JoeLena

Insight Enterprises (NASDAQ:NSIT) offered outstanding guidance for the year 2022 and the next five years. In my view, if NSIT continues to invest in new innovative technologies, and third parties keep selling solutions, free cash flow will likely trend north. Besides, the current balance sheet will likely allow for more acquisitions, which would enhance sales growth. Yes, there are risks from an eventual economic downturn or lack of innovation. However, I believe that at the current market price, Insight does not appear expensive. It is worth considering for investors trying to build a portfolio of growing business models.

Insight Enterprises Targets A Large And Fragmented Market

Insight Enterprises offers technological solutions to organizations in North America, Europe, the Middle East, Africa, and Asia-Pacific. Insight offers a variety of services to grow revenue, manage costs, mitigate risks, and obtain operational efficiencies. The industries served include finance, healthcare, and manufacturing among other industries.

Investor Presentation

The target market appears pretty big. Insight Enterprises, Inc. believes that its target market represents close to $700 billion in annual sales, and appears highly fragmented. It means that it may not be very difficult for management to acquire small targets.

Based on our analysis of Gartner market data, we believe the top 10 most comparable global solution providers represent less than 10% of our worldwide addressable market. We believe that we are well positioned in this highly fragmented global market with locations in 19 countries and our deep experience delivering IT solutions across the globe. Source: 10-k

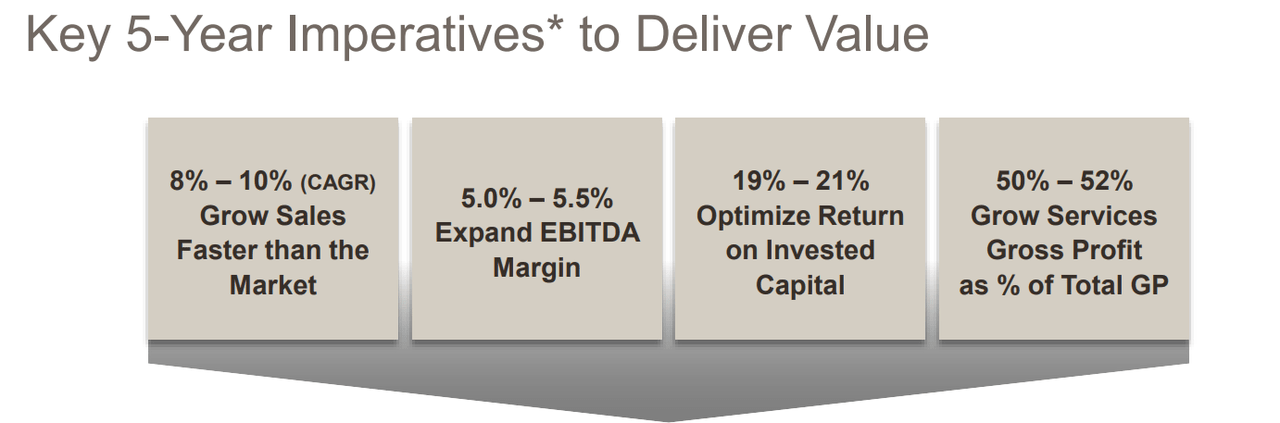

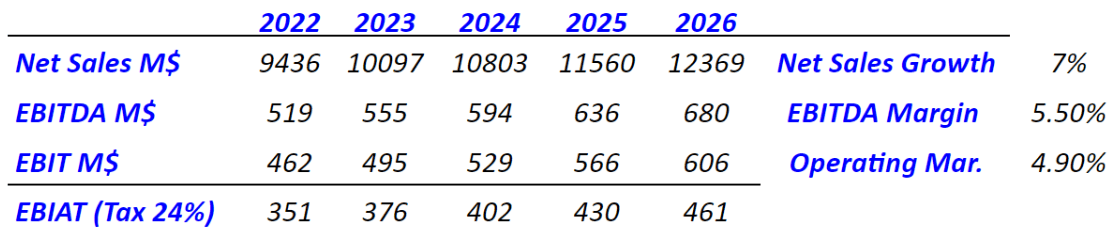

With that being said about Insight’s business model, the most interesting are the company’s expectations for the next five years. Insight Enterprises expects close to 8%-10% sales growth, an EBITDA margin close to 5%-5.5%, and a return on invested capital of 19%-21%. I used some of these figures in my financial model.

Investor Presentation

The Amount Of Leverage Would Allow More Acquisitions

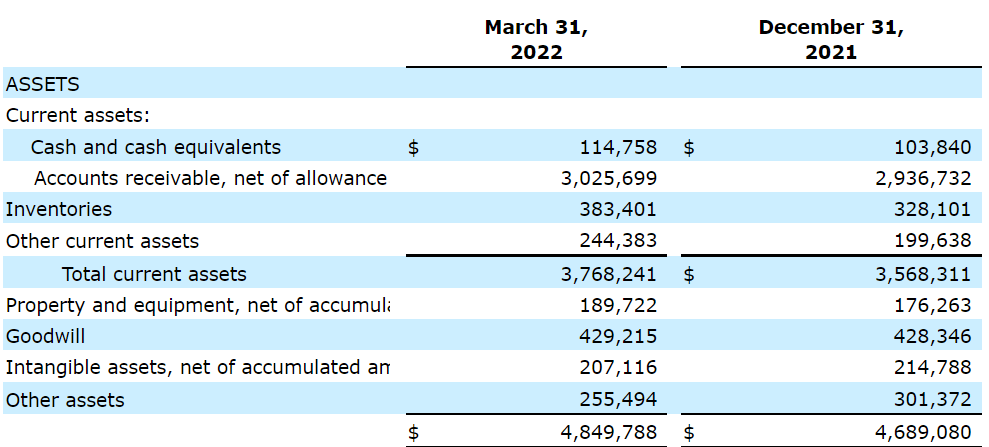

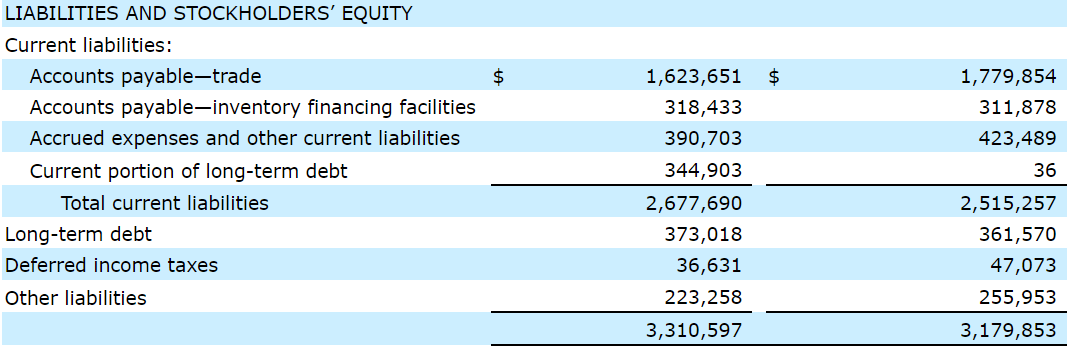

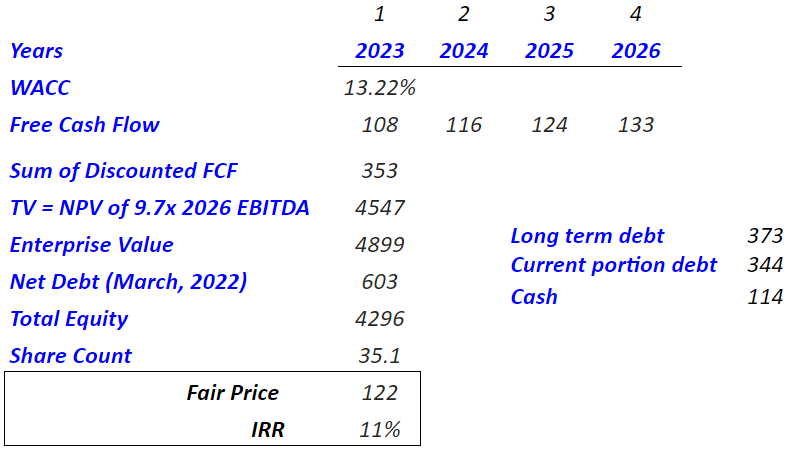

As of March 31, 2022, cash on hand is equal to $114 million, total assets are equal to $4.84 billion, and total liabilities stand at $3.31 billion. I think most financial advisors will not be afraid of Insight’s financial situation.

10-Q

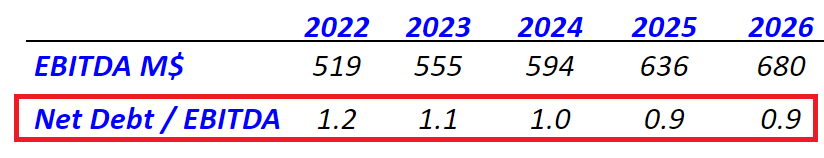

With net debt around $603 million, I believe that the net debt/EBITDA would stay close to 1.2x in the near future. I believe that Insight Enterprises could receive more leverage if necessary.

Lubo Capital 10-Q

With The Guidance Given By Insight Enterprises, the Fair Price Would Stand At Close To $121.4 Per Share

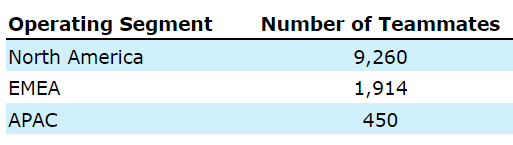

Under normal conditions, I believe that Insight Enterprises will be able to increase its penetration in new markets. Considering the number of employees in EMEA and APAC, in my opinion, Insight could increase its headcount outside the United States to enhance sales growth. A larger target market will likely mean more revenue growth.

10-k

Our strategy is to increase our penetration with new and existing clients within the areas of expertise across our geographic footprint in North America, EMEA and APAC. Source: 10-k

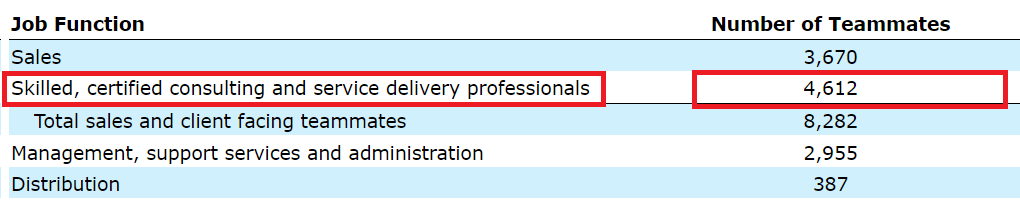

In my view, the fact that the number of certified consultants is larger than the number of sales personnel will likely help Insight Enterprises. It means that the investment in technical engineers and software developers is very relevant for management. I believe that we can expect quality services from Insight Enterprises:

10-k

We also invested in technical engineers, architects and software developers who create and deliver integrated IT solutions to our clients globally, a capability we believe differentiates us in the marketplace. Source: 10-k

