 2022. It holds 1 billion boe of best estimate contingent resources and is authorized for 80 thousand boepd.

Capital expenditures for 2022 have been confirmed at $170 million, up from $130 million at the beginning of the year. Of the $40 million increase, $10 million (or roughly 6%) represent a cost inflation provision, which the company believes will be enough to absorb any cost increase over the all year related to inflationary pressures. The remaining $30 million are the result of pulling forward some expenditures that had already been planned for next year. As a consequence, 2023 capex should come in even lower than this year, further boosting FCF generation.

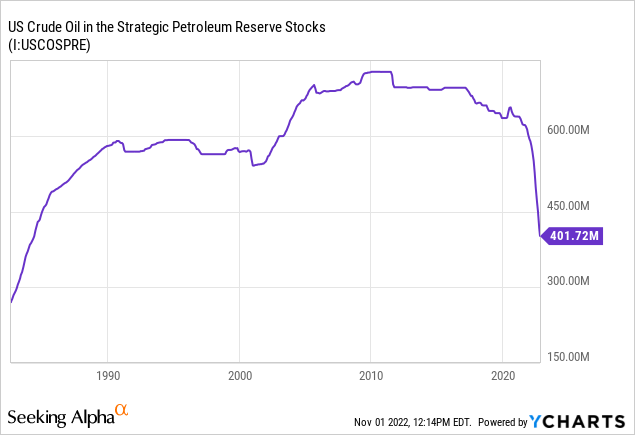

The share price has recently suffered in the face of several headwinds which, however, are beyond the control of the company. Oil prices have been under pressure, on the back of worldwide recessionary fears, a continuation of the zero-covid strategy in China, and new releases from the Strategic Petroleum Reserve (SPR) in the US. On top of this, the WCS differential to WTI has widened to a high of around $20 / boe.

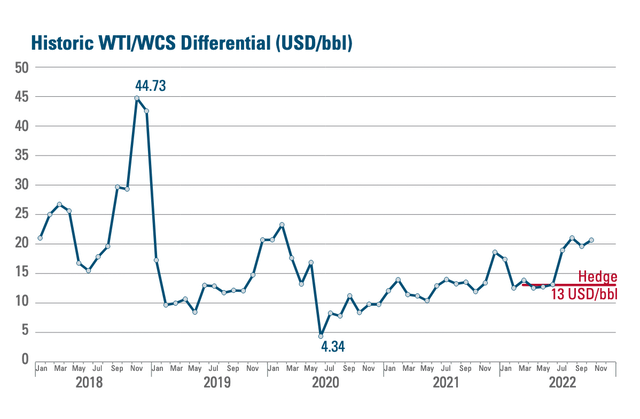

WTI/WCS differential (company’s Q3 2022 presentation)

This is probably the result of a combination of factors. First, heavy oil from Russia is still available at discounted prices and thus competing with Canadian oil. A similar dynamic is at play with the SPR releases consisting mostly of heavier barrels. Finally, demand from US refiners has been lower, due to outages and higher natural gas prices. However, these conditions cannot last indefinitely and, in any case, the company has prudently hedged approximately two-thirds of the WCS differential exposure at $13 / boe.

I will conclude with a few remarks regarding the direction of oil prices. Oil is currently trading more on sentiment than on fundamentals. The supply side in particular could not be more bullish.

Heading into the winter, EU bans to Russian oil will come into effect. Russia used to export around 7 million bpd of crude and refined products, of which 4 million to EU countries. However, since December 5, the EU will put a stop to Russian crude imports and, since February 5, also to Russian refined products. The oil price is more or less at the same level as before the invasion of Ukraine. However, this is a consequence of Russian oil still finding its way to consumers, with China and India in particular replacing demand from EU countries. This trend, however, cannot be expected to continue indefinitely, as the EU shipping ban comes into force and both Chinese and Indian imports from Russia are already at record levels. The result is that Russian exports will fall. The situation inside OPEC+ has changed dramatically from the pre-covid era, with Russia now unable, and therefore unwilling, to raise production and OPEC members overstating their spare capacity. In the event of a spike, the effect on oil prices could be dramatic, with a slower mean reversion as supply is now more inelastic.

Other headwinds are going to prove temporary. The Chinese zero-covid policy is untenable over a long period of time. The SPR releases will also need to stop, as the SPR is currently at its lowest level since 1984, and the US will need to rebuy 200 million barrels, probably at a higher price.

In conclusion, the macroeconomic outlook for energy prices remains bullish going into 2023. International Petroleum is excellently positioned to reap the benefits of the following years of sustained high prices, thanks to its superb management, strong balance sheet and future development opportunities, both organic and greenfield. Despite the year-to-date run-up in the share price, the company remains incredibly undervalued, which is why a buy rating is warranted.

Be the first to comment