Jeremy Poland

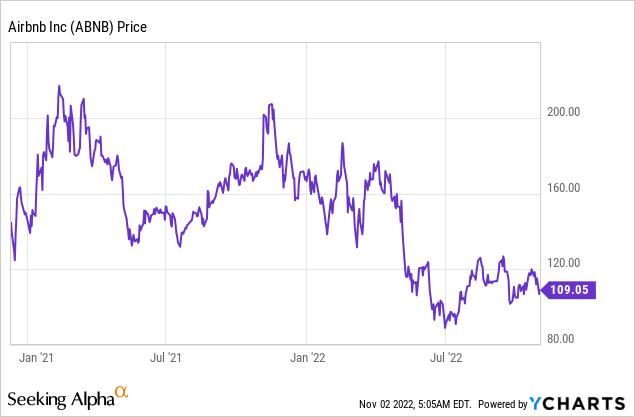

Airbnb, Inc. (NASDAQ:ABNB) is one of the most innovative and disruptive travel companies in history. The company operates in over 220 countries but owns no hotels or apartments directly. Its business effectively has an unlimited supply of inventory across even the most regions. Consumer habits are also changing from a traditional hotel room to those who want to rent a full house, apartment or even a treehouse. Its charismatic CEO Brian Chesky put it like this in the third quarter earnings call:

“The mall is now Amazon, the movie theater is now Netflix… People still want to get out of their house, they still want to have memories. They still want to have meaningful experiences and I think that’s why they continue to turn to Airbnb.” – CEO Brian Chesky

The company posted record results in the third quarter of 2022, beating both revenue and earnings estimates. Therefore in this post, I’m going to breakdown the financials and valuation for Airbnb, so let’s dive in.

Third Quarter Breakdown

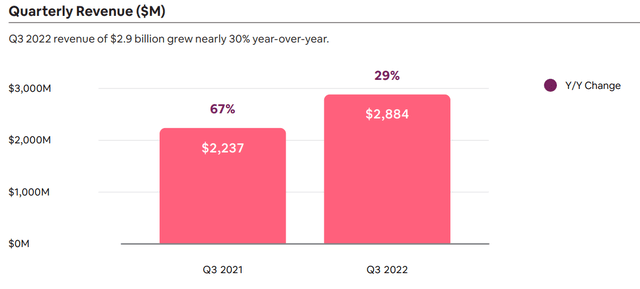

Airbnb generated solid financial results for the third quarter of 2022. The company reported a record quarter with Revenue of $2.88 billion, which increased by 29% year-over-year and beat analyst estimates by $35.93 million. This record revenue was driven by close to 100 million Nights and Experiences booked, up 25% year-over-year. Overall Gross booking value was $15.6 billion, up 31% year-over-year.

On a macro level, a huge amount of pent up travel demand drove strong results for travel during the peak summer season. Airbnb’s management noted that guests are now “returning to cities” and “crossing borders,” after a boom in domestic and countryside travel was seen during 2020/2021. City bookings increased by 27% year-over-year and Cross border bookings increased by 58% year-over-year.

Another key metric to watch is the percentage of long-term stays. In this case, Airbnb reported long-term stays equating to 20% of total gross nights booked, which is level with the prior year despite a “return to office” by many companies. Airbnb is targeting the hybrid worker and aiming to entice them into longer stays in remote locations.

New Product Features

As mentioned in my prior post, Airbnb launched a plethora of new features on May 11th for their “2022 Summer Release.” Its flagship feature was “Airbnb Categories,” which broke down Airbnb Homes by imaginative categories such as Desert Homes, Castles, Treehouses etc. Its categories have been viewed over 300 million times and have given the website a major traffic boost. The challenge now for the company will be to convert the many dreamers into doers. Many people which are visiting Airbnb Categories are simply window shopping for inspiration and are not necessarily ready to book.

The good news is the company’s focus on “brand marketing” has been incredibly effective, as over 90% of its website traffic is direct or unpaid. This means the company is a lot more efficient than many rival travel companies which will have to entice users in with paid advertisements.

The company also launched “AirCover” an extensive inbuilt travel insurance policy that Airbnb offers for free, which is unique in the industry. Aircover solves the main friction point with potential customers of an Airbnb. It is great booking a treehouse or a log cabin, but what happens if you turn up in the middle of the night and the host isn’t available or the place isn’t fit for purpose. With a hotel, such a worry is not usually prevalent as many have an onsite concierge with hotel managers etc. As someone who used to let Airbnb apartments, I have experience in this space and how challenging it is. It sounds simple renting your home, but it requires an immense amount of empathy for the guest, in order to make sure they have everything they need, for instance, enough towels for group bookings etc. As a result of AirCover, Airbnb’s net promoter score [NPS] has increased by 70pts. Also in the event of a host canceling last minute, AirCover has resulted in a 10% increase in rebookings.

On November 16th, Airbnb plans to further upgrade AirCover with extra improvements for the host and guest. In addition, the company plans to introduce a new/easy way for people to rent their homes on Airbnb as part of the “Winter release.”

Profitability & Investments

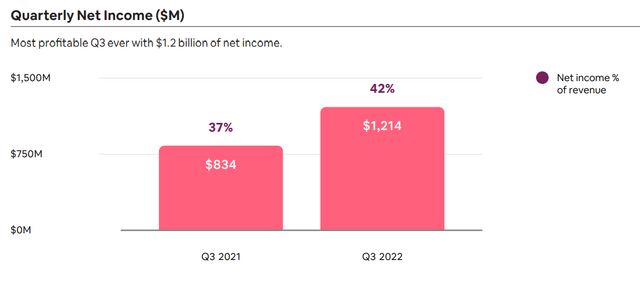

Airbnb reported a record quarter for profitability. Net Income was $1.2 billion, which increased by $400 million year-over-year and represents a solid 42% net income margin. Earnings Per Share was $1.79, which beat analyst expectations by $0.29.

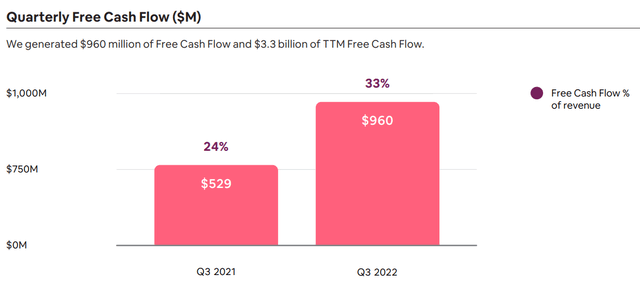

Adjusted EBITDA was a solid $1.5 billion and the company generated record free cash flow of $960 million.

Free Cash Flow (Airbnb Q3 Report)

Airbnb lost 80% of its business during the pandemic travel lockdown of 2020. Therefore, management’s new strategy is to focus on being a lean organization. As CEO and Founder Brian Chesky eloquently put it, we are going from “Navy to Navy Seals, a small elite group.” This has resulted in the company being already prepared for the recessionary environment somewhat, and the company hasn’t needed to change its hiring plans.

Tepid Outlook

Moving forward into the fourth quarter of 2022, Airbnb forecasts between $1.8 billion and $1.88 billion in revenue, which represents growth of between 17% and 23%. This is slower than the 29% revenue growth reported in Q3,22 and significantly less than the 67% revenue achieved in Q3,21. Part of this is driven by the cyclicality of the travel industry, as there is usually a summer peak and winter slowdown. However, the macroeconomic environment and FX headwinds driven by a strong dollar are also expected to impact growth. More on this in the “Risks” section.

The good news is Airbnb is a strong position to weather any storm. The company has a robust balance sheet with $9.6 billion in cash, cash equivalents, marketable securities, and restricted cash. Management showed confidence and authorized $2 billion of stock buybacks which are expected to offset dilution from employee stock programs.

Advanced Valuation

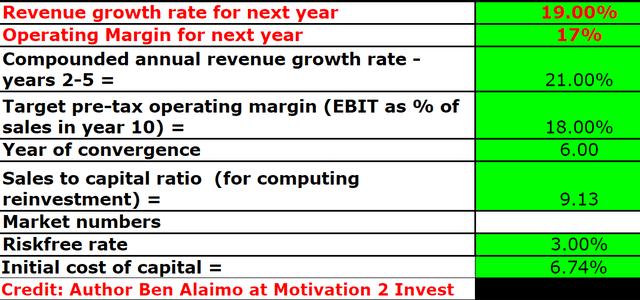

In order to value Airbnb, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow (“DCF”) method of valuation. I have forecasted 19% revenue growth for next year, which is aligned with management expectations and driven by a forecasted cyclical demand drop in travel. In years 2 to 5, I am forecasting revenue to grow by 21% per year.

Airbnb stock valuation 1 (created by author Ben at Motivation 2 Invest)

In order to increase the accuracy of the valuation, I have capitalized the company’s R&D expenses, which has boosted the operating margin slightly.

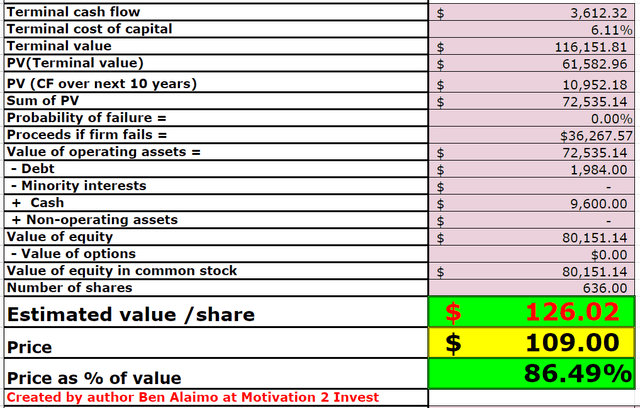

Airbnb stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $126/share. ABNB stock is trading at ~$109 per share at the time of writing and is thus ~14% undervalued.

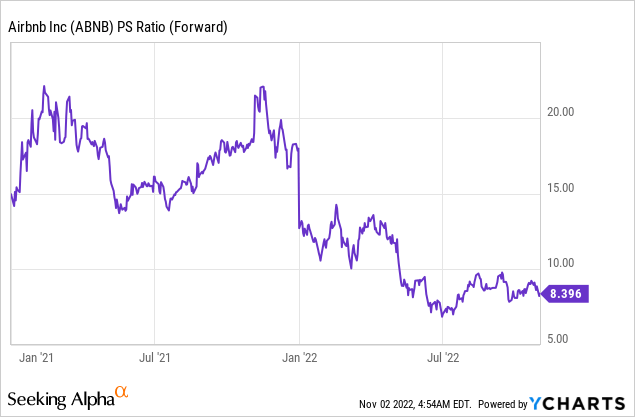

As an extra data point, Airbnb trades at a P/S ratio = 8.4, which is cheaper than its 2021 average of over 15.

Risks

Recession/Travel Slowdown

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. As consumers have their input costs squeezed through higher energy and food prices, they are likely to reduce discretionary spending on things such as travel. In addition, we are now entering a cyclically slow season for travel (winter), following a large boom during the summer months.

Final Thoughts

Airbnb is a tremendous company that has recovered from the travel lockdown in a stupendous manner. The company is now leaner, more focused and continually innovating with new features. Its strong brand means the business spends a lot less to acquire customers than competitors and it has broken records across all financial metrics during the third quarter. The stock is undervalued at the time of writing and thus could be a great long-term investment. However, do expect some volatility within the next year as the travel market corrects and the consumer tightens on discretionary expenses.

Be the first to comment