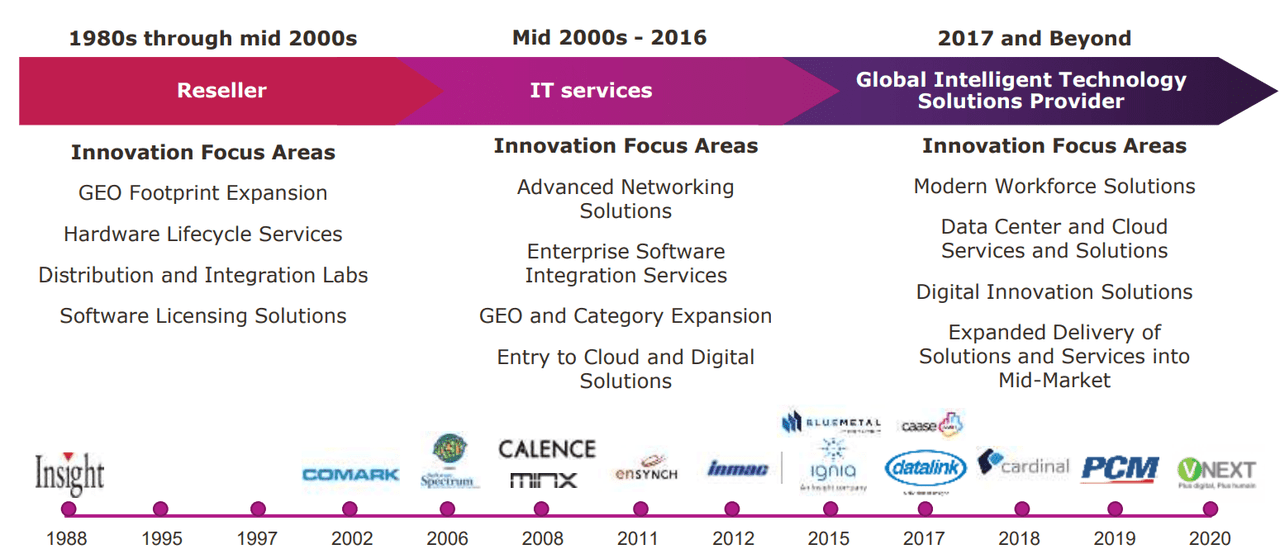

I also believe that the company’s accumulated expertise in the M&A markets will likely lead to larger inorganic growth in the near future. Let’s note that management acquired many businesses in the past, and the balance sheet will likely allow revenue growth.

2017 – Acquired Datalink Corporation and strengthened our position as a leading IT solutions provider.

2018 – Acquired Cardinal Solutions Group, Inc., a digital solutions provider and strengthened our digital innovations capabilities

2019 – Acquired PCM, Inc., a provider of multi-vendor technology offerings

2020 – Acquired vNext SAS, a French digital consulting services and managed services provider. Source: 10-k

Investor Presentation

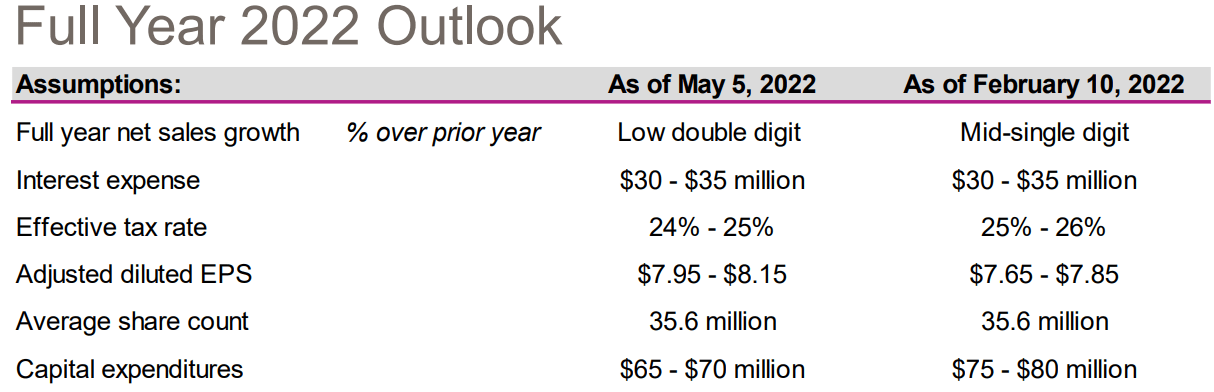

Management provided valuable information about the year 2022. Insight Enterprises believes that adjusted EPS will likely stand at around $7.65 per share, the share count would be close to 35 million, and capex would be $75-$80 million. I used some of these figures for my financial models.

