Feverpitched

The recession warnings have been piling up this year, but thanks to growth in consumer spending and hiring the US economic expansion has endured. Yesterday’s surprisingly weak retail sales data for November, however, suggest that the consumer sector may be buckling. If so, that leaves the labor market as the last major firewall that keeps the economic trend from slipping over the edge.

Unless it doesn’t. The question is whether a tight labor market can prevent an NBER-defined downturn? It’s clear that US economic activity is slowing, and is likely to decelerate further in the months ahead, in part because the effects of Federal Reserve’s interest-rate hikes, which are ongoing, have yet to fully impact economic activity. If a recession is near, or has already started, the contraction is likely to be mild. That could change, of course, but for the moment the odds appear low that the economy is set for a deep decline.

The problem is that if the consumer sector is weakening, the calculus could change, perhaps dramatically, depending on how spending fares. It’s still early to read November’s retail numbers as a smoking gun, but it’s worrisome that buying in November – typically a big month for holiday sales – posted a hefty downside loss that surprised economists.

Retail spending slumped 0.6% last month, the deepest monthly slide this year. “With weak global growth and the strong dollar compounding the domestic drag from higher interest rates, we suspect this weakness is a sign of things to come,” writes Andrew Hunter, senior U.S. economist at Capital Economics, in a research note.

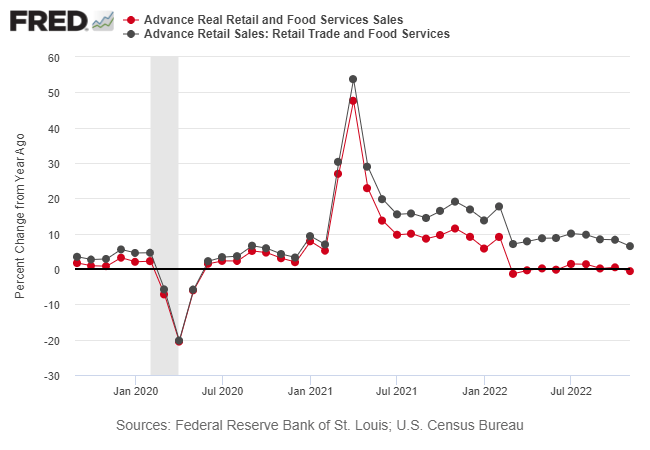

Monthly data is noisy and so looking at rolling one-year changes offers more signal. On that basis, retail spending still looks strong via a 6.5% increase in November vs. the year-earlier level. But at a time of higher inflation, the unadjusted year-on-year increase is misleading. Looking at real retail sales paints a darker picture: inflation-adjusted spending fell 0.6% vs. the year-ago level, the first negative print since June (red circles in chart below).

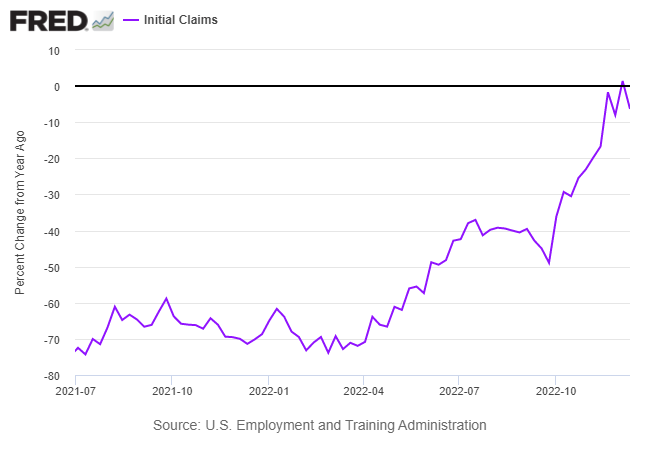

If consumer spending – the main pillar of US economic activity – is headed for trouble, can a robust trend in payrolls keep the expansion alive? Unclear, but it helps that the labor market remains tight. Jobless claims, a leading indicator, remain near multi-decade lows, which implies that hiring will continue to rise at a healthy pace.

But looking at the unadjusted year-over-year trend for claims suggests the tide may be turning. Claims have been trending lower vs. year-ago levels since the spring of 2021 but the trend looks set to start rising. If and when that occurs, and persists, the forecast for the labor market will deteriorate substantially.

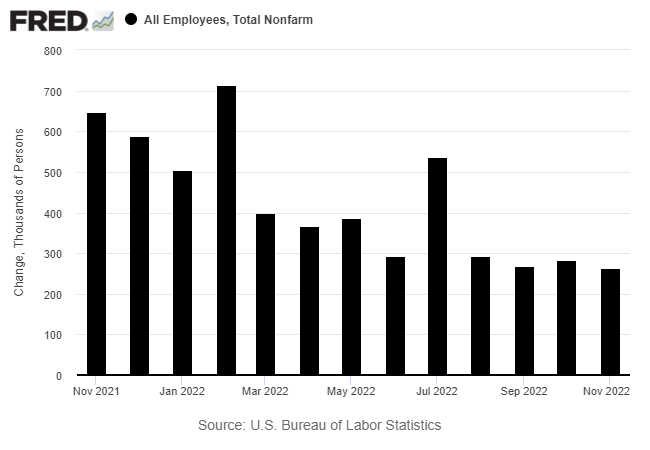

In fact, the labor-market growth is slowing, although November’s 263,000 increase in payrolls still ranks as a solid gain.

Deciding if hiring can remain a bulwark for the economic expansion is a gray area at the moment, but the next payrolls report for December (due on Jan. 6) could be decisive. In the current climate, a sharp downturn in hiring would be a sign that the die is cast for an economic contraction.

In fact, CapitalSpectator.com’s analytics featured in The US Business Cycle Risk Report indicate a the US is already contracting, albeit mildly so far. Will the next round of payrolls and consumer spending data offer compelling reasons to think otherwise?

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment