Robert Way/iStock Editorial via Getty Images

Swiss luxury company, The Swatch Group (OTCPK:SWGAY) is instantly recognised by its namesake watch brand. But make no mistake, these funky, popular and moderately priced plastic watches aren’t the only well-known brand it produces. The group boasts of brands like Omega, Longines and Rado as well, which would qualify, at the very least, as affordable luxury. It’s also a jeweller, with ownership of the Harry Winston brand, whose rare diamond engagement rings have been worn over the decades by celebrities from Jacqueline Kennedy Onassis to Jennifer Lopez.

Poor Investor Returns

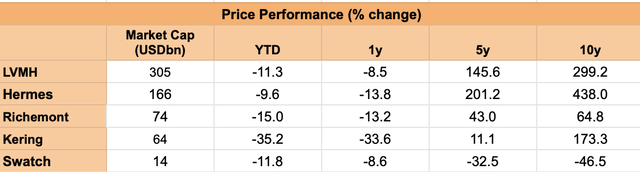

From an investor’s perspective, though, does the group’s established position as a luxury company, which owns 17 individual brands, translate into financial returns? Year-to-date, it has declined by 11.8%, which isn’t good for investors, of course.

But seen in context, it’s far from the worst. This is a far smaller fall than the 20% fall seen in the S&P 500 (SP500) index. It’s also not the biggest fall among luxury peers. Gucci owner Kering (OTCPK:PPRUY) is actually the worst performing with a 35% decline. Even Richemont (OTCPK:CFRUY) of Cartier watches and jewellery, has fallen a bit more by 15%. Hermes (OTCPK:HESAY) has had the smallest fall, but it’s not significantly better off than Swatch with a 9.6% decline.

The real challenge with the company’s ADRs is long-term performance. It’s the only luxury company to have given negative price returns over the last decade. Or even the last five years. So the question now is – Can Swatch turn around its stock market performance?

Inconsistent Revenue Growth

Looking at its past performance immediately shows where the gaps are. In four of the past 10 years, the company has reported a contraction in revenue. This of course includes the COVID-19 year of 2020. But even then, there are three bad years here, which indicates why its price might have been affected. Further, its absolute revenue number for the full year of 2021, leaving 2020 aside, is the lowest it has been in the past decade. This could be the continued impact of the pandemic. But it does make a glaring contrast to its luxury counterparts, which have had a record past year.

Similarly, this year hasn’t been particularly good for Swatch either. For the first half of the year (H1 2022), it reported just 7.4% net sales growth. To be fair, the latest numbers are only until then. This period was particularly bad for sales in China, which makes up for 42% of the company’s revenue. If it weren’t for the CHF 400 million hit from the region, growth would have been a far higher 18.3%.

Other luxury companies have reported a pickup in sales from the market since, so the same might be true for Swatch. Even then though, it’s hard to overlook the fact that it hasn’t shown continued momentum in other geographies as the others did in even H1 2022.

Relatively Low Operating Margin

At almost 14%, last year’s operating margin was the best Swatch has seen in six years. It has sustained it in H1 2022, so that’s some positive. But it’s still way lower than the 25.4% level it was at a decade ago. It’s also much lower than its luxury peers, all of whom have 20%+ margins.

Even Richemont, which so far was slightly less competitive on margins than the rest, has managed to recently bump them up after selling off its stake in the luxury marketplace Yoox Net-a-Porter. In a year of double-digit inflation like 2022, high margins can be particularly attractive because they show a company’s ability to pass on higher costs to consumers.

Falling Dividends

Swatch’s dividends for 2021 have also been the lowest in a decade, save 2020 when they fell even lower. This is despite the fact that its dividend payout ratio was at a low of 23.7% during the year. This is far lower than ratios for much of the past decade, in fact, it was even at the other extreme at 70% in 2016. Combined with the fact that it has consistently paid dividends over the past decade, if its dividends had grown last year, it could have looked like a far more attractive buy from a passive income perspective.

Why The Limited Price Fall?

Keeping these financial reasons in mind, the question that then comes to mind is as follows. If Swatch has underperformed its peers and its dividends aren’t a match with past years, why hasn’t its price fallen more? It has fallen only more than LVMH (OTCPK:LVMUY) and Hermes, and not by a significant margin.

One reason for this could be its outlook. The company expects growth to pick up in the second half of the year (H2 2022) in its last update. It said that the target for double-digit growth in local currencies for 2022 was “realistic”. China in particular was expected to pick up in H2 2022, along with strong growth from America and the rest of Asia.

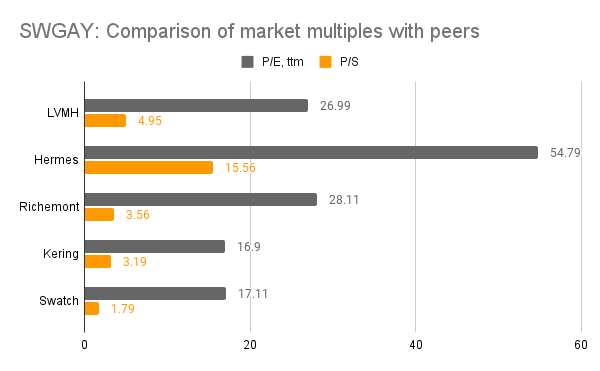

The second is its market multiples. At 17.1x, its twelve months trailing price-to-earnings ratio higher than the 13.4x for the Consumer Discretionary sector, but luxury companies tend to be valued higher. Compared to peers, it’s only slightly higher than that for Kering at 16.9x. And much lower than that for Richemont (28.1x), LVMH (27x) and Hermes (54.8x). Its price-to-sales ratio is also the lowest among peers (see chart below).

Source: Seeking Alpha

It’s little wonder then that its price has inched up a bit over the past month, by 5.4%. Other luxury companies have reported strong numbers in H2 2022, and its own projections look more optimistic for this half too. These factors could have encouraged investors to buy it.

What next?

However, the proof of the pudding lies in the eating, as they say. There’s no way of knowing if Swatch has indeed performed until it releases its key figures for 2022 in January next year. It has lagged behind in H1 2022, even though other luxury companies did relatively well despite the China stumbling block. Further, the fact remains that its operating margins are still significantly lower than its peers. But the biggest risk to buying it is its long-term performance. Ultimately, despite the promise of higher growth and relatively attractive valuations, it’s not a convincing enough story to be a Buy yet. A better picture will emerge once its full-year numbers are released to determine whether any turnaround is likely. I’m inclined to give it a Hold rating until then.

Be the first to comment