Investor Presentation

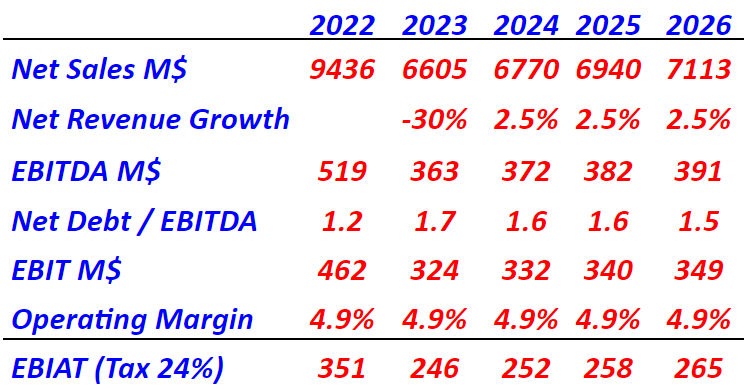

If we use constant sales growth of 7%, an EBITDA margin of 5.5%, operating margin of 4.9%, and effective tax of 24%, 2026 EBIAT would stand at $461 million. I believe that my figures in this case are quite conservative.

Lubo Capital

My results also included free cash flow around $108 and $133 million, cash of $114 million, and net debt of $603 million. The implied equity valuation would stand at $4.2 billion, and the fair price would be $122 per share. In fact, we would be talking about an internal rate of return close to 11%.

Lubo Capital

Very Pessimistic Conditions Would Lead To A Valuation Of $55 Per Share

Insight buys software and solutions from third-parties, which are later sold. Insight may not be able to acquire other products from third parties because publishers don’t produce them. Besides, management may not be able to acquire them at competitive prices. In the worst case, I believe that the company may suffer a decline in profitability. Besides, if expectations for free cash flow decline, the implied valuation would decline:

We acquire products for resale both directly from manufacturers and publishers and indirectly through distributors, and the loss of a significant partner relationship could cause a disruption in the availability of products to us. There can be no assurance that manufacturers and publishers will continue to sell or will not limit or curtail the availability of their product to resellers like us. The loss of, or change in business relationship with, any of our key vendor partners could negatively impact our business. Source: 10-k

Insight Enterprises is investing a significant amount of money in research and development and innovation. With that, I can’t be sure that R&D expenses will lead to sufficient technological evolution to remain competitive. Let’s keep in mind that Insight operates in a fast industry. If the company does not offer innovative solutions, demand for the company’s products will likely decline. Hence, net revenue expectations will likely diminish.

Cloud, security, and digital-related solutions are continuously evolving, and there is rapid development and technological evolution in areas such as IoT, edge-computing, computer vision, advanced machine learning and AI, automation, augmented reality, blockchain and as-a-service solutions. If we do not invest sufficiently in new technologies, successfully adapt to industry developments and evolving client demand at sufficient speed and scale, we may be unable to develop or maintain a competitive advantage in the market and execute on our growth strategy and initiatives, which could have a material adverse effect on our business. Source: 10-k

Insight Enterprises will likely suffer if there is an economic downturn. Clients may not be able to finance more innovative IT environments, so they may decide to delay payments. As a result, Insight Enterprises may see a decline in its revenue growth, or a decline in its expectations. Future free cash flow expectations could also diminish, which would lead to a decline in the company’s fair valuation. The worst outcome under this situation would include a decline in the stock price.

A prolonged slowdown in the global economy or similar crisis, or in a particular region or business or industry sector, or tightening of credit markets, could cause our clients to have difficulty accessing capital and credit sources, delay contractual payments, or delay or forgo decisions to upgrade or add to their existing IT environments, license new software or purchase products or services. Source: 10-k

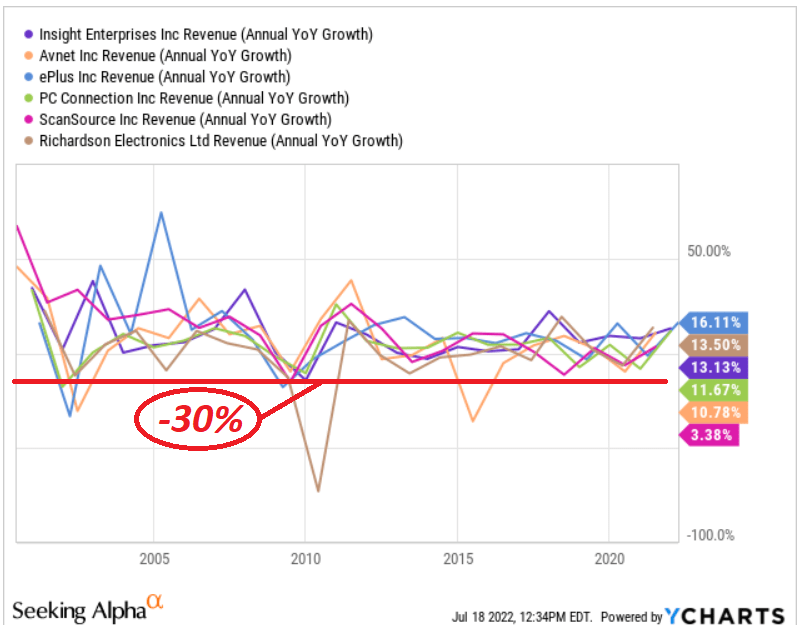

I studied the previous results delivered by other peers. In my view, the worst case scenario would include a decline in sales close to 30%, which was seen before the year 2010.

Ycharts

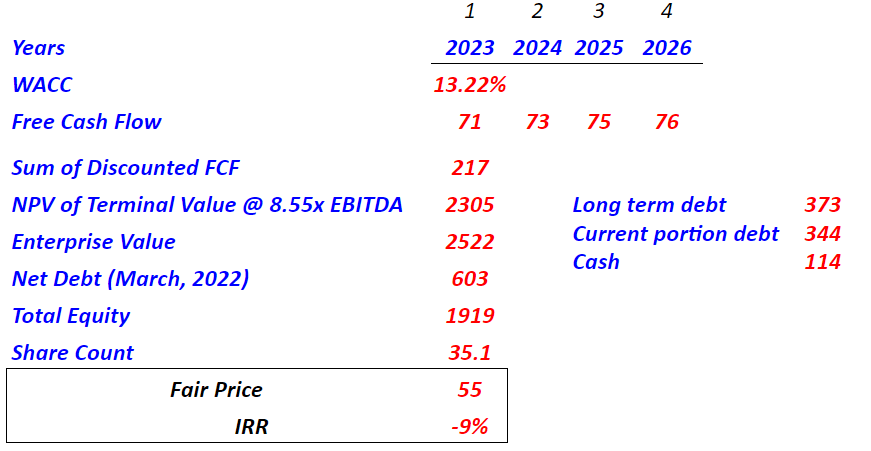

With a decline in revenue of -30% and sales growth close to 2.5% from 2024 to 2026, 2026 net revenue would stand at $7.1 billion. If we also assume an effective tax of 24%, 2026 earnings before interests and after taxes would be $265 million.

Lubo Capital

With the previous figures, I obtained a free cash flow around $71-$76 million from 2023 to 2026. The NPV of the terminal value would be $2.3 billion, and the fair price would stand at $55 per share.

Lubo Capital

Takeaway

Insight Enterprises provided beneficial guidance for the year 2022. I believe that management has an outstanding opportunity in Europe and Asia, where the company could increase its headcount to increase revenue. Considering the target market in which Insight Enterprises operates and its fragmentation, in my view, the company’s expertise in the M&A market will likely help. I do see some risks from an eventual economic downturn, lack of innovation, and issues with third-parties. However, in my view, the upside potential in the share price would justify a small position in the stock.

Be the first to comment